Singapore Inc involved in late play for Virgin

The 11th-hour deal lobbed on Wednesday morning by Virgin’s $2 billion bond holders increases the likelihood of Singapore Inc playing a role in a revived Virgin 2.0 in one way or another.

The 11th-hour deal lobbed on Wednesday morning by Virgin’s $2bn bond holders increases the likelihood of Singapore Inc playing a role in a revived Virgin 2.0 in one way or another.

Singapore Airlines has had a longstanding interest in Australia and was a 19.9 per cent shareholder in Virgin before it went into COVID-forced administration on April 21.

The airline, which sees itself as a direct and fierce competitor with Qantas, also launched a direct flight from Singapore to Canberra in early 2018, which was only suspended this year in the face of COVID travel restrictions.

One of the funds leading the recapitalisation proposal being put forward by the bondholders — details of which have been leaked but not formally been made public — is Singapore-based hedge fund Broad Peak Investment Advisers.

Founded in 2007 by two former employees of Goldman Sachs, Broad Peak is backed by Singapore’s $340bn sovereign wealth fund, Temasek.

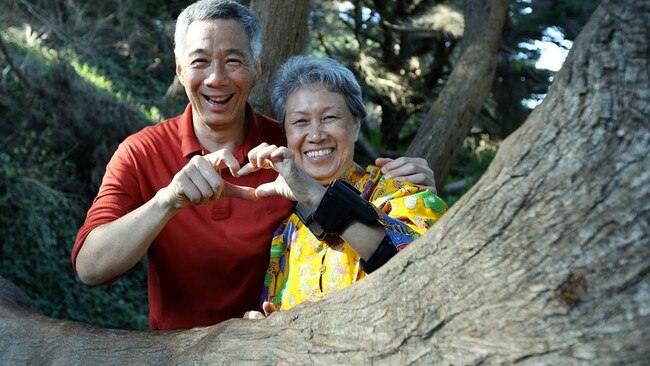

Run by Ho Ching, the wife of Singapore’s Prime Minister Lee Hisen Loong, the son of the founder of modern Singapore, the late Lee Kwan Yew, Temasek has had longstanding investments in Australia including through Optus.

Broad Peak could provide some of the financial fire power needed to make the bond holders recapitalisation plan a credible option in the face of two serious bids by New York-based hedge fund Cyrus and Bain Capital.

The bond holders are not saying how much exposure Broad Peak has to Virgin. But the Singapore fund has been a long standing supporter of the current Virgin management and plans by chief executive Paul Scurrah to turn a good airline into a profitable airline. It is not out of the question that if Broad Peak becomes a player in the future of Virgin that Singapore Inc or even Singapore Airlines could come back into the picture.

A major Asian-based investor fund, Broad Peak has had a longstanding interest in Australia.

It has been a shareholder in infant formula company Bellamy’s and equipment group Coates Hire. It has also been involved in other significant deals including media group PBL, toll road company BrisConnections and radiology company I-Med.

Broad Peak is seen as a fund with a broad and long- term interest in Australia.

There are strong ties between Broad Peak and Temasek.

One of the managing directors at Broad Peak is Chwee Mein Yap, who worked as managing director of investments for Temasek from 2004 to 2011.

His earlier experiences included being an accountant with Changi International Airport Services.

Temasek has been a co-investor in other deals with former bidder for Virgin, BGH Capital which was considered a strong contender to own the airline early on in the process.

Singapore Inc could also get a look into the future of Virgin through another bidder, Cyrus.

In an interview with the Australian newspaper two weeks ago, Cyrus adviser Jonathan Peachey, a former senior executive of the Virgin group, did not rule out the idea of Singapore Airlines becoming a financial backer of the Cyrus bid. Cyrus has established connections with Richard Branson and his Virgin group, which was an investor alongside Singapore Airlines in Virgin.

Sir Richard is expected to take an interest in whichever party is chosen to buy Virgin. Teaming up with Singapore Airlines for its combination of finance, aviation expertise and global airline connections would be a logical move for Cyrus if it were to run Virgin.

“Cyrus is prepared to finance the bid itself,” he told The Australian when asked if it was talking to other potential investors in Virgin, including Singapore Airlines.

“We have the funds available to do that,” he said.

“That said, there is a lot of interest in participating (in the deal) and we are in discussions with several sources of capital about playing a part in the business. We are very focused on the shareholder relationships being very functional and very like minded.

“To the extent that we bring partners into the deal, it is very important to Cyrus that those partners are like minded, that they share our vision for the business, which — by the way — is very aligned with management’s vision for the business.

“It is important for us that they are also prepared to take a long-term view and that they are able to bring value to the table.”

That would describe Singapore Airlines and it would also describe Temasek and Singapore Inc — as well as Broad Peak.

Singapore Inc has a much broader interest in and exposure to Australia than most Australians realise. Singapore is a small wealthy island with capital invested in the region and a strong interest in aviation and investment ties with Australia.

So don’t be surprised if Singapore Airlines/Temasek emerges as a key player in the future of Virgin over the next six weeks.