How interest rate increase would impact Aussie house prices

The consensus has been that property prices will continue to rise – but a worrying sign in the US could mean the complete opposite happens.

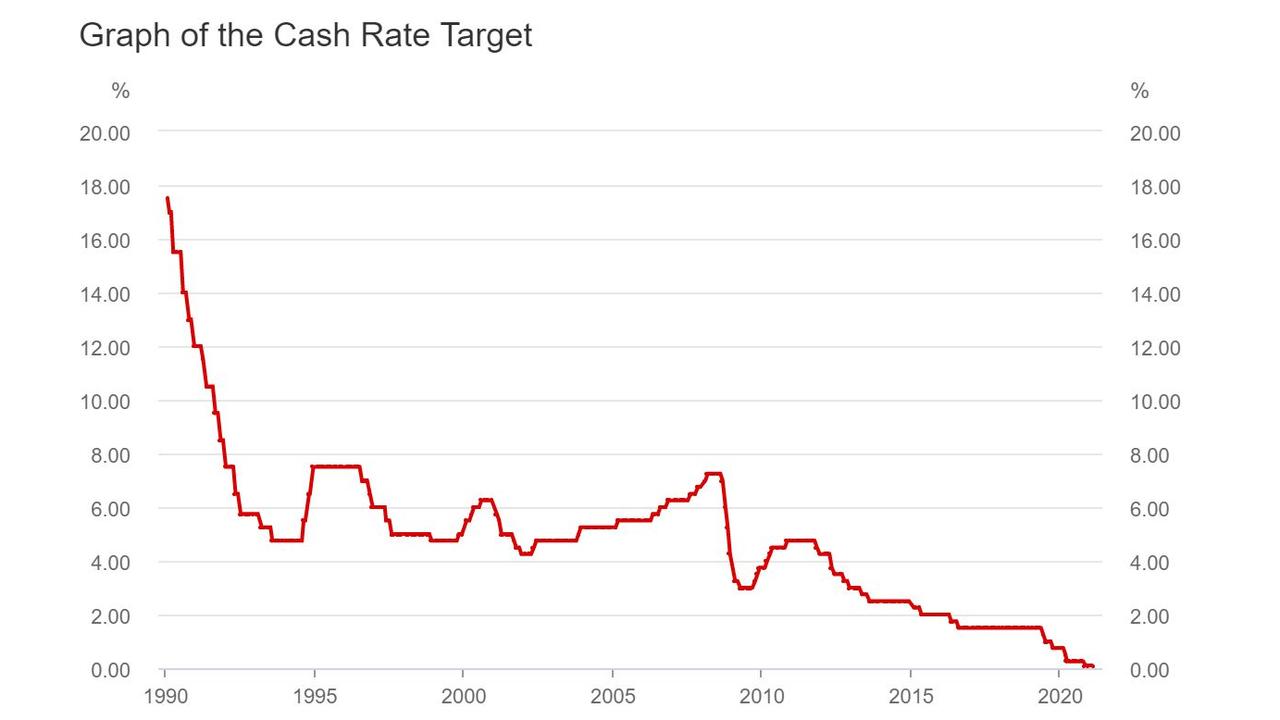

Since the overnight cash rate hit 17.5 per cent in January 1990, Australians have seen the RBA cut interest rates 51 times. Now, after more than three decades of interest rate cuts, the cash rate sits at just 0.1 per cent.

This has led some analysts to call the bottom, predicting that the cash rate will never be cut lower than it is today.

With the economy’s recovery from the pandemic still fragile and heavily reliant on government support and household savings, RBA governor Philip Lowe has stated interest rates would stay low for “as long as needed”.

In a recent appearance before a parliamentary committee, Mr Lowe stated that rates would stay at this level for up to three years.

RELATED: Property dreams are over for young Aussies

This was no doubt music to the ears of Australia’s 2.1 million property investors, and the more than 100,000 first homebuyers who purchased property since the pandemic began.

With many mortgage holders still facing an uncertain future, the predicted certainty about the stability of interest rates also provided a much-needed boost to household confidence. Partially as a result, the Westpac consumer sentiment index recently hit a decade high.

While the RBA does have a great deal of power to influence interest rates through a number of different tools it possesses, the direction of interest rates are not entirely within their control. They are ultimately guided by the tides of the global bond market.

Despite Governor Lowe’s view that rates would stay low for at least three years, financial markets are seeing things quite differently.

According to a report from Bloomberg, credit markets are pricing a 30 per cent chance of the RBA being forced to hike interest rates by the middle of next year.

As global government bond yields (aka borrowing costs) continue to rise, the RBA aren’t the only central bank beginning to see upward pressure on mortgage rates.

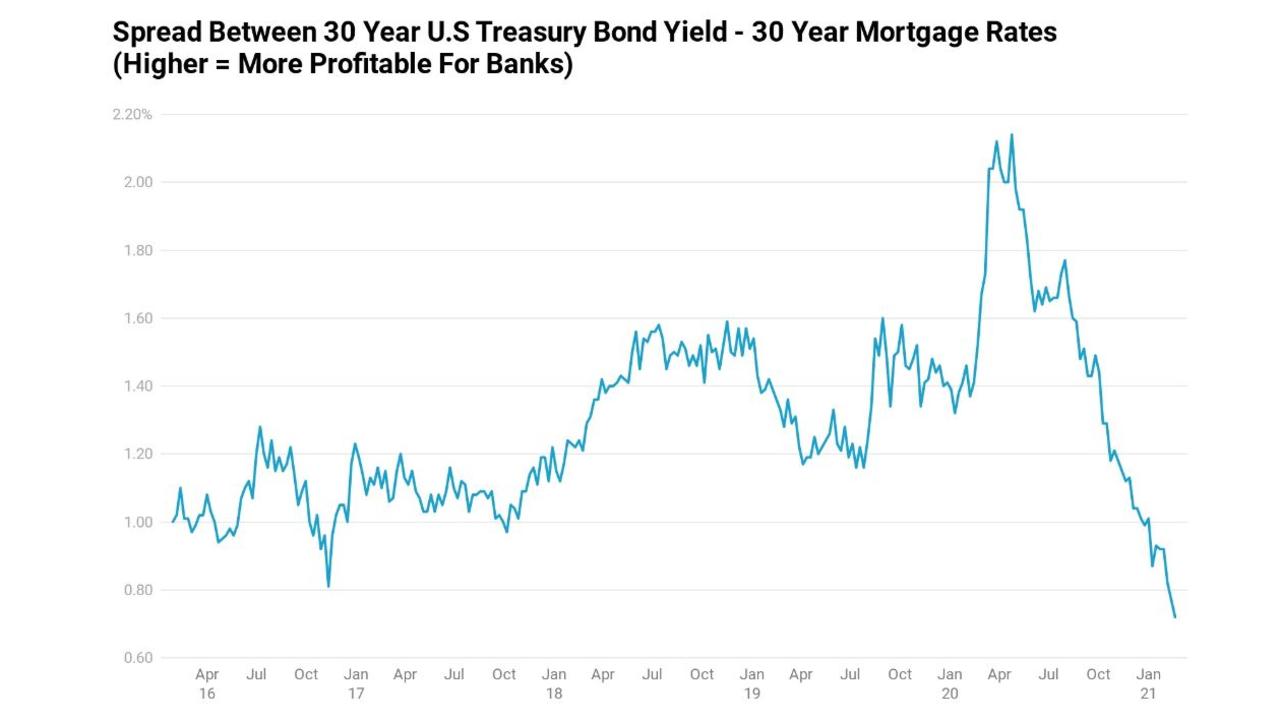

In the United States, banks have already started to raise mortgage rates without a move by the Federal Reserve. In the past four weeks, the interest rate on a 30-year fixed rate mortgage has risen by 0.45 per cent.

This has resulted in demand for mortgages beginning to cool. According to the US Mortgage Bankers Association mortgage applications to purchase a home, fell 11.4 per cent in the latest week’s data, with applications for refinancing down 11 per cent.

While the level of mortgage applications remains elevated, above pre-pandemic levels, if rates continue to rise, demand for property will likely moderate in time.

As global bond yields continue to rise, US banks are increasingly finding their lending margins squeezed, forcing them to raise mortgage rates in order to maintain profits and the stability of their businesses.

RELATED: Huge change 95 per cent of Aussies want

Back in Australia, there is an unprecedented consensus surrounding the direction of the property market. Across a wide range of analysts and market commentators there are few that disagree that residential property as an asset class is set to boom and likely very strong price growth in 2021.

Unlike other housing price booms that have occurred in the recent past, this one is predicted to be the first truly nationwide property boom in years with a few very notable exceptions.

But as mortgage rates in the United States and elsewhere continue to rise, the global bond market could slam on the brakes of this would be multi-year housing price boom.

In as little as 15 months time Aussie mortgage holders could be staring down the possibility of not only an interest rate hike, but the chance that rates may only rise from here.

After relying on interest rate cuts for over 30 years to make paying off our homes significantly easier and/or faster, the Aussie mortgage holder’s greatest friend, the interest rate cut, may be put to rest for the foreseeable future.

If we do see continued upward pressure on borrowing costs the RBA is not likely to sit idly by. It will use its various tools to attempt to continue to artificially suppress interest rates.

As it stands the RBA is engaging in yield curve control. In plain English, it has set a target it does not wish three-year government borrowing costs to significantly exceed (0.1 per cent) and is buying bonds in an attempt to keep borrowing costs in its target range.

So far it has been relatively successful in suppressing rates to its desired level, despite seeing some brief moments where their target was significantly exceeded.

RELATED: Stunning prediction for house prices

However, the Australian Government’s long-term borrowing costs have seen far more explosive growth in their relative cost.

In the past six weeks, the cost of the Federal Government borrowing money for a 10-year fixed term has effectively increased by 79 per cent, with interest rates rising from 0.94 per cent to 1.68 per cent.

Despite the RBA Governor’s promises of rates staying low for at least three years, the directions of interest rates are not entirely within his control. They are ultimately at the mercy of the unpredictable tides of the global bond market.

As the global bond market attempts to price in what lays ahead and borrowing costs continue to rise, Aussie mortgage holders and the Reserve Bank may increasingly find themselves caught in the crossfire.

Going forward, rates may stagnate at roughly this level or even go slightly lower again if the global recovery shows signs of faltering. But as the global consensus turns towards a more inflationary future, it’s possible the days of bargain basement interest rates may already be slowly drawing to a close.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator