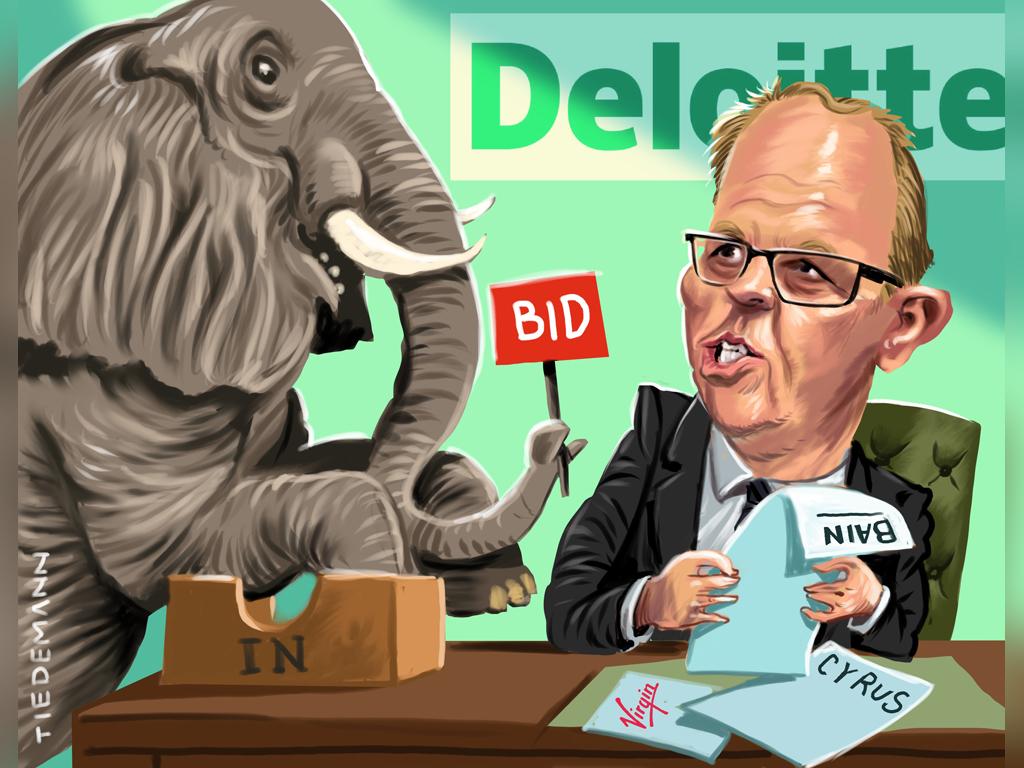

$1bn bond holder bid shakes up the Virgin sales process

The Virgin Australia sale process has been thrown into a spin by an eleventh-hour $1bn rescue proposal by its Singapore government-backed bond holders.

The Virgin Australia sale process has been thrown into a spin by an eleventh-hour $1bn rescue proposal by its Singapore government-backed bond holders which has been criticised by some unions and put fresh pressure on the administrator, Deloitte’s Vaughan Strawbridge.

Six days before Mr Strawbridge was due to the choose between US firms Bain and Cyrus as the airline’s new owners, representatives of 30-plus global institutions and 6000 mum and dad investors delivered the debt-for-equity plan to Mr Strawbridge early on Wednesday morning.

The move would keep Virgin Australia as a publicly listed company rather than, as one source close to the bond holders put it on Wednesday, see it “disappear into the opaque world of private ownership”.

Under the deal, the bond holders would provide $125m upfront to Deloitte to fund the remainder of the administration process, and a further capital injection of $800m.

Virgin Australia went into voluntary administration on April 21 owing $6.8bn to more than 15,000 creditors, including $2.1bn to bond holders.

Converting debt to equity would clear up to $3bn from Virgin’s balance sheet, putting the airline in a much stronger financial position should a second wave of COVID-19 occur.

As unions criticised the move as “disruptive with the potential to trigger a legal challenge”, the bond holders, advised by Faraday Associates and law firm Corrs Chambers Westgarth, spruiked their proposal as the best outcome for the airline, its employees and Australia.

“Our plan offers a sustainable capital structure underpinned by public ownership to provide certainty and support the strong operating plan for the airline,” a spokesman for the bond holders said. “This approach offers the fastest pathway to return Virgin to the new operating environment for Australian aviation and positions the airline to resume high-quality services to its millions of loyal Australian customers.”

The plan guarantees full employee entitlements, honours all travel credits provided by the administrator, supports the Velocity frequent flyer scheme being retained and enhanced and backs the airline remaining headquartered in Brisbane.

It allows bond holders who choose to sell their shares immediately to recover around 70c for each dollar they are owed, or they can hold on to their shares with the hope of selling at a higher price once Virgin and the global aviation sector recover from the COVID-19 pandemic.

Although the identity of the institutions involved was not made public, they include Singapore’s Broad Peak Investment Advisers backed by Singapore Airlines’ controlling shareholder Temasek, Australian fund manager Yarra Capital and wealth management firm Morgans.

It is understood the institutional bond holders who would provide fresh capital for the airline would not necessarily seek positions on the board.

A source said other global investment banks, pension funds and managed funds were also among the bond holders, who had “already showed their commitment to the airline” through their investments. The timing of the proposal — just six days before Deloitte is due to choose a winning bid — was unavoidable due to the administrator’s reluctance to give bond holders access to the data room earlier, the source added.

After they lodged an expression of interest on May 15, and an indicative bid on May 31, Deloitte “succumbed to pressure” to give bond holders’ access which allowed them to formulate their proposal.

The source said a team of 50 people including Virgin Blue co-founder Rob Sherrard and other former airline executives then did an “enormous amount of work” to finalise the recapitalisation plan.

They stressed the plan would allow management to run the airline as they saw fit, adding that bond holders were “super impressed” with the current executive team led by Paul Scurrah. As yet, the bond holders had not been able to engage with unions but the source said they expected they would see their proposal as a “breath of fresh air”.

A spokesperson for the bond holders added: “We are very keen to speak to unions and other stakeholders about our proposal to get Virgin Australia flying again when the Administration process permits those discussions. We regard the employees as the best ambassadors for the business and key to its quality service delivery.”

On Wednesday, unions were still awaiting details of the bond holders’ plan and one key association said they would be hesitant to support something they knew nothing about.

Australian Licensed Aircraft Engineers Association national secretary Steve Purvinas said the timing of the proposal appeared to be designed to “disrupt the process and potentially delay a sale”.

“If there are legal challenges as a result of this, the whole sale could fall through and more jobs will be lost,” Mr Purvinas.

The Flight Attendants Association of Australia was also concerned, having not seen “one document or had one conversation with the faceless group of bond holders”.

International division secretary Teri O’Toole, who revealed the FAAA’s support for Cyrus last week, said her position was unchanged.

ACTU president Michele O’Neil declined to comment.

Deloitte was also refusing to discuss the bond holders’ pitch on Wednesday ahead of a meeting with unions on Thursday.

Queensland government investment arm QIC, which has already struck deals with Bain and Cyrus to ensure Virgin Australia’s headquarters remain in Brisbane, is understood to be in ongoing discussions with bond holders.

The $200m being offered by QIC is conditional on jobs being retained in Brisbane.

Deputy Prime Minister Michael McCormack would not comment on the bond holders’ proposal, which has been marketed as an opportunity for Australian retail investors to retain ownership of Virgin.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout