Aussie bank’s big interest rate move

Another major financial institution has changed its rates ahead of the Reserve Bank of Australia’s decision on the official cash rate.

Another major financial institution has changed its rates ahead of the Reserve Bank of Australia’s decision on the official cash rate.

Malcolm Turnbull says Australia should not expect the US to not impose tariffs just because of the “special relationship” between the countries.

Australian homeowners could be the big winners if the Reserve Bank of Australia does what is expected later this month.

The money markets are rapidly backing the idea that the Reserve Bank will cut interest rates when they meet in a weeks’ time.

Some Australians are facing huge debts following a record credit card spend over the Christmas period.

A massive interest rates prediction has been revealed as a major RBA decision looms – but it’s not what millions of us want to hear.

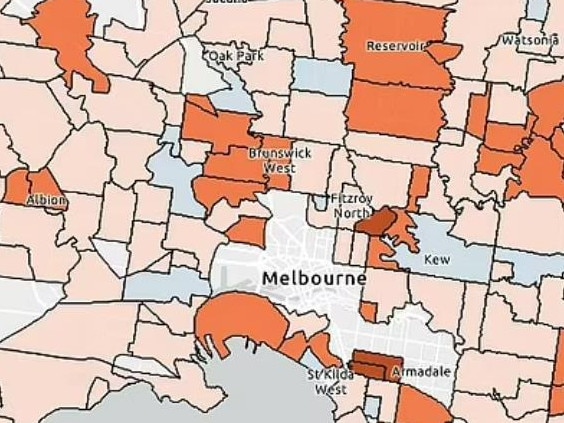

While owning a home is getting harder in most parts of Australia, researchers have set out to find how young Aussies can climb onto the property ladder.

Australia’s biggest bank says there may be some brief relief for those priced out of owning a home, but there could be a brutal side effect to cutting rates.

Nearly $50bn was wiped off the Australian sharemarket on Monday as fears of a trade war led by US President Donald Trump tariffs ripped through the local market.

Mortgage holders need more than one rate cut to start feeling relief, with only about 53,000 Aussies likely to move away from “at risk” should the RBA cut rates in February.

Australia remains behind its ambitious target of 1.2 million new homes by 2029 despite a bounce in new housing approvals in December.

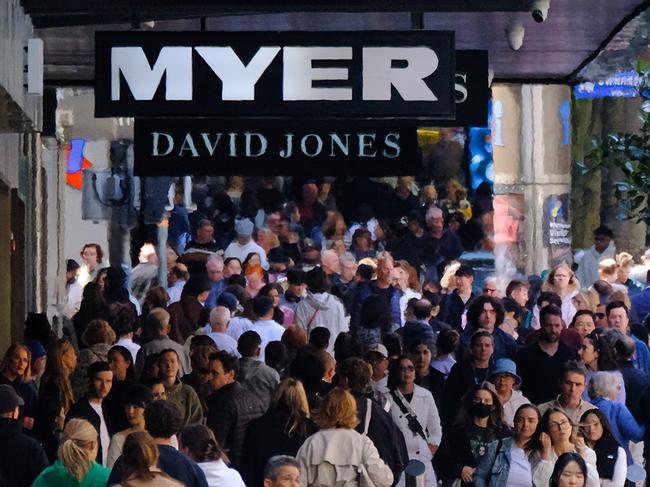

Aussies have returned to the stores on the back of cost-of-living relief, lifting consumer spending for the first time in nearly two years.

One of the big four banks has made a major call ahead of any Reserve Bank of Australia decision to cut the cash rate.

All four of the big banks now agree on when the Reserve Bank board will cut interest rates following welcome inflation data this week.

Australians are still feeling the pinch of cost-of-living rises even though the rate of inflation is slowing.

Applications are now open for young Aussies to get a tax-free $1321 cash boost, but there’s a catch.

One of Australia’s top finance experts says mortgage holders and businesses are being pushed to the brink – and something’s got to give.

In welcome news for mortgage holders, a third major bank is now expecting a rate cut in February following lower-than-expected inflation data.

A new report suggests help is on its way for struggling homeowners who have had their mortgage increase in many cases by $12,000 a year.

Australia’s economy might be hitting a turning point on the back of better household spending – but economists are warning more work needs to be done.

Struggling borrowers could finally get a rate cut in February, with inflation tipped to fall faster than the Reserve Bank has been expecting.

The Treasurer has urged “confidence, not complacency” ahead of Wednesday’s new inflation data, which could lead the RBA into its first rate cut since 2020.

The Prime Minister says his government has “done all it can” to tame inflation to allow the RBA to cut rates and deliver households much needed relief.

Two mining powerhouses are officially Australia’s best performing state economies, with one topping the list for the second time since 2014.

A huge number of Aussie households have said they are desperately needing a rate cut when the Reserve Bank next meets.

The Aussie sharemarket has snapped a three-day winning streak as consumer-facing stocks and an “unloved” mining sector drag the index lower.

Millions of Aussies are confronting a stark budget black hole, with an economic update exposing a serious $217bn breakdown in one state’s finances.

Australia’s weak dollar could see inflation tick up slightly, but it is unlikely to move the RBA on its next rate cut decision, a leading economist says.

A major bank has reduced its fixed-rate mortgages just weeks out from the Reserve Bank’s official rate-cut decision.

The Australian economy is expected to experience brighter days ahead off the back of expected interest rate cuts, but there is a massive catch for workers.

Original URL: https://www.news.com.au/finance/economy/interest-rates/page/5