ING slashes fixed term interest rates

One of Australia’s main banks will be lowering its fixed-term deals even though the RBA is expected to lift the cash rate.

One of Australia’s major banks is slashing its fixed-term loan deals despite predictions the RBA will lift the cash rate on Tuesday.

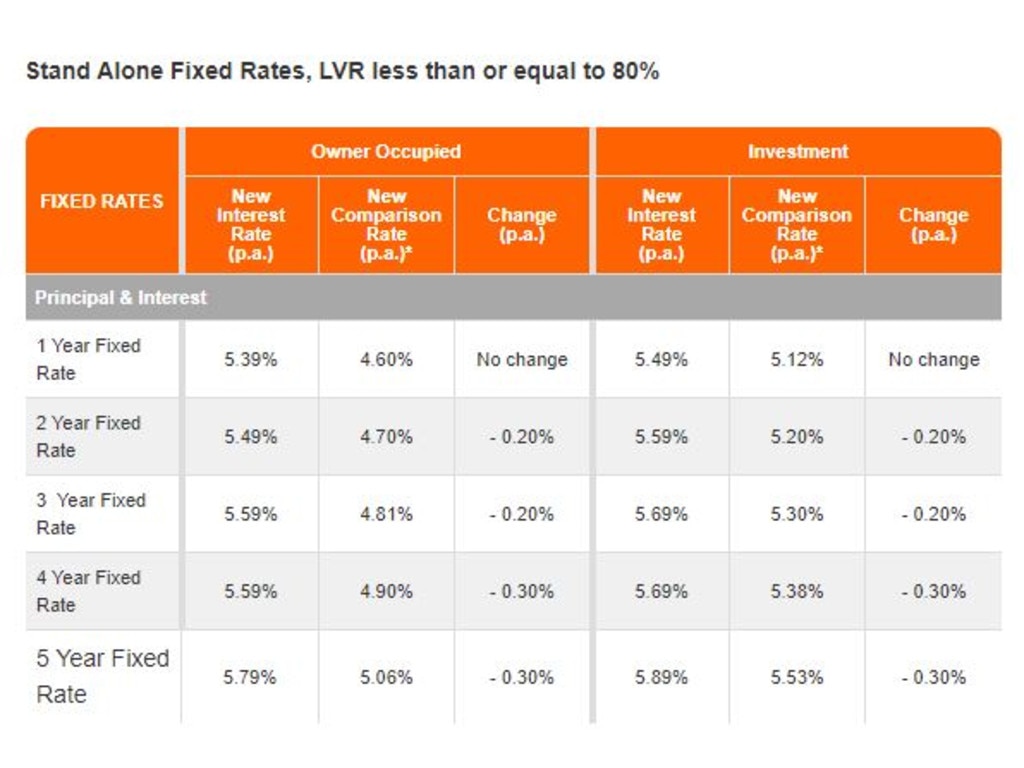

ING will decrease most of its fixed interest rates for both owner-occupiers and investors after tomorrow.

Fixed-rate loans of just one year won‘t have rates reduced, however, those who want to fix their rate for two or three years will be offered a rate that’s 0.2 per cent lower.

Those who want to fix their rates for four to five years will see a 0.3 per cent drop.

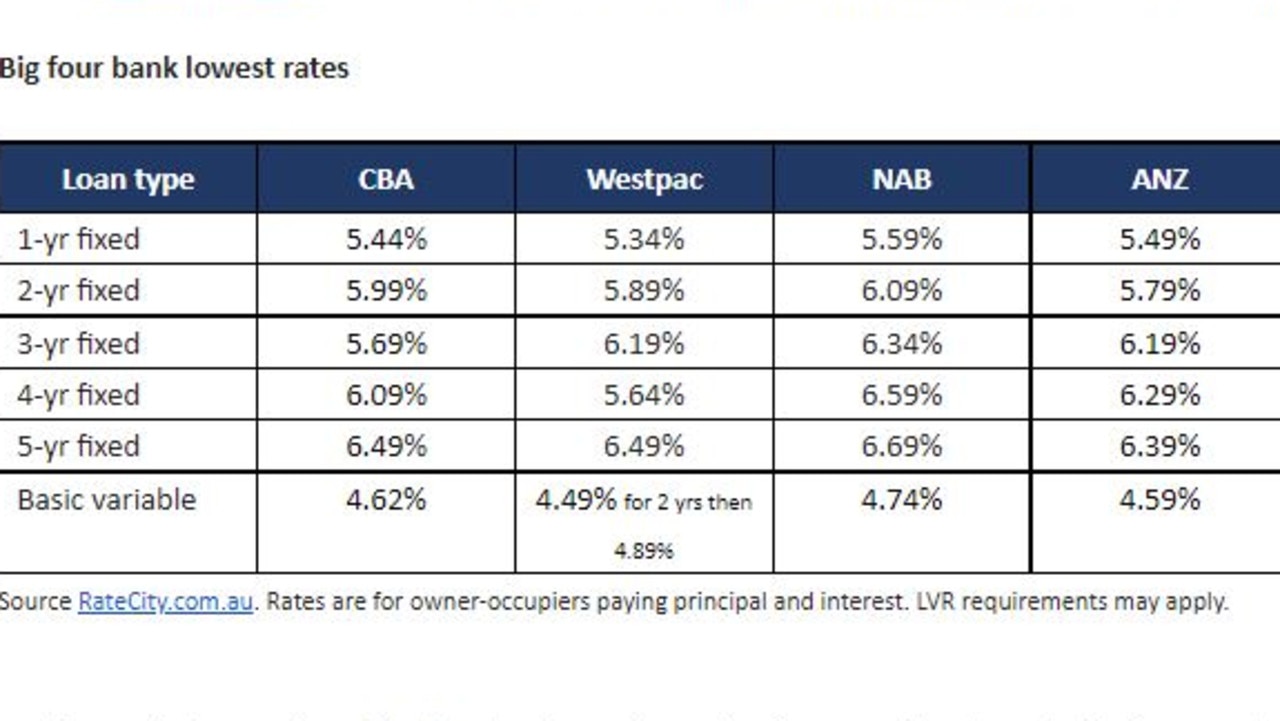

Some of the lower fixed-term interest rates offered by ING are competitive according to RateCity.com.au research director Sally Tindall, however, that‘s not the case with all of the loans offered.

“Even after these rate cuts on fixed rates from ING, they‘re are still significantly higher than others, but in some, they’re quite competitive,” Ms Tindall said.

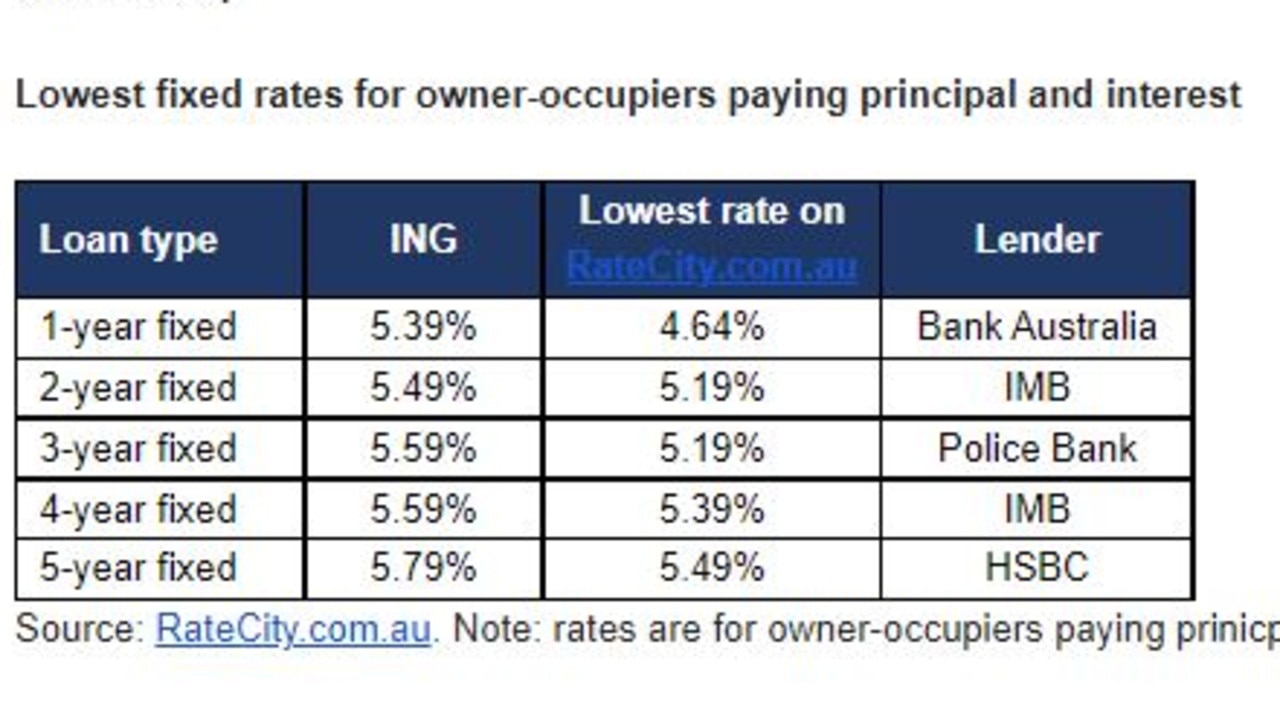

Ms Tindall noted that the one-year fixed-term loans at 5.39 per cent would not be reduced, and are a “far cry higher” than what‘s being offered by Bank Australia at 4.64 per cent.

“They get more competitive in the two-year category and the four-year category.

“They‘re stepping up the competition in this case, but it’s still worth shopping around.”

ING’s two-year fixed rate will be slashed by 0.2 to sit at 5.49 per cent after tomorrow, which is still higher than the 5.19 per cent offered by Police Bank.

For its four-year fixed rate, ING will now offer 5.59 per cent after lowering it by 0.3 per cent, which is higher than the 5.39 per cent offered by IMB.

Craig McDonald, owner of CBM Mortgages, said: “We are finding most new clients are opting for variable rates right now when you present to them variable and fixed options because of the much higher fixed rates being offered.

“As for existing mortgage holders, it’s paying to shop around. Clients falling off a fixed rate will find significant differences between existing and new lenders.

“Some of the differences in the variable rates offered can be 0.4% or more, which on any size loan is going to make a big difference to the repayment and the household budget.”

The Reserve Bank is expected to raise the cash rate by another 25 basis points after its December meeting on Tuesday.

That would take it to 3.10 per cent, the highest rate in over a decade.

Ms Tindall noted that the number of Australians opting to fix their mortgages has plummeted since its peak over the Covid-19 pandemic.

“They‘re just not opting for fixed rates at this moment because it’s a gamble, if someone is wedded to the idea of paying as little interest as possible, I can understand their nervousness for locking in their interest rates at this time,” she said.

Currently, only 4.0 per cent of mortgage holders are opting to fix their rates, that‘s down from the peak of 46 per cent in June 2021.

However, Ms Tindall noted that fixing interest rates might suit some homeowners.

“We are in a new era where Australians are quite shy about locking in their rate, but that doesn‘t mean you shouldn’t fix as fixing can suit some people’s personalities or finances,” she said.

“If someone is lying awake at night worrying about what the RBA‘s next move might be, it might be good to lock in that rate to have some certainty about their finances.

“It might work out for people with tight finances who watch the money in and money out of their accounts each month, for those people it‘s even more important to shop around.”