Australians’ desire to work from home affecting house prices

The pandemic disrupted our lives immensely but there’s one change we want to stay – and it’s already turning house prices on their head.

When the pandemic first hit early last year, Australia’s workplaces looked very different to what has now become the norm in a world still defined by COVID-19.

Working from home was still a relatively fringe option, generally reserved for only a select few office dwellers.

Yet here we stand, less than a year after the first lockdowns began, and a nationwide revolution in how we work has occurred.

As a result of the shift to working from home, many Australians increasingly find themselves reassessing their personal circumstances and priorities.

Where once being within comfortable commuting distance of a CBD was considered an absolute necessity, in this new world some Australians now find themselves working from home in an entirely different state.

With this new level of flexibility and acceptance of alternative working arrangements, many Australians have taken this opportunity to pursue a move to an outer suburban or regional area.

RELATED: One places house prices will get smashed

To what degree these trends will remain permanent is still a matter of ongoing debate, as the CBD-based office standard is reassessed through the evolving pandemic situation.

If it were up to the workers, it would almost certainly be permanent. According to a study conducted by Swinburne University for the Fair Work Commission, only 5 per cent of workers sent home during the pandemic want to return to the office full-time once the pandemic has finally concluded.

With such a large majority of Australians wanting to continue to work from home, this will likely have major implications for property prices across the country.

Professor Scott Galloway from New York University concluded that the money households saved on commuting to and from work, would end up being spent on their homes.

According to a 2013 study conducted by Dr Jian Wang of Southern Cross University, for the Australasian Railway Association, the average cost of owning a car and commuting to work five days a week was $11,031 per year.

While most office workers are unlikely to be working from home five days a week, even two or three days a week worth of commuting costs would be a major saving to household budgets.

This is projected to drive continued strong demand for suburban and regional property, where there is space for home office facilities to be set up or built.

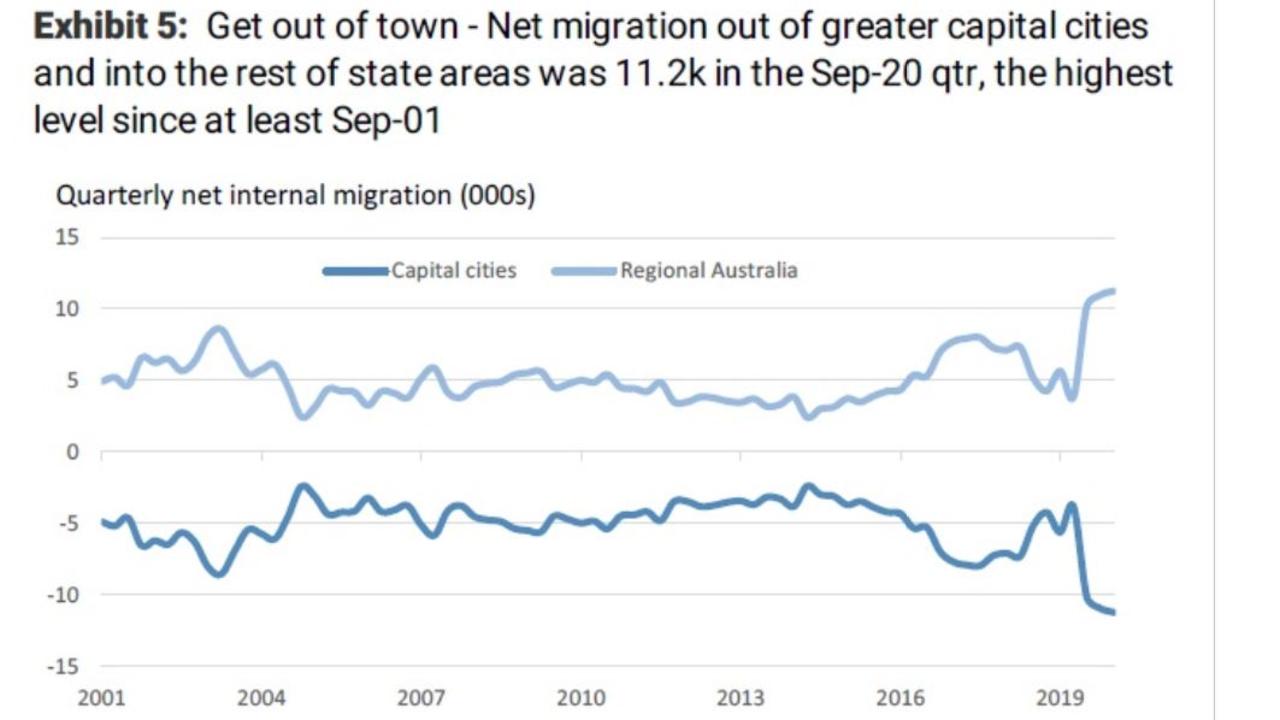

This shift away from the city into the regions has shown up strongly in the latest internal migration statistics. The number of Aussies leaving capital cities to move to regional areas is currently running at a 20-year high.

RELATED: Mass exodus as Aussies desert cities

Since the initial lockdowns were lifted, the tens of thousands of Australians exiting our cities have driven a boom in regional home prices and squeezed rents higher, in areas accustomed to only a fraction of the current demand.

According to housing price data provider CoreLogic, regional home prices have risen by 7.9 per cent on average over the past 12 months, while the combined average of all our capital cities came in at just 1.7 per cent.

RELATED: Dire warning for Aussie housing market

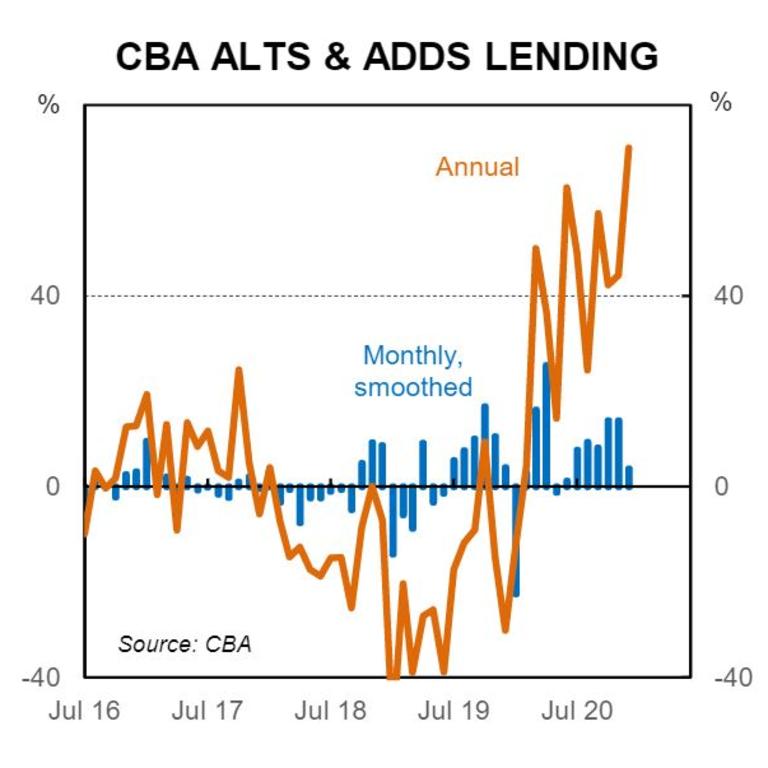

But it’s not just demand for a dedicated home office space that is driving the trend towards renovations, extensions and the buying of new homes.

With Australians increasingly spending far more time at home, they are also looking for more room and to spruce up their homes for other reasons.

These factors have combined to create enormous demand for lending to renovate or add an extension to our homes.

According to data from the Commonwealth Bank, lending for alterations and additions for homes has risen by around 70 per cent since the start of 2020.

RELATED: Buyers snap up regional properties

RELATED: NAB to hire 150 remote-only workers

While the exodus out of the cities and the trend towards working from home should provide support to housing prices in the regions, the news for holders of commercial property in the CBD is the polar opposite.

Demand for commercial real estate as well as apartments in and around CBDs is likely to remain weak.

According to Martin North, the principal of research firm Digital Finance Analytics, the pandemic had created a major shift in demand for different types of property.

“Generally, retail is still suffering quite badly, particularly in some of the CBD areas, whereas large industrial premises used for e-commerce, there is huge demand. So there is a change in the mix of demand for commercial property from retail and office accommodation,” Mr North said.

When asked about the impact of the pandemic on demand for property in the regions, he said: “The ABS (internal migration statistics) have showed the same shifts I have seen in my surveys. People buying away from Sydney and Melbourne, and heading to the regions and towards Queensland.”

Since the pandemic began to impact Australia significantly through closed borders, virus containment measures and government intervention, this has created winners and losers.

In this, the property market and its participants are no different.

For the foreseeable future, CBD commercial and residential property are likely to be the losers in the transformation of how Australians live and work.

Industrial property geared towards e-commerce and regional residential homes are likely to be the big winners, with the road back to the pre-COVID normal still seeming very far away.

It may be quite some time before we fully understand to what degree these trends will impact the market and how permanent they will prove to be. In the meantime some forms of Aussie property are seeing conditions for a boom, while others are seemingly heading for quite the bust.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator