ASX continues rebound for second day

Traders have ended the day on a high after poor results on the Australian share market earlier this week.

Traders have ended the day on a high after poor results on the Australian share market earlier this week.

Australia’s biggest company is betting almost $24bn on a massive new project designed to keep a growing world fed and healthy.

With the Israel-Hamas war entering its “second stage”, the Aussie share market has fallen to its lowest level since October 24 2022.

The benchmark sank to its lowest level of the year so far as interest rate sensitive stocks tumbled on increased odds of a November rate hike.

Losses in health and consumer stocks were offset by gains from miners and energy producers to send the benchmark higher on Tuesday.

The man who leaked confidential government information to clients has been exiled from the world of Australian finance.

Fears of an escalation of the Israel-Hamas has shaved 1.2 per cent off the Australian share benchmark on Friday.

The latest report from the Reserve Bank of Australia shows how much money the men and women who determine your mortgage bill make each year.

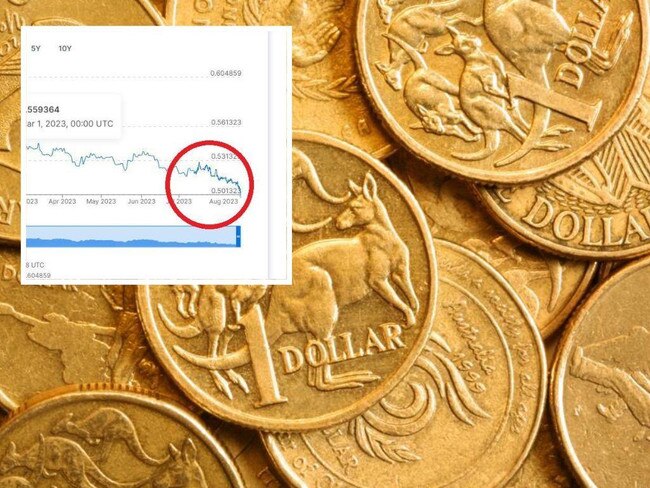

There’s one big reason that the Australian dollar is so weak against the US dollar – but it could mean an investing opportunity for the brave.

The sharemarket has cheered the news of a mega mine deal, but environmentalists say it’s a catastrophe for the climate crisis.

Multiple strikes have broken out across Australia’s food sector, putting more pressure on an industry rocked by surging inflation. But experts have cautioned labour is not to blame for rising grocery bills at the checkout.

The Aussie share market peaked above the 7000 threshold on Tuesday after the US Federal Reserve signalled an easing of its interest rate strategy.

After oil prices tumbled and Wall Street finished higher overnight, the local benchmark ended its three-day losing streak to finish in the green on Thursday.

One state’s premier has pledged to back small business with cost-of-living relief to help them stare down interest-rates and inflation pressures.

After Wall St sank lower overnight, the Aussie sharemarket wiped off 0.8 per cent of its value with the big four banks all finishing lower.

The Aussie share market suffered another steep fall on Wednesday, dropping 0.6 per cent when markets opened.

The Aussie share market plunged on Tuesday to its lowest level in six months following a rout in US Treasuries overnight.

Australia’s economic outlook has darkened, with the value of resource exports set for a staggering fall on the back of a China slowdown.

There’s new hope of a resolution to the industrial dispute affecting global energy markets with union workers agreeing to consider a set of recommendations to end the strike.

The Fair Work Commission noted the dispute between Chevron and unions has a potentially devastating effect on global energy markets, which was a key reason to expedite the next hearing.

The share market edged up to finish in the green at the closing bell for the fifth consecutive day of trading.

The Aussie share market remained largely flat with one major retailer seeing its profits slide by more than a third.

The Big Australian has produced billions in profits for shareholders, but the heady days of 2022 look to be over.

The Australian sharemarket closed flat at the end of the Friday trading session, bringing to an end its worst week in almost a year.

The Australian dollar has continued a major downward spiral today — dropping almost a full percentage point to a nine-month low.

The banks buoyed the Australian share market on Wednesday, after the Commonwealth Bank posted its full-year report.

More major banks have passed on the “Christmas killer” rate rise which has been slammed as harmful to renters and homeowners.

As the nation battles a cost of living crisis, new research has revealed the true value of a giant industry Australians contribute to every day.

Westpac has become the last of the big four banks to pass on rate hike pain to its customers, but the bad news comes with a silver lining.

Australia’s share market has reacted to one of Wall Street’s largest intra-day turnarounds in history, surging 1.8 per cent.

Original URL: https://www.news.com.au/finance/markets/australian-dollar/page/19