RBA interest rates: Further 0.25 per cent hike in December

Australians have been hit with more financial pain in the lead up to Christmas, with the latest decision on interest rates dropping.

Homeowners will take a hit to their finances just before Christmas with the Reserve Bank of Australia raising interest rates by 0.25 per cent again in December.

In the final decision for 2022, the RBA pushed up rates for the eighth consecutive month, after hikes began in May from a record low of 0.1 per cent.

It means rates have jumped again from 2.85 per cent to 3.1 per cent, which will lift the official cash rate to its highest level in 10 years.

The Commonwealth Bank, Australia’s biggest home lender, has changed its forecasts to have the Reserve Bank hiking rates again in February to 3.35 per cent, rather than stopping in December.

Gareth Aird, the bank’s head of Australian economics, had previously forecast Tuesday’s hike would be the last but he has updated his predictions after the RBA signalled more rate rises.

“The tweak in forward guidance was not as material as we anticipated and as a result we shift our risk case to our base case,” he said.

“We now expect one further 25 basis point rate hike in February 2023 for a peak in the cash rate of 3.35 per cent.”

Chief Economist at AMP Shane Oliver said he believes the cash rate has now “peaked” — with a high risk of one final 0.25 per cent hike to 3.35 per cent in February. By end 2023 or early 2024 he expects the RBA to start cutting rates.

“Our base case is that we are now at the peak, albeit with the high risk of one final 0.25% hike to 3.35% early next year,” he said.

Looking for budget strategies to cope with rising mortgage payments? Read Compare Money's guide >

“By early next year we expect that the combination of a sharp slowing in domestic demand, increasing signs that inflation has peaked and sharply weaker global growth which will in turn also drive inflation down will enable the RBA to keep rates on hold for an extended period. By late next year or early 2024 we expect the RBA to start cutting rates.”

However other economists have predicted worse to come and the RBA governor Phil Lowe said there may well be further rises coming.

“The Board expects to increase interest rates further over the period ahead, but it is not on a pre-set course,” he said. “It is closely monitoring the global economy, household spending and wage and price-setting behaviour.

“The size and timing of future interest rate increases will continue to be determined by the incoming data and the Board’s assessment of the outlook for inflation and the labour market.”

The major banks ANZ, NAB and Westpac had all forecast a 0.25 per cent increase, while Commonwealth Bank has also tipped the same rise although said there was a small chance of “no change”.

An 0.25 per cent increase would take the average discounted mortgage rate to 6.55 per cent, up from 3.45 per cent in April.

It means that months of interest rate hikes have seen $750,000 mortgages be slugged with an extra $1418 to monthly repayments.

Another 0.25 per cent rise would typically add $75 to monthly repayments for each $500,000 borrowed, according to RateCity, while homeowners with a $1.5 million loan would have seen their repayments jump by a whopping $2500 since May.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer available for a limited time only >

PropTrack senior economist Eleanor Creagh said interest rates had now hit their highest level since 2012, with the RBA trying to tackle high inflation while also monitoring domestic economic conditions and global risks.

“With inflation remaining high and increasing evidence of labour market tightness, the RBA has continued to raise the cash rate to ensure inflation expectations remain anchored,” she said.

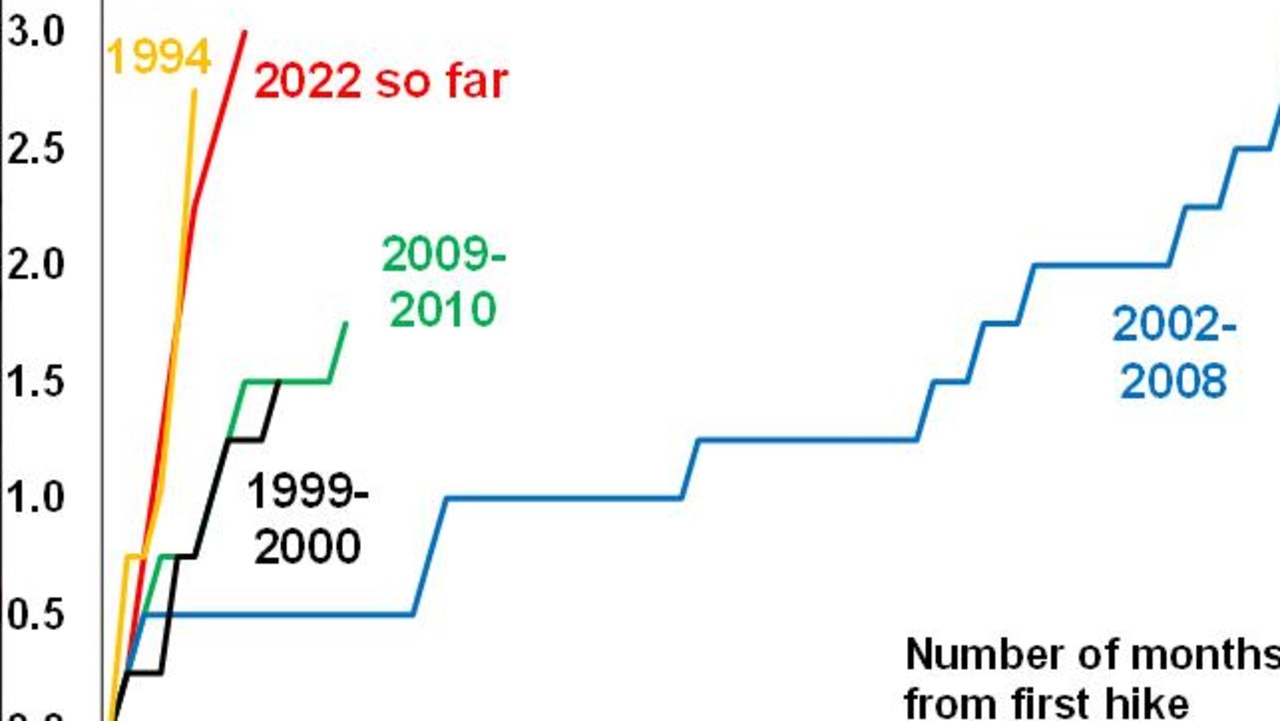

“The fastest rise to the cash rate since the 1990s has quickly rebalanced the housing market from last year’s extreme growth levels, with prices falling in most parts of the country.

“Prices nationally are now sitting 3.81 per cent below their March peak after falling for the eighth month in a row amid headwinds from monetary tightening.

“The most expensive markets of Sydney and Melbourne are leading the price declines. In Sydney, prices are down more than 6 per cent from peak and below levels recorded in November last year.

“With additional rate rises on the horizon, borrowing costs will continue to increase and maximum borrowing capacities will be further reduced, shrinking buyers’ budgets.”

She added home buyers had seen the amount they can borrow drop by a whopping 20 per cent.

CreditorWatch chief economist Anneke Thompson said the eighth consecutive rate rise will place “undeniable financial pressure on Australian households”.

“Combined with the budget’s forecast rising prices on everyday goods, housing and energy, and lacklustre wages growth, this latest increase in the cash rate all but guarantees consumer confidence will weaken as we enter the busy Christmas retail period,” she explained.

“Data and forecasts released in the latter half of October all point to difficult economic conditions in 2023. The RBA board will likely have carefully considered labour force data, which showed that the unemployment rate has stagnated at 3.5 per cent, employment growth has slowed dramatically, and job vacancies have stopped rising.”

Canstar analysis of lenders’ interest rates shows existing borrowers could be gifting the banks $155 more than new customers each month by paying a higher interest rate.

RBA data as recently as October shows there’s a 0.51 per cent difference between the interest rates existing borrowers are paying compared with new customers who are getting enticing special offers.

New borrowers are securing an average variable rate of 4.58 per cent compared to the much higher rate of 5.09 per cent afforded to existing borrowers.

On a $500,000 loan over 30 years, the difference in monthly repayments between these two rates amounts to $155.

Switching to a new lender in October dropped by 1 per cent from the previous month with less than $18 billion in loans refinanced.

Borrowers faced a 38 per cent increase in home loan repayments from April to November, adding more than $809 to repayments on a $500,000 loan over 30 years or $1618 on a $1 million loan.

Canstar group executive Steve Mickenbecker said the rate rises weren’t on any people’s wish list to Santa.

“Borrowers sitting tight in their homes, expecting an inflated cost of Christmas this year and already paying vastly inflated home loan repayments, will be looking for ways to enjoy the season while protecting their long-term financial viability,” he said.

“With the Reserve Bank reporting that existing borrowers are paying an interest rate that is half a percentage point higher than new borrowers, sitting tight is costing homeowners dearly. On a $500,000 loan over 30 years this interest rate difference can result in a saving of $155 per month. It may be time to make yourself a new borrower somewhere else.”

AMP chief economist Shane Oliver had backed a 0.25 per cent increase.

“Still high inflation, strong jobs and wages data and the absence of an RBA meeting in January are likely to drive another 0.25 per cent hike in December to 3.1 per cent, with the risk of one more hike to 3.35 per cent in February but by end 2023 we expect weak growth and a sharp fall in inflation to drive the start of rate cuts,” he said.

Bendigo Bank chief economist David Robertson said the RBA “will almost certainly” increase rates by 0.25 per cent this month, adding up to 3 per cent worth of hikes since May.

“Given the latest consumer price index data they will probably increase rates again in February, before a pause. Globally supply is slowly improving, which may see rates plateau in the low to mid 3 per cent, “ he said.

REA Group’s Cameron Kusher added the RBA had been clear there is still work to do to tame inflation and said he expected interest rates increases in December, as well as February and March next year and then a period of stability.

Last month, the RBA governor Philip Lowe flagged more interest rate increases after he issued a warning about inflation, saying that Australia risks a “severe recession” if the organisation doesn’t lift interest rates to combat the cost of living.

“The eel of inflation will be with us for longer (if we don’t lift rates) and the eventual increase in interest rates needed to bring inflation down will be even larger is would increase the risk of a seed, severe recession, and a sharp rise in unemployment,” he said during a speech to business leaders in Hobart in November.

Inflation is currently sitting at 7.3 per cent, something the RBA has been trying to tackle, as the cost of living increases sit at their highest since the 1990s.

Dr Lowe indicated rate hikes could become more aggressive in response to ever-rising inflation.

“If we need to step up to larger increases again to secure a return of inflation to target we will do that,” he said.

“Similarly, if the situation requires us to hold steady for a while, we will do that.

“Given the uncertainties regarding the outlook, we will be watching very carefully how the economy and the inflation pressures evolve over the summer.”

However, there could be some relief in sight for homeowners with some experts predicting the RBA to pause its aggressive round of rates hikes from next year.

HSBC senior economist Paul Bloxham saying there was a real chance the RBA could pause rising rates in early 2023, although hikes could return later in the year if the inflation problem lingers.

However, Morgan Stanley has tipped rates to keep increasing.

“Inflation is likely to show some re-acceleration, wage growth should continue to rise, and while spending and unemployment are likely to begin to turn, both will still be quite strong,” a note from the bank said.

“We forecast further 25 basis points hikes from the RBA in February and March to a terminal cash rate of 3.6 per cent.”

As for Australia’s big banks, CBA has predicted rates to stay at 3.1 per cent, while Westpac and ANZ expect it to peak at 3.85 per cent in May.

It comes as the looming “mortgage cliff” is set to hit next year with at least $270 billion in mortgages coming off historically low fixed interest rates.

“Around 35 per cent of outstanding housing credit is on fixed-rate terms,” the RBA said in its financial stability review in October. “Around two-thirds of these loans are due to expire by the end of 2023.”

Dr Lowe issued a stunning apology to Australians who took out a mortgage – during a period of record property prices, no less – based on the RBA’s repeated insistence that the official cash rate would not increase until 2024.