China trade war: Why iron ore industry is Australia’s trump card

Beijing is tightening the screws on the Morrison Government – but Australia has one thing in its back pocket that is vital for China.

Since the coronavirus crisis began back in January, Australia’s relationship with China has gradually transformed from one of economic co-operation out of mutual self-interest to one of a more tense, adversarial nature.

Where once Chinese demand for all manner of Australian exports was seen as a key boon to a number of different industries, from agriculture to education, it is now increasingly viewed by many as a liability, as Beijing increasingly tightens the screws on the Morrison Government and the Australian economy more broadly.

In recent months, China has effectively been engaged in a one-sided trade war with Australia, targeting exports such as barley, meat and university degrees, in an attempt to force the Government into backing down from its more assertive stance toward Beijing.

But as frustrated as Beijing becomes with Australia no longer sufficiently ‘toeing the line’ in its view, there is one export to China that stands alone, largely untouchable by Beijing unless it wishes to shoot itself in the foot in the process: Iron ore.

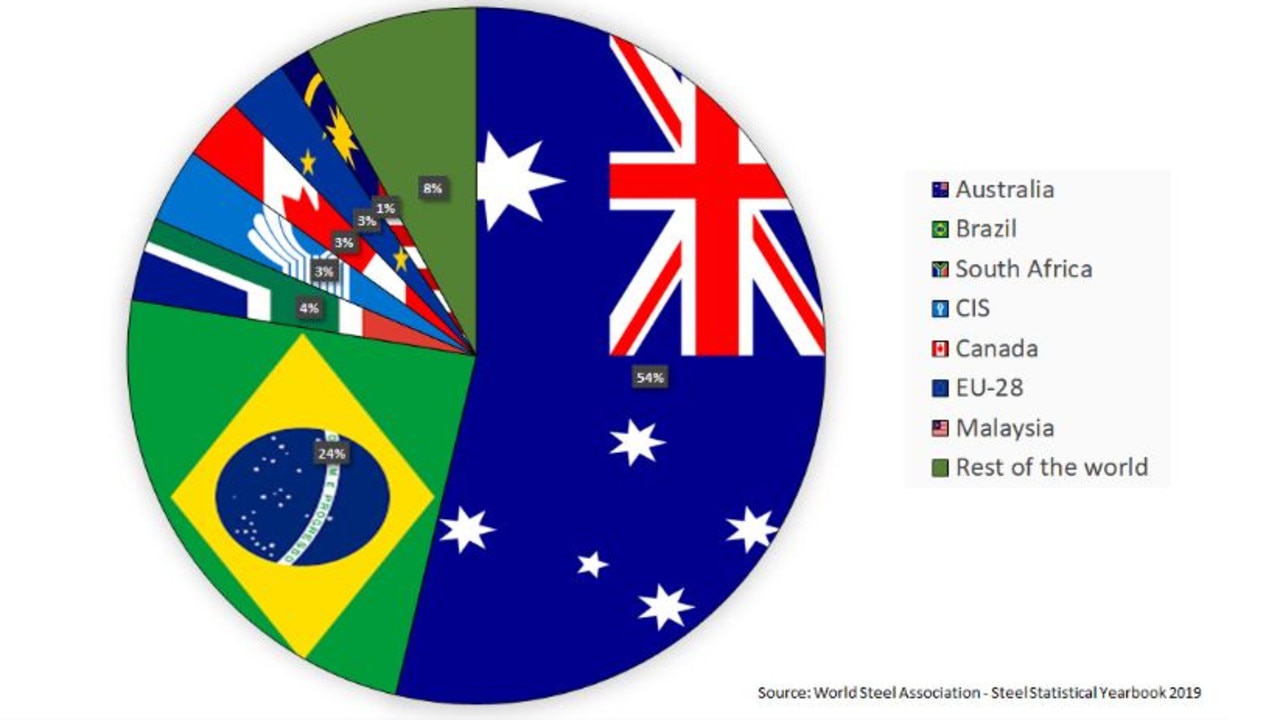

In 2018 Australia exported more iron ore than every other nation in the world put together. With Australian iron ore exports totalling 53.7 per cent of global supply, and its nearest rival Brazil, producing less than half that amount at 23.9 per cent, Australia has an effective monopoly on supplying the quantities of iron ore China requires to power some of the key growth engines of its economy.

RELATED: ‘Crazy’: Australia’s pandemic payday

Meanwhile, China consumes 69.1 per cent of all global iron ore exports, more than double the rest of the world combined.

While China may like nothing more than to be able to use Australia’s reliance on iron ore exports to attempt to leverage the Government into a more accommodative stance towards Beijing, they know full well that Australia is the only supplier that can fully satisfy their demand.

Now as the coronavirus crisis continues to unfold, Chinese imports of Australian iron ore have taken on an even greater level of importance, as Beijing attempts to cope with the economic impact of the virus and the associated lockdowns.

Determining the true extent of the damage to the Chinese economy and labour market caused by COVID-19 and the lockdowns is difficult, to say the least. Chinese statistics can be notorious for providing the outcomes authorities find desirable. Officially, the Chinese unemployment rate is 5.9 per cent, however the accuracy of this figure has been frequently questioned by analysts.

In June, Oxford University economist and former UBS senior economic adviser George Magnus stated in an interview with Bloomberg, that the true rate of Chinese unemployment was likely to be 15-20 per cent.

This view was shared by a group of analysts from Chinese Shandong-based brokerage firm Zhongtai Securities, who stated in a research report that it was likely that up to 70 million Chinese people may have lost their jobs during the crisis and that the true rate of unemployment was approximately 20.5 per cent.

Perhaps unsurprisingly, Zhongtai Securities later retracted its report and one of its authors said: “We should go by the official figures for unemployment.”

RELATED: Photos reveal new island fortress

After years of attempting to rebalance its economy away from infrastructure and construction-fuelled investment towards a more consumer-driven economy, Beijing has fallen back into old habits, increasingly relying on big spending on infrastructure projects to drive economic growth – much the same way as it did during the global financial crisis.

While Chinese stimulus programs are likely to have a total cost in the trillions of dollars, Beijing has also shown some clear signs that it intends to be as thrifty as possible when not focused on a select few priorities, after a growing Communist Party consensus that the GFC-era stimulus went somewhat overboard.

These priorities have become increasingly apparent in recent days after a series of damaging floods across China, including Wuhan, the original epicentre of the global COVID-19 outbreak.

In the aftermath of the floods in Anhui, Hubei and Jiangxi provinces which have a collective population of more than 150 million people, the Chinese Central Government’s National Development and Reform Commission allocated relief funds of just 309 million yuan ($A63.6 million).

RELATED: Why does China hate Australia and the US?

This led to some China experts to wonder why the central government in Beijing left the heavy lifting of disaster relief to “cash-strapped local governments” which were already struggling with the burden of recovering from the economic impact of COVID-19.

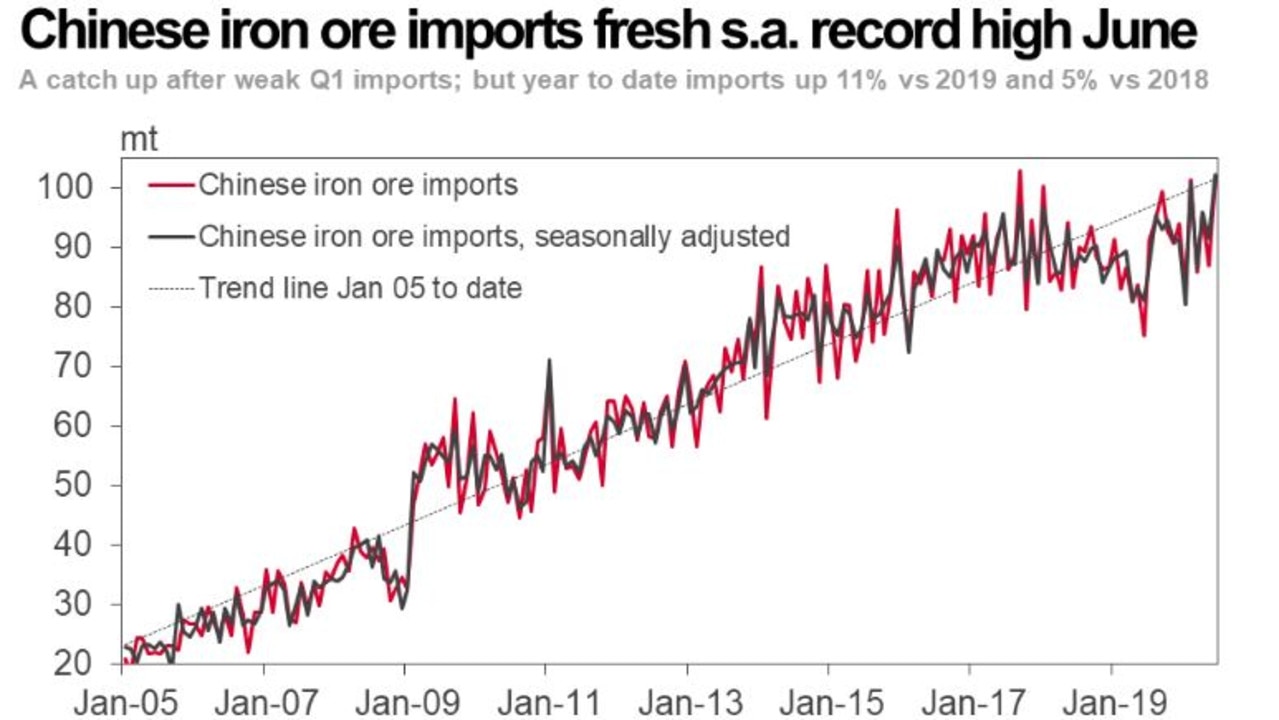

Looking at a chart of Chinese iron ore imports, it’s clear where a significant portion of China’s money is going.

Despite a significant drop off in global iron ore demand outside of China and other commodities such as thermal coal still struggling compared with pre-coronavirus, the enormous China-centric demand for iron ore has ensured prices have remained relatively strong.

If the relationship between Beijing and Canberra continues down its current path, it seems likely that the list of Australian industries targeted by the one-sided trade war may continue to grow.

RELATED: Downer says China reaction ‘complete miscalculation’

But as the CCP attempts to put its nation back on the path towards growth, China’s reliance on Australian iron ore will continue, potentially becoming even greater if infrastructure and construction spending once again goes further into overdrive.

Australia’s diplomatic relationship with China is likely to continue to be problematic for some time to come, as Canberra increasingly finds itself in the middle of the ongoing US-China tensions.

But despite Beijing’s ongoing threats that Australian iron ore may find itself a target of China’s growing ire, China’s insatiable appetite for iron ore will ensure it cannot act on those threats without severely damaging its own economic growth prospects in the long run.

Tarric Brooker is a freelance writer.