Dire warning for Aussie house prices as market continues to grow despite COVID pandemic

We were warned house prices could drop by a whopping 32 per cent but they stayed firm. Now there’s a stark warning about what could happen next.

When outsiders think about Australian culture, they might think of laid back people defined by sun, sand and backyard barbecues.

But amid the widely held stereotype of Aussies, there’s a part of our national identity that’s often overlooked: our nation’s collective obsession with housing.

From our airwaves being filled with content like Selling Houses Australia and Location, Location, Location to the millions of trips made by Aussies to the local Bunnings every month in order to spruce up their home or garden, there are few things that can grab our attention as much as our homes.

When the coronavirus pandemic first began to impact Australians in March last year, concerns about potentially large drops in housing prices quickly began to build, as the true scope of the crisis became clear.

In April, SQM Research concluded that if a worst-case scenario occurred for the economy and lockdowns lasted for six months across the country, a 30 per cent drop in housing prices was on the table. In May, the Commonwealth Bank followed, warning that a “prolonged downturn” could result in housing prices falling up to 32 per cent.

RELATED: Massive hurdle Aussie economy has to face

Yet here we stand more than eight months after these downside predictions were made and housing prices are significantly higher now across much of the country.

But how did Australia go from facing down potentially the most devastating housing price crash in more than a century, to rising speculation of a nationwide housing price boom?

In short, the Morrison government, Reserve Bank and banking regulator APRA threw an entire Bunnings worth of kitchen sinks at supporting the property market.

In co-operation with APRA, the banks allowed more than 493,000 mortgages to be deferred, with over 118,000 mortgages still deferred according to the latest data.

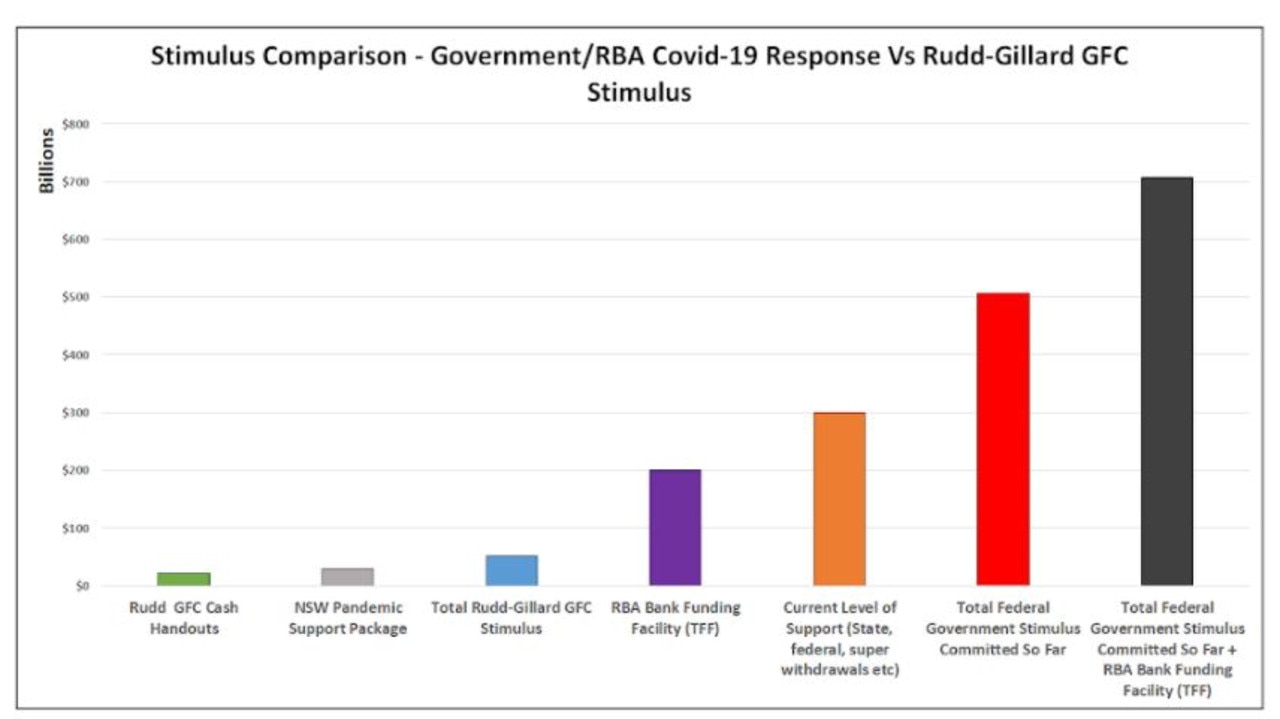

The Morrison government committed to $507 billion in stimulus policies, encompassing the JobKeeper program and JobSeeker supplement, among others.

At the same time the Reserve Bank (RBA) committed to up to $200 billion in near free (0.10 per cent interest) funding for the banks at a time when bank funding costs were spiking due to rising risks in financial markets.

To put these measures into perspective the entire Rudd-Gillard Global Financial Crisis era stimulus package was $51 billion spread over four years.

But where does this leave a property market that has been protected by a wall of more than $700 billion in support committed by the RBA and the Morrison government?

RELATED: Bold US move that will impact all Aussies

The sheer scale of support for housing prices led property analyst and SQM Research managing director Louis Christopher to conclude that: “They (the government) will never let a housing crash happen in this country”.

While the forces deployed to protect housing prices are indeed vast, there are also a number of rising risks on the horizon after a year defined by the so called “Extend and Pretend” economy.

RATES CAN ONLY GO UP

With the RBA cash rate at 0.10 per cent and global interest rates bouncing off the lowest levels in all of history, there is rising speculation that interest rates can only go up from here.

In the United States, analysts are already warning of rising American mortgage rates, as government borrowing costs begin to rise from record lows.

While the RBA has committed to keeping rates low for three years, using its bond buying program to artificially suppress interest rates. At the end of the day it’s the global bond market that is the ultimate decider of the direction of interest rates.

As it stands, rate rises are seen as unlikely for Australian borrowers. But with many economists predicting inflation to rise, in some cases significantly, interest rate hikes cannot be ruled out in the coming years.

A BUMPY ROAD AHEAD?

Despite a level of government expenditure that makes multiple years of World War II look positively thrifty by comparison, there are still a number of economic indicators flashing warning signs.

RELATED: Word that could screw Australia’s recovery

A survey conducted by lobby group Small Business Australia found that 415,000 small businesses were on the brink of going bust. If even a fraction of these businesses signalling distress were to close their doors for the final time, it’s likely that the government’s positive economic forecasts would be in jeopardy.

GLOBAL TROUBLE AHEAD?

Meanwhile, beyond our relatively virus free shores the world continues to grapple with the pandemic. In Europe, EU leaders are warning that mutated strains of the virus will keep the continent in longer and potentially stricter lockdowns, with no clear sense of when restrictions will be lifted.

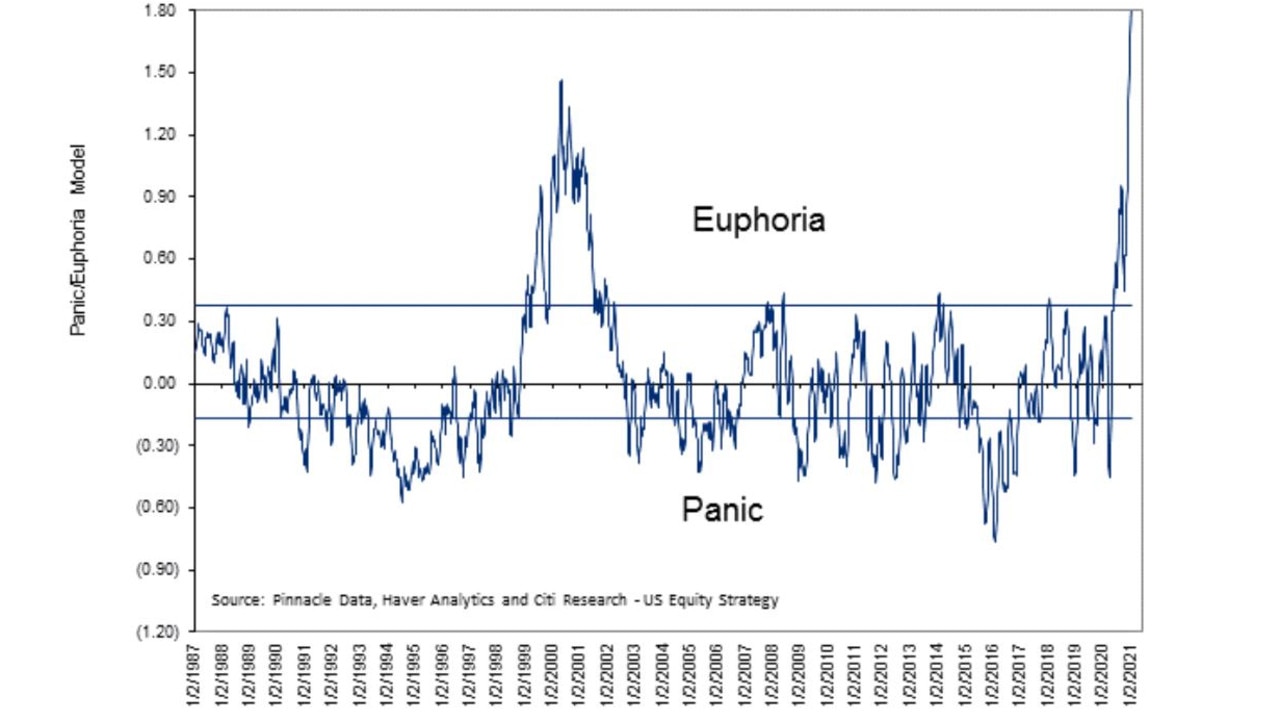

In financial markets around the globe, market indicators continue to flash warning signs not seen since the peak of the ‘Dotcom Bubble’ almost two decades ago. As a sense of market euphoria and a feeling that investors cannot lose, due to central bank intervention continues to spread.

LIFE AFTER THE KITCHEN SINK

Among housing analysts and economists there is a growing consensus that the government and RBA’s ‘Kitchen Sink’ level intervention will not only result in prices not falling, but a housing price boom in the months and years to come.

But amid the housing market confidence there are also risks ahead. From a slowing global economy due to mutated strains of the virus spreading across the world, to financial market contagion overwhelming the Morrison government’s intervention in the housing market.

While there is the relative certainty that the RBA and the Morrison government will continue to attempt to protect housing prices, the most sacred of sacred cows in Australian life.

In a world increasingly defined by the unexpected, there are also downside scenarios where no amount of kitchen sinks will be enough.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator