Xi Jinping doomsday prepping for ‘black swan’ and grey rhino’ threats

Experts say this time will be recorded as one of the “great bubbles of financial history” and it’s just about to pop. Xi Jinping is prepping but is anyone else?

When you think about doomsday preppers, a certain image comes to mind. A bit of a loner, who owns some sort of bunker, then fills it with survival equipment and enough tins of Spam to keep them fed until the sun burns out.

But some preppers couldn’t be further away from the stereotype of homemade backyard bunkers if they tried.

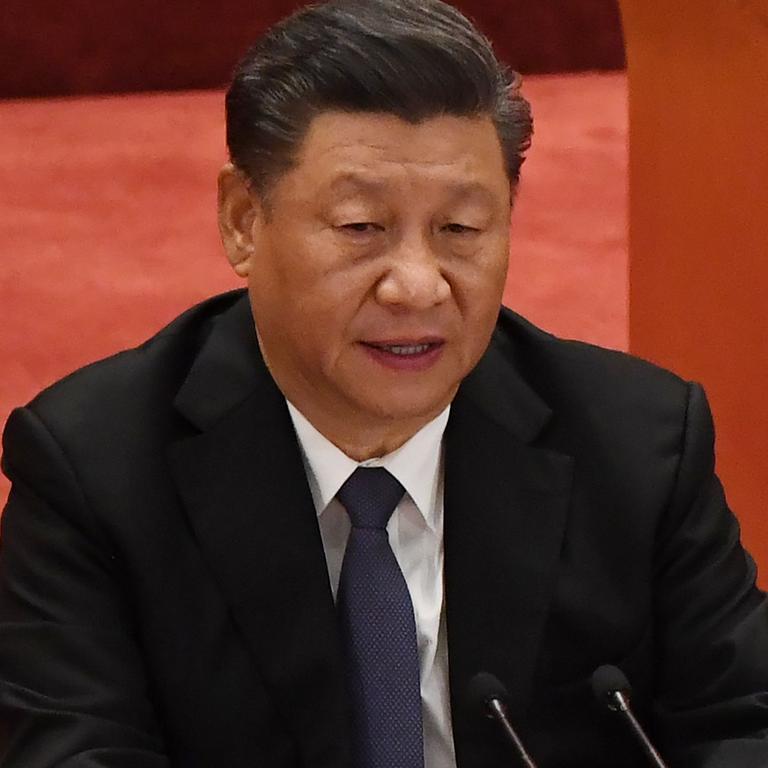

In fact, there is one very high-profile individual most people never would have expected as a prepper, who is better resourced and funded than some entire countries – Chinese President Xi Jinping.

RELATED: Aussie industry heading for apocalypse

Xi Jinping calls government to prepare for black swan events

For several years now, President Xi has been warning about possible “black swan” and “grey rhino” events.

Chinese state-run media reported that Xi ordered government officials to “prevent and defuse major risks” to “ensure a healthy economy and social stability”.

A “black swan” is an unpredictable event with extreme consequences, while a “grey rhino” is a big and visible threat that goes largely ignored.

Now amid a world still struggling with the COVID-19 pandemic, President Xi has renewed his calls for the Chinese government to prepare for “black swan” events and enacted a number of different policies to do so in Beijing’s latest five-year plan.

After seeing the pandemic take a wrecking ball to economies across the world, it’s perhaps unsurprising that President Xi and the Chinese government are concerned that the impact of the virus on the global economy and markets is far from over.

In recent months, Xi’s concerns have been echoed by a number of senior figures in Beijing, including the chair of China’s Banking and Insurance Regulatory Commission Guo Shuqing.

“I’m worried the bubble problem in foreign financial markets will one day pop,” Mr Guo said.

RELATED: China move that leaves Australia exposed

Fund managers warn of hyperinflation dangers

With interest rates still near the lowest levels in history and stock market valuations at all-time record highs, according to some indicators, it’s understandable why there are such high levels of concern in China that it may all come crashing down one day.

It’s not just Chinese authorities who are concerned over the future of the global markets and the financial system.

Fund manager Michael Burry who was immortalised in the 2015 film The Big Short for his correct prediction that the US housing market would crash, recently warned that resurgent inflation could wreak havoc on the world. Burry went on to compare the modern United States with Germany in the early 1920s before hyperinflation blew up the economy.

“Before the German hyperinflation in the 1920s, ‘everyone from the elevator operator up was playing the market’ and volumes became such that ‘the financial industry could not keep up with the paperwork’ … Sound familiar?” Mr Burry tweeted.

RELATED: Sign Aussie house prices could plummet

Mr Burry is not the only well-known investor to be raising the alarm. In a recent article, billionaire fund manager Jeremy Grantham shared his view that the current “fully-fledged epic bubble” would be “recorded as one of the great bubbles of financial history”.

Mr Grantham went on to predict that the bursting of the current financial market bubble would be remembered alongside the 1929 market crash that led to the Great Depression.

If the likes of Mr Grantham, Mr Burry and Mr Guo are correct, the world could be in for quite a challenging time in the coming years.

China ramps up defence spending in five-year plan

History teaches us that these types of epic market meltdowns can lead to social unrest, the rise of political extremism and even wars between great powers, if things are not managed properly.

Given President Xi’s position as effectively leader for life and the most senior custodian of the welfare of the Chinese people, it’s understandable why he wants China to steel itself against these possible scenarios and their potential aftermaths.

While part of Beijing’s five-year plan is a drive towards self-sufficiency and more resilient domestic economy, the Chinese Communist Party is also continuing to ramp up defence spending.

For 2021 the Chinese defence budget increased by 6.8 per cent or around A$17.3 billion. To put that into perspective, it’s slightly over 40 per cent of the entire Australian defence budget for the current financial year.

As we covered at news.com.au in recent weeks, as part of the ramp up in Chinese military capabilities, the Chinese Navy is in the midst of an epic shipbuilding program, which would leave Beijing far better equipped to deal with threats or potentially mount an invasion of Taiwan.

Stimulus programs only keeping countries above water

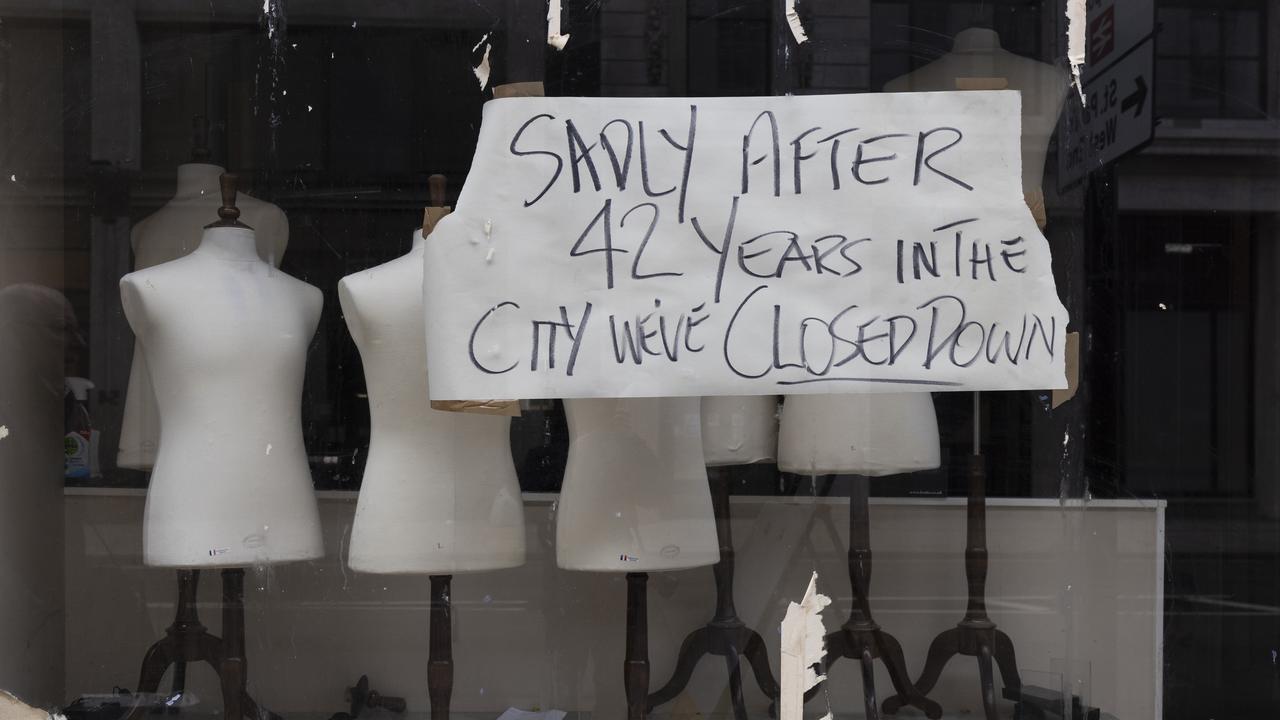

Meanwhile back in the Western world, nations generally continue to put the lion’s share of their chips on hoping for the best.

The US has already committed to $5 trillion in stimulus measures, which is around 8.5 times the size of the first two years of the Obama administrations stimulus measures during the global financial crisis. These measures have largely been targeted at keeping a struggling economy afloat, rather than the driving a robust and resilient recovery capable of enduring another black swan event.

Australia’s stimulus programs have been broadly similar, heavily targeted at keeping households and businesses above water.

While there are ongoing measures of support such as the Morrison Government’s $1.2 billion tourism rescue package, it represents only a small fraction of the more than $500 billion in stimulus which has been committed so far.

As an uncertain future unfolds, President Xi and the Chinese government may one day end up like so many other preppers who made plans for events that didn’t end up happening.

But if Xi is correct and the predictions of the likes of Michael Burry do become a reality, Beijing may find itself far better placed to deal with a black swan induced crisis than any of its rivals.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator