‘Sickening’: Family lost $1.1m in huge scam

Cyndy’s family lost $1.1 million to scammers. But she was shocked to uncover how Australia’s big four banks had facilitated the crime.

Scammers have been given a front door to people’s life savings through complacent social media platforms, such as Meta, and telcos.

Latest figures show Aussies had $2.7 billion stolen from them in one year alone.

A news.com.au special investigation has found in most cases the scammers could have been stopped.

The federal government’s proposed Scam Prevention Framework does not go far enough. Scam victims will remain out of pocket and unprotected, and in many cases left devastated.

One of the major issues for Australians is that obligations for refunds are ambiguous and inconsistent across the financial sector.

In October 2024, the UK introduced world-leading legislation making it mandatory for banks to compensate scam victims within five business days except in cases of gross negligence.

Consumer advocates, financial support organisations and some political leaders say it is time the same legislation was introduced here to put people before profit.

Cyndy’s family lost $1.1 million to scammers. But she was shocked to uncover how Australia’s big four banks had facilitated the crime.

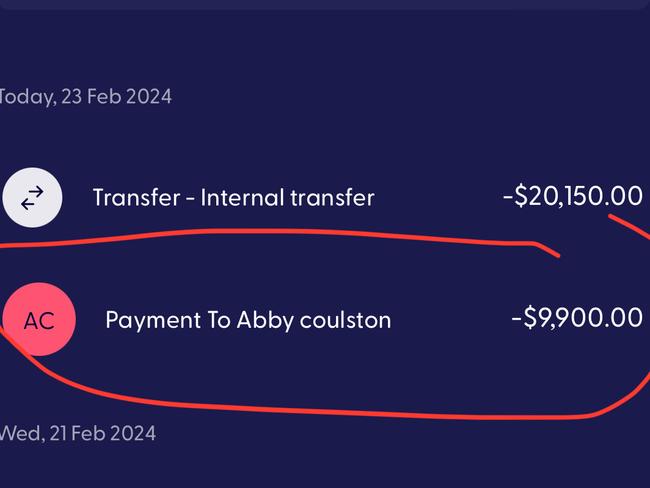

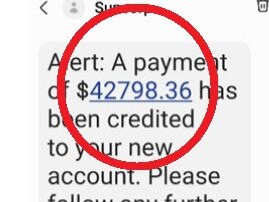

A mum, who thought she would never fall victim to fraud, was shocked when she uncovered the sinister way she had been tricked.

The Sydney family are “devastated” by the disappearance of their life savings and can’t afford groceries and even face having to sell their home.

Original URL: https://www.news.com.au/topics/bank-scams/page/4