Mortgage holders warned with signs pointing to interest rates rising as early as June

It’s the news we’ve all been waiting for but for one group of property owners, it could spell disaster.

Homeowners across the country might have to pay higher mortgages as early as June, with signs indicating interest rates will rise by then.

That could spell disaster for an estimated one million property owners who have never lived through a rate hike before as they have only recently entered the market.

The sobering outlook comes from the Commonwealth Bank (CBA), Australia’s largest bank, which has brought forward its estimation of when interests rates will rise.

It comes as costs of living continues to rise to record levels, a sure sign of inflation, putting pressure on the Reserve Bank of Australia to call a rate increase.

“We shift our central scenario for the first hike in the cash rate target to June 2022 (from August 2022),” Gareth Aird, the CBA’s head of Australian economics, wrote on Wednesday.

Later on, he added: “For context, we estimate there are over one million home borrowers who have never experienced an increase in mortgage rates.”

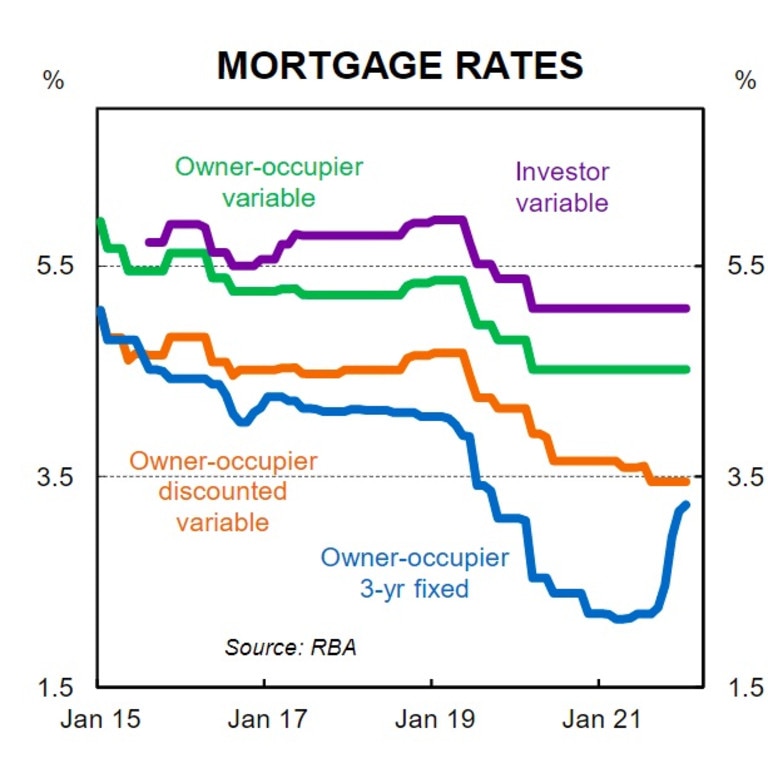

The official cash rate has been at a record low of 0.1 per cent since November 2020 in response to the Covid-19 pandemic but it is expected to jump by 1 per cent by the end of this year and hit 1.25 per cent next year.

Although a 1 per cent rise sounds like a tiny amount, it could add hundreds or even thousands of dollars extra every month for the average Australian mortgage.

Stream more property news live & on demand with Flash, a dedicated news streaming service. New to Flash? Try 14 days free now >

Last year, was an unprecedented year for property, with many new players entering the market off the back of high demand and surging prices which hadn’t been seen since the mid-1980s’ boom.

But it’s not just relatively new homeowners that will feel the sting of higher rates, either, Mr Aird warned.

People on variable home loans would of course be impacted immediately by the rate hike.

But the rising cash rate would also soon catch up with those on fixed mortgages.

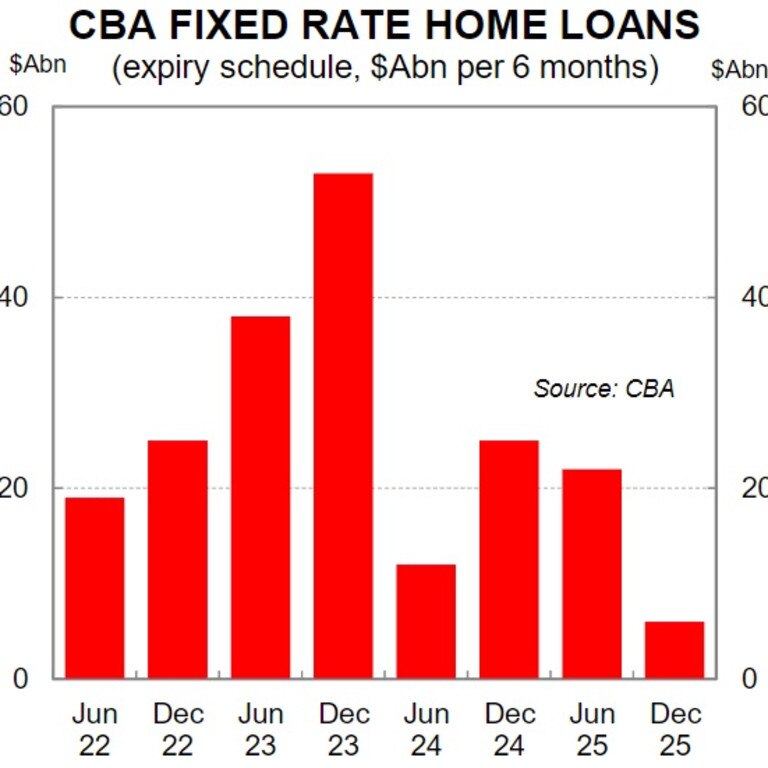

Mr Aird said a whopping $500 billion worth of fixed home loans was set to expire over the next two years, putting them at the centre of the rate hike.

“As a result, borrowers rolling off fixed rates will be refinancing their loans at a materially higher interest rate, which will have a significant impact on the interest cost of debt and household finances,” he added.

Other senior economists have marked out August as the month when crunch time would hit mortgage holders.

The Commonwealth originally agreed with this but has since brought forward its estimate after comments made by RBA Governor Philip Lowe.

Last Friday, Mr Lowe appeared before the House of Representatives Standing Committee on Economics and spoke about the state of inflation in the country.

He discusses supply chain issues and rising rates for cars and electronic products.

“So we want to see how that goes, and I think these uncertainties are not going to be resolved quickly,” he said.

“We are prepared to take the time, particularly given our inflation history and the prospect of low unemployment.”

More Coverage

This prompted the CBA to change its mind about when interest rate hikes would hit the Australian economy.

“We interpret this statement to mean that the RBA will conclude that inflation is ‘sustainably within the target range’ if the next two inflation prints are in line with their forecasts, provided wages growth continues to accelerate and the labour market further tightens, as we expect,” Mr Aird said.

“Based on the Governor’s comments last week we believe the RBA’s central scenario and reaction function is consistent with a first increase in the cash rate in August 2022.”