Sydney family lose $200k life-savings in Suncorp spoofing scam

The Sydney family are “devastated” by the disappearance of their life savings and can’t afford groceries and even face having to sell their home.

A Sydney family have fallen victim to a sinister scam that saw them lose their entire life-savings – a whopping $200,000.

The impact on Peter* and Madison*, the parents of two kids, has been devastating with the couple unable to afford groceries and contemplating whether they will have to sell their home and move in with family after saving up the money for the past 14 years.

“It’s very distressing … We have to be so mindful of money as we are living day to day in regards to our bank balance as we have lost $200,000. So our life has changed forever – all our goals and aspirations for years to come have been squashed or put back five to 10 years,” Peter told news.com.au.

“We can just pay the mortgage repayments but the problem was we had an offset account so that $200,000 was helping us as our mortgage repayments were a lot lower.

“Now it’s been taken out of our offset account it’s nil and void, so we are paying lot more money a month.

“Luckily my wage and wife’s wage covers the cost of the mortgage repayments but it doesn’t cover every day living like groceries, so we are relying on family helping us getting groceries and we are just talking the bare staples like bread and milk.”

How the scam unfolded

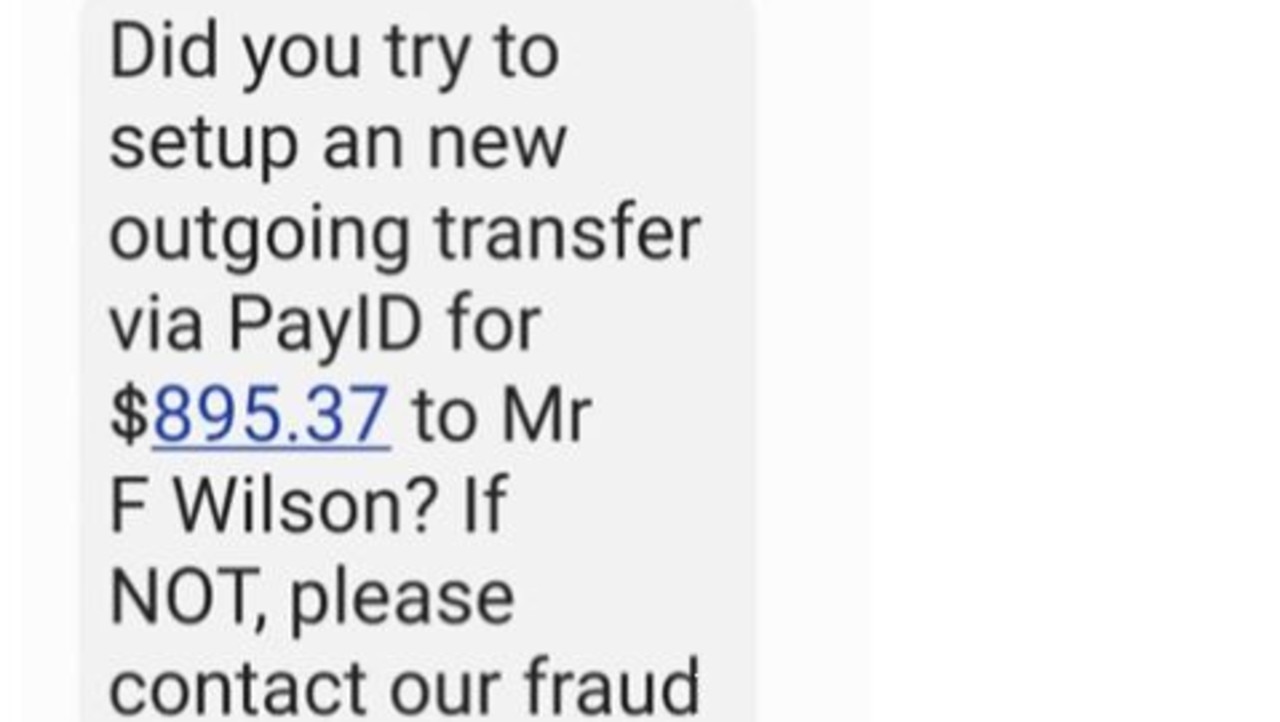

The couple’s horror experience began in December last year when Madison received a text message that appeared to be from Suncorp alerting her to a new pay ID set up in the amount of $895 – in a trail where other messages had been received from the bank.

It urged her to call Suncorp if the new transaction was fraudulent with a number included in the message, which supposedly would connect her to Suncorp’s fraud department.

Immediately, Madison called and it all seemed “legit” after a series of security questions were asked.

She was told the bank account had been hacked and that the security breach could result in a fake passport being made, someone walking into a branch and completely wiping out the funds.

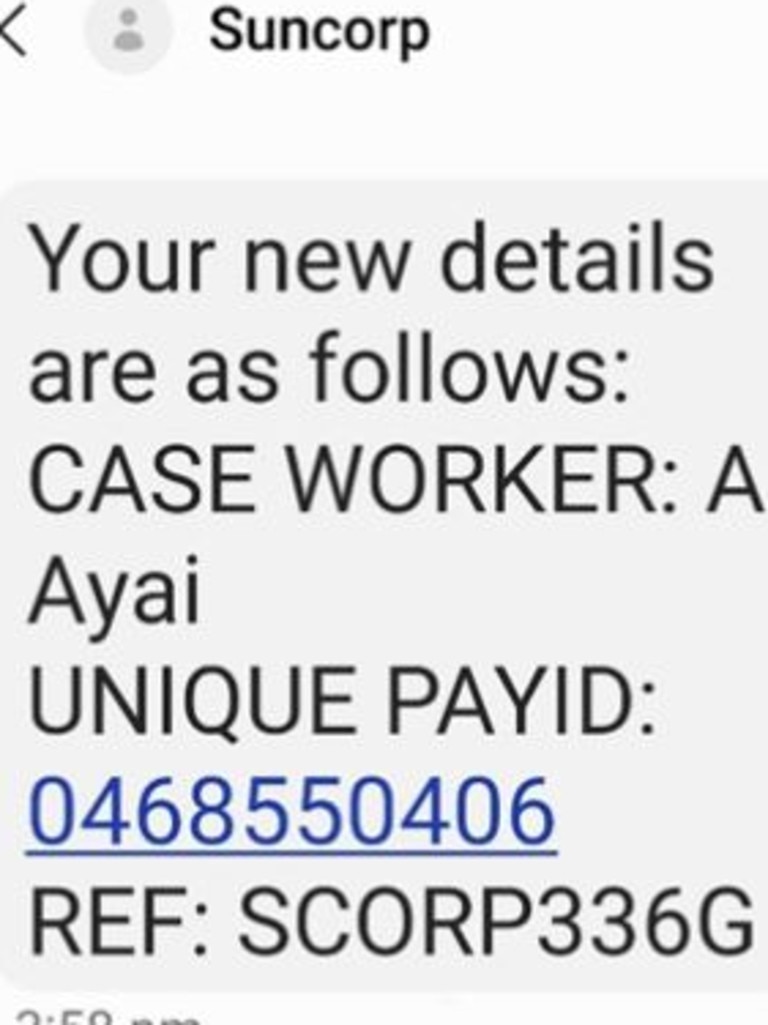

Little did Madison know she was talking to the hackers who told her she needed to increase the couple’s transfer limit from $5000 to $50,000 and move the family’s savings out into a newly created bank account.

Have a similar story? Continue the conversation | sarah.sharples@news.com.au

As the text appeared in the same thread as other correspondence from the bank this led Madison to believe the message was genuine and lulled her into a false sense of security.

But unfortunately it’s an increasingly common scam using a tactic called ‘spoofing’. This is where scammers overstamp the legitimate number that they are calling or texting, making it appear as if customers are receiving communication from the bank’s number.

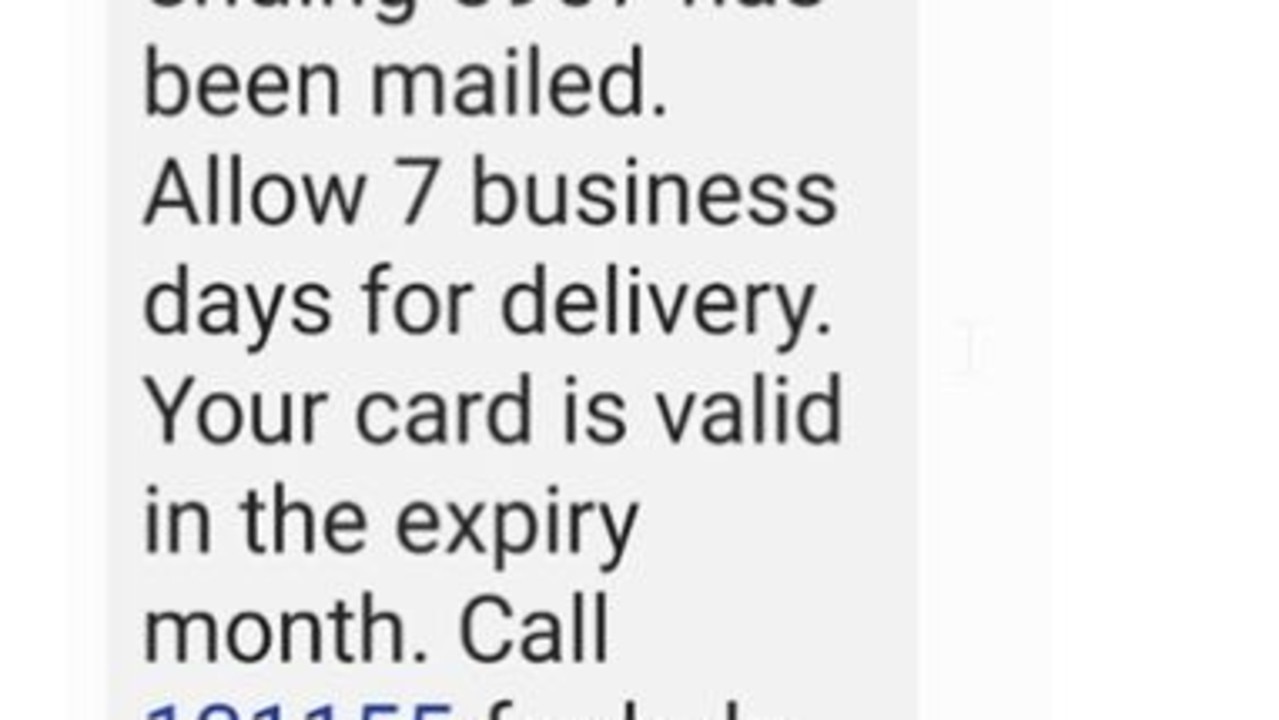

Over five days, the hackers called Madison to make a transfer of just under $50,000 each day and would also send follow up text messages in the same thread.

All up almost $250,000 was moved out of the couple’s account until it was eventually frozen by Suncorp.

‘Jaw dropped’

When Madison contacted the bank directly about the family’s frozen account, her “jaw dropped” as she was informed she had been the victim of a scam and the money had been moved into a Commonwealth Bank account.

The couple were told by Suncorp they were waiting for more information from CBA.

“It was obviously a very sleepless weekend and when we did speak to the fraud department they said ‘You transferred the money out so it’s not our responsibility, we won’t repay it and the chances are slim that you will get any money back’,” Peter added.

“We said we had received the message from the Suncorp system, so where is the sense of accountability? We have been with Suncorp for 28 years and have never taken a substantial amount out and yet we transferred almost $250,000 – that should have been another a red flag.

“We were with another banking institution and we tried to transfer $15,000 to buy a car and they blocked us and said we need to call them.”

The Sydney family claimed they were told just four hours after providing information about the scam that it wasn’t the bank’s fault.

The 47-year-old said Suncorp’s security process appeared “inadequate” and also claims the fraud department told him the hackers “were a step ahead” of the bank.

Laying in bed in the foetal position

But he was particularly scathing about the bank’s response after he outlined serious concerns about his wife’s mental health after falling for the scam.

“I spoke to the fraud department and said it’s taken an emotional toll, it’s still quite raw and my wife is literally laying in bed in the foetal position and I have two young children asking ‘Why isn’t mummy getting out of bed, why is mummy crying?,” he said.

“How am I meant to explain to an eight-year-old to 10-year-old they won’t have Christmas this year as we lost all our money and might have to sell the house and move in with our parents.

“There was no empathy from Suncorp when I was really worried about my wife’s mental health. They just told us to call Lifeline if you are worried.”

Peter said Suncorp also raised another “big red flag”.

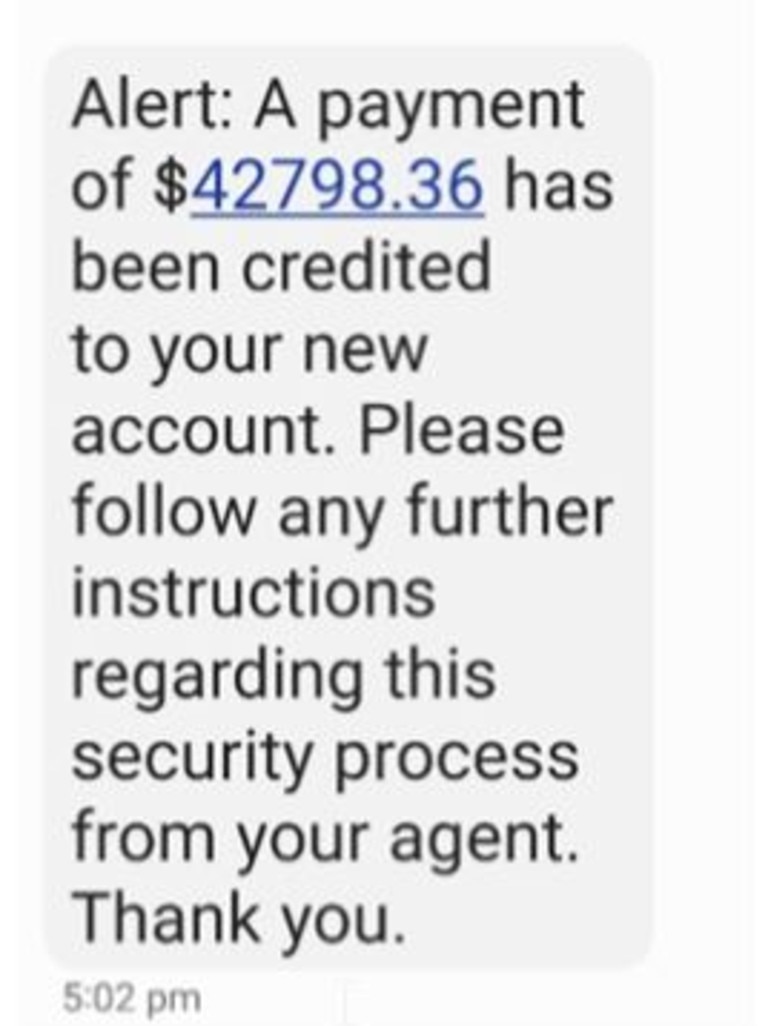

“CBA managed to block one of the transfers. It seemed to be that CBA blocked the first transfer of just under $50,000 and alerted Suncorp it was a scam,” he revealed.

“Suncorp and CBA then let the four further transfers go through the system with roughly similar amounts of money even though the first initial transfer had been flagged. So where is the sense of accountability? They are just blaming each other.”

CBA was able to recover $42,796 and return it to Suncorp but after that the case was closed.

As a result, the couple have made a complaint with independent resolution body the Australian Financial Complaints Authority against both banks.

‘We can’t afford anything’

The teacher said the entire experience had been “distressing” and his wife was now depressed and “distraught” – blaming herself for falling victim to the scam – and was experiencing an overwhelming feeling of “shame”.

“We were hoping to pay off our mortgage in about 10 to 12 years and it’s now going to push it back 25 to 35 years as we lost all our savings,” he added.

“Our dog just passed away before Christmas and we were wanting to get a new dog, but we can’t as we can’t afford it. We can’t afford anything.”

Suncorp bank executive general manager of everyday banking, Nick Fernando, said it was taking many steps to prevent scams, including monitoring accounts for suspicious activity, alerting customers to common scam types, and educating customers on the warning signs.

“The impacts of scams are devastating and take a significant financial and emotional toll on victims. Scammers’ tactics are becoming increasingly sophisticated, and our best defence is ongoing education and awareness. We all need to be vigilant against this issue in our community,” he added.

“Unfortunately, customers of all banks are being impacted by scams. Scam activity is deliberately designed to mislead, cause panic and confusion with the result that a customer willingly sends their own money to a scammer’s account.

“The scammer often immediately transfers the money from that bank account to a crypto platform where it becomes very difficult to trace and recover.

“If a customer receives a call, message or email that doesn’t feel right, they should stop and check with their bank. Suncorp Bank will never ask for your personal details or to transfer money and you should never feel pressured to take action.”

He added Suncorp Bank issued multiple specific warnings about the spoofing scam from 2 November onwards including on its website, banking app and in its internet banking platform.

More families scammed

However, the couple are looking a launch a class action against the banks as they have found five other families who bank with Suncorp that were impacted – including one due to have triplets.

The five families have lost between $25,000 and $80,000 each.

“Multiple families that are in QLD and also in Victoria are all in the same situation as us and we are looking to take legal action,” he said.

“I don’t want anyone else to go through the same thing we are going through, it’s heart wrenching.”

Peter just wants the family’s money back and for the bank’s to take accountability for the scam.

“We have worked so hard for this money over so many years. I’m not the type of person to be vindictive and to sue banks for emotional damage, but there’s got be a sense of accountability from the banks. You froze the first transfer but then there were four others over four subsequent days that you didn’t freeze – you suspected the first one was fraudulent and let the other fours go that doesn’t make any sense to me,” he said.

“We want them to own up that they stuffed up as $200,000 is loose change to them – there was $5 billion in profit for CBA, so $200,000 to them is nothing, but to us it’s everything. It’s our livelihood.

“I want Suncorp to put their hand up and say we were wrong, we didn’t protect you as a customer. They are happy for us to give them money for 28 years but the moment something goes wrong they are quick to shut up shop and not pay anything and not help us out.”

A Commonwealth spokesperson acknowledged the impact that frauds and scams are having on customers and the community broadly.

“Once we have been made aware of a scam or fraud on an account we work closely with other banks to take action and we do our best to recover any funds,” they added.

$96m lost to scams already

Peter said Suncorp had offered to decrease their interest rate by 1.5 per cent, to stop mortgage repayments for six months and offered $3000 to cover medical bills – but said this wasn’t good enough.

Mr Fernando added that if a Suncorp Bank customer is the victim of a scam, they offer a range of support services, including access to a customer advocate and its customer vulnerability hub.

There are calls for banks to invest more money in protecting Australians from scams as the big four banks are expected to collectively make an eye-watering $33 billion this financial year, according to UBS analysis.

This year alone Aussies have lost more than $96 million to scams, according to the ACCC.

Westpac and CBA have introduced technology checking the payee name and details match up but ANZ and NAB are yet to follow.

Meanwhile, Westpac and NAB have placed their phone numbers on “do not originate” lists to reduce incidences of spoofing.

There have also been calls for the big four banks to follow the UK’s lead where banks have signed up to a voluntary code where they refund the money lost in scams unless a customer acted fraudulently or with “gross negligence”.

*Names changed for privacy reasons