Australia’s economy faces major hit as China considers scrapping growth target

China’s plan to get out of a recession has benefited Australia by billions of dollars. But its new strategy could cost us $30 billion.

In the years since the Global Financial Crisis (GFC), the Australian economy has been heavily supported by demand for our mineral exports from China.

During the GFC’s dark days, when it looked like Australia would follow the world into recession, the explosive demand for iron ore and other bulk commodities not only dragged Australia out of doldrums, but into an economic boom.

But like so many other elements of our relationship with China in recent months, this boom may also lead to something of a bust.

For years, the Chinese government has set ambitious economic growth targets. One reason for this is to have a benchmark for provincial governments to guide the level of public investment to be made in the coming year.

But now, amid warnings from Chinese President Xi Jinping of a potential “black swan” or “grey rhino” unpredictable event, reports have emerged that the traditional economic growth target could be abandoned in 2021.

In the years since the GFC, the Chinese government has relied heavily on the construction of real estate and infrastructure in order to meet to the required economic growth target.

This is arguably why the “roads to nowhere” and “ghost cities” have arisen.

RELATED: ‘Concern’ over China’s new tactic

Unsurprisingly much of this construction is fuelled by large amounts of debt, with total overall Chinese debt rising to 335 per cent of GDP in the third quarter of 2020.

The rising risks from China’s growing debt pile have not escaped the attention of the Chinese government and China’s central bank, the People’s Bank of China.

This is arguably one of the key driving forces behind the push to abandon the traditional GDP growth target, potentially in favour of one based on labour market outcomes.

If Chinese officials have the mettle to pursue the task of rebalancing towards a more small/medium business-driven consumer economy, it could impact Australia significantly.

Without strong growth in real estate and infrastructure construction to drive demand for our commodity exports, Australia’s economy and budget bottom line could face a major hit.

This comes at a time that the Chinese government is already looking to cut steel production in order to meet carbon emission targets. The Chinese Minister for Industry and Information Technology Xiao Yaqing made a pledge in January to cut the output of crude steel to ensure total production falls year on year.

Even with a cut in total steel production, China would still be importing positively biblical amounts of Australia’s mineral exports, such as iron ore.

However, even a relatively small decrease in overall demand could have a disproportionate impact on Australia.

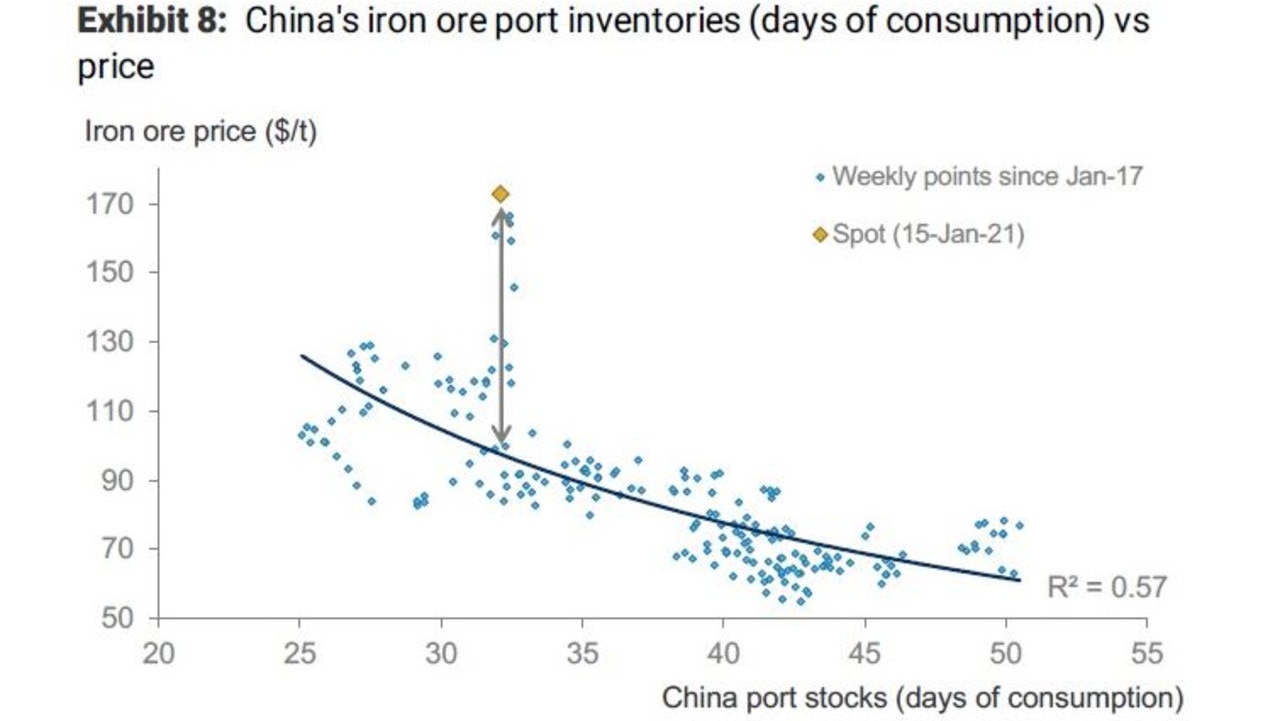

As it stands, iron ore prices are already highly elevated relative to the underlying demand and total iron ore stocks at China’s ports.

If iron ore prices were to revert to around the level implied by port inventories relative to current consumption, prices could drop from their recent highs around $US170 per tonne*, down to around $US100 per tonne.

RELATED: Next battleground with China

According to figures from Treasury, a significant drop in iron ore prices would be bad news for Australia, particularly at a time when the rest of the economy is still recovering from the pandemic.

For every $US10 the spot price of iron ore falls, annual GDP is reduced by $4.4 billion and the federal government’s revenue is reduced by $300 million.

With a price drop of up to $US70 per tonne potentially on the table based on some of the current indicators, the hit to the economy over the course of a year could be as much as $30.8 billion and reduce federal government revenue by $3 billion.

While any significant decrease in iron ore prices would be a blow to the budget bottom line and the broader economy, it is important to keep in mind the budget anticipated that iron ore would be just $US55 per tonne later this financial year, not the $US170 per tonne we have seen in recent weeks.

Nonetheless, all that additional revenue could provide a major boost to headline GDP and the recovery of a federal budget still drowning in red ink.

That being said, if China was to shift towards a more consumer-focused economy, it’s not only iron ore exports that would be impacted.

All sorts of bulk commodities from coking coal to copper could also take a hit, depending on underlying global demand outside of China.

In recent days, iron ore prices have seen significant declines of around 10 per cent from their peaks. While this may be just a pullback after a near-record bull run, there is some evidence to suggest that a peak in prices may be in sight.

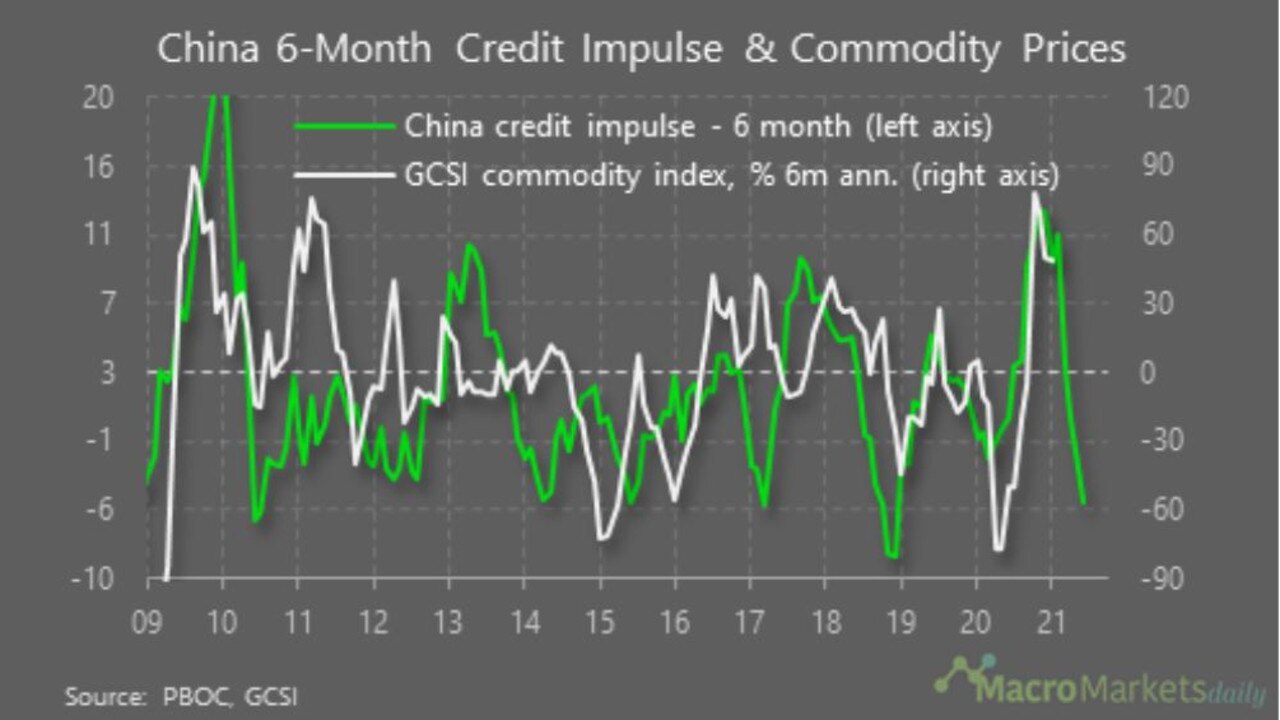

There is a correlation between China’s credit impulse and commodity prices, and in recent weeks the impulse has weakened significantly.

Given that much of China’s construction-driven growth is fuelled by debt, it’s perhaps unsurprising that there is a link between the two.

RELATED: China sanctions could benefit Australia

While the explosion in demand for iron ore and the near-record run-up in iron ore prices have provided an enormous boost to Australia’s economy in one of its darkest hours, if Beijing is willing to pull the trigger on the rebalancing of its economy that may be coming to an end.

It’s not the first time Beijing has claimed it would shift away from a debt-fuelled and construction-driven economy. However, given President Xi’s concerns of potential upheaval ahead and the growing drive for a more sustainable growth engine, Beijing finally making good on its promise to rebalance its economy cannot be ruled out.

With the potential for this move to have a potentially damaging impact on the Aussie economy, perhaps it’s time Australia thought seriously about an economic rebalancing of its own.

*Iron ore is priced in $US/metric tonne

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator