How much your mortgage will cost as interest rates rise to 0.35%

The average Sydneysider is going to have to pay as much as an extra $152 in monthly mortgage as the Reserve Bank of Australia lifts interest rates.

There’s pain on the horizon for Australian mortgage holders as the Reserve Bank of Australia increased interest rates.

The RBA on Tuesday afternoon announced it would lift Australia’s official cash rate by 25 basis points to 0.35 per cent from 0.1 per cent.

While a rate rise was widely expected, most experts predicted a far more modest increase of 15 basis points.

It is the first rate rise in 11 years – since November 2010 – and is a desperate attempt to clamp down on skyrocketing inflation, which has reached an annual rate of 5.1 per cent and has sent prices climbing at the fastest rate in two decades.

Here’s how much more money you’ll have to fork out if the interest rate on your mortgage increases.

The official cash rate has been at a record low of 0.1 per cent since November 2020 in response to the Covid-19 pandemic.

Interest rates in Australia reached an all time high of 17.50 per cent in January 1990. Since then, they have averaged 3.93 per cent.

The last time the RBA hiked up rates was in 2010 — which means for many Australians, this will be the first time they’ve experienced an interest rate rise.

AMP’s chief economist Shane Oliver told news.com.au ahead of the RBA’s meeting that experts were largely split about whether the rate would first be lifted by 0.15 or 0.25 per cent. It ended up being 0.25 per cent.

Mr Oliver also said most customers with variable mortgages paying off principal and interest loans would only be paying interest of around 3.5 per cent.

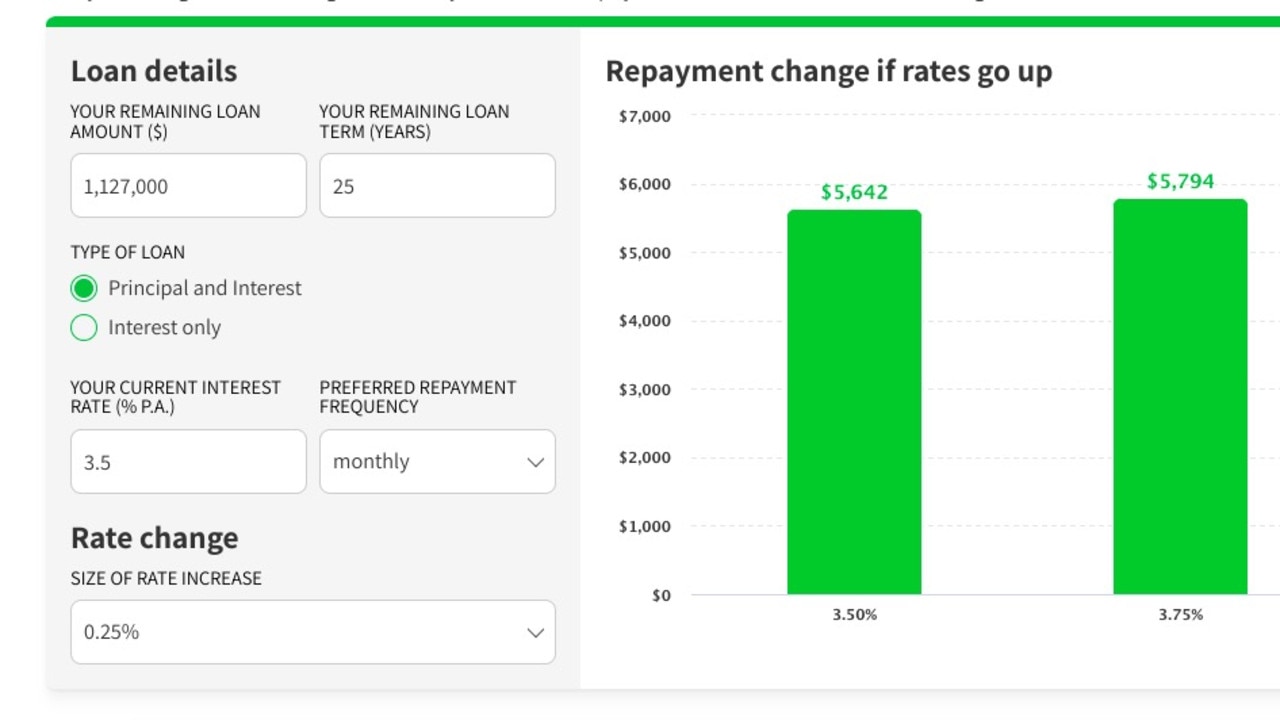

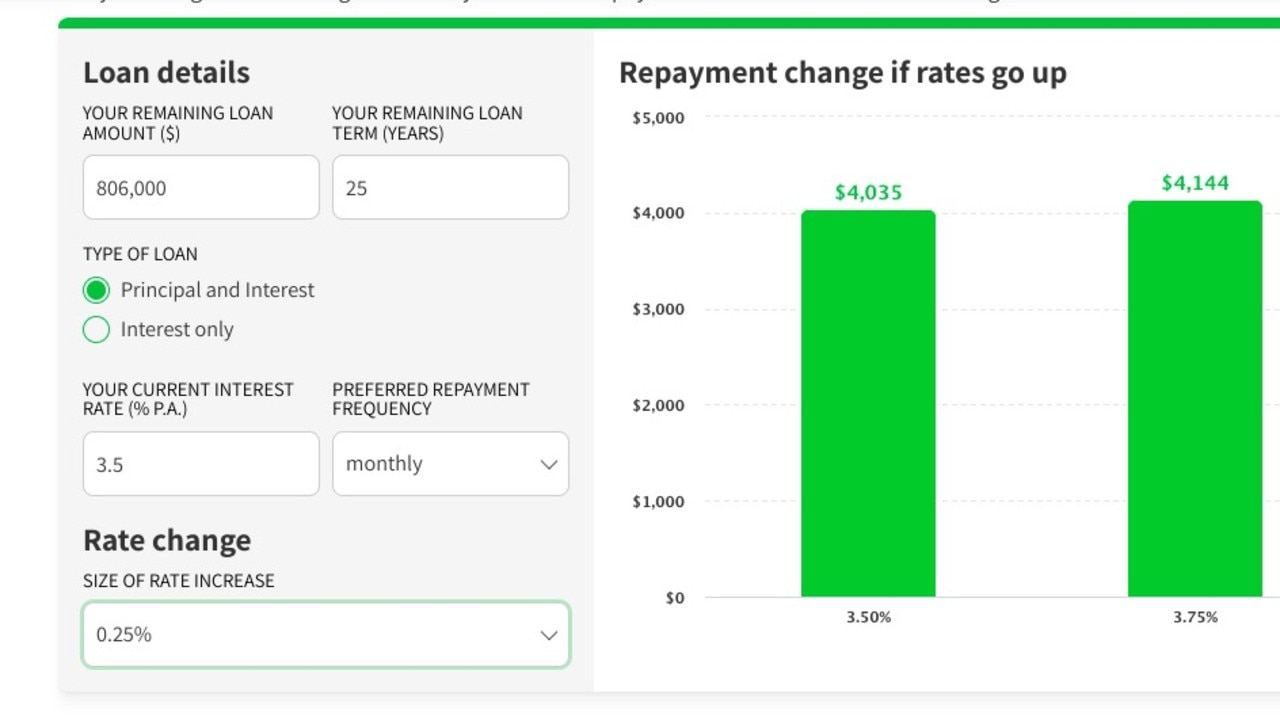

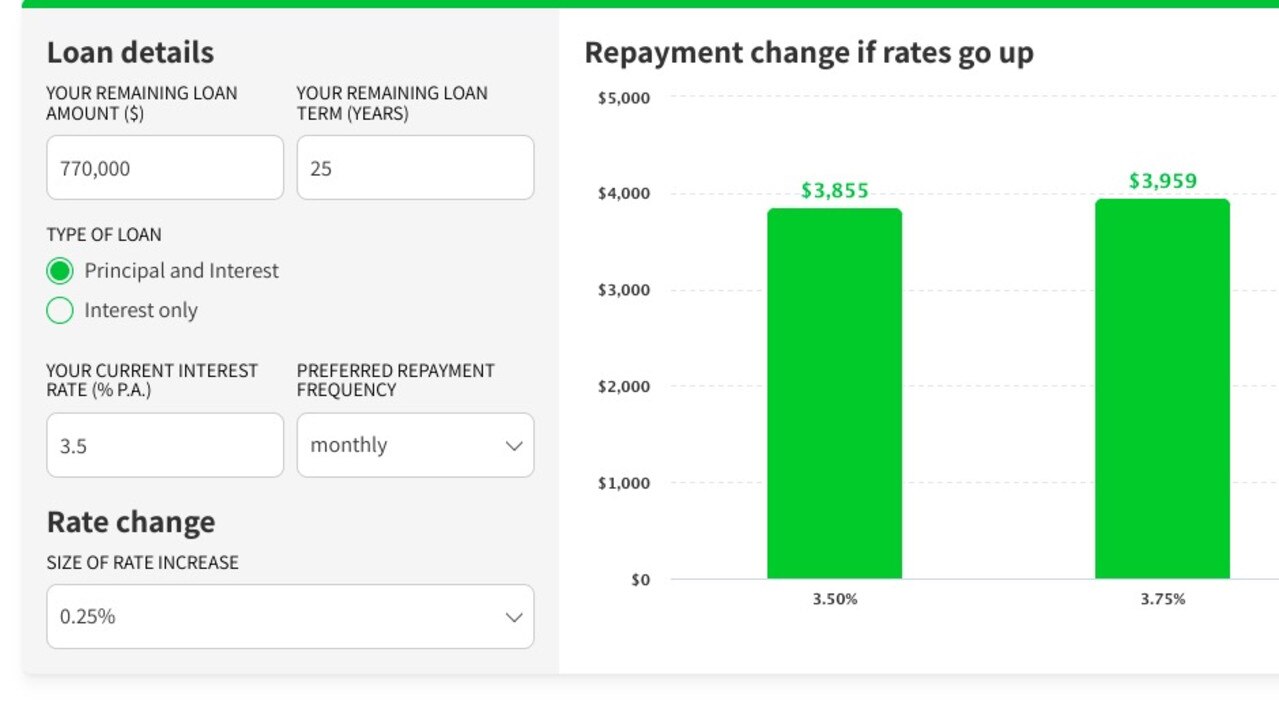

For simplicity’s sake, we’ve factored in a 25-year loan for the best comparison.

With rates rising by by 0.25 percentage points, repayments on a principal and interest loan of $500,000 would increase by an extra $68 a month, according to Mozo’s online calculator.

Recent data from CoreLogic found the average median dwelling price of properties in Australia’s capital cities, which we have compared in the tables below.

In Sydney, the average home worth $1,127,000 (assuming not a cent had been paid off) would go up by $152 at the 0.25 per cent rate.

Over in Melbourne, the average homeowner is facing an extra $109. Brisbane’s $770,000 median home would result in an additional monthly payment of $104.

Check out the link here to see how much your mortgage will go up.