The 300,000 Australian mortgages that shouldn’t exist

As interest rates rise, a big flaw is being exposed in how Australia has granted mortgages. How was this ever allowed to happen?

OPINION

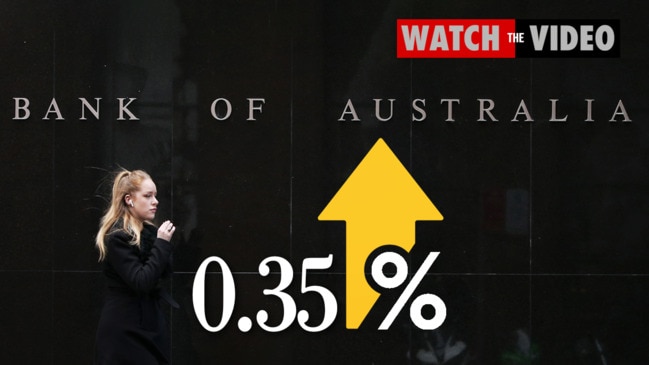

Interest rates went up from 0.1 per cent to 0.35 per cent on Tuesday and it’s potentially the start of a very long and scary road for any Aussies who took out huge mortgages while rates were low.

It’s been predicted rate rises could happen every month this year and if they go too high, up to 300,000 people could be in mortgage stress and unable to pay their mortgage.

It’s a worst-case scenario situation but it’s also completely possible.

For example, if you have a $500,000 loan and rates go up by 0.15 per cent then it will be an extra $40 a month which, quite frankly, if you can afford a house then you should be able to stretch to.

However, take that rate rise up to 2 per cent and it’s an extra $567 a month … which suddenly feels a lot more fraught.

For me, the worry Aussies are starting to feel is reminiscent of the UK in 2008 as the Global Financial Crisis (GFC) hit. I just hope Australia doesn’t end up down a similar path.

Don’t get me wrong, this is a very, very different situation to the GFC. Interest rates rising in Australia is something predictable, something we knew would happen and have been warned about. Although we were told by the Reserve Bank that it wouldn’t be until 2024.

The GFC was primarily caused by people in the US being given what’s called ‘subprime’ mortgages, which are generally given to people on lower incomes. They have higher interest rates and can increase over time. When people defaulted on those mortgages it had catastrophic global consequences that came as a huge shock to most of the people affected.

One thing is similar though. It was everyday people on low incomes that suffered most in the GFC – people who had been approved for mortgages that they should never have been given – and as interest rates go up in Australia, it will be those people who find themselves being crunched for cash once again.

I was in my 20s when the Global Financial Crisis hit the UK. Not long out of uni and optimistic about finally earning some money, I was rudely slapped in the face when the GFC came along.

I was made redundant (twice) and when I did land a long-term job, I had a pay freeze that lasted five years. Thankfully I didn’t own a home at the time, otherwise I would probably have had to declare myself bankrupt.

I’m not going to lie, it was a grim time. It was especially grim in quite deprived areas such as Nottingham where I lived, where people had been encouraged to take out 100 per cent mortgages with no deposit.

People defaulted on those mortgages and houses plummeted in value as banks sold off properties trying to recoup their money. ‘For sale’ signs flooded the city, particularly in areas where cramped new builds had been thrown up by greedy developers wanting to maximise on the fact everyone seemed to be able to buy a house, no matter how low their income was.

These people had been sold the dream of home ownership and banks had loaned them the money. They hadn’t been greedy or lied about what they earnt, they had been offered these deals by prestigious financial institutions that should have known better.

Many fingers were pointed at who was to blame. Ultimately, the British public blamed the banks but there didn’t seem to be any real consequences for them.

Going through the GFC at such a young age left me with an enduring fear of ever being left unable to pay my mortgage. I vowed I would never buy a home with less than a 10 per cent deposit and to never have a mortgage more than five times my income, no matter how tempting it felt.

Many Aussies have done just that though – bought houses they may not be able to afford the payments on if interest rates rise.

They’ve pulled money out of their superannuation, taken on interest only mortgages and taken out huge loans which are affordable right now, but it could be a very different story by Christmas if the cash rate hits 2 per cent.

Over the past two years, APRA data shows 280,000 people or households have been given mortgages that are over six times their income and/or with a high loan to value ratio, which means they’re in huge danger of mortgage stress.

If interest rates were always going to go up then why was this allowed to happen?

If 300,000 Aussies do end up defaulting on their mortgages then that will be shameful for Australia. Shameful because they should probably never have been given the mortgages in the first place.

Home ownership is part of the Great Australian Dream and everyone should be able to achieve it, but not at the cost of losing everything they have.

Riah Matthews is the commissioning editor for news.com.au.