Major banks forecast that housing prices will drop in 2023, but interest rate rises put some at risk

Australian house prices are set for a small increase this year before finally plunging in 2023 - but it’s not good news for everyone.

Major banks expect the steam to go out of rapidly rising property prices this year, and for a price plunge in 2023.

While for soon-to-be homebuyers this is good news, the changing conditions are putting one group in particular at risk.

Chris Richardson, partner at Deloitte Access Economics, told news.com.authose who had taken advantage of record-low interest rates during the pandemic, and bought a home that would usually be out of their price range were in for a rude shock.

“Your specific [at-risk] group is the same people who are always at risk when interest rates start to climb up after a long period of fall,” he said.

“They are the people who just bought a house. They paid too much. They were funded by the bank of mum and dad.

“It’s that group who will need to stretch because they will genuinely need to save, or save more than they’re doing. That’s painful. It’s a bigger group than usual because it’s basically been over a decade since interest rates went up.”

Stream more property news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 14 days free now >

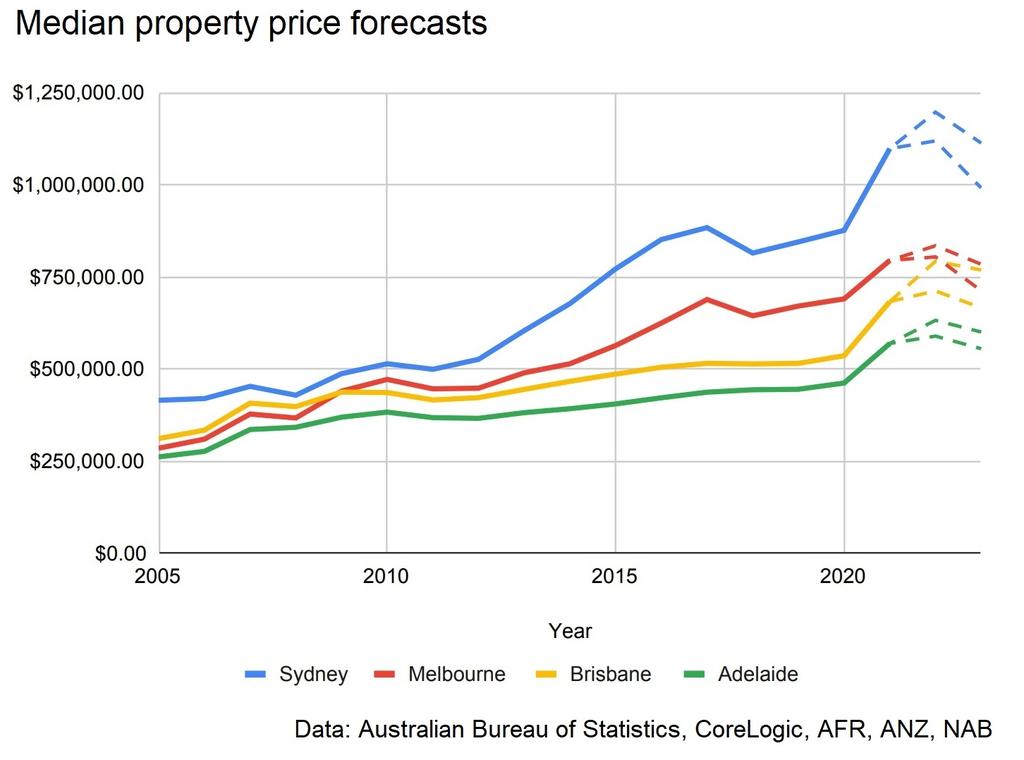

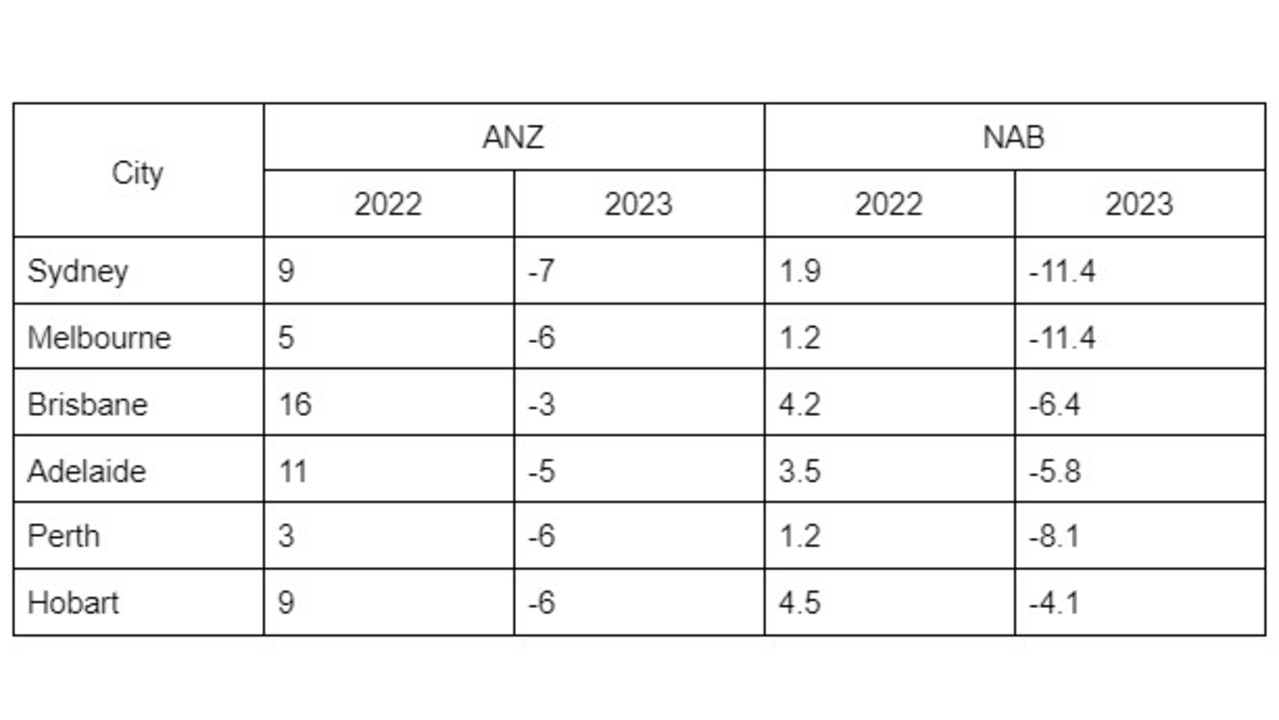

ANZ has forecasted housing prices in Australia’s capital cities will increase by eight per cent on average in 2022 and decrease by six per cent in 2023, downgraded from the four per cent decrease it previously anticipated.

NAB had less bullish estimates, predicting 2.7 per cent growth in 2022 and a 9.3 per cent decrease in 2023.

CBA’s January update predicted that housing prices will increase by seven per cent this year and fall by 10 per cent in the next.

There is significant fluctuation in predictions across the different capital cities, but there is a general consensus that Brisbane’s housing market will undergo significant growth this year (16 per cent according to ANZ and 4.2 per cent according to NAB), compared to Perth which is tipped to see more modest gains (three per cent ANZ and 1.2 per cent as per NAB).

In comparison, Sydney housing prices are expected to rise between 1.2 per cent (NAB) and five per cent (ANZ) in 2022, and fall between six per cent (ANZ) and 11.4 per cent (NAB) in 2023.

Melbourne housing prices are expected to rise between 1.2 per cent (NAB) and five per cent (ANZ) in 2022, and fall between six per cent (ANZ) and 11.4 per cent (NAB) in 2023.

Regardless, the expected cooling of the housing market across the capital cities as a whole will come as welcome news for prospective homebuyers left chasing shadows after the meteoric price rises in the last two years.

Felicity Emmett, senior economist at ANZ and one of the forecasting report’s authors, says that the downgrade from a four per cent forecasted decrease in 2023 contained in the last report to a six per cent decrease in the current one was reflective of changing expectations of the RBA’s interest rates.

“Previously we didn’t expect the RBA to start lifting the cash rate until the first half of 2023, we now expect them to start lifting the cash rate in September 2022, and lift it to two per cent by the end of 2023.”

The Commonwealth Bank January update predicts that the Reserve Bank will raise rates from August this year.

The RBA has held the official interest rate at 0.1 per cent since December 2020. There is a consensus among economists that the US Federal Reserve will soon raise rates and the Bank of England has already raised interest rates twice this year.

Notably, inflation in both economies has outpaced Australia’s 3.5 per cent year-on-year inflation rate, with the UK rate sitting at 5.5 per cent and the US rate at a record-breaking 7.5 per cent.

Ms Emmett said the 2023 forecast would have been lower but for positive signs in the economy such as the record-low unemployment rate, return of immigration, and high household savings.

Most homeowners, she said, should not be overly worried about the forecast that their property’s value will depreciate in 2023.

“From late 2020 to the end of 2022, people will have seen an average gain in house prices around 30 per cent. So when you think about our forecast of a six per cent decline in 2023, it’s really just a modest correction in that context. I think people will still feel very wealthy, given the earlier rise in prices.”

As for those looking to buy, Mr Richardson said prospective homebuyers should no longer feel pressured to enter the property market, because rapidly rising housing prices have eased.

“If you’re thinking about being in the market, there’s no rush,” he said.

“Give FOMO the boot.”