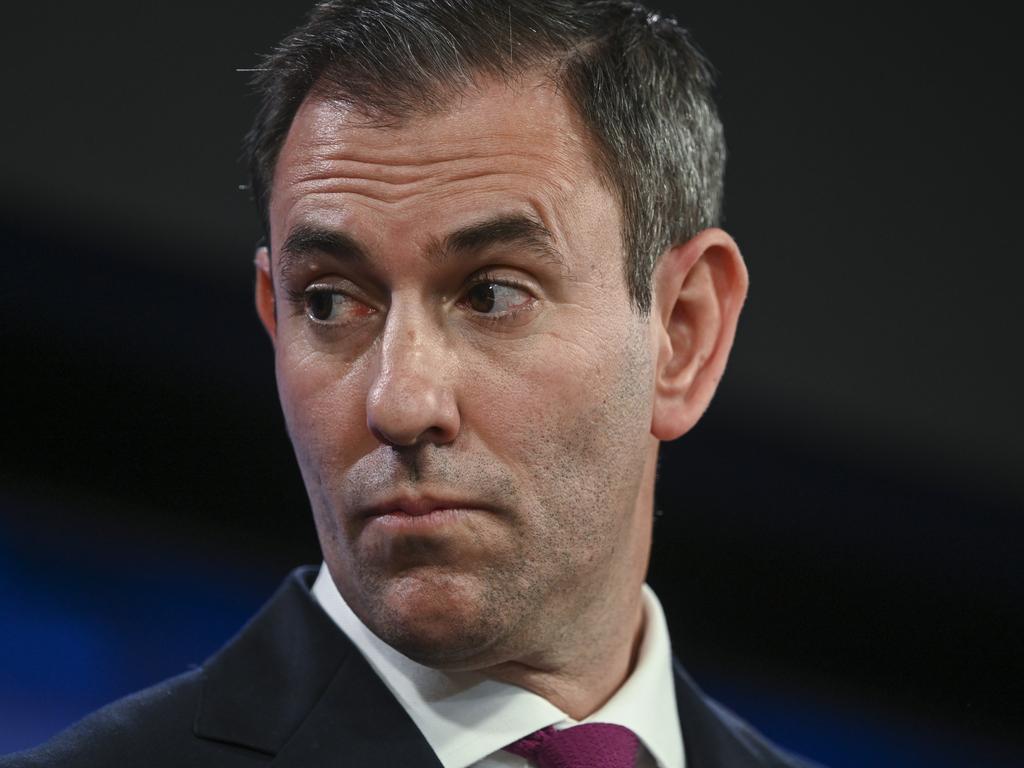

Economic reform to secure nation’s future prosperity? Pay it all forward, says Jim Chalmers

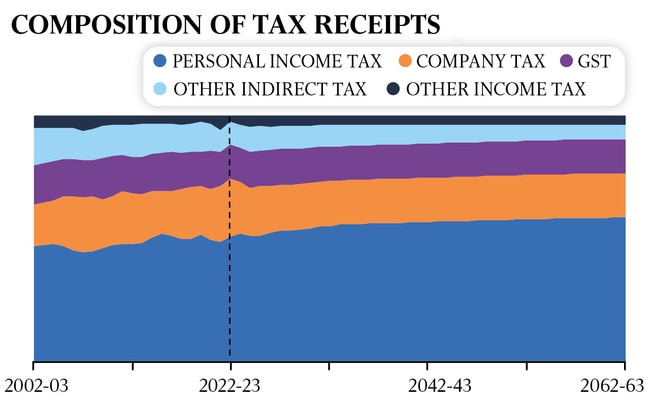

Jim Chalmers has shifted responsibility for overhauling the tax system to future governments amid warnings that personal income tax will make-up almost 60 per cent of total receipts by 2063.

Jim Chalmers has shifted responsibility for an overhaul of the tax system to future governments and defended Labor’s “big, broad, ambitious reform agenda”, amid warnings that personal income tax will make up almost 60 per cent of total receipts by 2063.

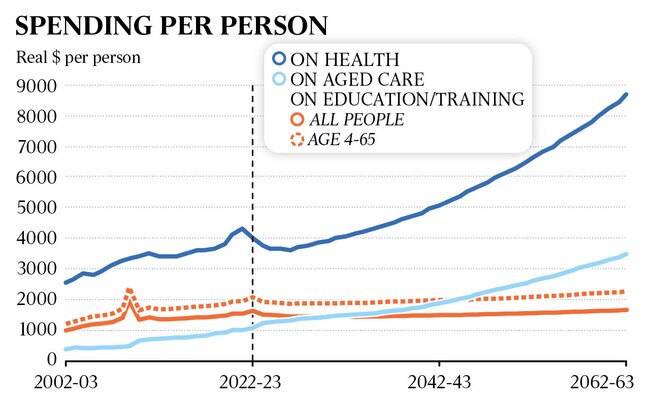

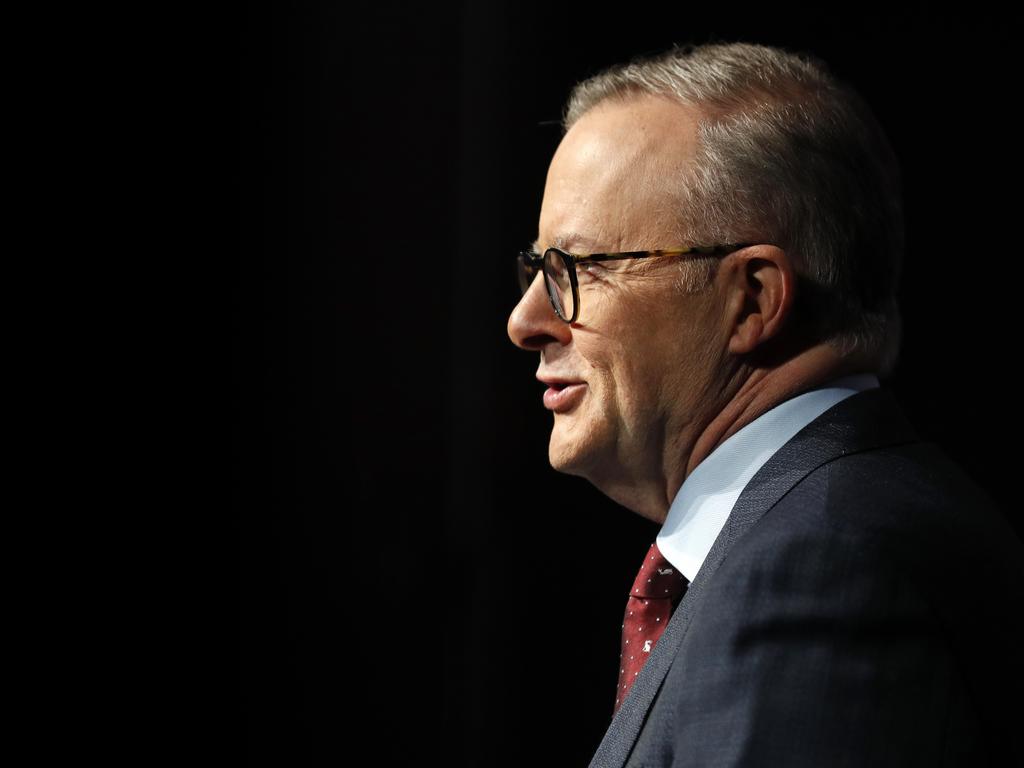

The Intergenerational Report, released on Thursday, said that without new tax measures to offset legacy revenue streams, including plunging fuel and tobacco excise, younger Australians will be hit with mammoth tax bills to fund the ballooning costs of essential services.

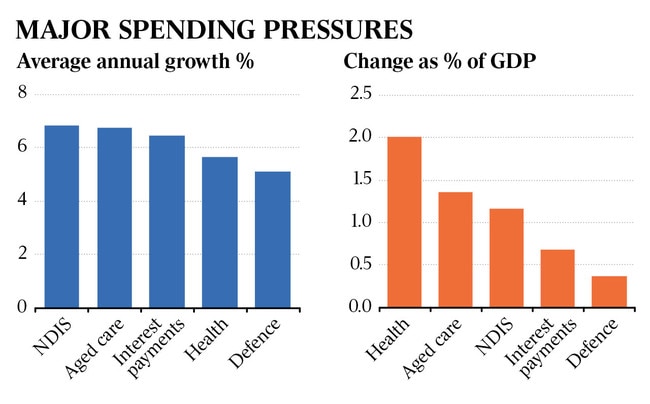

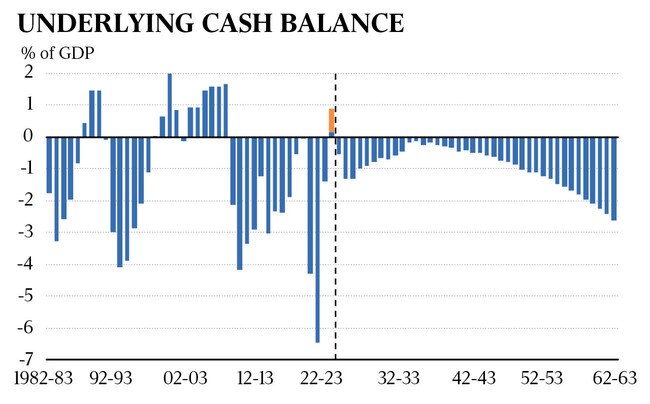

Treasury’s outlook forecasts four decades of deficits fuelled by spiralling spending pressures on the NDIS, defence, health, aged care and debt repayments, which combined will expand from one-third of all government expenses to half by 2063.

Warning of an ageing population and a growing tax burden on future generations, the Intergenerational Report downgraded real GDP growth from 2.6 to 2.2 per cent out to 2062-63 after adopting a more pessimistic productivity outlook than Josh Frydenberg’s 2021 report.

The Treasurer – under pressure from business groups, economists and the Coalition to pursue tax reforms – conceded that governments in coming years would need to take action on bracket creep, road-user charges and encouraging Australians to spend more of their superannuation.

Dr Chalmers championed Labor’s policy agenda in its first 15 months as being as bold as any other government’s since federation but resisted making immediate concessions to business leaders who wanted sweeping tax reforms and new incentives to boost productivity.

With the report forecasting a doubling in the number of over-65s and fewer workers to underwrite essential services, Dr Chalmers said the government’s employment white paper next month would focus on older workers and “how we can give them more choices”.

“We’re not contemplating a change to the pension age,” Dr Chalmers said. “But we are looking for ways to give older workers more options and more choices. More chances if they want to work rather than necessarily compelling them to work more.

“People make different decisions and maybe people in blue-collar industries have got different abilities in their 70s than people in white-collar industries.

“So, it is a major focus of ours to try to work out, in a world where there will be a smaller and smaller pool of workers, how do we encourage people to work more if they want to?”

Referencing the stage three tax cuts, which are due to commence next year and have sparked fierce debate inside Labor over whether they should be trimmed, Dr Chalmers said future governments would need to take further action on bracket creep.

“Between next year and 2063, governments … of both political persuasions will take decisions to return some or all of the bracket creep that we see in the economy, and so that number will change over time,” he said.

The Treasurer also said new road-user charges would be discussed with the states and territories over the next few years as fuel excise stalls, with more Australians shifting to electric and low-emissions vehicles. Dr Chalmers pointed to changes to the petroleum resource rent tax, high-balance superannuation tax concessions, tobacco excise and multinationals as examples of Labor’s tax reform agenda.

The Intergenerational Report shows that a doubling in the size of the $3.5 trillion retirement savings pool will ease pressure on the age pension. Spending on the pension will drop from 2.3 per cent of GDP now, to 2 per cent by 2062-63 and “contribute significantly to the sustainability of the budget”.

In response to concerns that Australians were not spending their super in retirement, Dr Chalmers said he was working with Financial Services Minister Stephen Jones on policies focused around retirement-income products. “People are more frugal than they need to be, they’re more conservative than they probably want to be because there is what the experts call this longevity risk in the superannuation system,” he said.

“Super is one of the big national advantages that we have, but it’s not perfect. We need to keep working to try and perfect it and one of the things that we will turn our mind to now … will be in that retirement phase.”

Opposition Treasury spokesman Angus Taylor said the Intergenerational Report revealed Labor’s “true plan for a big Australia with higher taxes, higher spending and deficits” for the next 40 years. “This report paints a picture of Labor’s bleak future,” Mr Taylor said. “Deficits as far as the eye can see but not a solution in sight. Australians are worried about what their lives are going to be like in 40 days not in 40 years.”

While the report forecasts decades of deficits, it reveals that gross debt to GDP is projected to be 11.3 percentage points lower in 2060-61 compared with the same year in the 2021 IGR. Treasury analysis claims that the government’s budget-repair measures are expected to lower the long-term interest burden by $440bn.

In his National Press Club speech, Dr Chalmers committed to eight reform priorities including easing the cost-of-living, getting the budget “in better nick” and capitalising on the net-zero transition.

Other reforms include “broadening and deepening our industrial base, leveraging capital and lifting investment, building a bigger and better-trained workforce, designing more efficient markets and reforming economic institutions”.

Business leaders and economists urged the government to embrace tax reform and remove productivity barriers. Australian Chamber of Commerce and Industry chief executive Andrew McKellar said the nation “must not sleepwalk into mediocrity”.

“Insipid economic growth of 2.2 per cent a year, on average, will be inadequate to meet our societal aspirations,” Mr McKellar said. “Kickstarting productivity is crucial, but equally important for Australia’s long-term prosperity is comprehensive tax reform.”

AiGroup chief executive Innes Willox said the country could not improve lagging productivity “if the government takes these productivity improvement levers off the table by rejecting the need for comprehensive tax reform”. Business Council of Australia chief executive Jennifer Westacott, who this week released the peak body’s Seize the Moment report, said the Intergenerational Report “sounded the alarm on the urgent need to grow our economy”.

KPMG chief economist Brendan Rynne said the report revealed that the “dynamics of population and evolution of business” meant current tax settings would “not be fit for purpose over (the) mid-long term”.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout