Liquidators pursue creditors of collapsed builder Exel Infragroup which owes $4.2m

A victim of a collapsed building firm is furious because the liquidators are chasing his business for $31,000 even though he’s already thousands out of pocket.

A victim of a collapsed building firm is furious because the liquidators are chasing his business for money even though he’s already thousands out of pocket.

Callum Phillips’ traffic business, Synergy Traffic Management, is currently facing a $63,000 loss due to the liquidation of a contractor on a major railway project in regional Victorian.

But his small Shepparton business, with just 18 employees, was hit with a fresh blow last month when the liquidators demanded he pay them $31,000.

In August, news.com.au reported that Exel Infragroup Pty Ltd had plunged into liquidation owing $4.272 million.

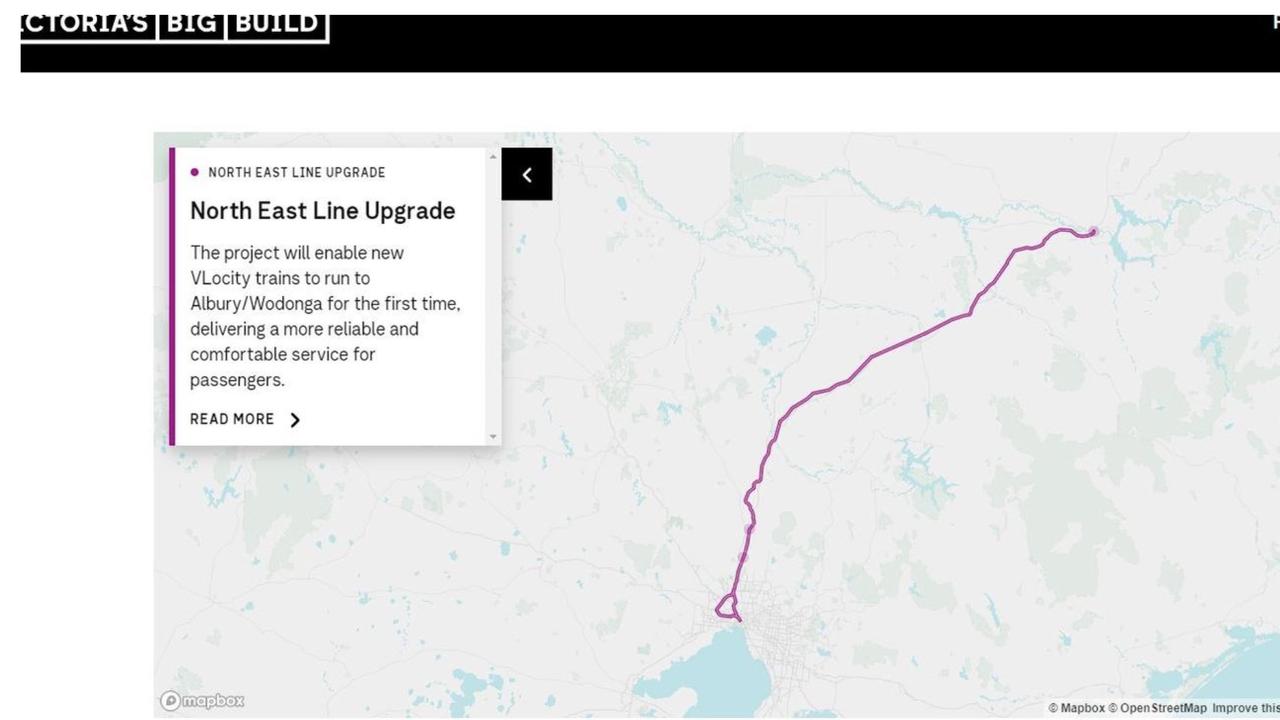

The Victorian-based business was a civil excavation firm with a focus on project management, and was also the lead contractor for parts of the state’s Big Build rail project, in charge of the North East Line Upgrade at Lilliput and Balmattum in rural Victoria.

The majority of its creditors were casual staff owed small amounts of money, and the company’s former director Djin Siauw said that a large portion of its debt was owed to shareholders such as himself who tried to prop up the company.

Mr Phillips is one of the half a dozen unsecured creditors owed money but due to a payment made to him in the six months before the company went bust, the liquidators are claiming it was unfair and should be distributed equally among creditors.

“We weren’t expecting that letter at all,” Mr Phillips said to news.com.au. “We were hoping for some good news rather than more heart ache.”

Petr Vrsecky and Paul Allan of insolvency firm PKF Melbourne are the appointed liquidators, and in conversation with news.com.au, Mr Vrsecky said “Anyone who received money in the last six months (has to) tip it back in and share it”.

According to a statutory liquidator’s report lodged with the corporate regulator, seven creditors received payments in the six months before Exel Infragroup went under.

The total of these payments added up to $253,254.

All seven companies, which includes Synergy Traffic Management, have been sent letters of demand.

During this period of time, Exel Infragroup also paid the Australian Taxation Office $111,000. The liquidators have indicated this might also be an unfair payment, and they have sent through a freedom of information request to find out more.

On October 17, Mr Phillips received the alarming letter which stated that the $31,000 payment he received from Exel Infragroup was considered “voidable” because the company was insolvent at the time.

Mr Phillips has engaged lawyers to fight the demand.

“They said we won’t see a cent of what we return,” he lamented.

Indeed, in the same statutory report, it’s stated that unsecured creditors like Mr Phillips are unlikely to receive any return for their losses.

“At this stage, a dividend to any class of creditor is unlikely,” the report reads.

This makes it even more untenable for the small business owner to comply with the demand.

“It doesn't give me any pleasure to do it, being well aware some of these creditors are already out of pocket,” Mr Vrsecky, one of the joint liquidators, explained, but added “it’s part of my job”.

Mr Vrsecky acknowledged that if these trade creditors complied with his demands, the money would go into costs first — which would involve paying liquidator fees — and then whatever was left would go to other creditors.

“That would be distributed across the whole body of creditors,” he said.

“The costs would come out first and then the balance gets distributed. Any employee claim gets priority. The rest would be distributed across the remaining unsecured creditors.”

Do you know more or have a similar story? Get in touch | alex.turner-cohen@news.com.au

The liquidators have also issued a demand of payment to VicTrack, the government body that hired them to complete the railway project.

According to the statutory report, VicTrack owes the business nearly $33,000.

Previously, VicTrack stated to news.com.au that all payments to Exel Infragroup had been made.

However, there is a dispute over variations to the original contract.

Liquidators have established that Exel Infragroup was insolvent since at least December last year.

At the time of its collapse, the company had just $29.93 in its bank account.

Six related creditors linked to the business are owed around $2.9 million while another six trade creditors owed over $1 million in unsecured debt.

There are also 61 employees owed $47,000 in entitlements.

Wendy Lovell, the member for Northern Victoria Region, is now calling on the state government to fully reimburse the subbies left out of pocket.

“My disappointment is that the government have continued to ignore that small businesses are out of pocket because of their incompetence,”

“They’re quite content to take the infrastructure but not prepared to compensate them.

“It’s not good enough.”

Ms Lovell previously brought up the issue in state parliament demanding contractors like Mr Phillips be reimbursed.

“The action that I seek is for the minister to intervene and fund the full payment of all outstanding money owed to subcontractors for work on the state government’s northeast line upgrade to ensure subcontractors have confidence to participate in future government projects,” she said in a question tabled in the Victorian parliament earlier in September, aimed at Jacinta Allan, who was the Minister for Transport and Infrastructure at the time.

In her address to parliament, Ms Lovell also flagged another devastated creditor, CountryWide Asphalt in Wodonga, which has lost out on payments of more than $378,000 due to Exel Infragroup’s untimely demise.

The MP acknowledged this was a “significant amount” of money for CountryWide Asphalt “which impacts on its ability to meet its own financial obligations”.

Danny Pearson, the new Minister for Transport and Infrastructure, and Jacinta Allan, now premier of Victoria, were both contacted for comment.

alex.turner-cohen@news.com.au