Surprise move adds to the turbulence in airline dogfight

After two months in administration, the last thing staff want is further distractions and uncertainty.

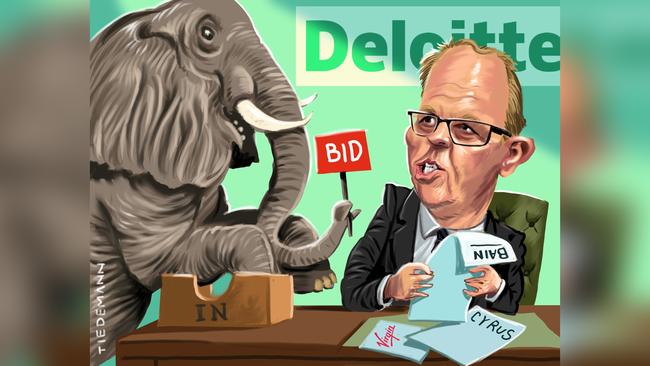

Negotiations between Deloitte’s Vaughan Strawbidge and the two shortlisted bidders, Bain Capital and Cyrus Capital, are down to the wire, with the end now in sight.

An announcement is due by June 30.

The mood among staff, who are also creditors and will hold some sway over the outcome of the second creditors’ meeting in August, was more anxious than celebratory.

To be fair, the Virgin bond holders haven’t just arrived at the scene of Virgin’s crash landing; they’ve been lurking in the background for well over a month.

They expressed interest in the airline on May 15, put in a non-binding offer at the end of May, entered the data room on June 11, and have sat through presentations by Virgin management.

The amorphous group, comprising 6000 overwhelmingly Australian retail investors and 30 institutions with about $11 trillion under management, are owed $2.1bn.

They also happen to be the effective owners of Virgin now that the equity is worthless.

In a nutshell, the plan is to engineer a debt-for-equity swap, inject about $800m to get Virgin ready for takeoff, a further $125m to tide it over until the creditors’ meeting, and then pay creditors a handsome 70c in the dollar compared to the debt’s secondary market value of about 10c.

Then, hey presto, Virgin will resume its place on the ASX, worth $1.4bn.

But not everyone is convinced.

One of the problems with the deed of company arrangement process chosen by Deloitte to sell Virgin is its vulnerability to leverage exerted at the creditors’ meeting.

The bond holders might scoff, but if they can fan enough uncertainty about the meeting’s outcome, that’s leverage to use against a rival Virgin bidder to inflate the value of your debt.

Some Virgin debt holders reckon it’s a crazy time to sell an airline in the middle of a global pandemic, when conditions are worse than the aftermath of the September 11, 2001 terrorist attacks.

Given that most of them have invested for about five years, why not give them the choice of when to exit?

The first opportunity would be the Virgin IPO, or they could back the current Virgin management team to turn the airline’s fortunes around, hopefully in a much less hostile operating environment.

The team pulled together by the bond holders, which includes Rob Sherrard who was one of the main architects of the airline’s original Virgin Blue incarnation, suggests that they are in for the longer haul — not just for a quick buck through greenmail.

Sherrard hatched the plan for Australia’s second national carrier with Brett Godfrey, then a junior finance manager at Virgin Atlantic, in a West London pub during the 1993 Ashes series.

They took the concept to Richard Branson, who agreed to provide $10m in seed capital and a $15m loan to fund the discount airline.

Climate challenge

The Business Council of Australia’s submission to the Morrison government’s low-emissions investment road map is a sad reflection of Canberra’s climate-policy vacuum.

To its credit, the BCA affirms its support for the science of climate change, and the need to limit global warming to less than two degrees by transitioning to net zero emissions before 2050.

The submission even backs a price on carbon to “drive the transition and incentivise investment in low and no-emissions technology”.

However, while some BCA members applaud the lobby group’s own transition to science-based policy, they also know that Canberra is a lost cause.

In the same way, they’ll continue to argue for corporate tax cuts, knowing that it’s toxic in the current political environment.

Submissions on the Technology Investment Roadmap discussion paper closed last Sunday on June 21.

Some companies complained that they got a copy of the BCA draft submission last Thursday and were asked for their contribution on one of the most complex policy issues imaginable by the close of business on Friday.

The truth is that the BCA organised a policy roundtable on June 11, which just goes to show that climate change is capable of creating division on anything.

The discussion paper, released last May, proposes a framework to accelerate low-emissions technologies.

Its biggest flaw, as expected, is that it doesn’t put forward any emissions reduction targets, let alone how to achieve them.

The BCA submission was never going to re-litigate the climate wars. It accepts that technology has to drive the transition to net zero emissions, but also create “new job opportunities and industries and maintain Australia’s competitiveness”.

Appearing before parliament yesterday, BCA president Tim Reed said there was a role for gas to play, but it would diminish over time as the nation moved to cleaner energy sources like renewables and pumped hydro.

“We believe that we should be technology-agnostic in the investment decisions that we’re making but that those investment decisions need to be made with the long-term view to being net zero by 2050,” Reed said.

Separately, an APRA program to assess the vulnerability of the financial sector to climate risk has officially been put on the backburner, as all regulators prioritise their COVID-19 responses.

The Australian Prudential Regulation Authority’s plan was to design the vulnerability assessment this year and roll it out in 2021, starting with the banks and spreading to other industries.

While the development of the program has been paused, the rollout is still likely to occur next year, with some kind of announcement likely before September 30.

Entities will be asked to estimate the physical impact of the changing climate, including weather events, on their balance sheets, along with the transition risks to a low-carbon economy.

The timing was meant to chime with similar efforts by offshore regulators, with the results to be analysed with the Reserve Bank and co-ordinated with the Australian Securities & Investments Commission through the Council of Financial Regulators.

Input would also come from the CSIRO and the Bureau of Meteorology. The undertaking was high on the regulatory agenda, but everything pales compared to the coronavirus.

There was no mention of the program’s deferral in a CoFR release on Wednesday concerning its scheduled quarterly meeting on June 19.

While economic activity was beginning to recover in some sectors, the CoFR said the pandemic was likely to have “long-lasting” effects in Australia and overseas.

Council members, including the RBA, APRA, ASIC and the Treasury, also discussed support measures, including temporary loan repayment deferrals, which begin to unwind in September.

Separately, APRA is negotiating with the banks to extend the loan deferrals in return for capital relief so repayment holidays are not treated as a period of arrears.

“Members agreed that financial institutions, regulators and governments will need to continue to show flexibility in order to support the objectives of economic recovery, resilience of financial institutions, and fair household and business outcomes,” the CoFR said.

gluyasr@theaustralian.com.au Twitter: @gluyasr

If you think 9000 Virgin Australia employees were high-fiving on news that a third bidder for the collapsed airline had joined the fray on Wednesday, you’d be well wide of the mark.