Australia’s retail apocalypse coming when pandemic spending ends

They did surprisingly well during the pandemic but a sharp change in consumer behaviour could leave this much-loved industry floundering.

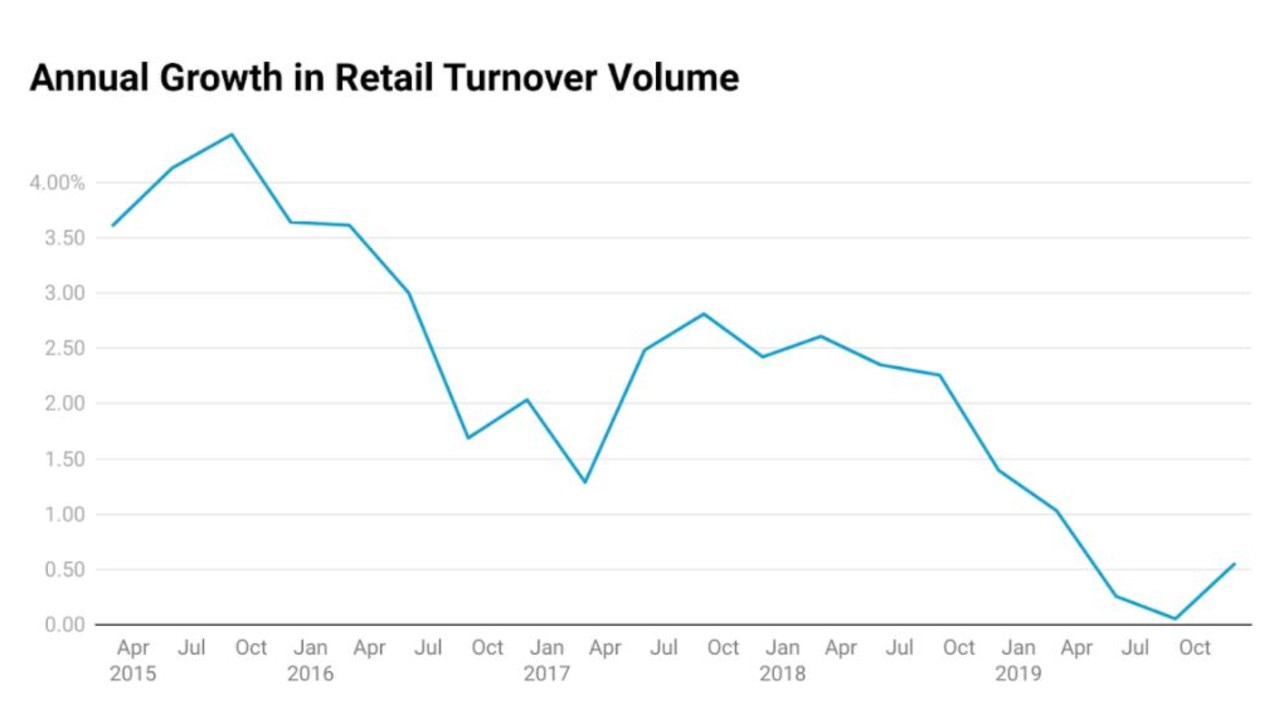

In late 2019, long before most of us had heard of the COVID-19 virus which would come to define our lives, Australia’s retail sector was already deep in the doldrums.

With retail sales growth at anaemic levels and stores continuing to close in our shopping centres and street malls, elements of the media dubbed it the “retail apocalypse”.

Despite the nation’s immigration intake bringing in over 200,000 additional consumers every year, retail sales growth in volume terms was at its lowest level since the recession of the 1990s.

RELATED: Sign Aussie house prices could plummet

In an ironic twist of fate, COVID-19 changed all that.

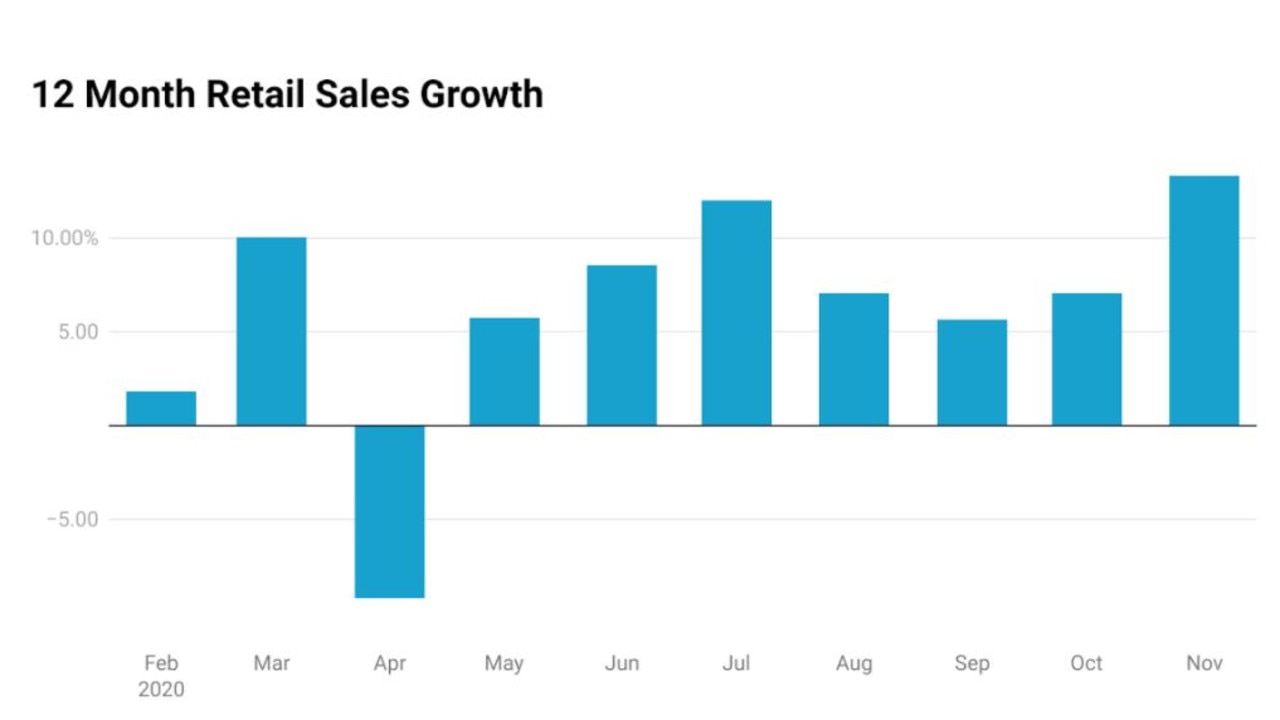

In just a few months, retail sales growth went from practically flat lining to record levels of spending.

Between February and November 2020, monthly retail sales turnover rose by an enormous 13.3 per cent. Prior to the pandemic this was a level of growth that existed only in the wildest dreams of the most optimistic retailers.

RELATED: One month to economic carnage

But amid the pandemic and in the unlikeliest of circumstances, their dreams came true, with annual retail sales growth rising more than seven fold.

The government’s response to the pandemic, in the form of lockdowns, movement restrictions and unprecedented levels of stimulus had created a perfect storm of positive factors for some retailers.

Instead of households spending their money on services such as travel or trips to the cinema, all this cash went directly into spending on retail goods. As a result, some of the nation’s biggest retailers saw sales skyrocket to record highs.

Veteran retailer and Harvey Norman chairman, Gerry Harvey, recently told the Weekend Australian that nothing in 60 years has been as good as the current retail environment.

“I have been doing this since the late 1950s and I have never seen anything like this, and I have seen quite a few recessions and boom times and nothing has ever been as good for retail,” Harvey said.

Unfortunately for the nation’s retailers, none of the previously mentioned factors driving this unprecedented retail boom are permanent.

In time, household spending on services will return to pre-pandemic levels, as more Australians feel comfortable going away on holiday and having a night out on the town.

In the coming months the impact of government stimulus will begin to fade away, as the JobSeeker supplement and JobKeeper both come to a conclusion in just a few weeks’ time.

In effect, the pandemic retail boom brought forward a great deal of consumer demand.

With Australians stuck at home and unable to travel or even go down the pub, all of a sudden getting that new outdoor setting from Bunnings or the new TV from JB Hi-Fi seemed like a great idea.

The detail... alcohol and recreational good spending standouts through the year... what could go wrong... #ausbizpic.twitter.com/OCi466HUvM

— Alex Joiner (@IFM_Economist) March 4, 2021

The need for a bit of retail therapy was quite real for many Australians after they emerged from lockdown. This was particularly true of Victorians who suffered far more and for far longer than the majority of other Australians.

But now as hopes continue to rise that our society can finally begin to return to normal, a realisation will dawn for many households in the coming year. We only need so many desks to work from home, outdoor furniture for entertaining and televisions to watch.

As it stands, furniture, recreational goods, consumer electronics and hardware sales all remain well above their pre-COVID levels almost a year after the initial lockdowns began to impact our lives.

This is unlikely to continue. In the coming months and years, the balance of household spending will likely head toward its pre-COVID normal, potentially hitting retailers who have taken advantage of this major shift in spending quite hard.

If retail sales volumes do return to their pre-COVID levels or perhaps even a little less due to exhausted demand for certain items, this leaves retailers in the same mess they found themselves in at the start of last year, amid the ‘retail apocalypse’.

Based on the pre-pandemic retail sales growth rate, for retail sales turnover to recapture its November 2020 high, it would take around six and a half years. With retail sales recapturing their previous highs around the middle of 2027.

Like many things in the post-coronavirus world, there will likely be winners and losers as things continue to return to normal.

Retailers who have enjoyed bumper sales for things like home furnishings and office equipment will likely see demand drop off significantly, as spending rebalances and Australians look to get out of the house.

For restaurants, cinemas and other long suffering service providers, things are looking up. As COVID restrictions are lifted and we can finally head out for a proper night on the town once more, many are looking to make up for lost time.

For the moment, Australia is enjoying the last billions of the bulk of government stimulus and are spending accordingly. But as things continue to return to normal and the confidence boost from government intervention begins to fade, the “retail apocalypse” is arguably likely to pick up where it left off.

Through the unprecedented intervention of the Morrison government, many Australians never felt the COVID-19 recession for any longer than a few weeks. On paper the recession is over, but as the tailwinds supporting retail sales finally begin to fade, it may feel like one for some of Australia’s long suffering retailers.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator