Terrifying prediction for Aussie mortgages as interest rate hikes loom

There’s an ominous prediction for just how far Australian mortgages could rise if they follow the same path as the US.

It’s been more than a decade since the last interest rate rise, and in that time the risk of rising rates has slowly evolved and transformed in the minds of Aussie mortgage holders.

Something that was once an ever-present concern took on a near mythical quality in recent years. Tax hikes were something that took place once upon a time, but weren’t really a worry anymore.

When RBA Governor Philip Lowe confirmed for what felt like the hundredth time late last year that interest rates wouldn’t rise until 2024 at the earliest, it appeared likely that mortgage holders had nothing to worry about.

After seeing the RBA cut rates 18 times without a single rate rise over 11 years, it may have seemed like the direction of rates was clear.

Is America the canary in the coal mine?

In recent weeks, though, the US Federal Reserve (The Fed) raised interest rates for the first time in this cycle, taking the Federal Funds Rate (the US equivalent of the RBA cash rate) to 0.25 per cent.

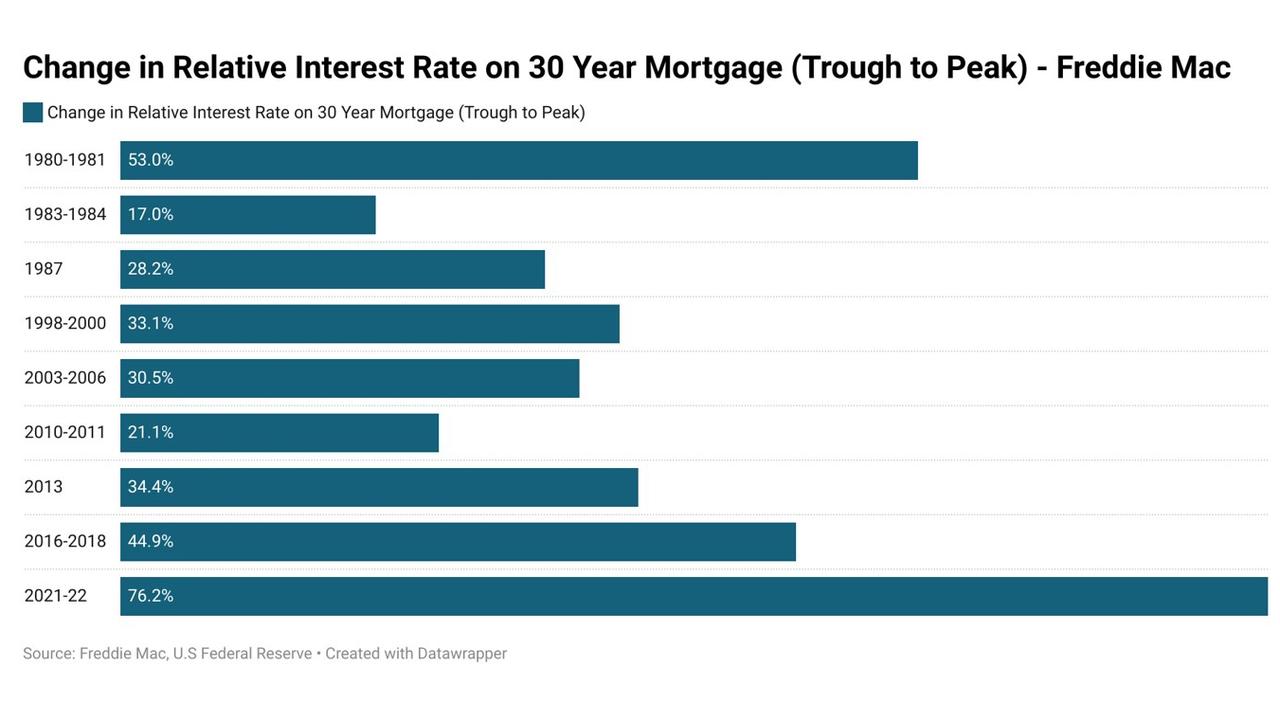

But despite the Fed only starting its rate hike cycle recently, US mortgage rates have been on the rise since the middle of January last year. Since the 30-year fixed mortgage rate bottomed out at 2.65 per cent, it has since risen to 4.67 per cent or by roughly 76 per cent in relative terms.

It should be pointed out that this data only covers up until the week ending March 31 and there is some evidence to suggest that since then US rates have continued their meteoric rise towards 5 per cent.

Much of the increase in American mortgage rates has taken place since the beginning of the year, with rates rising by 1.56 per cent in the first three months of the year alone.

In relative terms, the current US mortgage rate rise cycle is the largest since 1980.

The current rate hike cycle in relative terms is more than 2.5 times larger than the one that occurred in the run-up to the collapse of the US housing market and the start of 2008’s global financial crisis.

The path for Australian interest rates

Despite the RBA’s previous assertions that rates would not rise prior to 2024, in recent months they have been forced to change their tune significantly. While their formal statements lack concrete guidance on when rates will rise and by how much, in the world of the monetary policy tea leaf readers, a June rate hike is now considered likely.

As US mortgage rates continue to rocket, many in Australia are now wondering could the same thing happen here?

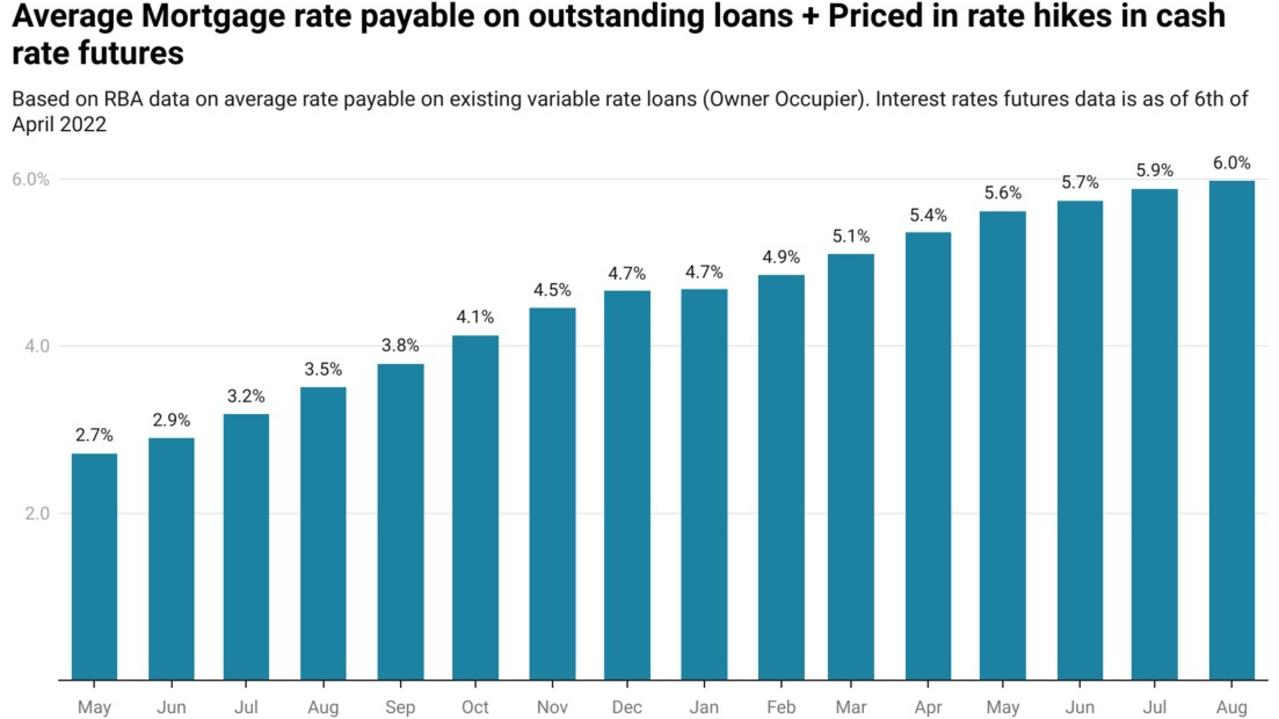

According to the market pricing of Australian interest rate futures, it’s certainly a possibility.

Currently the market is pricing in rates lifting off in June, a total of eight rate hikes by the end of the year and 12 by the middle of next year.

While the direction of rates currently being priced in by interest rates futures markets is concerning for some mortgage holders, it’s far from set in stone and remains just one possible future, the one the market currently considers most likely.

In the past, the market has been incorrect and off significantly in predicting rapid Australian rate hike cycles, but given the challenging backdrop of rising global inflation and rocketing US mortgage rates, it’s possible this time could be different.

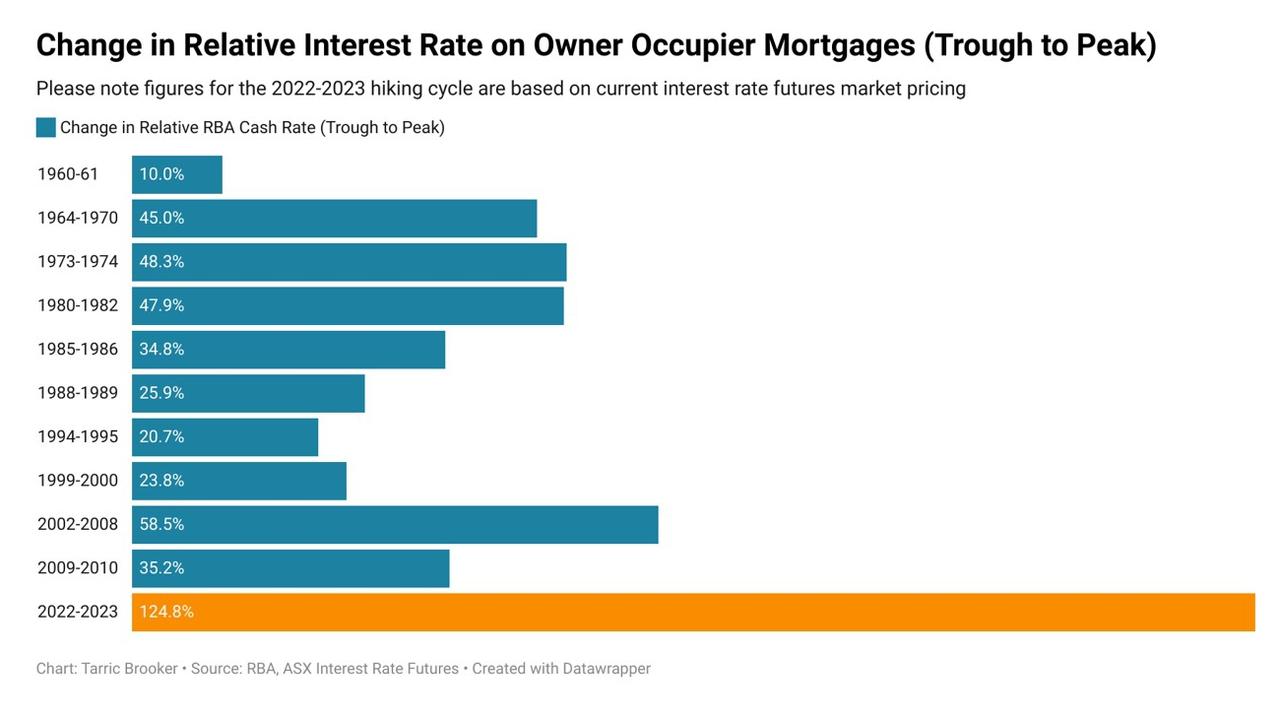

But let’s say for argument’s sake that the market is correct; how would the predicted hiking cycle compare with those we have seen in past generations?

If the market pricing of a 3.4 per cent cash rate by August next year is correct, this would represent the largest hiking cycle in relative terms since comparable records began.

In terms of the rate payable on the average owner-occupier mortgage, it would rise by 124.8 per cent or more than double the previous record high which occurred between 2002 and 2008.

Even when contrasted with the run-up in rates to 17 per cent between May 1988 and June 1989, the current projected rise in relative terms is roughly five times as large.

A challenging outlook

While interest rate futures are projecting by far the most challenging increase to Australian interest rates in the nation’s history, that is just one viewpoint and far from a concrete certainty.

In terms of the expectations of some of Australia’s most respected interest rate commentators, they generally see higher rates, but not as high as current market pricing.

On Thursday, Westpac’s Bill Evans revised the banks projections to include five rate hikes in 2022, a cash rate at 1.25 per cent by years end and a peak of 2 per cent.

Meanwhile, Commonwealth Bank and UBS don’t believe the cash rate will even get that far, suggesting the terminal level would be closer to around 1.25 per cent to 1.5 per cent.

More Coverage

Ultimately, we live in highly uncertain and complex times. Between the war in Ukraine, ongoing lockdowns in China and growing social unrest around the world, this time may indeed be different.

While there are warnings that the cash rate hitting above 3 per cent could crash the housing market and cause a recession, predicting exactly what will be required to get inflation under control during these unprecedented circumstances remains unclear.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator