Question of identity at BCA power bash

Nothing like the Business Council of Australia’s annual dinner to break off a snapshot of the nation’s corporate hierarchy, or measure the ego inflation of certain CEOs for the annals of history. It’s the same schtick each year, but Wednesday night marked a grand finale for BCA chief executive Jennifer Westacott, who worked the noisy ballroom at the Sofitel Wentworth for the last time after 12 years helming the lobby group.

Arrivals were pressed for identification, but not BHP chief executive Mike Henry, who was waved through by a fan on the desk.

“I know who you are,” they giggled at him. Not as much luck for ANZ boss Shayne Elliott, however. He was forced to fish out his ID, poor fella.

Fresh from Tuesday’s results, Henry was soon spotted in the company of Woodside’s Meg O’Neill, with nary a drink in sight. Much to discuss between them, of course, given Woodside gobbled up BHP’s energy business last year. Elliott, meanwhile, found a friend in Telstra’s Vicki Brady. Commiserating over the ACCC’s recent decision to block his purchase of Suncorp Bank?

On what was clearly one of the bigger kids’ tables, right in front of the stage, we spotted all the noted chairs grouped in formation. UBS’s Lindsay Maxsted, Qantas’s Richard Goyder, BHP’s Ken MacKenzie, Origin’s Scott Perkins, and GWS’s outgoing scallywag Tony Shepherd (a former BCA chair himself) who’s looking for a successor at the AFL club. The good word is that his replacement could even be BCA president and good mate Tim Reed. Why not keep it all in the family?

Speaking of Reed, the tieless one arranged himself a coveted seat alongside Anthony Albanese, Google Australia MD and BCA director Mel Silva, NAB chief Ross McEwan and Rohan Mead, MD of Australian Unity.

Not far was David “I give a” Gonski with former Origin chief Grant King and Transurban chair Craig Drummond. Gonski later found much to discuss with Committee for Sydney chair Michael Rose.

Always important to note who didn’t turn up, and conspicuously absent was outgoing Qantas chief Alan Joyce. We can only assume it came at Albo’s request – he does that sometimes, doesn’t he?

Jim Chalmers was clocked as a late arrival by his boss. “You’re late,” Albo chided, extending a hand. “Sir,” came the reply. “Nice to see you mate.”

The Treasurer later took a seat next to CBA’s Matt Comyn (a BCA director), Woodside’s O’Neill and ASX chief executive Helen Lofthouse, who appeared to execute some subtle lobbying of Chalmers, from what we could tell. That has to be in light of the imminent departure of Grant Lovett, the exchange’s manager of government relations. He finishes up on Friday, we’re told.

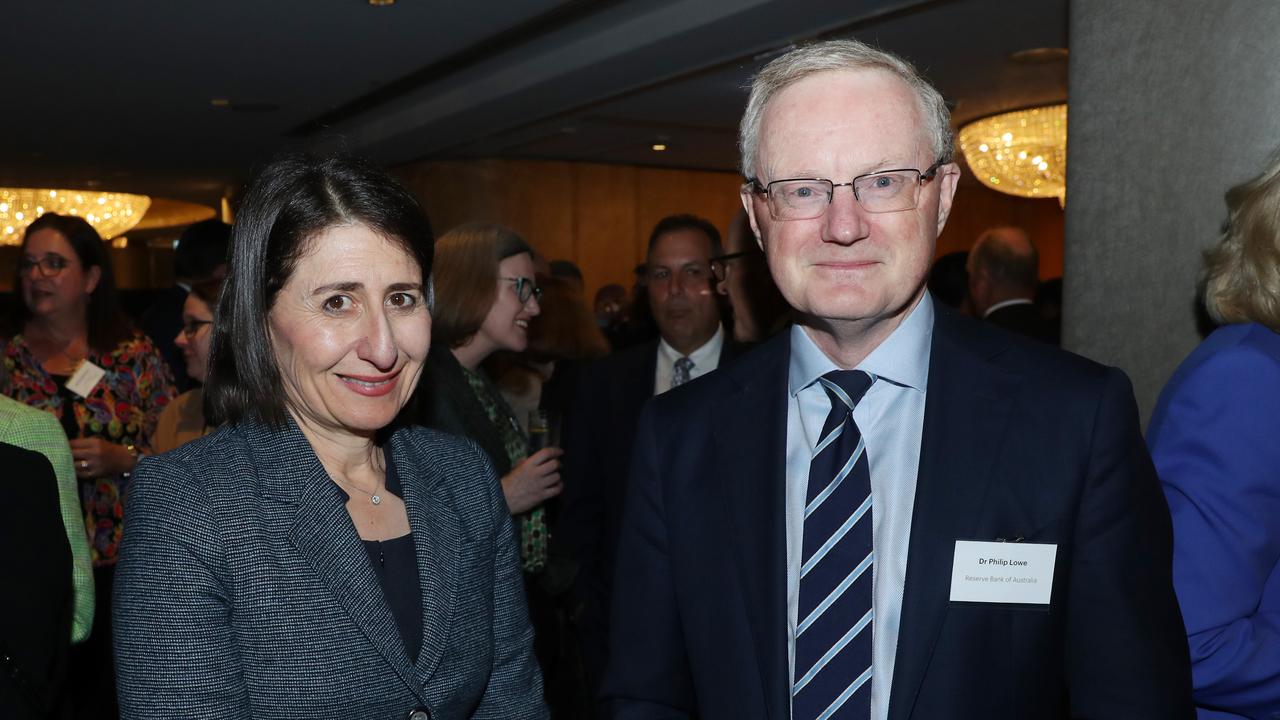

Presumably former NSW premier Gladys Berejiklian found the venue to be an auspicious location. It was here, in 2019, that she took to the podium to celebrate an election drubbing of Labor’s Michael Daley, now the NSW Attorney-General. She returned on Wednesday as an Optus executive, albeit a besmirched one. Yes, the corruption findings; we won’t go on about it, but we’re still waiting to hear if she’ll try to give that inconvenience a tickle from the top.

She didn’t look that miffed while talking to outgoing RBA governor Phil Lowe, watched on by former foreign minister Julie Bishop from the sidelines.

Bishop posed up soon after with the PM, the pair getting along most splendidly. We’re still waiting to hear if Albo will choose Bishop to be appointed our next ambassador to Paris. Everyone knows she wants it. If not, les rêves partent en fumée, as they say.

Meanwhile, former defence minister, Christopher Pyne, discarded his nametag rather early. We caught him in a bilateral dialogue with Australia-ASEAN business forum chair Francis Wong.

Given Westacott’s impending exit, it only made sense that she was seated next to her heir, Bran Black – soon to be $1m richer courtesy of the salary and perks – and Finance Minister Katy Gallagher.

The ACT senator was fresh from an afternoon behind the velvet curtains of O Bar and Dining’s Salon Privé, dropping crumbs to Labor donors on the government’s intergenerational report, due out on Thursday. It only cost those present $4000 a head.

Looks like Westacott enjoyed a long goodbye, too, judging by the lunches. She was spotted only days ago at Rockpool with former ABC chair Maurice Newman (at his table, naturally), and Newman was there last night, too, of course, yukking it up with Citi Australia CEO Mark Woodruff.

Fenton sell-off

The high-profile collapse of Melbourne designer homewares and furniture business Fenton & Fenton has forced owners Lucy Fenton and her husband Joshua Markey to begin liquidating their personal assets.

The couple have listed their designer home in Melbourne’s affluent south east with a plan to reap more than $3.1m from the divestment.

The company collapsed at the start of August. Two weeks later a caveat that had been placed over the couple’s historic pile by a Sydney-based business lender, described as a mortgagee, was withdrawn from the title.

It had been there since December 2019, well before the retail business went bust. We can only wonder if the caveat was used as security for a loan to support the business.

While the lender no longer holds security over the property, it would seem it’s mortgaged to NAB, which has also claimed $1.5m as a creditor of the defunct business.

Fenton & Fenton is now in the hands of liquidators from EY with debts of about $3.8m, about half of which is owed to customers.

The business is controlled by a company called Fentmark Investments, of which Fenton and Markey are the only directors and shareholders.

Markey has included himself as a creditor of the collapsed group, an EY report indicates he has claimed $21,559 as an employee of his own business.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout