Australians expected to spend COVID savings in 2021 as borders open

The end of March will signify a huge change for Australia which could see the economy fall off a cliff – unless Aussies start doing one thing.

In about 50 days’ time, we find out if the big assumption is true. A lot is riding on this assumption. The whole nation’s economic performance and all our jobs are at stake.

The assumption? That people who built up big savings in their bank account in 2020 will spend them in 2021, and spend them if the economy is beginning to falter. The risk is those savings don’t get spent and a faltering economy gets even worse.

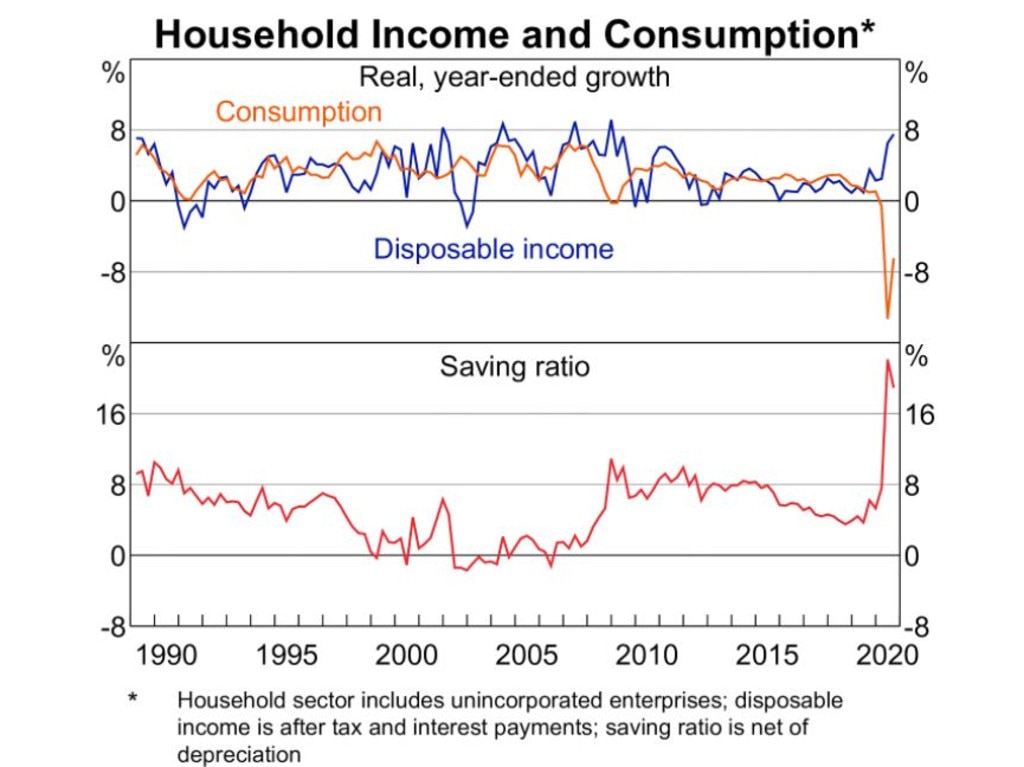

First, let’s establish the basics here. The pandemic has been a time of huge savings for most Australians, as the next chart shows. Bank balances have been helped on both sides: There’s less to spend money on and more income coming in.

RELATED: Massive hurdle Aussie economy has to face

In 2021 we expect two things to happen. First, there will be more things to spend money on. Options will open up again. State borders will crack open and people will go on holidays. A lot of pent-up weddings and 21st birthdays will be held. Bands will tour. Movie theatres will admit more patrons, the list goes on.

But also, income support will stop. The JobSeeker supplement and JobKeeper are both scheduled to stop in late March. It is hard to overemphasise just how big these two programs have been. Many billions has been spent and it will all stop in March. What will happen then? Will the economy somehow keep going at the same pace?

One person’s spending is another person’s income. That’s how the economy works. When spending goes up, income goes up and the economy gets stronger.

Normally this is a merry cycle that goes on and on. In 2020 the Australian government kept adding money into the cycle, making the economy much stronger than it would otherwise have been.

The boss of Australia’s central bank says he reckons the end of those two big spending programs will be a blip because of people’s huge new buffers.

“Over the next six months, aggregate household income is expected to decline as the pandemic support payments unwind. Normally, when income falls, so too does consumption. But we are not in normal times,” he said in a presentation in Canberra on Wednesday.

“The extra savings over the past six months and the bigger financial buffers can support future spending – people will have more freedom to spend as restrictions are eased and be more willing to spend as uncertainty recedes. So we are expecting the recovery in consumer spending to continue.”

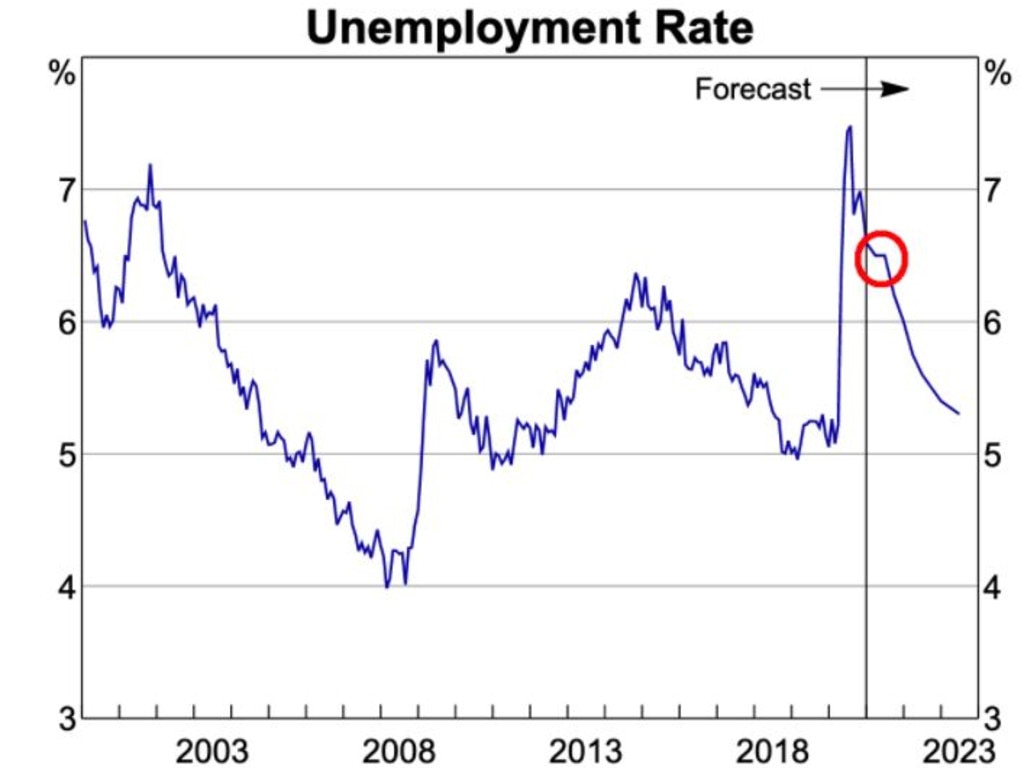

The official forecasts for unemployment show a tiny pause around the time that JobKeeper finishes.

RELATED: China’s new strategy a disaster for Aus

See that little plateau? I circled it in red. Unemployment is steady for a moment, but only for a moment. Then it is forecast to keep falling fast. This graph is from the Reserve Bank, who are famous for forecasts that don’t come true. What this chart doesn’t show you is any sense of the uncertainty around the future.

Upon questioning though the RBA chairman will freely admit this is brand new territory and forecasts should be treated with even more caution than usual.

“Our sense is job creation is going to continue, I’m hoping that is enough to offset the job losses but there is a degree of uncertainty around as we have not been in this area before – so we don’t have any experience to draw on. It’s possible it could go the other way. But the central scenario is we continue to recover.”

Let’s look at that quote again: “It’s possible it could go the other way.” That’s always true with forecasts and it is especially important to remember when the forecasts are based on big assumptions.

WITHDRAWAL SYMPTOMS

The government is forcing the economy to go cold turkey on JobKeeper. Their expectation is the Australian economy won’t get withdrawal symptoms because all those savings will smoothly take over from government spending. But that’s just an assumption. In 2021, Australians will make up their own minds on what to do with their money. Maybe they won’t want to blow it all at JB HiFi after all.

We might see house prices rising in 2021 and decide to keep our money in the bank to fund a future house purchase instead of spending up.

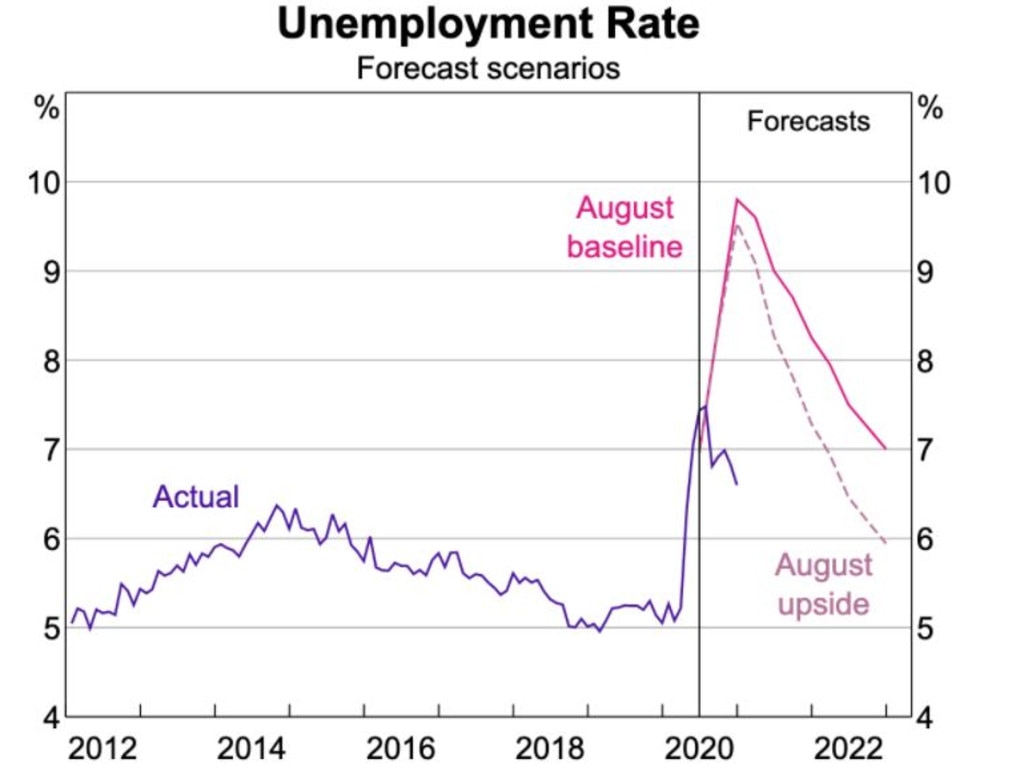

Economic policymakers have already been surprised once in this pandemic. The RBA thought unemployment would hit almost 10 per cent. Instead it only hit 7 per cent, as the next graph shows.

The most unexpected thing was the scale and effect of government spending. Nobody thought it would work so well. It worked very well indeed. Government tipping billions of dollars into the economy saved us from total wrack and ruin.

RELATED: Bold move that will impact all Aussies

There would be an ironic symmetry here if we were surprised about the powerful effect of government spending twice: wow, it works really well when it is brought in! Then also: wow, it totally stops working when you stop doing it!

Are we that easily fooled, as a nation? I fear the answer is yes. We find out in 50 days’ time.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.