Trump D-day to shake up campaign

Voters will be watching Anthony Albanese and Peter Dutton closely this week, with another round of Trump tariffs set to shake up the campaign.

Voters will be watching Anthony Albanese and Peter Dutton closely this week, with another round of Trump tariffs set to shake up the campaign.

An expert has issued a grim wake up call as countless Aussies hold their breath hoping for another interest rate cut within days.

Cost of living relief and a modest tax cut are unlikely to slow the RBA’s progress on cutting rates, according to analysts.

Homeowners have received a new boost, with falls in inflation renewing hopes for an early rate cut.

President Trump’s hawkish tariff talk has softened and the local bourse soaked up the resulting Wall St boom.

Australia’s central bank is likely to be nervous ahead of its next rate decision for one very good reason that’s out of its hands.

A steep decline in employment figures has raised alarm bells as older workers quit the workforce – but the sudden exit has raised the prospect of an April rate cut.

One of Donald Trump’s most shocking policies is about to hit Australia in a big way – and none of us will be immune from the aftermath.

Australian homeowners may have to resign themselves to higher mortgage payments as political tensions in the US continue to rise.

Australian businesses have been hit with a grim forecast for the year ahead, as US President Donald Trump implements his tariff plan.

The Reserve Bank says the data will decide when it cuts the official cash rate again, as developments from US tariffs complicate the decision.

A major bank has reduced its variable rates, as experts predict a ‘rates war’ between the big four lenders is about to heat up.

Australian economic growth will likely slow over the next two years, a leading forecaster has warned, as Trump’s tariff agenda shadows the world.

Australia’s sharemarket snapped a three-day losing streak on the back of the major miners, as the price of gold and iron ore climbed throughout the trading day.

US President Donald Trump has sparked a bloodbath in global stock markets and Aussie shares were not immune on Tuesday.

US President Donald Trump has refused to rule out a recession in the world’s largest economy and now Aussie shares are plummeting.

Chickpea sales to India have given the Australian economy an unlikely boost, according to the latest current account figures.

The Reserve Bank concedes there is still uncertainty around Australia’s cost of living and has hinted what its next move on rates will be.

Decade-high interest rates are not “the source” of Australia’s cost of living problem, former Reserve Bank governor Philip Lowe has said.

The Australian housing market has surged on the back of interest rate cuts, completely reversing a soft start to the year.

Rate relief for millions of Australians starts on Friday as the first of the big four banks finally pass on the RBA’s rate cut to mortgage holders.

The RBA deputy governor has shared how Donald Trump’s tariff threat affected the central bank’s decision to cut interest rates earlier this month.

Mortgage holders hoping for back-to-back rate cuts have taken a hit after the latest inflation figures were released.

Australians are weighing up taking on extra-long loan terms to reduce monthly repayments on their mortgages as cost pressures continue to bite.

Frustrated Aussie savers have been urged to get one up on banks who have left them in the dark by doing one thing.

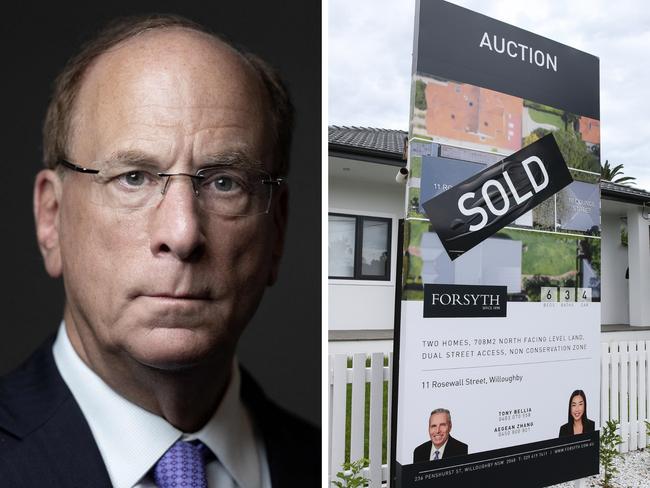

The head of the world’s largest investment firm has called for a new type of mortgage that would represent a major shake-up in Australia’s housing market.

Analysts have discovered a major clue that the RBA is planning to do far more than it’s letting on – and the impact could be massive for us all.

It’s only going to get worse for Aussie savers already on their knees after the Reserve Bank’s decision to cut interest rates.

Aussie mortgage holders are at risk of losing tens of millions of dollars in interest the longer lenders withhold passing on the latest rate cut.

Aussie households are feeling the pinch, with a single rate cut unlikely to relieve them of their mortgage stress.

Original URL: https://www.news.com.au/finance/economy/interest-rates/page/3