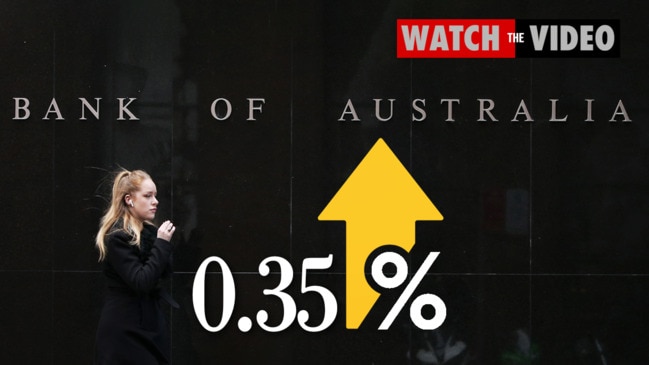

RBA announces first interest rate rise in 11 years as inflation skyrockets

Pain is officially on the way for Australian homeowners, with the Reserve Bank announcing the first interest rate rise since 2010.

Aussie homeowners have been dealt a massive blow, with the Reserve Bank of Australia announcing the first interest rate rise in more than a decade in a shock move.

The RBA on Tuesday afternoon announced it would lift Australia’s official cash rate by 25 basis points to 0.35 per cent from 0.1 per cent.

While a rate rise was widely expected, most experts predicted a far more modest increase of 15 basis points.

It is the first rate rise in 11 years – since November 2010 – and is a desperate attempt to clamp down on skyrocketing inflation, which has reached an annual rate of 5.1 per cent and has sent prices climbing at the fastest rate in two decades.

It is also the first rate rise during an election campaign since 2007, when John Howard lost out to Kevin Rudd, and the ALP wasted no time in sticking the boot into the Prime Minister.

“It was hard enough to make ends meet under Scott Morrison and today it got even harder for millions of Australians,” Labor leader Anthony Albanese and Shadow Treasurer Jim Chalmers said in a joint press release.

“Even before today’s decision Australians were facing a full-blown costs of living crisis on his watch.

“Scott Morrison’s economic credibility was already in tatters, now it’s completely shredded.”

The nation’s cash rate has been sitting at the historic low of 0.1 since 2020, when it was slashed in response to the Covid-19 crisis.

Rising interest rates don't have to deter you from saving for a house deposit. Read Compare Money's tips >

RBA’s shock move

In a statement released immediately after the decision, RBA boss Philip Lowe said “now was the right time to begin withdrawing some of the extraordinary monetary support that was put in place to help the Australian economy during the pandemic”.

“The economy has proven to be resilient and inflation has picked up more quickly, and to a higher level, than was expected,” he explained.

“There is also evidence that wages growth is picking up. Given this, and the very low level of interest rates, it is appropriate to start the process of normalising monetary conditions.

“The resilience of the Australian economy is particularly evident in the labour market, with the unemployment rate declining over recent months to 4 per cent and labour force participation increasing to a record high.

“Both job vacancies and job ads are also at high levels. The central forecast is for the unemployment rate to decline to around 3½ per cent by early 2023 and remain around this level thereafter. This would be the lowest rate of unemployment in almost 50 years.”

While noting that “the outlook for economic growth in Australia also remains positive”, Dr Lowe said there were “ongoing uncertainties” about the global economy rising due to the Covid pandemic, the war in Ukraine and “declining consumer purchasing power from higher inflation”.

Dr Lowe also gave an ominous hint at things to come.

“The Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time. This will require a further lift in interest rates over the period ahead,” he said.

“The Board will continue to closely monitor the incoming information and evolving balance of risks as it determines the timing and extent of future interest rate increases.”

Dr Lowe also held a press conference on Tuesday afternoon, acknowledging that the rate rise “comes earlier than the guidance that the bank was providing during the dark days of the pandemic”.

“During that period … the national health situation was precarious, the economic outlook was dire and it was clouded by a lot of uncertainty. The board wanted to do everything it could, in those circumstances to help get the country through that difficult period,” he said.

“In those unprecedented times, we charged that the economic damage from the pandemic was likely to require interest rates remain low in Australia for years. As things have turned out the economy has been much more resilient than we had expected, which is clearly very welcome news.”

Australia reacts to bombshell move

Callam Pickering, APAC economist at global job site Indeed, said “runaway inflation” had left the RBA with little choice but to raise the cash rate today – but questioned if more could have been done.

“This rate hike will be the first of many over the next six months as the bank tries to curtail historically high inflation. Under the circumstances it was surprising that they didn’t hike more aggressively,” he said.

“Supply-chain disruptions and the Ukraine war has pushed inflation to its highest level since the introduction of the GST in 2000.

“Whether these rate hikes will work is difficult to determine. Australia has imported high inflation from abroad and that is not typically a channel through which the RBA has tremendous influence.

“If the RBA hikes rates at a slower pace – which they almost certainly will – the resulting depreciation in the Australian dollar would put upward pressure on inflation.”

PropTrack economist Paul Ryan agreed the RBA’s hand had been forced.

“By moving today, rather than waiting for further data in June, the RBA is signalling that it will intervene to curb stronger than expected inflationary pressures, despite the ongoing federal election campaign,” he said.

“While the RBA seeks to remain independent from politics, failing to adjust policy may have been viewed as a greater political intervention.

“While this increase in rates was small, it signals the start of a series of interest rate rises before the end of 2022. This will weigh on housing price growth, which has clearly slowed in anticipation of these higher borrowing costs.”

Rate hikes ‘not going to stop’

While a rate rise to 0.25 per cent is relatively minor, economists believe the RBA won’t stop there, with some experts predicting interest rates will rise to 2.5 per cent by the end of 2022.

In fact, senior economist at Nomura Australia and rate strategist Andrew Ticehurst recently told The Daily Telegraph they believe the interest rate will be increased monthly until December, meaning we could be in for a rate rise every month until Christmas.

According to comparison site Rate City, a rate rise to 0.25 per cent would translate to repayments jumping by $39 for the average owner-occupier with a $500,000 debt and 25 years remaining – a figure which will soar to $511 per month if the cash rate continues to rise to 2 per cent, as widely expected.

Rate City research director Sally Tindall said borrowers “should be aware the RBA is not going to stop at just one hike”.

“The RBA is likely to lift the cash rate multiple times over the next six to 12 months as it works to bring inflation back under control,” she explained.

“If the cash rate gets to 2 per cent by May next year, then someone with $500,000 owing on their loan today and 25 years remaining could be looking at a total increase to their monthly repayments of $511.

“That’s going to be a lot for many borrowers to swallow, particularly anyone already struggling to make the monthly budget add up.

“Variable rate borrowers don’t have to take these RBA hikes lying down. If you haven’t given your mortgage a health check recently, now’s the time to do so.”

But the prospect of non-stop rate rises has some on edge, with Australian Council of Social Service CEO Dr Cassandra Goldie warning the next government against taking a hard line on budget spending.

“Interest rates will inevitably rise above their historically low level, but we hope the RBA follows its own advice to hasten slowly from now on so that the benefits of full employment are realised,” she said.

“Along with improved income supports for those who are struggling the most, the best way to ease cost of living pressures is to strive for full employment, promote growth in wages and tackle the housing crisis, particularly for renters and those struggling the most.

“Avoiding a rapid rise in interest rates would also ease the impact on people who have taken on high levels of debt, with little behind them, to break into our vastly overpriced housing market.

“The major parties should rule out brutal spending cuts like those in 2014 which would smother jobs growth.”

Good news for savers

However, a rate rise is not all bad news, with savers set to be the big winners after two long years of earning little to no interest.

“With inflation surging at the fastest pace in two decades, and savings rates at all-time lows, most people’s hard-earned cash has been going backwards. It’s time to turn this around,” Ms Tindall said.

“While we expect banks to finally start lifting deposit rates, there’s no guarantee they’ll mirror the RBA the whole way.

“Banks are full to the brim with cash. This will make it a costly exercise to pass these hikes on in full, but that’s what they should do.”