‘Sick’: Woman’s $200k find in mum’s house

The $200,000 was from a life insurance policy but ended up in the pockets of scammers – and that was only the “tip of the iceberg”.

Scammers have been given a front door to people’s life savings through complacent social media platforms, such as Meta, and telcos.

Latest figures show Aussies had $2.7 billion stolen from them in one year alone.

A news.com.au special investigation has found in most cases the scammers could have been stopped.

The federal government’s proposed Scam Prevention Framework does not go far enough. Scam victims will remain out of pocket and unprotected, and in many cases left devastated.

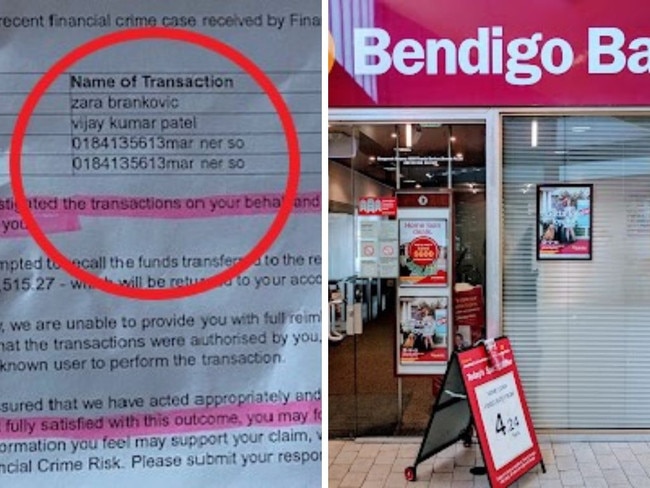

One of the major issues for Australians is that obligations for refunds are ambiguous and inconsistent across the financial sector.

In October 2024, the UK introduced world-leading legislation making it mandatory for banks to compensate scam victims within five business days except in cases of gross negligence.

Consumer advocates, financial support organisations and some political leaders say it is time the same legislation was introduced here to put people before profit.

The $200,000 was from a life insurance policy but ended up in the pockets of scammers – and that was only the “tip of the iceberg”.

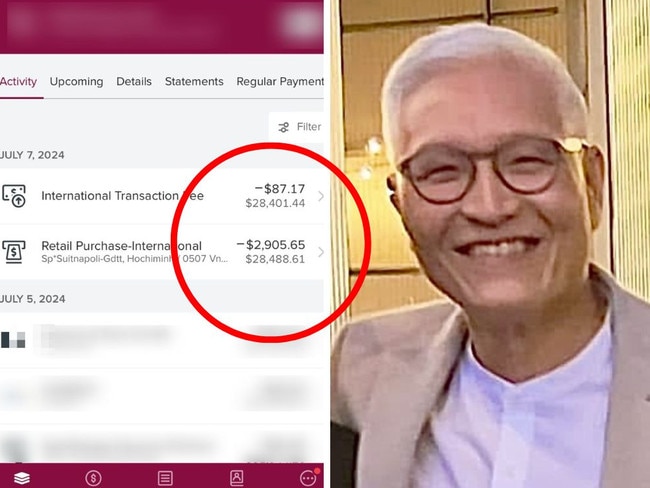

An Australian man is counting himself lucky after stopping scammers from stealing his life savings because of one simple decision he made that morning.

They thought they were becoming homeowners – but instead they basically became homeless and destitute in the blink of an eye.

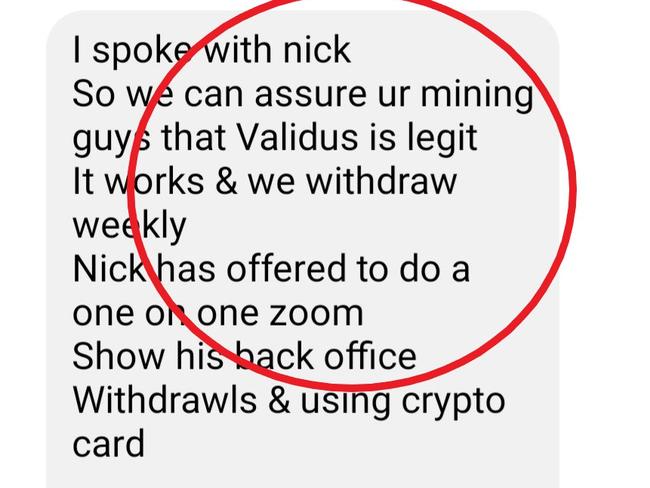

The opportunity seemed like a good way to make some cash on the side. But it was soon taking up all his time — and money.

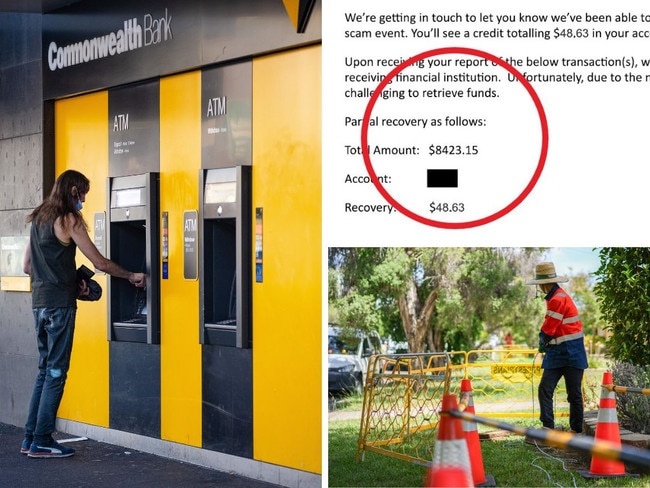

An Aussie man called his bank while scammers were still on the phone to him, draining his life savings. But what the bank did next left him appalled.

A Melbourne man saw his money disappear from his account but was shocked when the bank blamed him. What he did next changed everything.

A Melbourne woman has revealed the “disaster” she found herself in as scammers drained her life savings, including while she was in her bank branch.

Sinister criminals are targeting Australians, draining their bank accounts, but also threatening and abusing them along the way.

In just over an hour, an Australian mum lost $20,000. What the bank did next made her daughter’s “blood boil”.

Australian workers have been caught up in a chilling scam with a lot of money lost. Warning: Distressing

Original URL: https://www.news.com.au/topics/bank-scams/page/3