China’s trade sanctions likely to leave Australia better off due to skyrocketing iron ore prices

China’s trade moves have sparked an unexpected benefit for Australia – driving up the price for one key resource so much it could make up for other losses.

China’s trade actions on Australian wine, beef and other goods may have delivered a substantial hit to our economy but this is likely to be offset by the booming iron ore price, new analysis suggests.

While specific industries targeted by China will be hurting, the trade tensions with Australia are driving up prices for iron ore and could leave the economy better off overall.

Deloitte economist Chris Richardson said a “fear tax” had driven iron ore prices so high, they were making up for Chinese government moves against Australia’s wine, beef, lamb, barley, timber, lobsters, coal and other goods.

He is now predicting a higher than anticipated tax haul for the Federal Government.

“Iron ore prices are close to the peak prices we saw during the mining boom, which is remarkable considering economic conditions and the fact that China’s economy is not as strong as it was,” Mr Richardson told news.com.au.

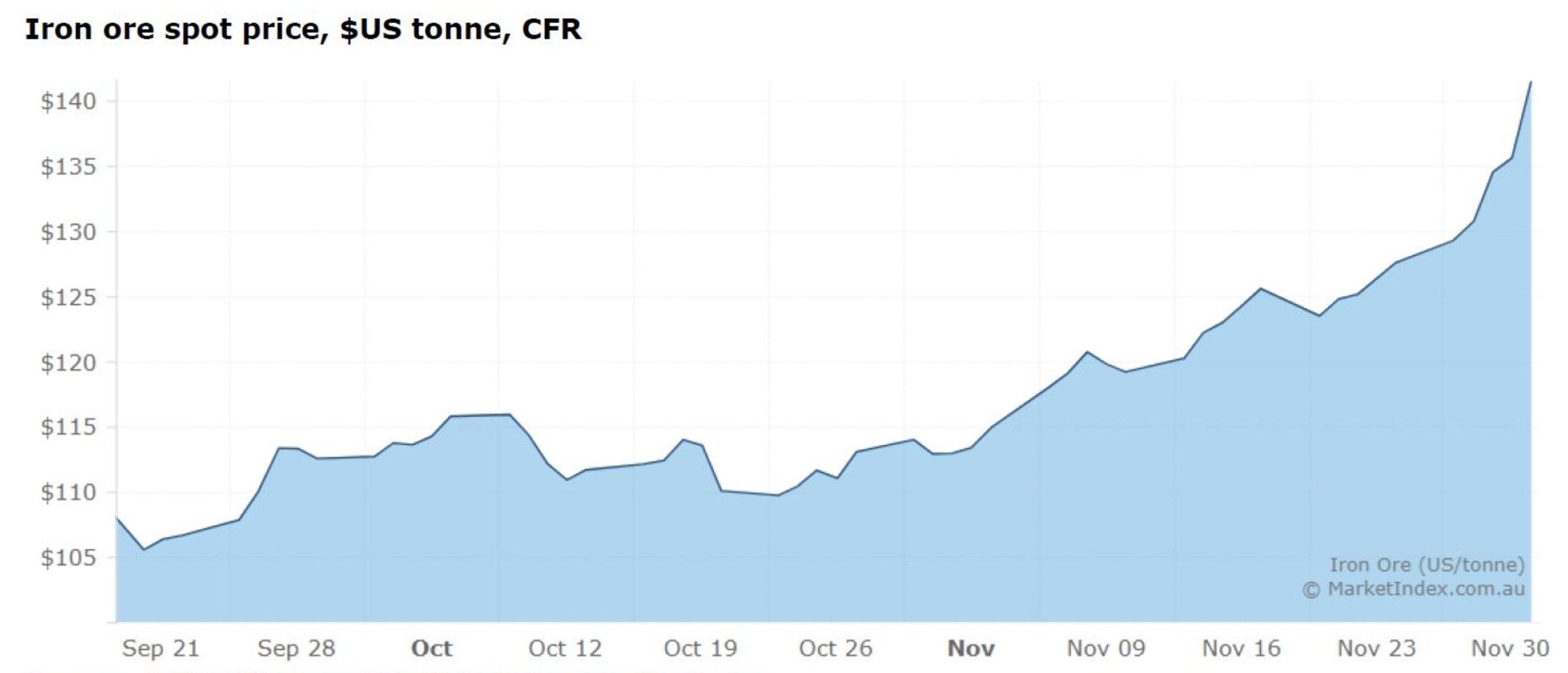

He said according to MarketWatch, the price of iron ore has increased by $23 per tonne since November 30 when it was $129. It is now $152 per tonne.

There are a number of reasons for the skyrocketing prices but it seems that China’s trade war is one important factor.

Even though China is unlikely to act against Australia’s iron ore as it would “cost them a bomb”, Mr Richardson said some people were still worried that they will.

He said this had led to speculators and steel mills in China buying up the resource in case a ban came down and they had to find other more expensive sources of iron ore.

RELATED: What’s next in China’s firing line

Australia is the world’s largest seller of iron ore and while any trade sanctions would likely send prices lower for its product, China would still need to buy iron ore from another country and this would see prices increase for those suppliers.

“This is what happens in a situation when there is a trade war between the biggest buyer and the biggest seller, it’s a mess and everyone loses,” Mr Richardson said.

China already struggles to get all the iron ore it needs to make steel for its vast manufacturing industry and there are low inventories of the product at ports.

“The bottom line is that China’s trade war with Australia is making us money rather than losing it,” Mr Richardson said.

Other factors driving prices up include heavy rain that may see supplies fall from Brazil, which is the world’s second-largest supplier after Australia. The La Nina weather pattern could also bring cyclones to Western Australia and disrupt supplies from Australia.

All commodities are priced in US dollars and so the falls in the currency have also made iron ore more expensive, alongside low interest rates.

Mr Richardson said low interest rates meant speculators wanting to buy iron ore could also take out cheaper loans, helping to push up prices in much the same way that low interest rates drive up house prices.

“There are lots of reasons why prices are on a moonshot at the moment,” he said.

“But the market is already tight and it didn’t need much spark to burst into flame, and it truly is aflame at the moment, it’s rocketing along.”

Mr Richardson is now predicting that the red-hot price for iron ore will see the economy grow by more than Treasury predicted.

He believes that the Budget bottom line will be $3 billion better than the Treasury predicted in October. The latest figures are due to be released this week.

“There is a lot of good news, job markets and company profits are looking better than they were,” he said.

“It’s still not good – this has been a shocker of a year – but it’s better than it was.”

China’s unofficial ban on Australian coal has also seen the price of coking coal in China soar to a four-year high.

Prices for Australia’s premium coking coal are now so low, it’s cheaper than the cost of coal produced domestically in China, despite China’s coal being of much lower quality.

With Australia seemingly frozen out, China has turned to Canada for its supply despite having to pay higher prices.

Last month, Canada’s largest diversified mining company Teck Resources said it had increased its sales into China and had managed to get higher prices than Australia was getting for its product.

Earlier this year, Trade Minister Simon Birmingham also suggested other tariffs could prove detrimental to Chinese consumers.

Modelling from the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) found China could potentially see a loss of $3.6 billion due to its reliance on Australia’s quality barley for brewing beer.

It claimed the tariff would see Chinese buyers shift to alternative sources for malting barley, which would likely result in lower returns for their products.

“The need to find alternative supplies of barley leads to an increase in demand for Chinese-grown barley. In response, Chinese agriculture shifts towards a less efficient production mix of coarse grains (corn and barley), which further compounds the effect of the tariff,” the report states.

charis.chang@news.com.au | @charischang2