Aussie dollar in free fall amid bloodbath

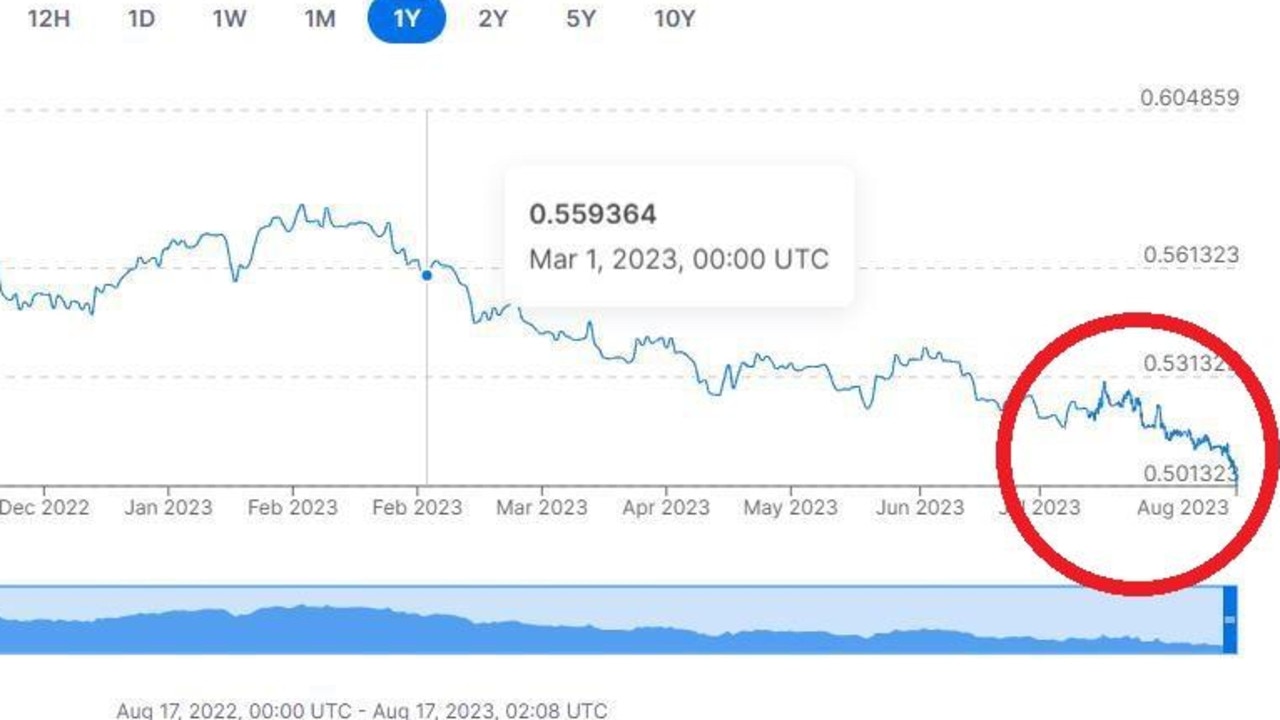

The Australian dollar has continued a major downward spiral today — dropping almost a full percentage point to a nine-month low.

The Australian dollar has continued a major downward spiral today — dropping almost a full percentage point on Thursday to a nine-month low of US63.64 cents.

The currency sank 0.9 per cent after a weaker-than-expected Australian jobs report. It was at US64c before the data was released.

The drop means the Aussie currency has sunk more than 5 per cent so far this month.

The drop comes amid turmoil in the global economy as a massive collapse in China is sending economic shockwaves around the world.

Shares in Chinese property giant Country Garden plunged on Monday after it missed bond payments and warned of multibillion-dollar losses, deepening concerns over the nation’s heavily indebted real estate sector.

Its stock price was down by more than 16 per cent at 11am in Hong Kong (1pm AEST).

Country Garden is a privately owned real estate giant named in Forbes’ list of the 500 largest companies in the world. Its boss, Yang Huiyan, was until recently one of the richest women in Asia.

Horror Aussie dollar prediction

This comes as a top investment strategist has predicted the Australian dollar will drop to a record-low of US 40 cents in as soon as five years, as the world begins to enter a global recession.

David Llewellyn-Smith of MB Super and Nucleus Wealth attributes the plunge to several factors, but emphasised the impact of China’s slowing economy on Australia’s future.

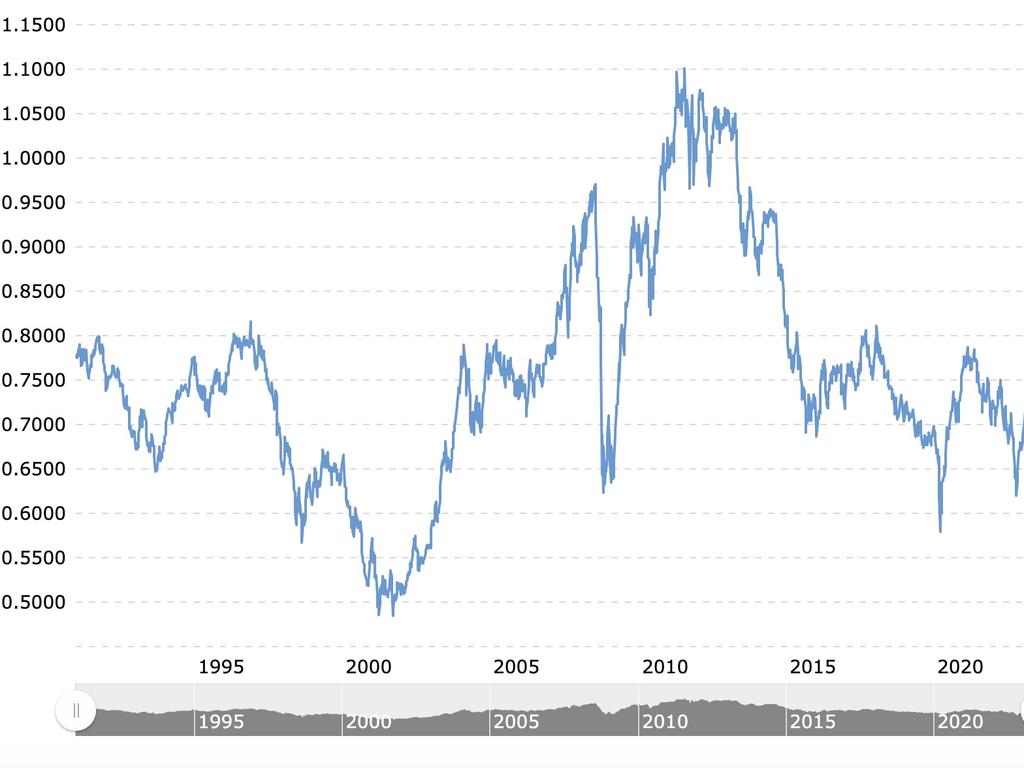

Mr Llewellyn-Smith said the climate is in many ways reflective of what happened with Japan at the end of the 20th century, when the nation experienced an economic decline after a massive growth period.

He argues that China has now reached the precipice of its gargantuan economic boom and now has a massive housing bubble to contend with. According to the economist, the nation of 1.4 billion has sold roughly $12 trillion in property that is yet to be built.

“We’ve begun to replicate what happened in the 1990s. The 90s was a decade long unwind where Japan had consumed a lot of iron ore and became a superpower,” he told news.com.au.

“That is now happening with China, who is replaying that almost precisely. They’ve had their economic boom, and now it’s turning. Their $64 trillion housing market is an enormous bubble with astronomic holes.”

The 90s saw a “ceaseless slide in commodity prices” that in part resulted in the Australian dollar dropping to just 50c on the US dollar by the turn of the century. If that were to replicate, Australia will be dragged down with its major trading partner.

Mr Llewellyn-Smith said the situation in China “truly surpasses Japan” in the 80s, warning their “enormous” housing market is “in the process of unwinding”.

Mr Llewellyn-Smith also drew parallels to the USA’s tech boom in the 90s and the current rise in artificial intelligence industries, asserting that the North American superpower would thrive in the coming years.

He said the coming fluctuations will be a “big adjustment for Australia” but assured it wasn’t alone, with European countries heavily tied to China’s economy also predicted to face changes.

“I expect Europe to deflate a fair bit because it’s very dependent on Chinese growth,” he said.

“It becomes much more expensive to travel to the US or anywhere that is pegged to the US but there will be other places that will be much more similar to today and I think Europe might be okay.”

If the Aussie dollar were to fall to 40 US cents, it would make overseas holidays drastically more expensive. However, he believes US imports are unlikely to see a massive change even if the dollar slides to a record low.

In June, Mr Llewellyn-Smith criticised Australian politicians for declining living standards amid rampant inflation Down Under, claiming that the surging immigration rate had effectively shielded the fact the nation was in a recession.

“Politicians use a simple trick to hide your shrinking economic slice,” he wrote.

“They increase mass immigration to drive population growth in times of trouble. More people means more transactions and so more GDP. A larger pie.

“Of course, more people amid a downturn means an even smaller slice of economic activity for you than otherwise, but because nobody reports the latter, it doesn’t matter.

“The pollies get to claim there is no recession and parade themselves as great successes.”

According to Mr Llewellyn-Smith, GDP per capita “used to be a much more important measure than GDP for policymakers”, because it measures how your living standards are performing.

“But, in these post-truth days, your living standards have taken a back seat to the needs of toxic politicians who would rather you not know when you are getting poorer,” he continued.

“So we are looking at the longest per capita recession that anybody can remember. This is going to lift unemployment well above 5 per cent and sink your hoped-for pay rise. That’s another blow to your living standards.”