Rising interest rates could slash up to $216,000 off value of homes

A chilling warning has been issued to homeowners, saying they could face trouble as they face significant drops in the value of their property.

Soaring interest rates and plunging house prices could slash up to $216,000 off the value of an Australian home by the end of next year, particularly for new homeowners, analysis has revealed.

The chilling warning shows homeowners risk sliding into negative equity meaning they owe more on the mortgage than the property is worth.

The analysis revealed that those who purchased with a 10 per cent deposit could suffer negative equity as high as 7 per cent.

For example, a house purchased for $1.4 million in Sydney in November last year would see a whopping $216,000 slashed from its value by the end of 2023, the RateCity analysis of ANZ house price forecasts and CoreLogic data found.

It comes as experts anticipate interest rates to rise for the eighth consecutive time in December.

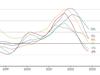

After the Reserve Bank put the official cash rate up for the first time in over a decade back in May, Australian interest rates have jumped from a record low of 0.1 per cent to 2.85 per cent. A further 0.25 per cent rise expected in December would take the cash rate above 3 per cent.

Stream more property news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer available for a limited time only >

Both Hobart and Melbourne homeowners would fall into 4 per cent negative equity, the analysis showed.

In Melbourne, those who purchased property for $997,000 would see a staggering $164,156 wiped from the value of their home as interest rates have skyrocketed in 2022.

A Hobart homeowner who had spent $767,000 on a home in November 2021 would suffer $126,000 drop in the value of their home by the end of next year.

Even recent Canberra homeowners were expected to fall into 2 per cent negative equity just two years after purchasing, meaning an incredible $151,439 would be slashed from the value of their home.

Combining house prices across the capital cities showed generally homeowners would be forced into negative equity worth 4 per cent, adding up to an average home costing $922,000 seeing almost $153,000 wiped off the value of their property.

First-time homebuyers are at particular risk of falling into negative equity as they typically enter the market with lower deposits and higher loan-to-value ratios, while also having lower incomes and savings buffers.

Rising interest rates have also seen homeowners slugged with higher repayments.

Sydney saw the highest rise after rates were increased by 0.25 per cent in November, with an increase of $115 per month based on the median loan size of $768,000, according to PropTrack data.

That was followed by mortgage holders in the ACT, who saw a $105 increase in their monthly repayments and Melburnians, who were hit with a $96 increase.

Sally Tindall, head of research at RateCity, said Australia’s property market looks set to be on a rollercoaster ride over the next couple of years with prices expected to fall further in 2023 as the RBA grapples with soaring inflation.

“Anyone who bought at the peak should unsubscribe from property market notifications and focus on paying down their debt,” she said.

“The key issue is if people can’t keep up their repayments in the face of rising rates. If that’s you, reach out to your bank to see if they can provide assistance, and get some independent financial advice as to what your options might be.”

People who bought recently with a small deposit could also find it difficult to refinance their mortgage over the next couple of years, she said.

“That’s because lenders typically ask new borrowers, even refinancers, to pay lenders mortgage insurance if they own less than 20 per cent of their property – a cost that can easily run into the tens of thousands of dollars and potentially negate any savings made from refinancing,” she said.

“Borrowers who can’t refinance their loan because of their equity position should still negotiate with their lender for a better rate. This will help them make their monthly repayments, and potentially extra so they can break out of mortgage prison faster.

“If a person’s equity falls into negative territory, lenders are unlikely to take them on at all as a new customer which means they’re stuck with their current lender.”

The RateCity analysis revealed apartment owners in Sydney would suffer the worst negative equity at 8 per cent after purchasing for $846,000 in November 2021 they would see $162,333 wiped from the value of their property by the end of next year.

Melbourne apartment owners would suffer a $99,000 drop in value on their $619,000 home, while Hobart homeowners would suffer a similar fate with $95,000 slashed from their $579,000 property.

In Canberra, owners would see $78,000 wiped from the value of their $573,000 apartment.