Why Reserve Bank shouldn’t hurry to raise interest rates

The Australian economy is at a crossroads with experts in “uproar” over what to do. One move in particular would “reek of panic”.

ANALYSIS

There’s uproar brewing in the Australian economy over potential steep interest rate hikes.

Interest rate futures market are now pricing a 1 per cent lift in the cash rate over next year. Some economists are even more hawkish.

In my opinion, there are four reasons why the RBA does not need to hike rates in the near future.

The first is that after six straight years of missing the inflation target, snuffing it out the moment it lobs into the range reeks of panic. Instead, the RBA should let the inflation rate overshoot for a bit if that is in the offing; that is what it has said it will do.

Second, most of the inflation is coming from outside of the economy, via oil, and so on. For local inflation, the RBA has been clear that it needs to see 3 per cent wages growth and that has not been seen for a decade or so.

Recent wage gains also need to be allowed to overshoot given they are, in part at least, driven by temporary pandemic distortions.

For instance, as closed borders have made irrefutably obvious, the planned resumption of mass immigration will immediately weigh on wages, just as it did the last cycle.

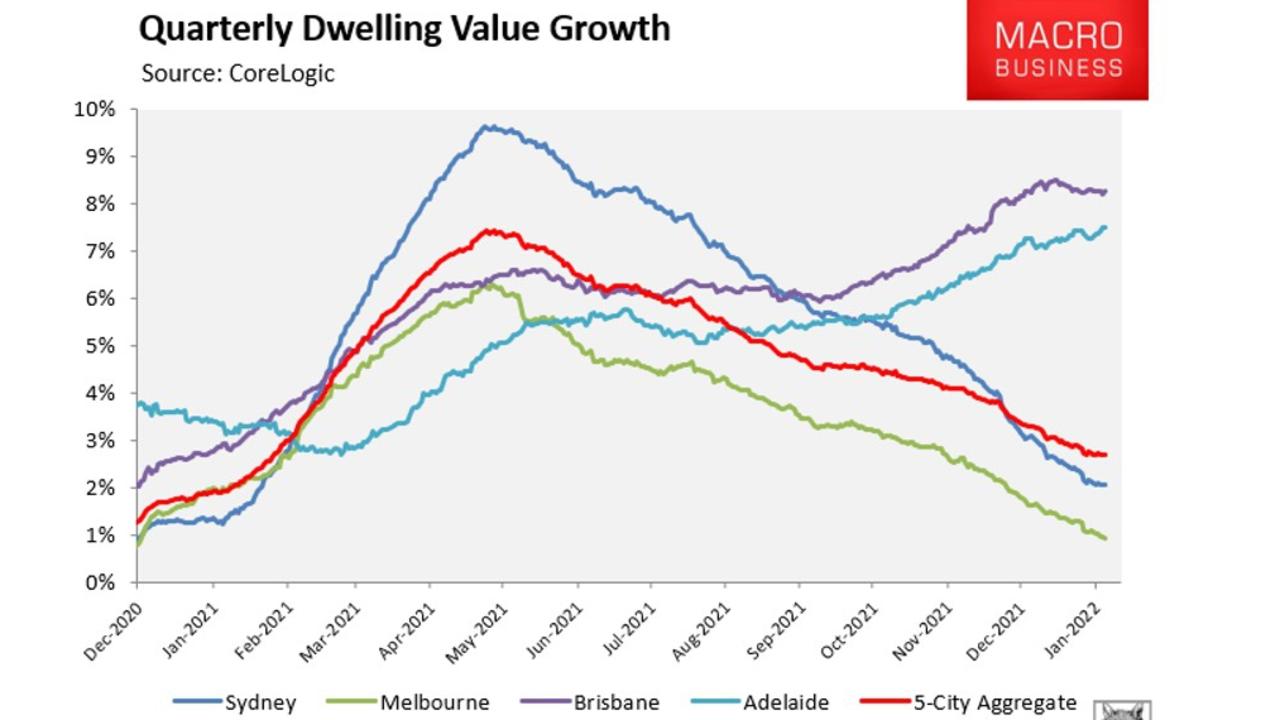

Third, the number one driver of Australian household confidence and consumption – house prices – is stalling fast.

Macroprudential and fixed-rate mortgages hikes have already ended the boom at a brick wall. There are big rate hikes now embedded in the fixed-rate reset going out years that will automatically ratchet up household pressure.

A correction is baked-in for Australia’s two largest cities. Any rate hikes at this juncture risk an inflation-snuffing downward spiral.

Yet, none of these is the main reason that the RBA should be in no hurry.

The fourth and final reason the RBA shouldn’t and probably won’t hike rates is due to external factors, like much of the inflation is. It is the peculiar combination of moves by the US and Chinese central banks.

In the US, the Fed is moving aggressively to crush inflation that is considerably worse than in Australia. To do this it is going to have to risk an outright US recession.

This is because Wall Street is encouraging markets to hedge inflation by bidding up commodities, only succeeding in creating more inflation in the process. The Fed will have to kill this trade, most obvious in oil, and the only way to do it is to damage demand enough that commodity prices crash.

Oddly, it is being aided in this endeavour by authorities in China who have embarked on the weakest stimulus program in modern times despite the bowel-shaking adjustment under way in the Chinese property market. More easing can be expected from China, but Beijing appears steadfast in its determination to end for good the property overbuilding that has driven so much global growth for the past decade and more.

Ending the commodity mania will probably take a few Federal Open Market Committee (FOMC) rate hikes and trigger a US “recession panic” in markets by mid-year. If it does take longer, then it won’t be by much. A typical monetary tightening route is already under way in global junk debt and equity.

For the RBA, this circumstance is eerily similar to the set-up of early 2008 when the Aussie central bank hiked rates directly into the last great Fed-inspired bust. Then, too, the RBA was trying to fight largely imported inflation and only ended up crushing domestic demand instead.

The banks might get one or two “out of cycle” flexible mortgage rate hikes through before markets fall apart but hopefully … probably … the RBA has learned the lesson of 2008 and will ignore the inflation peacocks squawking in front of the oncoming Mack truck.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.