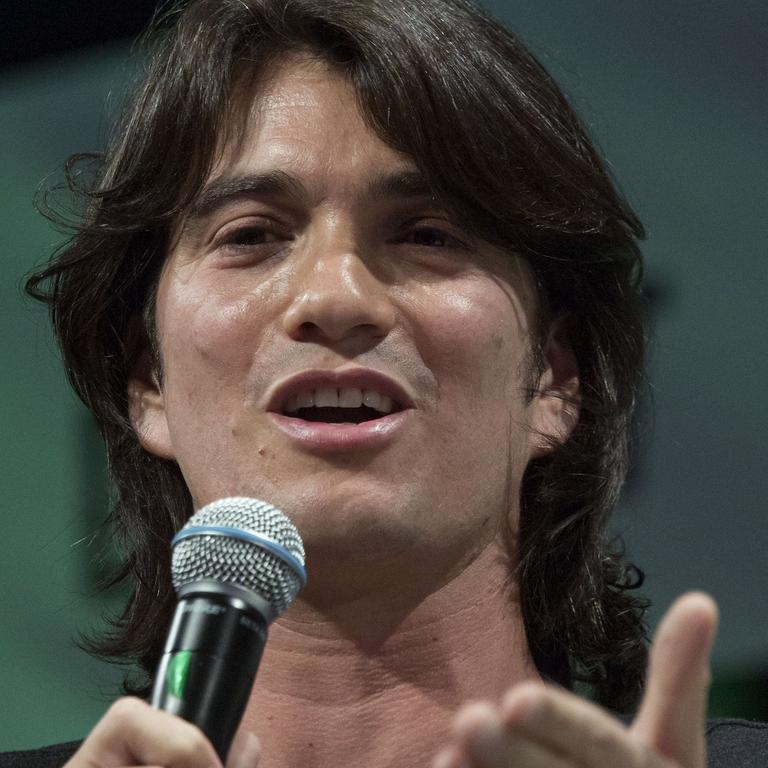

WeWork CEO Adam Neumann’s fatal business mistake cost $16 billion

Adam Neumann was poised to become one of the world’s richest entrepreneurs until a fatal misjudgment saw the value of his business plummet.

It was all going swimmingly for the wildly successful start-up WeWork and its co-founder Adam Neumann.

The office space-sharing company became synonymous with trendy workspaces and was storming towards a massive public offering, with some bankers reportedly touting a valuation as high as $A95 billion.

According to Bloomberg, that would have left Mr Neumann’s 22 per cent stake worth an eye-watering $A20 billion.

But WeWork has had to continually cut its valuation target over the last couple of weeks over doubts about its prospects from potential investor and is now under pressure to postpone its market debut.

Bloomberg reported early backer Fidelity Investments cut its valuation on WeCo, the start-up’s parent company, and it is now predicted its value is currently as low as $A22 billion.

This means Mr Neumann’s stake has been whittled down to about $A4.4 billion, nearly $A16 billion less than was initially touted.

RELATED: WeWork co-founder slammed over payment

WHAT WENT WRONG?

Earlier this week it was reported some investors were worried about scepticism surrounding the company’s business model and wanted its planned initial public offering (IPO) to be pushed to 2020.

They doubt WeWork’s ability to make money fast enough and also wonder if the company was solid enough to withstand a slowdown in the global economy, sources said.

The New York-based start-up that launched in 2010 touts itself as revolutionising commercial real estate by offering shared, flexible workspace arrangements, and has operations in 111 cities in 29 countries.

The company lost $A2.8 billion last year with revenues of $A2.6 billion. WeWork has ventured into new areas like residential apartments and education, and tells investors they should see its quarterly losses as investments.

But certain moves by co-founder Adam Neumann, such as personally investing in real estate before renting it back to WeWork, have also caused consternation.

The co-working company, which calls itself a pioneer in the “space-as-a-service” business, provides office space decorated with bright colours and industrial themes, offering free coffee, e-supplies and utilities.

After WeWork filed to go public recently it was revealed Mr Neumann had been paid a staggering $US5.9 million ($A8,678,605) by his own company.

The reason for the payment? The use of the word “we”.

The payment came about when WeWork “reorganised and rebranded” as The We Company in January ahead of its initial public-offering filing.

Mr Neumann, 40, owned the trademark “We” through a private company, We Holdings LLC, which then sold the use of the word to WeWork.

The controversial move was panned by a range of experts, including New York University marketing professor Scott Galloway, Axios’ Dan Primack and Trition Research Inc CEO Rett Wallace.

“Adam also owned the rights to the ‘We’ trademark, which the firm decided they must own and paid the founder/CEO $US5.9 million for the rights. The rights to a name nearly identical to the name of the firm where he’s the founder/CEO and largest shareholder. YOU. CAN’T. MAKE. THIS. SH*T. UP,” Mr Galloway said, according to Business Insider.

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au