CBA predicts 2021 Aussie house price boom of 8 per cent

Commonwealth Bank released its massive yearly profit results and also made a shocking prediction about what house prices will do in 2021.

Commonwealth Bank reported its profits on Wednesday, and they made a cool $5 billion in the last six months alone.

Revenues were around $12 billion, costs were a bit over $6 billion and they paid $1.6 billion in tax, leaving around $5 billion for shareholders. Not bad going for a pandemic!

The really interesting thing in their financial reports, however, was not the news that banks make completely crazy amounts of profit. We knew that. What was interesting was what they told us about the future.

RELATED: 50 days before potential bloodbath

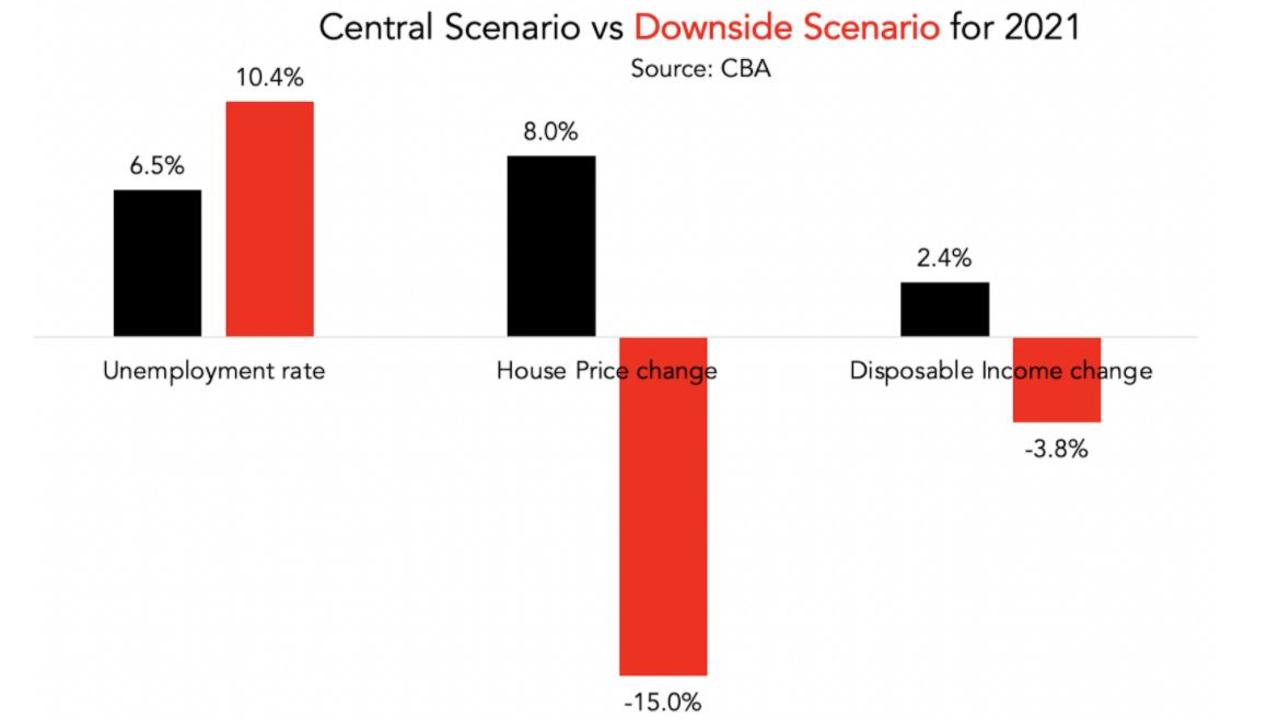

Commonwealth Bank forecasts what it thinks will happen in the future. It is forecasting an enormous boom in asset prices: house price growth of 8 per cent this year and stock price growth of 12 per cent. It also expects unemployment to fall even as JobKeeper goes away.

This is all just its main scenario, which they call the “central scenario”. There’s also a downside scenario and an upside scenario, as you’d expect.

But they are apparently also quietly bracing for the worst, as the bank revealed it has also produced a “severe downside scenario”. I asked the bank for more details on that and apparently it is too shocking for public consumption because they wouldn’t send it to me.

But even the simple downside scenario makes for shocking reading. In it, unemployment goes up to 10.4 per cent, disposable incomes falls by 3.8 per cent and house prices drop 15 per cent.

Remember, this is not their secret severe downside scenario. This is the one they were happy to release.

RELATED: Our JB Hi-Fi obsession is changing the world

What happens with the economy is very important to the Commonwealth Bank. It is Australia’s biggest housing lender.

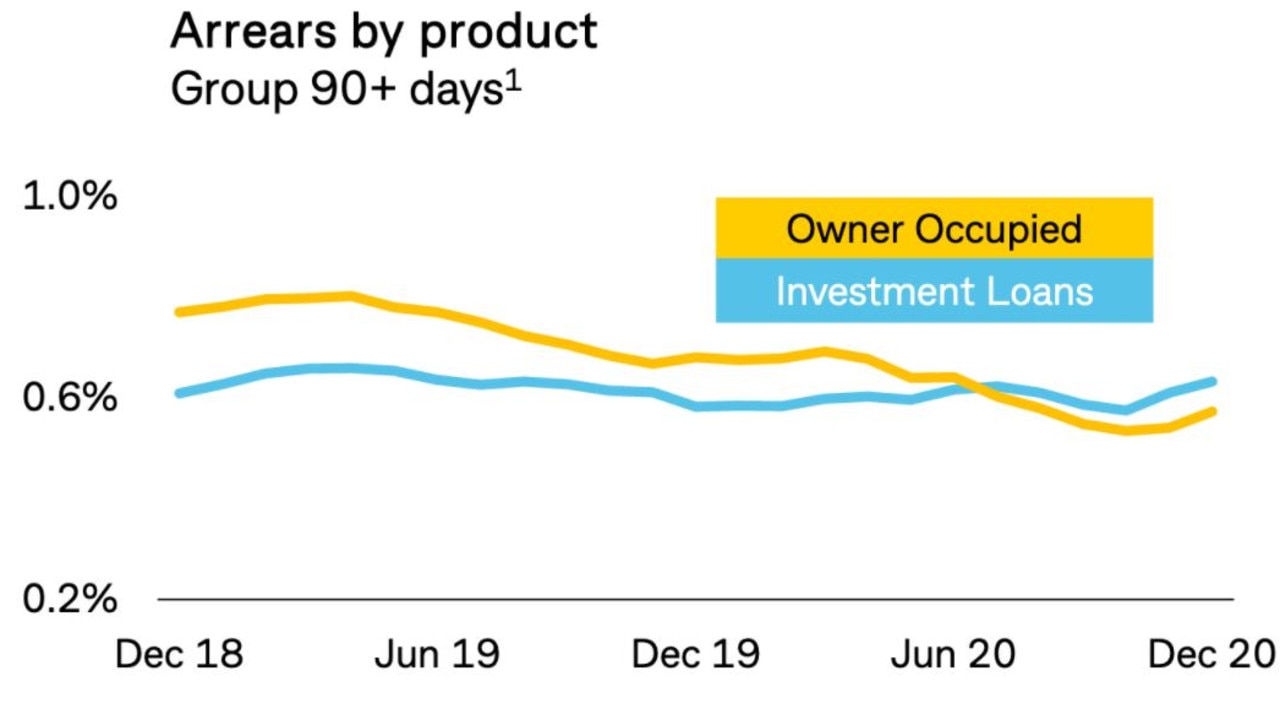

Is everything sunny in the world of home loans? You might think so if you look at mortgage arrears. Those are the loans where people are behind on their payments and mortgages in arrears are more likely to turn into mortgage defaults. But mortgage arrears are well down.

RELATED: Massive hurdle Aussie economy has to face

Arrears appear to be down. But the bank doesn’t count deferrals as arrears. Remember how banks let their customers put loans on deferral? Commonwealth Bank still has $9 billion worth of loans which aren’t being paid back at all.

That’s a lot less than the peak in 2020, to be sure. But $9 billion is not a number to sneeze at, especially since almost half of them are in one geographic area.

Victoria, which has had the worst of the pandemic, naturally has the highest number of mortgages still in deferral. The risk of loans going bad would seem to be worst in the southern state, which is battling fresh outbreaks of the virus even now.

Victoria’s prospects for 2021 are clouded by what happens in the next few months. Another outbreak prior to widespread vaccination is possible.

In 2020, outbreaks happened in Victoria during Spring. It is easy to forget because of the big wave that followed but Victoria had community transmission March 2020.

The spread of the virus does seem to depend on seasonal factors and so as the weather cools in Melbourne, the risk of outbreaks is real. Especially with the new more highly transmissible variants on the loose.

RELATED: Bold US move that will impact all Aussies

Delays in the vaccine mean Australia is slipping into a risky zone.

The initial phases of the rollout were always going to be slow, with just 80,000 people a week getting vaccinated at the beginning. Delays in the arrival of vaccines mean it will be mid-Spring before a sizeable chunk of the population has their jab.

One more lockdown is not out of the question, and that would come at an economic cost.

That’s just the virus risk. There’s also risk around what happens to Australian consumers when the JobSeeker supplement expires and JobSeeker is removed. The Reserve Bank says it expects income to fall 3 per cent and consumption to rise 14 per cent in the year to June.

Normally if income falls consumption rises, so we shall have to see what happens there.

Over-optimism is, according to the World Bank, a classic symptom of the early phase of the recovery from a recession.

PRUDENT

Of course, Commonwealth Bank is not betting the whole bank on the central scenario coming true. The reason they have a downside scenario – and a severe downside scenario – is they want to be ready in case of disaster. Commonwealth bank boss Matt Comyn was careful to point out that they hope for the best but prepare for the worst.

“We could withstand a much more significant economic deterioration than we are anticipating,” he said on Wednesday

Still, he says, it would be very helpful for all those deferred mortgages if the economy kept going well. The remaining mortgages on deferral belong disproportionately to people who have really suffered in the pandemic – like people who work in travel or major events.

It will be much easier for them to get the mortgage repayments back on track if the unemployment rate keeps dropping.

Of course, some won’t be able to get back on track and will have to sell their property. If they have to sell, it will be much better to sell into a rising market.

It is easy to see why the Commonwealth Bank would want to believe in their central scenario. But as we know from 2020, life doesn’t always turn out the way you want.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.