High-flying WeWork founder still worth billions after company’s bankruptcy

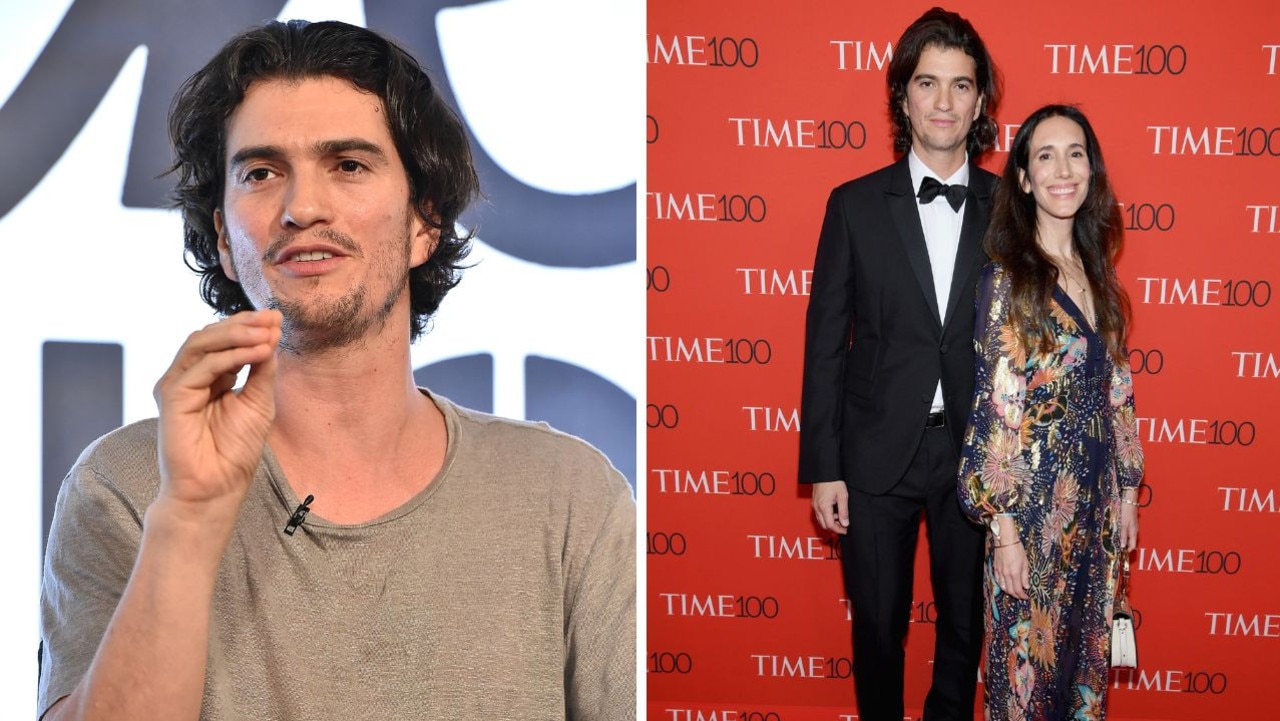

WeWork founder and ex-CEO Adam Neumann has managed to maintain his $1.7 billion fortune despite the start-ups bankruptcy filing.

WeWork founder and ex-CEO Adam Neumann has managed to maintain his $1.7 billion fortune as his once-high-flying start-up faced a slew of troubles that ended with a bankruptcy filing this week.

When the co-working giant initiated Chapter 11 proceedings Monday, it had $19 billion in liabilities and $15 billion in assets, according to Bloomberg.

Neumann’s ability to sustain a 10-figure net worth can be attributed to the juiced-up stock award worth $245 million he received when he was ousted as chief in 2019 over reports about his outlandish behaviour.

Neumann was also handed $200 million in cash as part of a sweetheart exit package, though he was left with a battered reputation following reports of booze-soaked affairs and wads of marijuana found on his private jet trips.

The 44-year-old executive was also able to extract huge amounts of cash from his company before it stumbled into financial ruin, including during the merger with a special purpose acquisition company that helped the company go public, according to Bloomberg.

Payouts to Neumann included a $185 million non-compete agreement, a $106 million settlement payment, and $578 million received for shares sold by Neumann’s We Holdings to SoftBank, filings show.

The merger filing, which mentioned Neumann’s name a whopping 197 times, also outlined a $432 million loan from SoftBank — the Japanese technology group that owns about 60% of WeWork — to Neumann, secured by some of his now-measly WeWork stake, Bloomberg reported.

However, owning 10% of WeWork’s shares means Neumann hasn’t always gotten away scot-free: When the company went public in October 2021, Neumann had a fortune of $2.3 billion, with nearly one-third of his wealth tied up in his start-up’s stock.

WeWork’s share price has since fallen more than 99%.

Neumann called the company’s fall from grace “disappointing” in a statement issued on the day of the bankruptcy filing.

“It has been challenging for me to watch from the sidelines since 2019 as WeWork has failed to take advantage of a product that is more relevant today than ever before,” he added.

Representatives for Neumann did not immediately respond to The Post’s request for comment.

There are rumblings that Neumann and WeWork could have a type of reunion, people familiar with the matter told Bloomberg.

Since Neumann’s non-compete with the company has expired, he’s been approached to get involved with WeWork post-bankruptcy, an anonymous source told the outlet.

Neumann’s statement left the door open to this possibility. “With the right strategy and team, a reorganisation will enable WeWork to emerge successfully,” Neumann said.

Meanwhile, since leaving WeWork, Neumann has stayed under the radar building a new start-up, Flow — a starkly different narrative from WeWork’s peak, when it was valued at $47 billion and a seemingly carefree Neumann pounded champagne at events as early as 9am.

Flow — a real estate tech venture that vows to solve inequities in the rental-housing market — received a $350 million investment from venture capital firm Andreessen Horowitz at a $1 billion valuation in August of 2022 before even beginning operations, according to Bloomberg.

Since launching in 2022, the platform has reportedly built up a portfolio of 3,000 units across major US metro areas thanks to Neumann’s ability to acquire majority stakes in apartment buildings worth as much as $1 billion, according to Forbes.

Bloomberg said Neumann’s own investment into Flow couldn’t be determined, meaning his fortune could exceed the $1.7 billion currently listed on the Billionaires Index.

Neumann has long invested in real estate, including when he scooped up stylish digs in Manhattan’s Gramercy Park neighbourhood, combining two units on the top floor at 78 Irving Place to create a 7,880-square-foot pad.

However, he’s been trying to sell the six-bedroom New York triplex since 2020, first putting it up for sale in 2020 for $37.5 million after quietly attempting to shop it off-market in 2019.

When Covid hit, Neumann yanked the apartment from the market before relisting it last year for $32 million. With no luck, it was pulled from the market again and relisted for a third time last month, according to records on Zillow.

The price for the luxurious abode — which features keyed elevator access, a private roof terrace, and a skylit spiral staircase — was pushed back up to $36 million.

In the same Gramercy Park building, Neumann also bought two apartments on the first floor for $7.2 million, which he still reportedly owns.

This article originally appeared on the New York Post and was reproduced with permission