Nasty shock coming for mortgage payers as interest rates rise

Interest rates are rising but how much will that increase your mortgage payments by? Some Aussies are in for a rude awakening.

Interest rates are rising, with serious implications for Australia’s household finances. Some households will find rate hikes hit them like a ton of bricks.

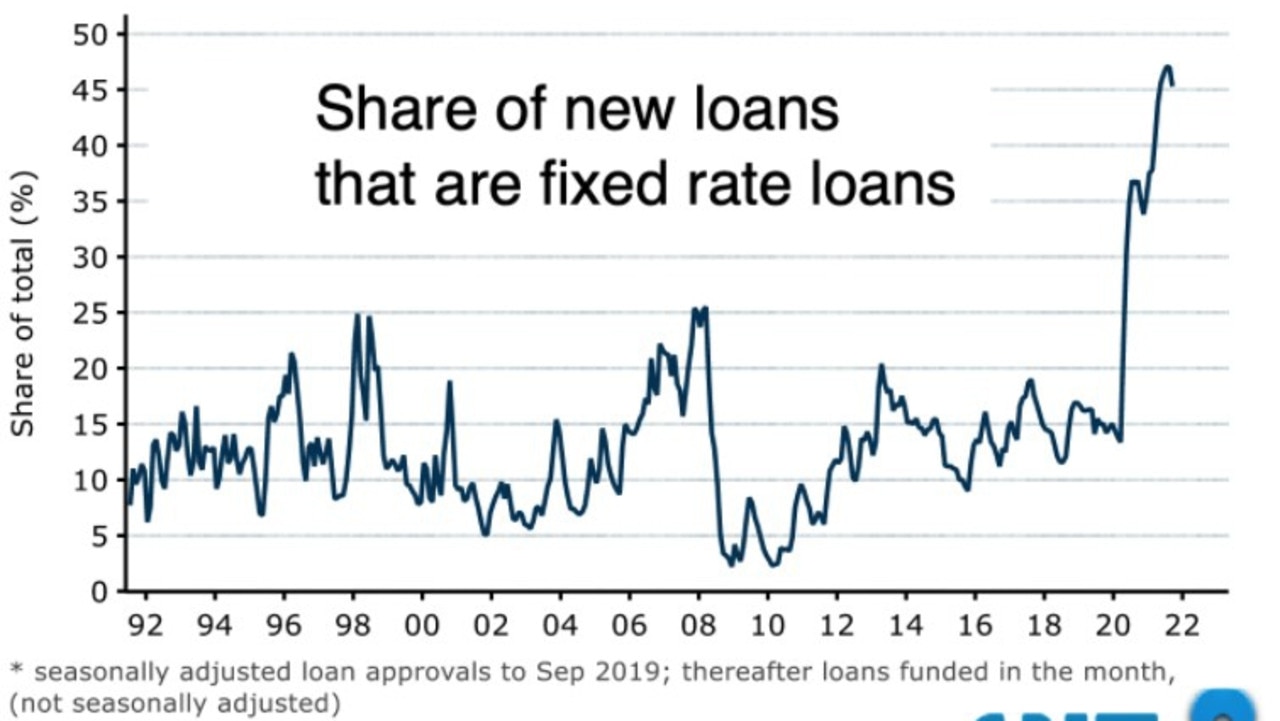

Australia has changed in the last few years. We used to be a nation in love with variable interest rate mortgages. But recently we started loving fixed rate mortgages too. As the next graph shows, people have been locking in low mortgage rates at never-before seen levels. Nearly half of all new loans are fixed rate loans. This is going to matter a lot.

Fixed rate is a funny name because they’re not really fixed, not for ever. You might have a two-year fixed rate or a three-year fixed rate, but eventually your term is up. Then one day the bank rings you up and you answer the phone with trembling hands.

You have to refinance and when that happens, you catch up on several years of interest rate movements all at once.

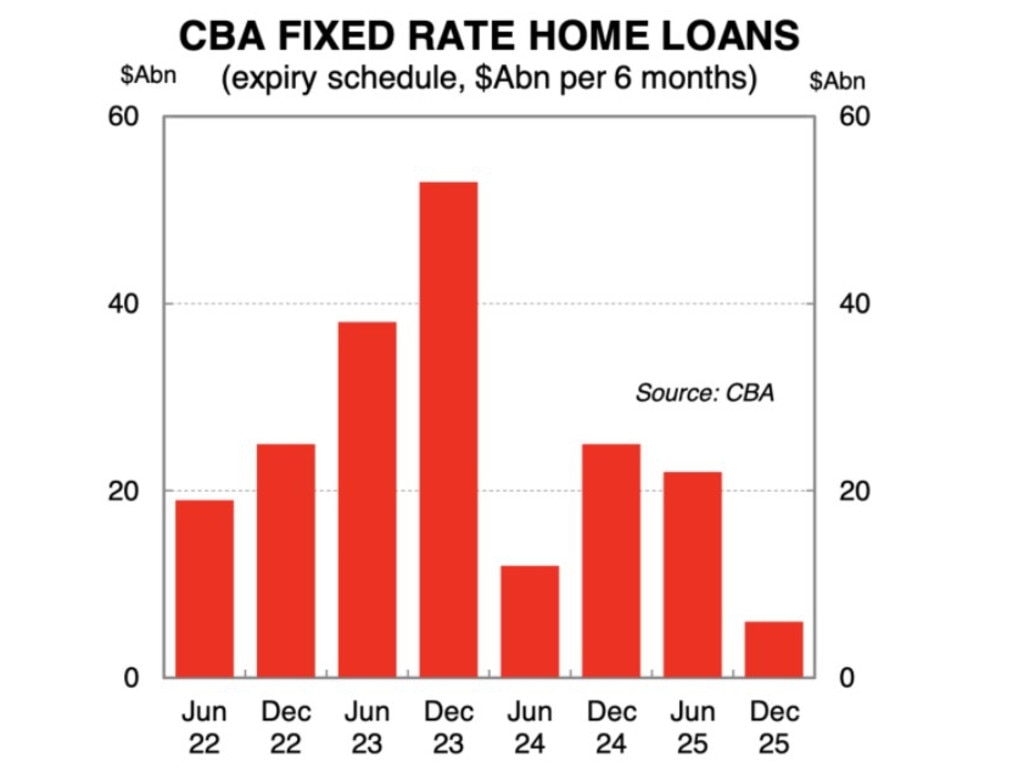

People are going to be refinancing in 2023 in particular, and when that happens, kapow, they are going to suddenly be whacked with a lot of interest rate rises at once.

The next chart shows when fixed rate mortgages are going to expire, and December 2023 is going to be the biggest month. At that time a lot of people might go from a 2 per cent interest rate to, say 4.5 per cent. On a $400,000 loan on a 25-year term, that would be an extra $243 per fortnight.

“We estimate the average loan rate of the fixed rate mortgages currently in the system sits between 2.25 per cent and 2.5 per cent. This rate is expected to be significantly lower than both the standard variable rate and fixed rates over H2 22 and 2023,” Commonwealth Bank Economist Gareth Aird said this week in a note to clients.

“As a result, borrowers rolling off fixed rates will be refinancing their loans at a materially higher interest rate, which will have a significant impact on the interest cost of debt and household finances.”

Many households will be absolutely fine. A lot of people got ahead on their mortgages during Covid, saving money that would have otherwise been spent on travel and meals out. But not everyone could manage that.

A sudden interest rate hike could be quite a shock for some borrowers. And with rising prices we all might not have as much spare money as we expected. More is being spent on fuel and groceries. When the mortgage has to be paid, what will be cut?

The future of interest rates

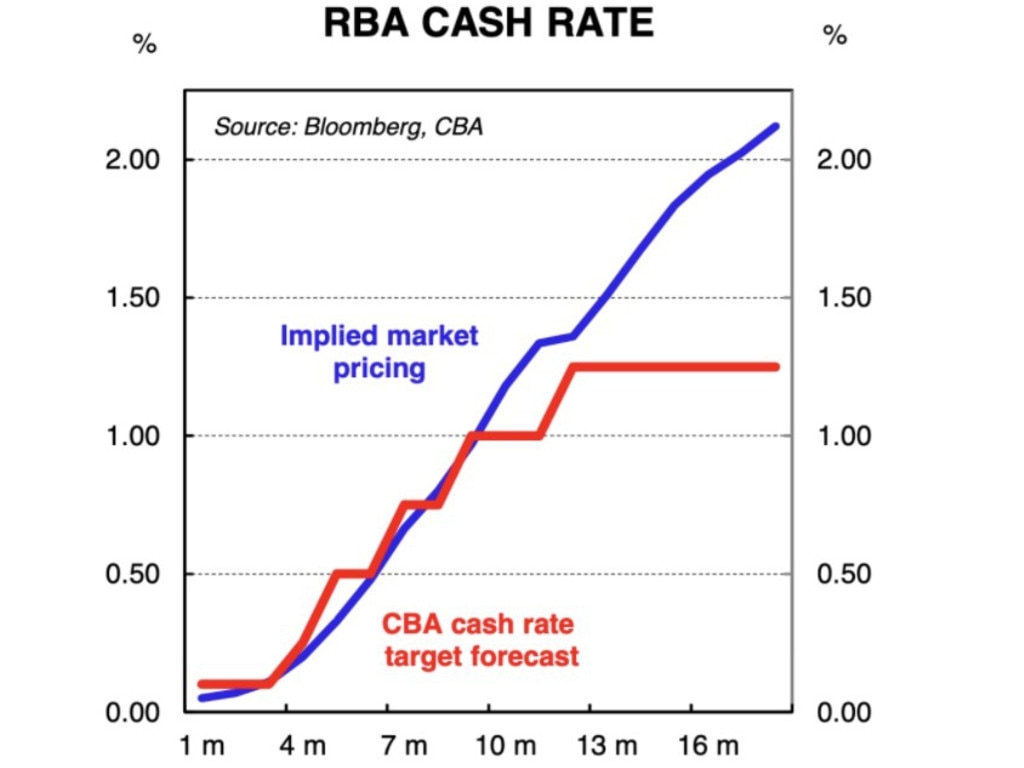

Interest rates are expected to rise over the next few years. Markets think the official interest rate will rise from 0.1 per cent to over 2 per cent by the middle of 2023.

Commonwealth Bank economists think the official interest rate will rise to 1.25 per cent and then hover there. Either way, mortgage interest rates will continue to be several percentage points higher than the official interest rate.

Why will interest rates rise just when households are also facing inflation pressure from other sources? That doesn’t seem fair! The answer is higher interest rates are designed to stop inflation from getting too high.

The idea is that if interest rates are high, people stop borrowing and spending so much, and the pace of price rises slows down.

You can see the same theory in reverse in the pandemic – by making borrowing cheap, the idea was to lift spending, lift economic activity, and lift inflation.

The RBA aims to keep inflation low and steady, between 2 and 3 per cent, although it has had quite a bit of difficulty getting the numbers to land where they want in the last few years, missing mostly to the low side.

House prices

Rising interest rates will take money out of household pockets, and also flatten the housing market. ANZ Bank forecasts house prices to rise by 8 per cent in 2022 but then fall by 6 per cent in 2023.

That might really add insult to injury for some borrowers whose fixed term loans end in 2023 – they will suddenly be paying more to own something while it is falling in price.

The economic recovery from the pandemic will be long and slow, and full of absurdities like this. We need to hope for wage rises that are broad as well as big, because when interest rates and prices are rising, households that don’t get strong wage rises will potentially get left behind.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.