Raising US interest rates will challenge China’s economy

An abrupt about-face by President Xi Jinping suggests China is in crisis mode as rising interest rates pose a grave threat to its economy.

In the years leading up to the pandemic, Chinese President Xi Jinping warned that the global economy faced challenges and that a Black Swan event was a serious risk for the Chinese economy and the world.

Since the pandemic began, the People’s Bank of China, financial regulators and the senior Chinese Communist Party leadership have further intensified their calls for systemic risk to be addressed, with growing concerns about the course of global financial markets being expressed last year.

But in recent months the mood has changed significantly.

President Xi’s U-turn

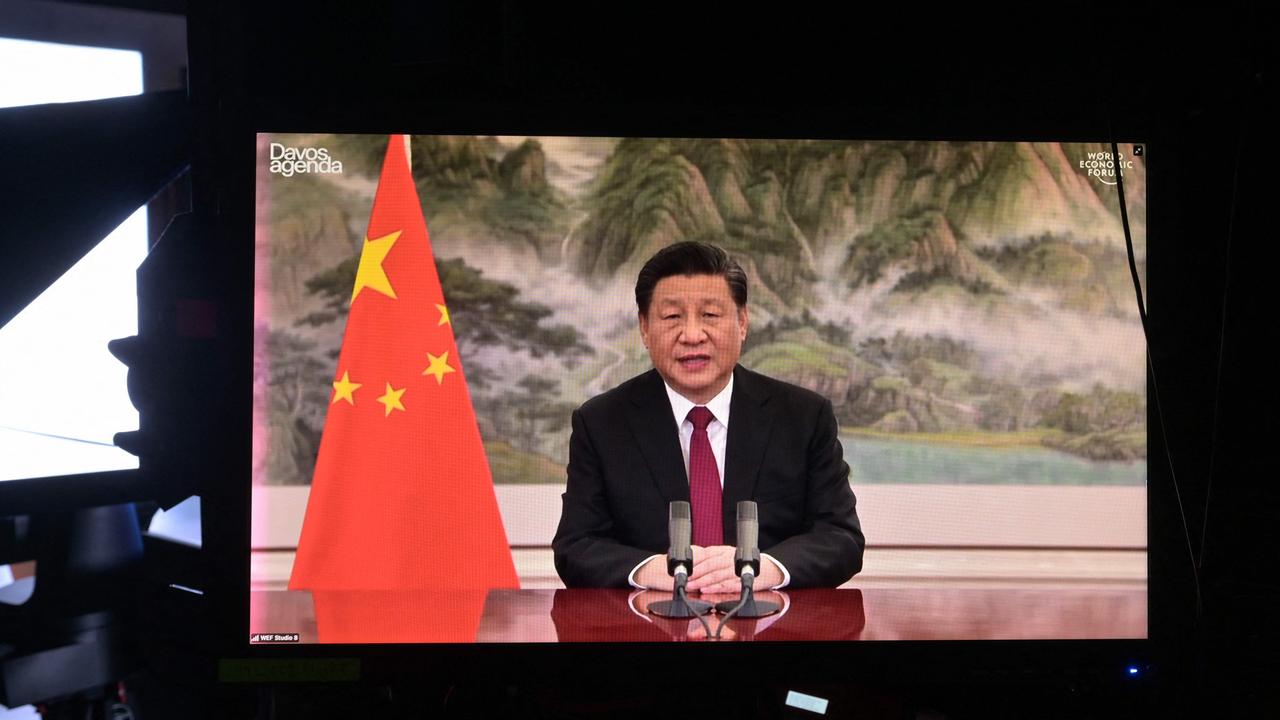

In a virtual address to the World Economic Forum Davos Agenda summit in mid-January, President Xi had a very clear message for the US Federal Reserve and its Chairman, Jerome Powell: please don’t raise interest rates.

“If major economies slam on the brakes or take a U-turn in their monetary policies, there would be serious negative spillovers. They would present challenges to global economic and financial stability, and developing countries would bear the brunt of it,” Xi said.

With US inflation currently running at seven per cent per year and inflation a growing risk to the economic recovery from the pandemic globally, Xi’s comments are the polar opposite of the intentions of a rising number of central banks, including the US Federal Reserve.

Growing risks in China

While we can only speculate on the reasons behind the shift in the narrative coming out of Beijing, it’s clear that there are risks building within the Chinese economy.

The Chinese government’s crackdown on the riskier elements of its property sector has had a major impact on the industry, the demand for materials and the broader economy.

According to a recent report from investment bank UBS, housing starts are down 31 per cent year on year in December.

China commodity demand indicators

— 🅰🅻🅴🆂🆂🅸🅾 (@AlessioUrban) January 20, 2022

Bloomberg, UBS@AvidCommentator@Theimmigrant84@TheMarketDogpic.twitter.com/6FFgU4KiwW

With the property sector and associated industries accounting for almost one third of all Chinese GDP, there are growing concerns that issues within the industry may prompt a broader downturn within the economy.

As risks continue to build, and growth within the consumer driven elements of the economy deteriorate, this has created a rather ironic and in some ways contradictory set of circumstances.

One foot on the accelerator, one foot on the brake

Despite the economic pain the Chinese government’s much needed attempts to rein in risks in the property sector has created, they have so far refused to significantly alter their course.

However, with so much of China’s economic fortunes wrapped up in the property sector, the Chinese government was left with a simple choice, accept much lower growth figures or find another engine of economic expansion.

Given the immense size of China’s economy and the practical impossibility of replacing property led growth with sufficient domestic consumer consumption in the short term, Beijing was left with one very familiar option it has used before extensively, infrastructure construction.

This is yet another departure from the course established by Beijing.

During the leadership of President Xi’s predecessor, former President Hu Jintao, Hu reiterated the need for China to rebalance its economy away from fixed asset investment and construction toward a more consumer led growth model.

Even as late as the middle of last year, the Chinese government halted work in two high speed rail projects worth 130 billion yuan ($29 billion), due to concerns over the rising level of local government debt.

Now as risks within the global economy continue to build and the true scale of China’s own economic slowdown become clear, Beijing are not only putting their foot back on the accelerator of infrastructure construction, they are putting the pedal to the metal.

In the mega city of Shanghai, an entire year’s worth of infrastructure and investment bonds will be issued by the end of June.

For the 2022 calendar year Beijing has allocated a quota of 1.46 trillion yuan ($326 billion) in local government special bonds, as the country seeks to boost local infrastructure investment and steady economic growth.

According to a report from Yuan Talks, a Chinese economy and markets focused news outlet, local governments recently issued 190 billion yuan ($42 billion) worth of bonds in just one week.

The course of Chinese monetary policy has also shifted significantly in recent days, with the People’s Bank of China (PBOC) cutting the benchmark one year loan rate twice in as many months, for the first time since shortly after the pandemic began.

Global Central Bank Update:

— Charlie Bilello (@charliebilello) January 21, 2022

-China cut rates for the 2nd month in a row, 10 bps decrease to 3.70%. Moving against the global trend of tighter monetary policy. pic.twitter.com/nd57cHcGbV

Australia’s fortunes

In recent years it has been said that Australia’s economic fortunes ride on the back of a bulk carrier and with as much as half of all exports flowing to China, the Middle Kingdom’s economic fortunes have certainly come to define our own.

The trillion dollar question that may come to define Australia’s economic fortunes in 2022 may be, can Chinese infrastructure construction fill the inevitable hole that will be left by the property sector should Beijing continue on its current path?

With Omicron still a major factor affecting the Chinese economy significantly and the IMF warning of a slowing global economy, the outlook is at best murky.

As the Chinese government’s strategy continues to evolve, they arguably have their finger hovering over the panic button. They have already cut interest rates and thrown caution to the wind in expanding local government debt, further moves to stimulate growth may require an even greater degree of action.

Ultimately, if the US Federal Reserve does raise interest rates in March as markets are expecting, against the advice of President Xi, China may face some challenging economic dilemmas in 2022.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator