RBA says house prices could drop by 15 per cent over next two years

The RBA has urged lenders and borrowers to consider one thing as they make a worrying prediction about Aussie house prices.

The RBA has warned of “falls in housing prices”, and estimated house prices could be 15 per cent lower than expected over the next two years, in real terms, thanks to rising interest rates.

“It is important that lenders and borrowers consider the potential for falls in housing prices,” says Australia’s Reserve bank, as it prepares to hike interest rates as soon as June.

The fresh warnings on the housing market came in a review of the stability of Australia’s financial system released on Friday.

The review itself shows the RBA has been rather nervous about how much Aussies households are borrowing – it is full of page after page of analysis of whether households will cope with rate rises, and who is most likely to end up in strife.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

The RBA’s prediction on house prices comes from a model that says if interest rates rise by 2 percentage points house prices will be 15 per cent lower in two years time, inflation-adjusted, than they would have been if interest rates stayed steady. i.e. This is not a time to expect house prices to keep on rising like they have been.

Rates

Interest rates impact house prices because the higher rates go, the higher the mortgage repayments.

When interest rates are higher, people can’t afford big mortgages and so have less to spend on a house. The more interest rates rise, the more the housing market is affected.

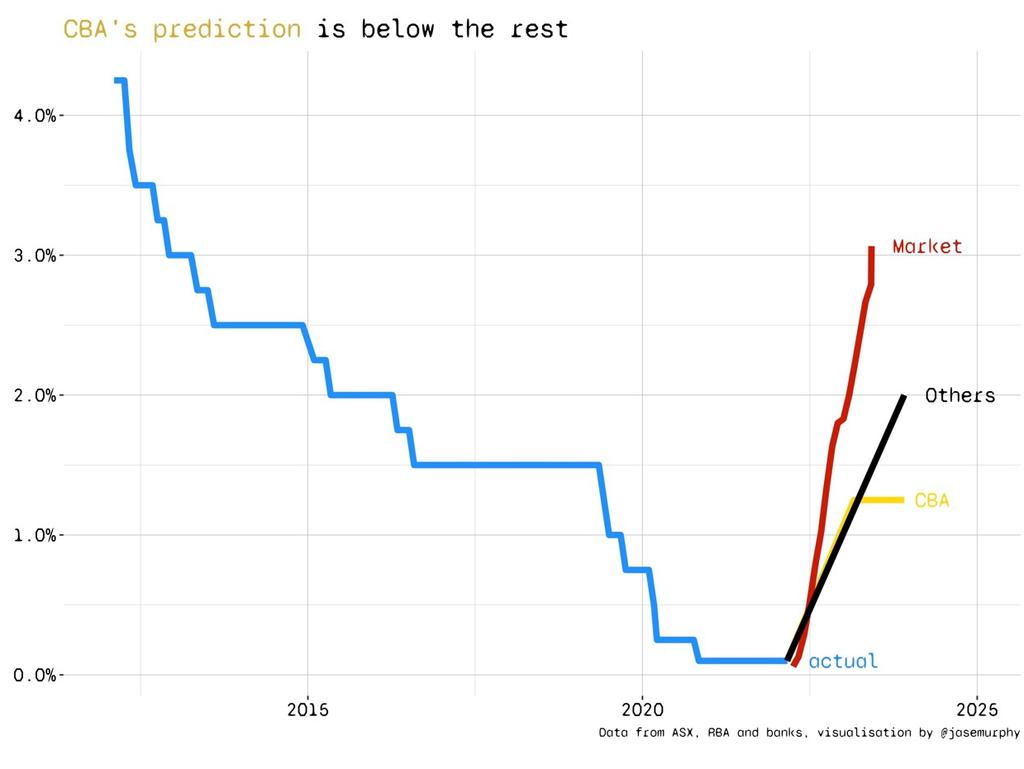

So how much will interest rates rise? Is a 2 per cent rise in interest rates likely?

It depends who you ask. There’s the “market expectation” which reckons interest rates will rise even more than that. There are forecasts from three of Australia’s major banks which agree with the RBA’s assumption rates will rise about 2 percentage points.

But then there’s the forecast from Commonwealth Bank (CBA), which reckons a 2 per cent rise is too much – they think official interest rates will only rise to about 1.25 per cent.

That smaller interest rate rise might sound comforting, but Commonwealth Bank thinks even a small rate rise will be enough to flatten the housing market this year and knock it down by 8 per cent in 2023.

They are predicting an 8 per cent fall over the next two years, (this is actually a more aggressive prediction than the RBA’s one, once you unpick all the RBA’s technical language about inflation-adjustment.) But what would the Commonwealth bank know, right? They’re only the nation’s largest mortgage maker.

The RBA, for its part, is worried less about house prices, and more about how many people will default on their mortgage when the repayments go up.

The good news is Australians have been doing a lot of saving recently, so many people are ahead on their mortgage. The typical mortgage holder is 20 months ahead on payments, up from nine months at the start of the pandemic.

But not everyone is typical. One-in-five borrowers on variable rate mortgages would end up with debt repayments eating up over 30 per cent of their income (30 per cent is the level the RBA considers “high”).

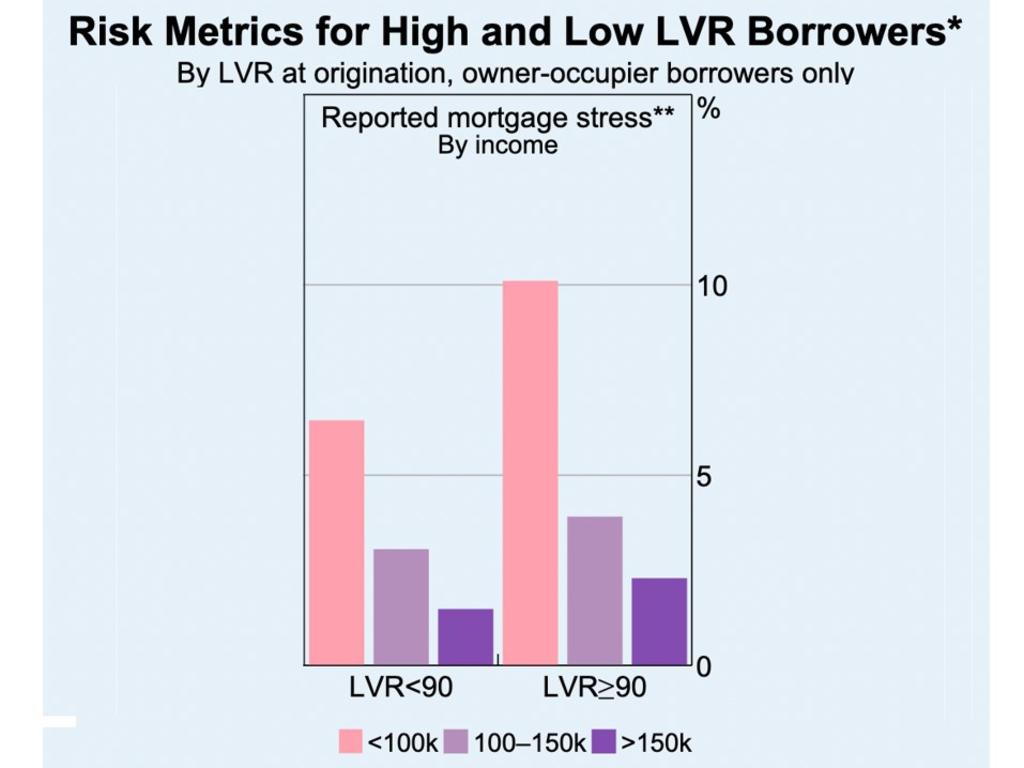

When your loan is big compared to your income, there’s trouble brewing

As the next chart shows, borrowers with income under $100,000 who take out a loan with a loan-to-value ratio (LVR) of over 90 per cent are the most likely to land in mortgage stress. They are the pink bar on the right side, and one-in-ten such borrowers will be unable to make repayments at some point.

The other phenomenon the RBA is concerned about is borrowers with high debt-to-income ratios. Anything over six (e.g. you earn $100,000 and borrow $600,000) is considered a worry.

“An increasing share of both investors and owner-occupiers have been taking out high debt-to-income loans,” the RBA says.

The reason the RBA is so worried is they know they are about to start hiking interest rates, and they want to be as prepared as possible for the heckstorm that will cause.

More Coverage

Interest rate hikes are now expected to start in June. That means less than two months before the banks pass on the rate rises and variable rate mortgages rise.

People on fixed mortgages can feel smug now but will take a massive whack when their fixed period expires and their repayments go up dramatically.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.