‘Profound’ impact on house prices from 1 per cent cash rate rise

Uncertainty around house prices continues, but there’s one move that’s sure to have an impact – and it’s not good news.

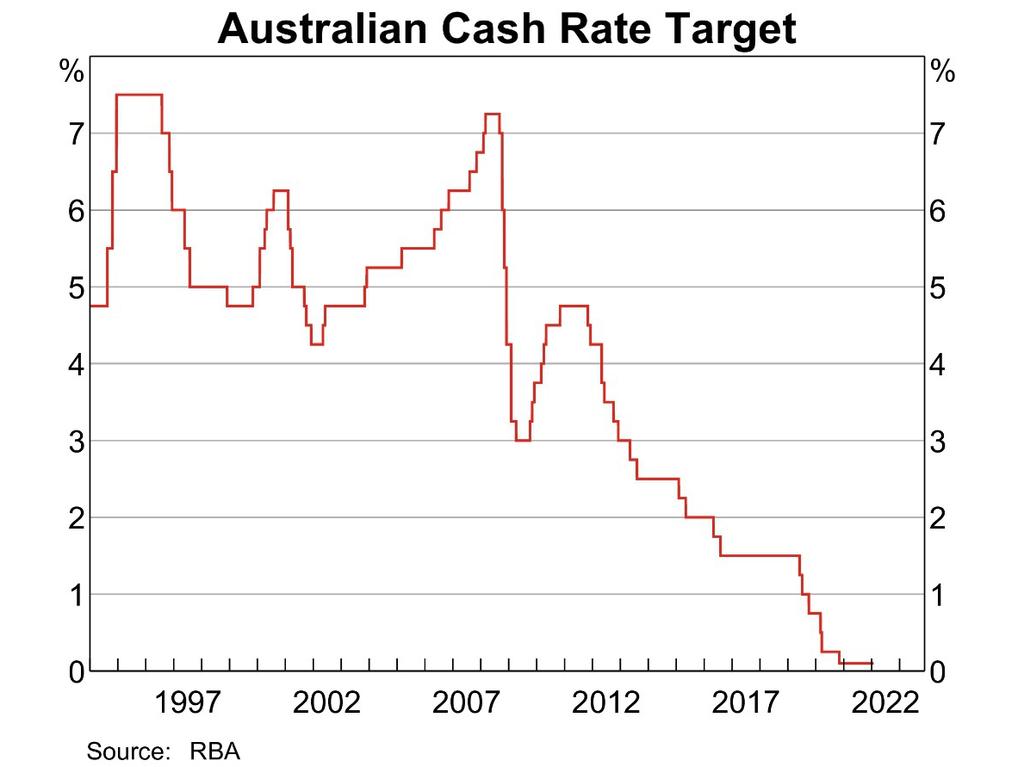

For more than 11 years, Australians have seen interest rates go only one way, as the Reserve Bank slashed the cash rate, time and time again.

Long gone was the once very present fear that interest rates could skyrocket and put significant stress on households.

Between June 1968 and June 1989, the average standard variable rate went from 5.38 per cent to 17 per cent.

This embedded apprehension about rising interest rates within large swathes of entire generations of mortgage holders that felt the impact of mortgage repayments consuming an increasing portion of family budgets.

Then over the next 33 years things changed immeasurably. Over time, the anxiety surrounding rising rates slowly evaporated, until finally it dissipated almost entirely.

Looking back on how things have unfolded, it’s easy to understand why. Between January 1990 and November 2020, the RBA cut rates 51 times, taking the cash rate from 17.5 per cent to just 0.1 per cent.

While rates can and did rise during that time, since November 2010 the RBA hasn’t raised interest rates even once.

This has arguably created the polar opposite conditions to those who defined that psychology of mortgage holders during the era of continued upward pressure on interest rates.

In a world where there are mortgage holders who are more than halfway through their loan term without ever seeing a rate rise and with the RBA insisting that rates wouldn’t rise until 2024 until recently, that mindset made sense.

However, like households were forced to adapt to rising rates in the late 1960s, that major shift could be upon us again if interest rate futures markets are correct.

Has the game changed?

In the middle of last year a Reuters poll of 15 economists concluded that the RBA wouldn’t raise rates until mid-2023 at the earliest.

Since then rate hike expectations have been completely transformed.

Currently futures markets are pricing in rate hikes to begin in July, with four rate rises priced in by year end.

From a longer term perspective, the markets expectation is that the cash rate will hit around 2.5 per cent at the end of 2023.

If a person, household or business is expecting to struggle financially with interest rate increases they'd better hope the (median) economist is right rather than current market pricing... #RBAhttps://t.co/ztjHzKNJ0kpic.twitter.com/eju2Az0UIX

— Alex Joiner (@IFM_Economist) February 18, 2022

While this is currently how markets see things unfolding, things are far from set in stone. It’s entirely possible that the market could be off base, just like it was in the middle of last year when it was expecting a very slow lift-off in rates, years into the future.

The impact on housing prices

According to an RBA research paper, for each 1.0 per cent the cash rate falls, housing prices increase by 30 per cent (10 per cent per year over three years).

Fifth largest increase in house prices in 172 years will correct after hikes... https://t.co/6jI4lHTovbpic.twitter.com/eHGlUxV9nm

— christopher joye (@cjoye) February 22, 2022

Since the RBA began cutting interest rates in June 2019, that is arguably exactly what has happened in many locales around the nation, with that trend accelerated significantly by the impact of the pandemic.

But if interest rates rising by 1 per cent can raise housing prices by 30 per cent, what would a 1 per cent or even 2.5 per cent rise in the cash rate, like the one currently priced in by the market, do to housing prices?

According to an analysis by Coolabah Capital founder Christopher Joye, the impact of the first 1 per cent rise in the cash rate could be a major turning point for housing prices.

“Even 100 basis points (1 per cent) of increases would have profound consequences for asset pricing. Combined with some out-of-cycle rises from banks courtesy of normalising funding costs, this would probably force house prices, for example, to correct about 15 to 25 per cent.

“In fact, the RBA’s own house price forecasting model, which we have replicated and refined, implies a larger drawdown of about 33 per cent,” Mr Joye wrote in the AFR.

Coolabah Capital isn’t the only one predicting that rate hikes will have a significant impact on housing prices. Westpac is predicting 14 per cent decline in 2023 as rate hikes bite the market, with the Commonwealth Bank and National Australia Bank (NAB) penciling in 10 per cent declines.

What is old is new again

After almost 12 years without seeing interest rates rise, predicting how mortgage holders and the broader property market will react to rising rates is at best challenging.

In the years since rates last rose, the expectation that rates would remain low has become deeply entrenched in the psyches of many borrowers, with that viewpoint repeatedly reinforced in recent years by various RBA representatives stating rates wouldn’t rise by 2024.

For rates to now rise and potentially rise relatively quickly, it could be quite the shock to borrowers and a housing market that has only seen rates go one way for a decade – down.

Rising interest rates also don’t occur in a vacuum; there are knock-on effects within markets and the economy which could end up giving the RBA reason to pause or potentially even reverse the direction of rising rates.

For example, $93 billion in home equity was withdrawn by mortgage holders in the year to June 2021. This compares with a total of $951.4 billion in total personal income for the 2018-19 financial year.

If waning confidence or falling housing prices significantly impacted this borrowing, it could result in a major reduction in economic growth or perhaps even a recession.

As an economy that is heavily driven by housing prices and housing-driven economic activities, this may give the RBA pause as it attempts to simultaneously balance inflation and the impact of rising rates on the economy.

Ultimately, the deciding factors may come from overseas, whether it’s pressure from global markets for the RBA to follow the lead of the US Federal Reserve or a potential slowdown in the global economy prompting the RBA to take a slow and steady approach to raising rates.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator