Analysts put Woolworths in the bargain bin

Woolworths has faced a slew of revised profit forecasts from analysts in the wake of its trading update on Tuesday.

Woolworths has faced a slew of revised profit forecasts from analysts in the wake of its trading update on Tuesday, which revealed a blowout in one-off costs to almost $600m, with investors questioning the retailer’s struggling profitability in the face of booming grocery sales.

The new pre-tax earnings guidance provided by Woolworths of $3.2bn to $3.25bn was less than a consensus forecast leading into the trading update of about $3.32bn, and as much as 5 per cent below some analyst estimates as concerns were raised over Woolworths’ failure to gain profit leverage from its investments in capital expenditure.

That capex bill will only grow further with Woolworths announcing this week a plan to build two automated distribution centres in Sydney, costing as much as $780m.

Woolworths also revealed its underpaid wages bill had now blown out to $500m, including interest and costs, while its hotels arm would see earnings fall as much as $200m due to the mass shutdowns of pubs caused by the coronavirus pandemic.

Goldman Sachs analyst Andrew McLennan revised his net profit forecasts downward by 6.4 per cent for 2020 and down by 0.8 per cent in fiscal 2021 as well as lowering the share price target to $35.90.

“Woolworths provided a mixed trading update, highlighting strong ongoing sales trends across all divisions (except for hotels) over the fourth quarter, but more than offset by significant cost increases associated with COVID response and what looks to be a weaker underlying performance in food, potentially due to channel impacts (stronger online, weaker metro were noted by management) and higher than anticipated labour costs,’’ Mr McLennan said.

He echoed comments by other analysts in regards to the return on investment Woolworths could get from the new automated distribution centres, which will cost $700m to $780m and are expected to be completed by the end of 2023, with initial benefits expected to be realised in the 2025 financial year.

Coles is investing as much as $1bn in its own automated warehouses.

“While supportive for long term competitiveness, the site is expected to open at around the same time as rival Coles’ NSW and Queensland automated distribution centres, suggesting the benefits to Woolworths may be more about maintaining competitiveness in a dynamic sector rather than generating increased returns,” he said. Morgan Stanley analyst Niraj Shah has reduced his estimated fiscal 2020 EBIT target by 5 per cent, and by 2 per cent from 2021 to 2022.

He noted in his report to clients that “leverage appears elusive given significant cost growth”.

Morgan Stanley has a price target for Woolworths of $36.

“Sales stronger, but profit disappoints. When will the operating leverage come through?” asked UBS analyst Aryan Norozi, who expects Woolworths earnings to fall 5 to 6 per cent between 2020 and 2022. However, UBS believes Woolworths will emerge from the pandemic in a stronger position and has maintained a buy recommendation on the stock.

“While one or two quarters of heightened sales and cost of doing business are not material to the valuations of listed grocers, we believe Woolworths will exit COVID-19 stronger, with higher share, richer data and an opportunity to expand share of customer wallets long term.”

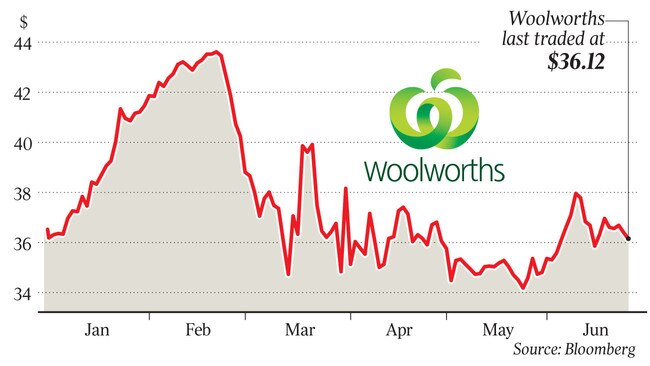

Shares in Woolworths ended down 26c at $36.12.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout