Liquidator’s report exposes extent of Australian airline Bonza’s debt

The unnerving amount of debt in an Australian company has been revealed, with allegations it traded while being tens of millions in the red.

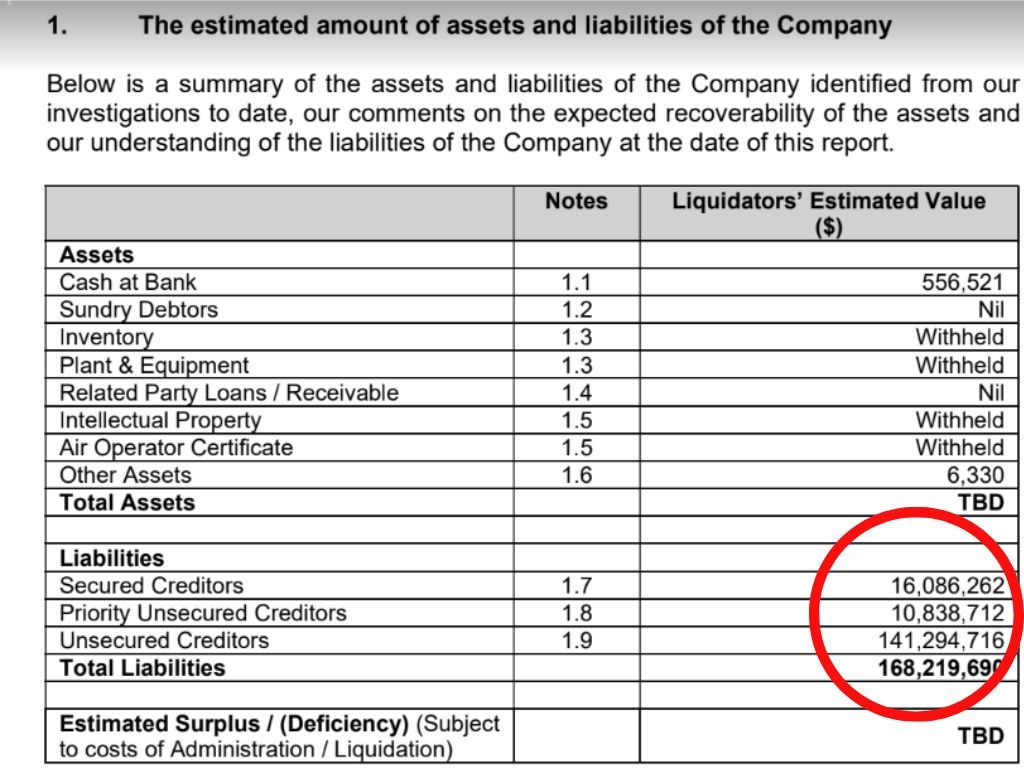

Liquidators have revealed the full extent of collapsed airline Bonza’s mountain of debt, with a damning new report showing almost $170 million is owed to creditors — while customers have been left millions of dollars out of pocket.

Earlier this year, news.com.au reported that Bonza had abruptly stopped flights, leaving both passengers and employees in the lurch, and ultimately collapsing into liquidation one month after appointing administrators in April.

At the time, the appointed administrator Hall Chadwick scrambled to determine whether Bonza could emerge from administration and re-enter the skies, but after weeks of seeking a bailout — administrators did not receive any binding offers for the embattled airline.

In mid-June, the insolvency firm terminated hundreds of Bonza workers and officially cancelled all future flights. At the time, Australia’s Transport Workers Union suggested around $10 million would be owed to employees — but that figure has ballooned to almost $17m.

The new report, viewed by news.com.au, suggests a staggering $168.2 million is owed to creditors, with liquidators able to recover just $556,000 from the Bonza’s pre-appointment bank accounts. It is understood no further funds will likely be recovered, suggesting creditors, including 323 staff and more than tens of thousands of customers, may walk away with nothing.

News.com.au has contacted Hall Chadwick for comment.

As outlined in the October report, the administrators from Hall Chadwick backed initial claims made in their June report that Bonza potentially traded while insolvent, however, this has not been confirmed amid further investigations.

Hall Chadwick’s initial 129-page creditors report from June, highlighted major flaws in the aviation business.

This allegation, which Hall Chadwick said remained under investigation in their latest report dated October 2, said that Bonza had “significant” solvency and operational concerns.

Hall Chadwick identified four main areas requiring further investigation, being ‘failure to exercise reasonable care and diligence in discharge of director’s duties’, ‘failure to act in good faith’, ‘improper use of position to gain an advantage’ and ‘improper use of information’.

The administrators said they will continue conducting investigations to determine if there is any evidence to sustain the allegation of a possible breach of Section 588G of the Act by the Directors and holding company, by allowing the Company to trade while insolvent.

“We will continue our investigations with respect to insolvent trading and voidable transactions and pursue applicable recovery actions.”

The administrators declared on July 25 of this year, that “demands” were issued to directors with respect to the claims arising from alleged insolvent trading and breaches of directors duties.

“To date, we have not received any substantial responses from the Directors or Daedalus to the demands,” the report read.

Bonza never turned a profit and reported a loss of $80 million this financial year on top of a $50 million loss last financial year. It is understood the airline owes the tax office about $2 million, the ABC reported.

Bonza was back by Miami-based firm 777 Partners, with the airline not taking to the skies until February 2023 after an initial launch date in June 2022.

The airline spiralled in April this year, just over one year from the carrier’s first flight, with aviation experts citing multiple hurdles leading to the airline’s ultimate collapse.

For one, Bonza did not compete in the Brisbane-Sydney-Melbourne market or what the aviation industry refers to as Australia’s “Golden Triangle”.

This meant the company lost out on the airline market’s most concentrated money pot.

“The Golden Triangle is so important because this is where most of the action happens and where the money is being made,” Professor Rico Merkert, deputy director at the Institute of Transport and Logistics Studies at the University of Sydney Business School, told NewsWire.

“In terms of seats, both Sydney to Melbourne and Sydney to Brisbane are in the top 10 of the busiest routes globally and when measured in revenues generated, Sydney to Melbourne is typically among the top three in the world and was No. 1 in 2023 in front of London to New York.

Virgin co-founder Brett Godfrey told ABC’s Four Corners the airline — and the company’s business plan — was a doomed idea from the start.

“If Qantas or Virgin thought it was a great idea to fly 180-seat aeroplanes between Maroochydore and Cairns, well, they probably would’ve done it. There just wasn’t the market there,” he said.

“It was economic suicide from the outset.”