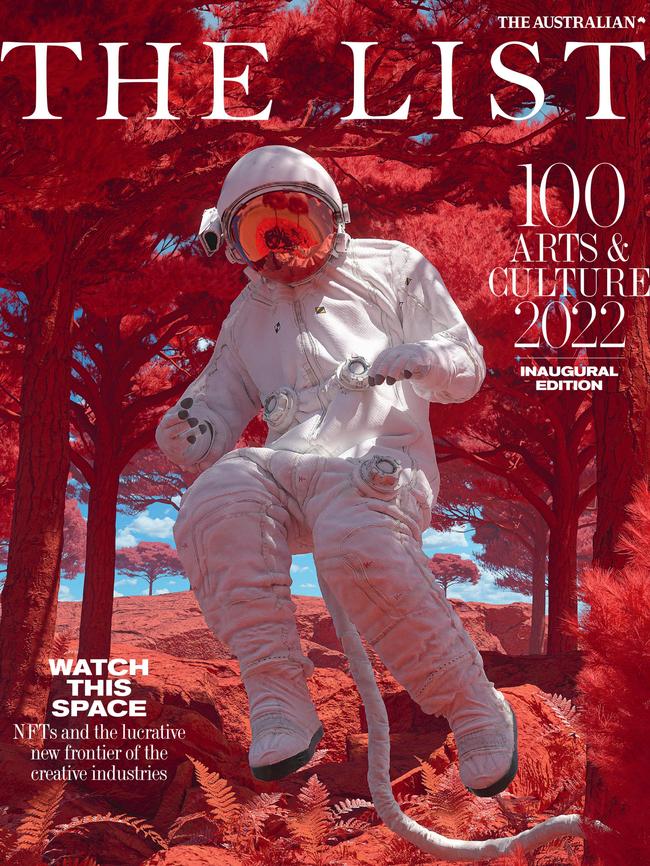

Chain reaction as artists ride the crypto wave

From Arnhem Land to capital cities, artists are embracing technology in new and inventive ways. But does digital art live up to the hype and hefty price tags?

Early last year, with the wet season bearing down on the stringybarks, a note of puzzlement passed through the community of artists who lived and worked on the far northern edge of Arnhem Land.

Word had reached them about a new form of expression taking hold around the world. The images on their screens might have seemed curiously infantile – digital cats, cartoon apes, pixelated faces – but the technology itself was intriguing. And so, like many other artists around the world, the Aboriginal artists of Buku-Larrnggay Mulka Centre started to pay closer attention, lured by the creative potential of this strange digital phenomenon as well as the surge of interest among collectors and evangelists alike.

It was around this time that Mr W. Wanambi, a Yirrkala artist best known for his work on bark and memorial poles, came across the three letters that were energising certain parts of the art world. NFTs were still a relatively niche concern, but Wanambi wanted to know more. As the cultural director of the Mulka Project, a digital archive at Yirrkala, Wanambi played a leadership role in the creative development of his community. He saw an opportunity to promote his art and to raise money for the art centre. “Wow, that’s interesting,” he thought. “Let’s try it.”

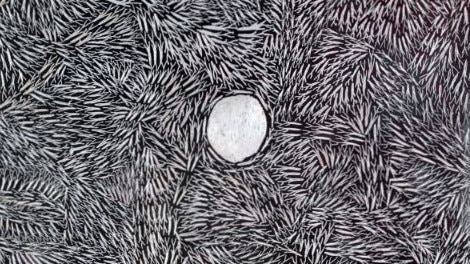

Within months, Wanambi had launched a series of NFTs with the support of the Sydney-based venture capitalist and blockchain enthusiast Mark Carnegie. His series was developed from a detailed scan of one of his bark paintings, Wawurritjpal, from which he created 81 individual offerings like high-tech jigsaw pieces. Carnegie’s funding also extended to a second Yolngu artist, Ishmael Marika, who made NFTs from hand-drawn generative animations based on sacred saltwater songlines.

As Wanambi saw it, this experiment (and it is very much a pilot project) simply represented another way to support his community. The plan was clear: funds raised from these NFTs would be used to acquire the original, physical artwork for the collection at Yirrkala. But for all the claims that have been made about the transformative power of the crypto world – the influential American tech investor Cathie Wood has said “This is how I felt when the internet first came about” – the artist was calm about the moment before him. Marshall McLuhan be damned: the message, not the medium, remains key.

ARTS & CULTURE 100

‘Who will stand up for the arts?’ Ben Quilty

Australia must now recognise the depth of talent in its midst and celebrate a new generation of cultural leaders.

Shape shifter and a captivating artist

When artist Ramesh Mario Nithiyendran couldn’t see himself reflected in any corner of the art world, he decided to create his own niche.

The kid’s all right: a stellar rapper stays grounded

At 18, Australian rapper The Kid Laroi is a global superstar in his field. So where did he come from, and where to next?

Chain reaction as artists ride the crypto wave

From Arnhem Land to capital cities, artists are embracing technology in new and inventive ways. But does digital art live up to the hype and hefty price tags?

What’s the point of art?

What’s the point of art? Perhaps Jackson Pollock said it best: ‘Art is coming face to face with yourself.’

How Baker Boy took hip-hop across the divide

As homegrown hip-hop has gained traction, standout Indigenous performer Baker Boy is about unifying black and white Australia.

What celebrated novelist Hannah Kent did next

Acclaimed South Australian novelist Hannah Kent explains why her creative leap into screenwriting was so nerve-wracking.

Aussiewood draws on a deep talent pool

There’s a story behind Aussiewood and why our homegrown stars and local industry play well on screens big and small around the world.

Star turn: from bricklayer’s son to principal artist

Prodded into taking dance lessons at an early age, Callum Linnane tapped into the passion that has elevated him to the ranks of ballet’s most exciting performers.

Arts rainmakers see more ways to source funds

Arts philanthropy has embraced the digital age, with the constraints of the pandemic spawning new schemes to buttress the cultural bottom line.

Out of the wings comes a strong, diverse cast

Asian-Australians make up a fair portion of our population and that fact is finally being reflected on stage and screen.

The new temples of the arts

There’s a cultural building expansion under way, with fresh galleries and facilities in which to experience modern visions of the world.

It’s ‘look at moi’ as local drama has a moment

Streaming television services are investing heavily in Australian stories, and audiences can’t get enough.

Curtain call: ‘How lucky are we?’

Australia’s musical theatre is booming and seeking to make up for time lost in the pandemic.

Key change as the show goes on, again

After a livelihood-destroying two-year hiatus, the live-music industry is joyfully finding its feet again, much to the delight of audiences.

Artist’s Vivid example of making a mark

The gods must be smiling on Sydney artist Ramesh Mario Nithiyendran, a Sri Lankan migrant whose riotously colourful sculptures have captured the public’s imagination.

Close-up: the system finds its stars

Who will be our next Cate Blanchett or Russell Crowe? There must be something in the water, as talented young Australians are taking over the stage and screen.

Arts & Culture list: our panel

We put together an expert panel of journalists to compile the inaugural list of 100 game changers in the arts. Learn more about the panel.

Wanambi’s own story came to an end earlier this month when the artist died in Darwin, aged 59. Just a few weeks before his passing, he found himself reflecting on the way Yolngu stories would carry through regardless of whether an artist chooses to express themselves on bark, or recycled metals, or a church panel, or in a digital form that requires a particular kind of currency for a sale.

“It doesn’t matter,” Wanambi said. “It’s just how you’re presenting ideas to the world. It’s all about communicating, and the songlines are all tied in one part, so it doesn’t matter how you put it. It’s good to share in a different way, in a different method. The better way you’re presenting it, the better way the wider world can understand.”

But let’s pause for a moment. It’s easy to be swept away on the crypto wave, lost in jargon and the dreams of frontier technology. Only recently, as we can see from Arnhem Land, has the broader art world been dipping a toe into these waters with any serious intent. But artists of all stripes have been experimenting with advances in technology for as long as technology has been advancing, searching for new connections, new audiences, new platforms for creativity.

Now, if you listen to those in the know, we’re entering a new phase of the internet called Web 3.0, which is when decentralisation comes to the fore. Hence the appeal of blockchains and NFTs.

[In] trading with cryptocurrencies, proof of ownership is secure. It’s probably easier to steal a painting from a gallery than a blockchain-traded NFT

Artists are adjusting to disruption in countless ways. Streaming has changed the game for film and TV. Social media, as we have seen from TikTok stars such as Mary McGillivray, has opened up fresh channels for communication. An awkward new word, “phygital”, reflects the fusion of physical and digital experiences, and artists are active in that space, too.

Musicians, having seen their earnings fall alongside the rise of giants such as Spotify, have turned to platforms such as Patreon, which helps them forge a closer relationship with their fans. Patreon, launched by YouTube musician Jack Conte in 2013, allows musicians and others to charge subscribers to access their content. Fans can sign up for everything from new music to merchandise, live tickets, even a meal with their favourite band. The company is valued at $4 billion, its success due in part to the so-called creator economy thriving during the pandemic.

Writers, too, have more options than ever as publishing models fragment. “I’m restless for new forms of writing,” wrote Nikki Gemmell recently, and she’s one of many looking for different ways to tell stories. Salman Rushdie is a high-profile example, having turned to Substack, the online newsletter platform on which he is releasing essays and fiction. Other Substack writers include Chuck Palahniuk, George Saunders and Patti Smith, who told Variety in March about the “positive pressure” from subscribers. “It’s sharpening my skills and my work ethic, too.”

Of course, a good story is a good story, regardless of the delivery service. Midnight’s Children could have been serialised on Twitter (if the bird existed in 1981) and Rushdie’s novel still would have been a masterpiece.

There’s no question, though, that with billions of dollars at stake, and no shortage of hype, the crypto market stands apart. Naturally, the appeal goes well beyond visual art: the lucrative gaming industry has embraced this future faster than most.

A Sydney startup called Immutable, founded four years ago by Robbie Ferguson and his brother James, was recently valued at $2.5 billion following its latest funding round. Investors are impressed by the company’s promise to revolutionise the gaming experience with blockchain technology. In February the company signed a deal with GameStop, the American retailer, to build an NFT marketplace and establish a $100 million fund for developers. In case there was any doubt, NFTs are big business.

But a little history, for those who are still wondering WTF is going on. First, the acronym. NFT stands for non-fungible token, which means a unique, tradeable digital asset. That asset could be an image, a video, an animation with music attached. Ownership of that asset is guaranteed through interconnected, decentralised networks known as blockchains.

You might wonder how you can own a digital artwork when the file can be copied with a simple keystroke, but consider a real-world example. If you have a poster of Les Demoiselles d’Avignon on your wall, this doesn’t change the fact that Picasso’s actual painting remains part of the Museum of Modern Art collection in New York. So it is with NFTs.

One local industry figure uses a simpler example: “If I handed you a pencil, we can see that you hold the pencil and I don’t. But if I sent you a picture of the pencil, you can’t tell if I kept a copy for myself. NFTs mean there’s only one digital pencil to pass on.”

Provenance is a serious issue for art professionals, and NFTs offer a potential solution. By using blockchain technology, trading with cryptocurrencies such as Bitcoin or Ethereum, proof of ownership is secure. It’s probably easier to steal a painting from a gallery than a blockchain-traded NFT.

At this point the cynic might object to the use of Picasso in the same breath as an NFT. British critic Waldemar Januszczak has written about how “a bored generation of nouveau riche collectors, with holes where knowledge and taste should be, had discovered a fresh video game: bidding for art”. Even more strident was The Guardian’s Jonathan Jones, who focused on the endless talk of money: “NFTs are not good for art.”

Much of this cynicism relates to the people involved, the quality of the art produced and the mountains of money being spent. Paris Hilton is a prominent collector, but whether her name inspires confidence among wealthy Manhattan patrons is another matter. Early NFT successes include the Bored Ape Yacht Club collection, whose buyers ranged from Eminem to Madonna, and computer-generated avatars known as CryptoPunks. NFTs were growing in popularity but still stood at some remove from more mainstream cultural networks.

Then came the event that forced the art world to pay attention. In March 2021, a digital collage by Mike Winkelmann, a graphic designer from South Carolina known as Beeple, sold at Christie’s for $US69.3 million. The auction house, sniffing the wind, accepted payment in Ethereum for the first time.

The result put Beeple in elevated company, as he secured the third-highest price for the work of a living artist behind Jeff Koons and David Hockney. Christie’s later auctioned another Beeple work – a hybrid, part digital and part physical – for almost $29 million.

Mainstream artists quickly came to the party, among them Damien Hirst and Urs Fischer.

As well as the Yolngu artists of Arnhem Land, other Australians exploring the boundaries of NFT include Reko Rennie and Serwah Attafuah, two young talents who work across multiple disciplines.

Last month, Sotheby’s auction house in Hong Kong sold an NFT collaboration between Raoul Marks, an Australian filmmaker and two-time Emmy winner, and contemporary Chinese painter Jia Aili. It sold for $HKD 3.276 million, and represented what Marks called an “important step towards traditional and NFT art worlds coming together”.

For his part, Winkelmann is well aware of Beeple’s reputation in traditional art circles. In a recent interview with The Washington Post, he said he was trying to expand the possibilities of what art can be: “I feel like the pretentiousness level in the art world is so high that I literally would not even want to be called an artist.”

The fine-art market is still in its infancy when it comes to NFTs, and more education is needed to bring these worlds closer together. “A lot of the time you’ll find platforms deep in the crypto space who don’t know much about the art world, and vice versa,” says Michelle Grey, chief executive of the Australian agency Culture Vault. The curated NFT platform launched in February is designed to bridge the gap between the traditional art world and the crypto community. It brings together artists to explore blockchain technology, including Rennie and Attafuah.

Digital art, as Grey points out, is not itself new. The innovation centres on the new way to authenticate and trade it. When Winkelmann started out as Beeple, his ambition was as much about building a crypto-community as creating art. As for the sceptics, Grey encourages people to consider the amount of good art and bad art in the physical world also. Crypto doesn’t have a monopoly on mediocrity. It’s also a matter of taste. Some people might prefer sculptures to painting, digital art to sound art.

Grey says NFTs deserve a fair hearing. “They get a bad rap because the whole point of decentralisation and being online is that it’s available for everyone to see. In this space you can see it all together.”

Museums have been responding with various levels of urgency. Some Italian institutions, as well as Russia’s Hermitage Museum, have sold NFT reproductions of masterpieces by the likes of Caravaggio, Raphael, Monet and Van Gogh – essentially limited-edition digital postcards to raise money. The British Museum, too, launched a partnership with a French startup to sell limited digital copies of Hokusai, Turner and others. Beyond that, directors don’t seem in any rush to acquire multimillion-dollar NFTs for their collections.

Suzanne Cotter, the new director of Sydney’s Museum of Contemporary Art, is happy to wait and see how it all unfolds. While encyclopaedic museums will inevitably begin collecting in this space, the MCA is unlikely to be the first.

Cotter sees NFTs as occupying a similar space to limited editions and artist proofs, but acknowledges that the technology is still evolving. “I would err more on the side of caution,” she says. “I think there’s a lot to work out.”

There will always be breathless activity on secondary markets, with cashed-up investors racing to keep pace with the latest cultural trends, but Cotter says those results might as well be taking place on another world for all their relevance to daily operations.

“I think it’s such a different realm and we just have to separate ourselves and see things for what they are,” she says, adding that there may yet be a place for NFTs in major collections. The momentum, as ever, will come down to the artists themselves.

“I’m not panicked by it but I don’t think we should ignore it,” she says. “We just need to remain open to and curious about the way artists are working.”