Joyce is preparing to hand over the air carrier he has run for 15 years – at times ruthlessly – to an internal successor, chief financial officer Vanessa Hudson, with the transition already underway. Inside Qantas’ Mascot headquarters power and longer-term planning decisions are already start to shift to Hudson’s desk before Joyce’s formal exit at the airline’s November annual meeting.

With a massive restructuring made in the depths of the Covid-19 crisis, Qantas is now different and fundamentally more confident airline from when Joyce started out as boss in 2008 in the midst of another crisis: the global financial meltdown.

Even taking on unions by extraordinary action of grounding the entire fleet in 2011 was no match for the Covid-19 pandemic that represented a wrecking ball for the entire aviation industry.

Joyce’s mantra is that to do nothing in a crisis is the worst choice than making a decision – even if it is the incorrect one.

It can’t be disputed the boom time conditions of aviation globally means Qantas too is riding the wave and is now the most financially secure it has been since it was privatised. Profit is important as it means it is in a much better place to take external shocks. The big question is whether Qantas is simply surfing the travel super-cycle, or if it is a genuinely changed airline.

From the outset debt remains well below its historical range, and it is spinning off cash in the billions. It has also been able to build out market share since the Covid-19 pandemic in the face of weakened rivals.

Qantas’ two main engines – domestic and international – are firing at the same time and are spinning off record profits thanks to mile-high margins that are likely to stay for now.

Even with rising interest rates weighing on the domestic economy, Qantas still sees a strong start to the 2024 financial year. Something that is giving the airline added confidence.

In his final months Joyce is trying to show he is switching from rebuilding its balance sheet to investing in customers.

This means spending billions on dozens of brand new planes. Qantas too is rebuilding its airport lounges, working at reducing much hated cancellations and finding lost bags. It is gifting millions of free frequent flyer points and trying to take the sting out of high ticket prices with a string of ultra-cheap snap seat sales across Qantas and its discount carrier Jetstar.

Covid-19 hits

The biggest legacy Joyce leaves is the brutal decision to fundamentally restructure the airline, including axing more than 9800 jobs and outsource services in the early days of Covid-19. At the same time his chief financial officer Hudson raised nearly $2bn of funds and sold off property in the depths of the Covid grounding.

This allowed Qantas to secure a cash pile and rebuild in a way that Joyce sought best to run it for the long term. He points to this monster restructuring program now delivering $1bn in earnings benefits compared to pre-Covid and has contributed to the $2.47bn underlying full year profit delivered Thursday. This result came at the top end of several profit upgrades issued by Qantas’ through the year and compares to last year’s heavy loss of $1.86bn.

The proof point will be as Qantas continues to ramp back up to 100 per cent of pre-Covid capacity compared to 77 per cent currently. The restructuring promise to proportionally lower the cost base as more volume travels through the machine.

This will come even as jobs are returning, full-time staff numbers are up 16 per cent over the past year to 25,426 and are expected to move higher as more planes arrive to renew the fleet.

On the current numbers, Qantas’ job numbers are now only 14 per cent below the pre-Covid-19 levels.

The invisible stuff from Joyce is change in corporate culture from the uncertain 2000s until today. Safety is still at the core of its operations, but it is more commercially focused, decisive and is trying to be customer responsive. Indeed Hudson, who has spent most of her career with Qantas, called out the shift in culture under Joyce as being the biggest driver of the airline today.

Joyce and his board rolled the dice through the depths of Covid-19, anticipating the pandemic wouldn’t last forever. From this they issued the first of the monster fleet orders including 45 new aircraft over the next two years, coming at a cost of $US4.3bn ($6.6bn). On Thursday, Qantas unveiled plans to buy more: Up to 12 new wide body A350s and 12 Boeing 787s arriving from 2027.

This is a bet on sustained international expansion for ultra-long distance flights for beyond the next decade. Joyce says it was the initial Covid-19 orders that allowed Qantas to jump the queue, with other airlines around the world scrambling to build out capacity. To underscore heat in the market trans-Tasman rival Air New Zealand also extended its order book on Wednesday and now has 16 aircraft including eight Boeing 787 Dreamliners scheduled for delivery between 2024 and 2028.

The new aircraft promise a smoother, more reliable passenger experience, but the difference will be in the bottom line. They will use substantially less fuel one of the biggest costs for running an airline.

With low-cost carrier Jetstar – the airline that Joyce led before taking the top job – Qantas has put air travel in the reach of everyone, Joyce says. This means too with Qantas at the premium end and Jetstar at the discount end both have been able to squeeze Virgin in the middle.

Joyce points to the turnaround in the international business that has been important to be able to invest in fleet renewals and become a specialist in flying ultra-long routes. Joyce adds that early in his tenure there was an argument among investors to exit international because it was seen as an “albatross around our necks”.

Other areas of loyalty remain a consistent earner with margins running in excess of 20 per cent and freight has delivered a step change. Meanwhile, Joyce says his airline is underpinning demand for low-emission aviation fuel to be produced in Australia.

Among the biggest hit to Joyce’s legacy has been Qantas’ poor record coming out of the Covid-19 pandemic, where the deep cuts left the airline unprepared for a surge in demand for travel. The airline too was also caught out by broader bottlenecks right through aviation, but Joyce became the face of most travellers’ ire.

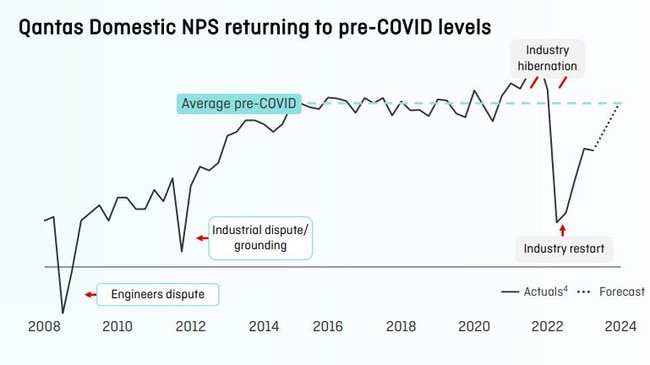

Demand for travel continues to outstrip capacity, but there is evidence that customer satisfaction remains damaged from Covid-19 disruption. Its closely watched net promoter score is sitting below 2014 levels. While recovery has been rapid, there remains a substantial gap for the average pre-Covid-19.

Joyce says the restart from Covid-19 “has not been as smooth as we would like it”.

He has said Qantas tried to do too much at once and hadn’t accounted for the full limitations of Covid-19.

“We didn’t deliver it to the highest stations our customers wanted. I had to apologise for that. People and Qantas are fixing that. It’s not quite there where we need it to be,” he says.

Joyce leaves with a higher profile than nearly any other Australian CEO.

That comes with the job at Qantas, where the CEO is front and centre when the planes don’t take off or battle with unions. Joyce has also fallen out with customers, who have been ready to target him over the Qantas brand.

The profile has also been important for Qantas, just as the airline also relies on political influence to ensure the heavy regulation of aviation which also balances unions, airports and access rights bend in the airline’s favour. Joyce’s massive profile however could work against him in the near term as him considers his next steps outside of Qantas, including possible board roles. It might be bittersweet for the airline boss, but he has few regrets.

“You put in so much of your effort. But you’re working with a great team of individuals, which is always a good thing.”

Digital divide

Anthony Albanese briefly wandered off his prepared speech at the Business Council of Australia annual dinner in Sydney on Wednesday night to express frustration at just how far behind the public service is when it comes to digitisation.

In an era where artificial intelligence can hold conversations, navigate cars, find information or do a deep dive on data analysis, much of the public service still relies on paper. Indeed the Prime Minister highlighted that to his surprise the national registration of guns was still stuck in a paper-based system.

The difference between business and government on digitisation was “night and day”, Albanese told the executives in the room. There was a lot the government could learn from business in getting its digital house in order, he added. There have been efforts to digitise the Commonwealth government going back years, but it appears ad hoc and department heads have resisted full reform for fear of giving up what technology they have. At the same time few governments have political will to undertake a fraught tech rebuild on such a scale, which will only likely benefit a different government years down the track.

The Intergenerational Report released by Treasurer Jim Chalmers highlights how digitisation is one of the big forces set to shape the Australian economy in decades to come.

While there is plenty of incentive for businesses to get moving, it offers little urgency for the government to get moving. Part of the solution to Australia’s sagging labour productivity highlighted in the Intergenerational Report is the government’s own digital transformation. This will become critical as mega-spending areas of the budget including health care, aged care and the NDIS are projected to increase as a share of GDP from 6.2 per cent this year to 10.7 per cent over the next 40 years.

Defence spending, which is set to push up to 2.3 per cent of GDP over the long term could also benefit from efficiency that digitisation promises.

Technology investment promises to make it possible to automate some of the more routine aspects of work and allows workers to produce more with less, freeing up time to focus on more complex tasks. The benefits also cascade right through the system and stand to supercharge productive interaction between public and private sector.

The NSW state government has so far led the way on digitisation of its entire public sector under former minister for digital government Victor Dominello. With the Federal and other state governments dragging their feet this is a huge productivity dividend simply being left on the table.

johnstone@theaustralian.com.au

Even Alan Joyce concedes it was a bittersweet moment as he delivered a thumping headline profit for Qantas, the same airline that was facing the prospect of running out of money in the early days of Covid-19.