‘Xmas killer’: RBA raises interest rates for eighth consecutive time

More major banks have passed on the “Christmas killer” rate rise which has been slammed as harmful to renters and homeowners.

Christmas is officially ruined for many people after the Reserve Bank of Australia raised interest rates for the eighth consecutive time.

The RBA announced on Tuesday that it was hiking the cash rate by 25 basis points, bringing it to 3.1 per cent — the highest level since 2012.

The big banks have begun to announce they will pass on the RBA’s rate rise to its variable rate customers.

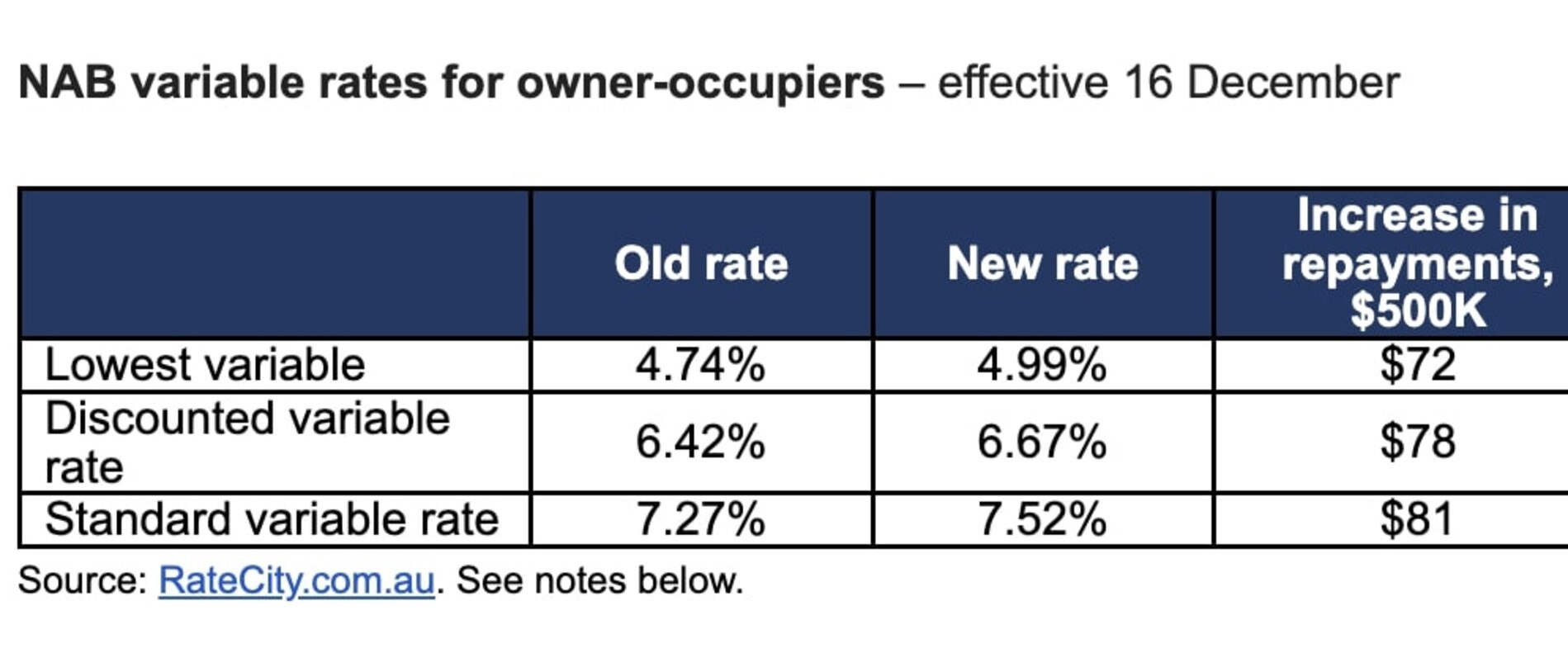

NAB was the first of the big four banks to pass on the rate hike, with variable mortgage holders to cop the full 0.25 per cent rise.

From December 16, NAB will see its discounted variable rate reach 6.67 per cent, representing a $78 increase in monthly repayments for a $500,000 loan.

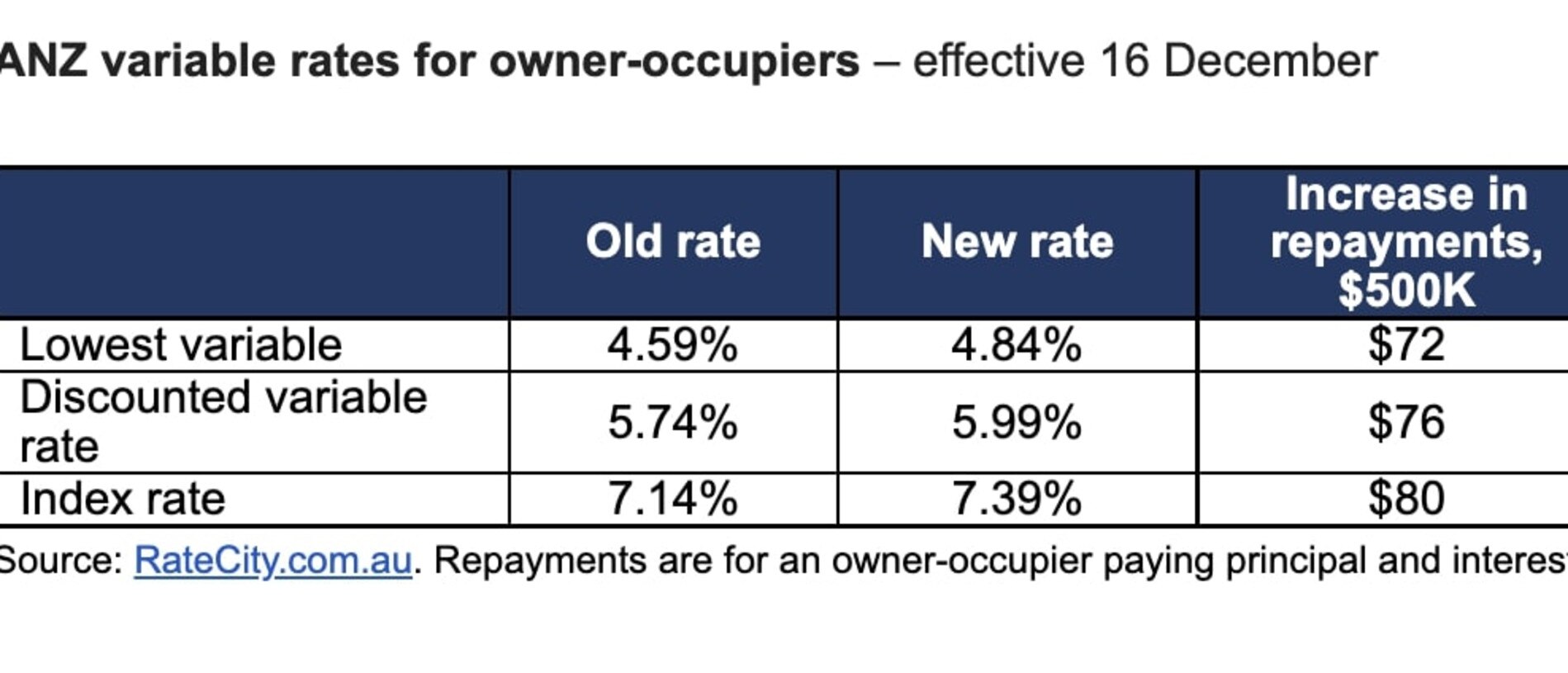

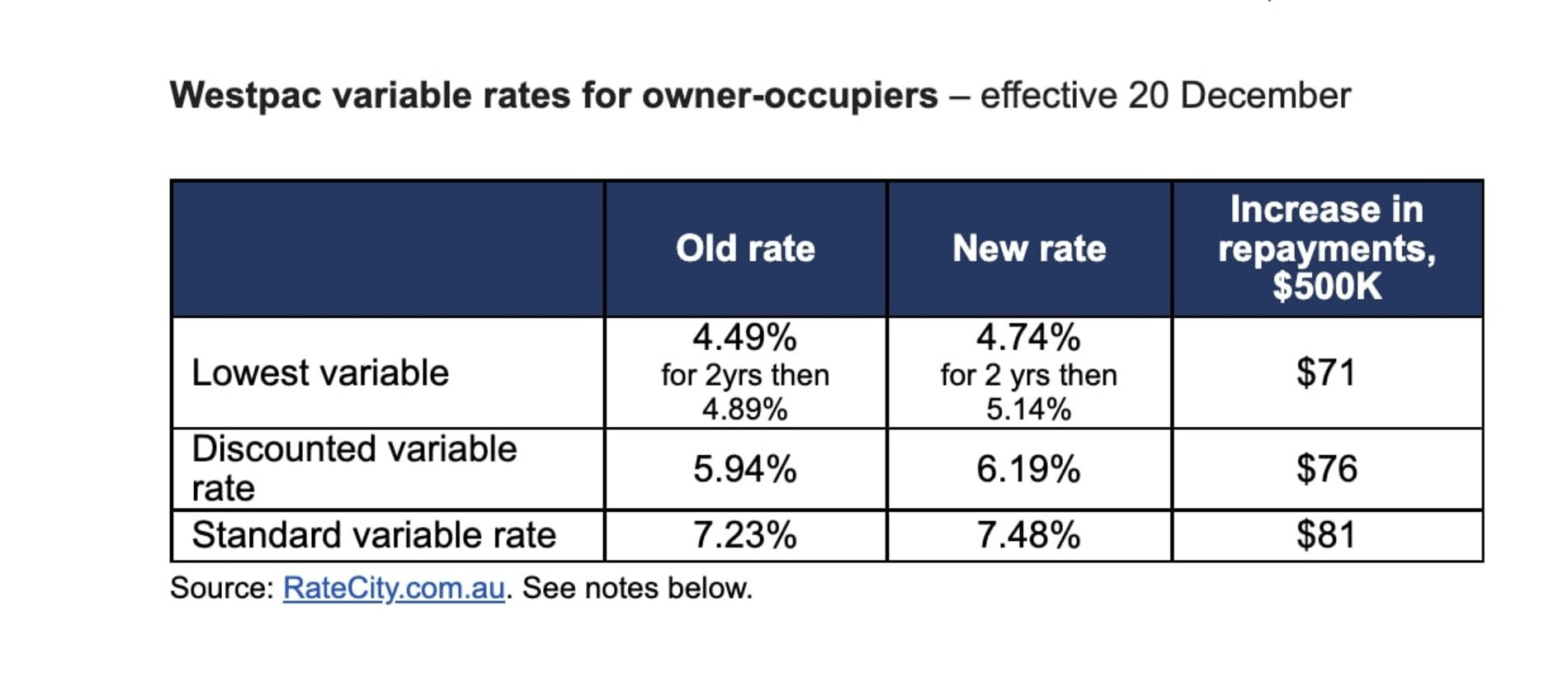

Westpac and ANZ have also passed on the rate rise for variable owner-occupier customers.

ANZ will see its discounted variable rate hit 5.99 per cent and its index rate jump to 7.39 per cent from December 16.

NAB customers can expect to pay $72-81 more each month if they took out a $500,000 loan.

Westpac will now see its standard variable rate hit 6.18 per cent and its standard rate reach 7.48 per cent from December 20.

Commonwealth Bank (CBA) has also announced it will be passing on the rate hike, effective December 16.

It’s basic rate will now sit at 4.87 per cent and it’s discounted variable rate will now be between 4.82 and 6.49 per cent.

CBA’s standard variable rate will now be 7.55 per cent.

Athena Home Loans will also be increasing its rates “in line” with the RBA’s announcement, the bank said on Tuesday.

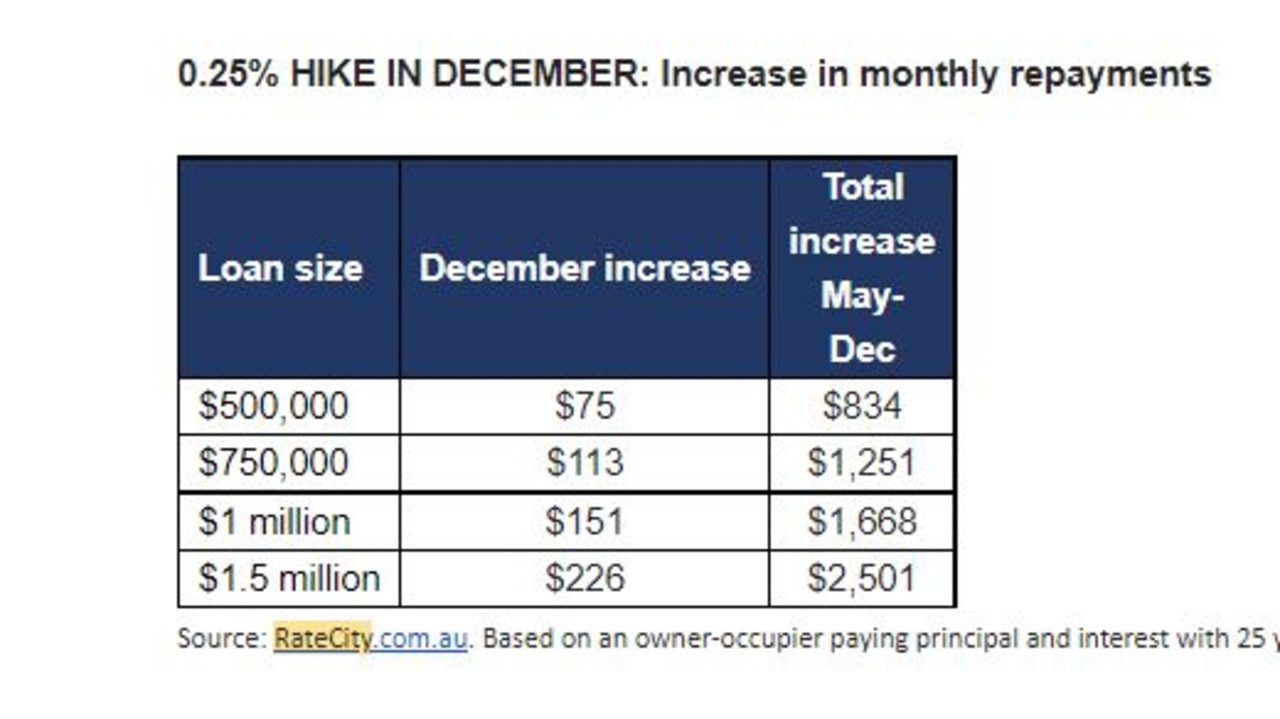

The hike will add about $80 to the monthly payment on a $500,000 mortgage.

That would take the total increase in monthly payments since April to $910 per month or $11,000 for the year.

“To comfortably afford this, you’d need to be earning a minimum income of just over $180,000 – significantly more than the average salary,” Graham Cooke, head of consumer research at Finder, said.

Governor Philip Lowe said the “substantial cumulative increase” in interest rates since May had been necessary to ensure the current period of high inflation was only temporary.

“High inflation damages our economy and makes life more difficult for people,” he said.

“The board’s priority is to re-establish low inflation and return inflation to the two to three per cent range over time.

“The board recognises that monetary policy operates with a lag and that the full effect of the increase in interest rates is yet to be felt in mortgage payments.”

Dr Lowe said the board expected to increase interest rates further.

“It is closely monitoring the global economy, household spending and wage and price-setting behaviour,” he said.

“The size and timing of future interest rate increases will continue to be determined by the incoming data and the board’s assessment of the outlook for inflation and the labour market.”

In some good news, there will be relief for Australians in the New Year because the RBA board will not meet in January.

After the announcement, Treasurer Jim Chalmers told reporters Australia was a “hostage” to developments over which we had no control.

“Obviously, the war in Ukraine is causing havoc on global energy markets,” he said.

“The Covid situation in China is something that we’re monitoring closely, given the obvious consequences for our economy.

“There are some welcome signals out of the US but we’re still expecting a substantial tightening of monetary policy there.

“The UK is obviously in a very difficult position, as is Europe.

“The full impact of these interest rate rises from our own independent central bank are obviously still to be felt, and the magnitude of that impact and the timing of that impact is still in many ways uncertain.”

Mr Chalmers also noted harsh weather events and natural disasters had the capacity to have a substantial impact on the economy and budget.

“When there are a number of things in our economy that we can’t control, the government’s job is to focus on where we can make a meaningful difference,” he said.

“Our economic plan is about making the budget more responsible, the economy more resilient and fighting inflation as our number one priority in economic policy.

“Australians are paying a hefty price for nine months of Russian aggression.

“We need to take the sting out of these energy price rises on behalf of industries and Australians right around the country. That remains our objective.

“We’re doing a lot of work on this front with the regulators and the states and with industry and with others to see if we can act in a meaningful, temporary and responsible way in this area.”

Shadow Treasurer Angus Taylor said more than three million families with a mortgage were starting to feel the impact of cash rate rises since May.

“We know rate rises take some time to flow through to mortgage holders and these steady increases will add further pressure to household budgets already under strain from the rising cost of groceries, fuel and energy bills,” Mr Taylor said.

“Many Australian families will be struggling this Christmas and the pain is only set to deepen into the New Year with thousands of fixed rate loans set to rollover from February.“

Mr Taylor said it was “abundantly clear” that the Albanese government was failing to tackle inflationary pressures at the source.

“Whether it is their failure to resolve energy price pressures or failing to rein in spending, the inaction of this government is increasing pressure on the budgets of hardworking Australian families,“ he said.

Dr Lowe noted inflation was still too high, at 6.9 per cent over the year to October.

“Global factors explain much of this high inflation, but strong domestic demand relative to the ability of the economy to meet that demand is also playing a role,” he said.

“Returning inflation to target requires a more sustainable balance between demand and supply.”

Inflation is forecast to peak at about eight per cent over the year to the December quarter, before declining next year due to the ongoing resolution of global supply-side problems, recent falls in some commodity prices and slower growth in demand.

“Medium-term inflation expectations remain well anchored, and it is important that this remains the case,” Dr Lowe said.

But Ray White Group chief economist Nerida Conisbee noted 6.9 per cent inflation was lower than the 7.3 per cent recorded in September.

“With inflation now starting to come back, it is looking like interest rate rises are coming to an end,” she said.

“While inflation has come back a little bit, there are still challenges in the construction industry, flooding has impacted food costs and very big increases in advertised rents are yet to flow through to inflation numbers.

“More positively, fuel costs have come back and supply chain blockages have eased.

“The market was pricing in a peak of 4.1 per cent but that has now pulled back to 3.7 per cent. An even lower inflation rate in November will pull this back even further.”

The RBA forecasts CPI inflation to decline over the next couple of years to be a little above three per cent over 2024.

Dr Lowe noted the Australian economy was continuing to grow solidly.

“Economic growth is expected to moderate over the year ahead as the global economy slows, the bounce-back in spending on services runs its course, and growth in household consumption slows due to tighter financial conditions,” he said.

Growth is forecast to be about 1.5 per cent next year and in 2024.

Dr Lowe further commented that the labour market remained very tight, with many firms having difficulty hiring workers.

Unemployment fell to 3.4 per cent in October — the lowest rate since 1974.

“Wages growth is continuing to pick up from the low rates of recent years and a further pick-up is expected due to the tight labour market and higher inflation,” Dr Lowe said.

“Given the importance of avoiding a prices-wages spiral, the board will continue to pay close attention to both the evolution of labour costs and the price-setting behaviour of firms in the period ahead.”

PropTrack senior economist Eleanor Creagh said the board remained committed to overcoming the challenge of high inflation, while also monitoring domestic economic conditions and global risks.

“Wages growth accelerated in the September quarter and rose by 3.4 per cent in the 12 months to September 2022,” she said.

“This is the strongest acceleration in over a decade, with labour market tightness translating to stronger wage rises.

“With inflation remaining high and increasing evidence of labour market tightness, the RBA has continued to raise the cash rate to ensure inflation expectations remain ‘anchored’.

“The fastest rise to the cash rate since the 1990s has quickly rebalanced the housing market from last year’s extreme growth levels, with prices falling in most parts of the country.”

Prices nationally are now sitting 3.81 per cent below their March peak, led by declines in the most expensive markets of Sydney and Melbourne.

“With additional rate rises on the horizon, borrowing costs will continue to increase and maximum borrowing capacities will be further reduced, shrinking buyers’ budgets,” Ms Creagh said.

“Maximum borrowing capacities have dropped by more than 20 per cent. The significant reduction in borrowing capacities implies further price falls.

“It will take time for higher interest rates to fully affect home prices, so prices are likely to continue to fall as interest rates continue to rise.

“However, if interest rates peak in 2023, price falls are likely to ease, with values stabilising as interest rate uncertainty reduces.”

Ms Creagh said the downward pressure from rate rises would be somewhat countered by positive demand effects from tight rental markets, rebounding foreign migration, stronger wages growth and housing supply pressures over the long run.

Last week, Dr Lowe apologised to Australians for giving them unclear guidance that led to many people taking out big mortgages in the expectation that interest rates would remain low until 2024.

On Monday, Property Club’s Kevin Young said a rate rise could ruin Christmas for many people, including renters.

“This rental situation is the worst I’ve ever seen in the 50 years I’ve spent in property,” he said.

“Give renters some sort of relief for Christmas because inflation can’t be used anymore as the excuse to increase interest rates.”

Property Group predicts that average weekly rents for those living in the capital cities could surge by over 20 per cent in 2023 “because the supply of rental property is chronically low at a time of rising demand”.

Dr Lowe previously warned renters to expect a hit to their hip pocket through 2023.

“The other supply side issue we are focused on is the supply of housing because the rental vacancy rate now is quite low, and the population growth is picking up,” Dr Lowe told the Senate Economics Legislation Committee in late November.

“I’m imagining that we’ll see increased pressure on rents over the next year as population growth collides with fairly modest growth in the supply of housing.”

Property expert Chris Martin agreed renters would be facing a harsh Christmas with rents on the rise.

“The issue is whether increasing interest rates makes investing in new property more difficult,” Dr Martin said.

“Higher interest rates make it harder for would-be owner-occupiers to invest in creating new houses to boost supply.”

However, Dr Martin said Australians needed to be critical of landlords arguing that interest rates should be lower to keep rental costs down.

“We didn’t see the reverse for that long period where interest rates were low, we didn’t see landlords passing on decreases to tenants,” he said.

The government needed to be looking at more relief for renters amid high-interest rates and inflation, Dr Martin added.

“We need to be looking at inflation-fighting tools that are more sectoral specific and that might include things like rent regulation,” he said.

“Cost of living pressures and rents are rising, a perfectly sensible way of dealing with that is to introduce legal restrictions on rent increases rather than relying on interest rate increases that will make an investment in housing more difficult for the range of investors.”

Mr Young said the government needed to be focusing on supporting investors.

“What they should be doing is incentivising first-home property investors through a range of policies to get them back into the market,” he said.

Renters are not the only group of Australians who will be suffering from tight budgets over the Christmas period.

Another rate hike is also threatening to “kill the budget and pinch on the Christmas” of first homebuyers according to University of Western Australia economics professor Jakob Madsen.

He argued the effect on homeowners would be greater than the effect on renters.

“It’s definitely going to be a killer. It’s going to be a drag on people’s finances,” he said.

“There’s no question that those with a high mortgage are going to be in serious trouble over the next few years.”

Read related topics:Reserve Bank