‘Do not see it happening’: Expert reveals interest rates prediction ahead of RBA meeting

An expert has issued a grim wake up call as countless Aussies hold their breath hoping for another interest rate cut within days.

COMMENT

The absence of the truth can constitute a lie. Especially when it comes to monetary policy.

Markets and Reserve Bank of Australia watchers are mostly expecting a hold in next week’s April meeting.

This is probably the base case.

It’s not because we don’t need a rate cut. We do.

Inflation is beaten.

Wage growth is in free fall.

The economy is weak.

But the RBA is enough of a political institution to avoid cutting in April and waiting until after the election in May.

The good news is this unnecessary hair shirt being pulled over your head will mean more cuts later in the year as the economy plays second fiddle to the RBA’s delicate sensibilities.

Who sees what?

Of the four major banks, CBA, NAB and Westpac all see another rate cut in the second quarter but are not confident of April.

ANZ sees no further cuts before the third quarter.

Even other dovish forecasters who were right about the February cut, such as Goldman Sachs, are unsure about April owing, in part, to election timing.

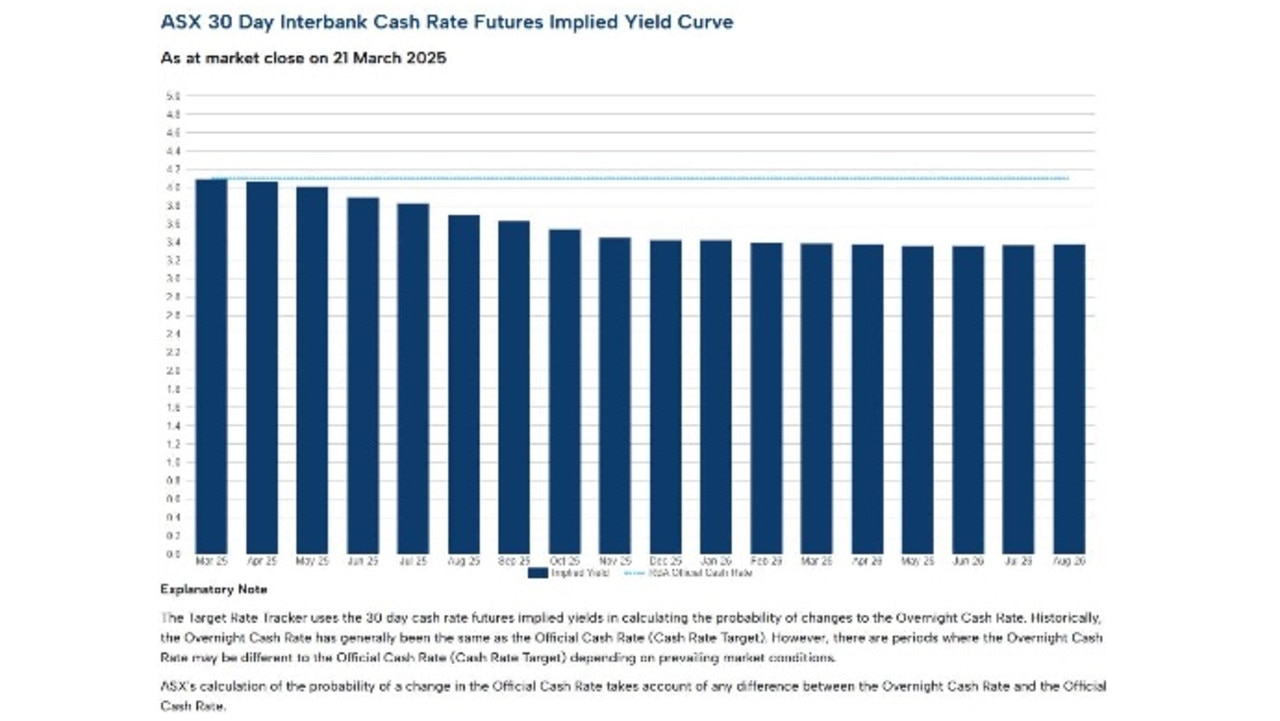

Likewise, interest rate futures markets do not see it happening, though they expect another second-quarter cut, with half a cut priced by May and a full cut by June.

The RBA should cut. Every top-tier data point since its last meeting has gone backwards. The NAB survey, capital expenditures intentions, wage forerunners and jobs.

Monthly inflation is firmly back in the range at 2.5 per cent headline and trimmed mean at 2.8 per cent. Both are trending lower at a good clip.

How do we know the RBA is politicised?

It’s pretty easy to find corruption at the RBA.

Exhibit one is its persistent over-hawkishness despite all evidence to the contrary.

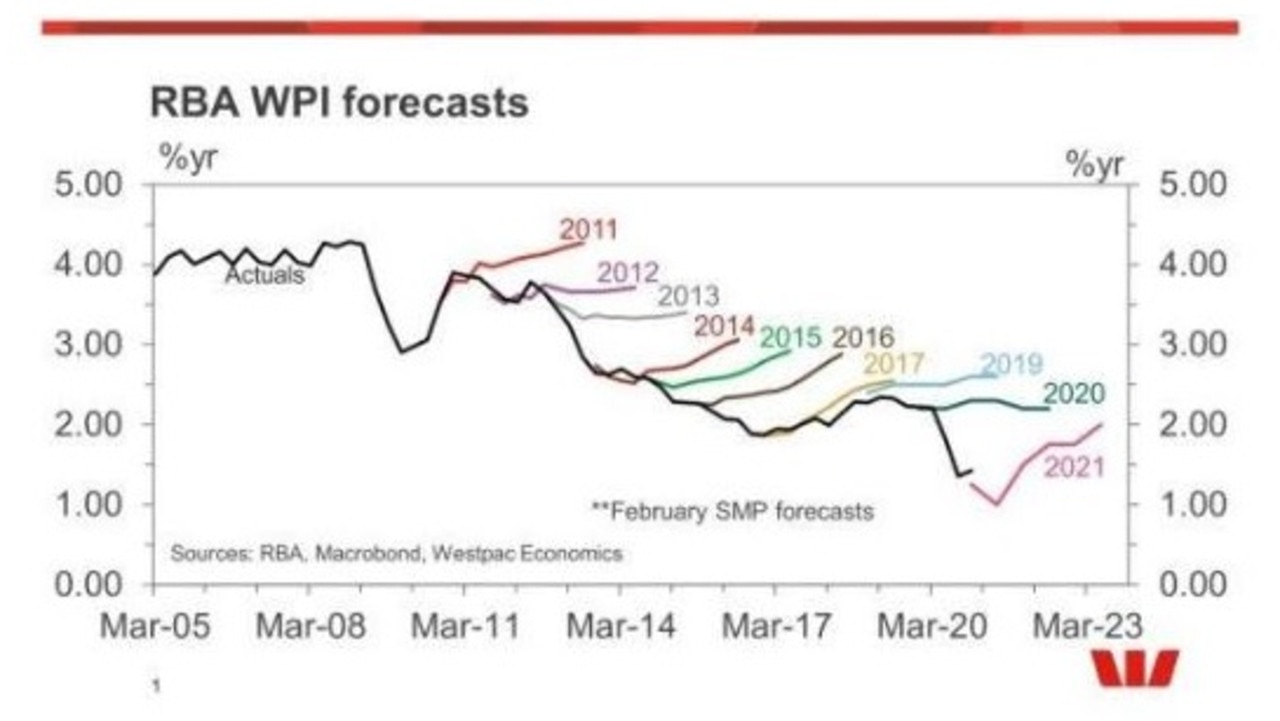

As we saw in the last business cycle, the RBA refuses to believe that Australian wages are structurally weak, owing to Australia’s unique immigration-led labour market expansion growth model.

This is not an economic judgment. It is a political one. Because the RBA knows that if it were to tell the truth about the model, that it favours the living standards of migrants over the existing population, then support for it would very likely collapse at the ballot box.

As a result, the bank pumps out amazingly obtuse pieces of research into endlessly weak wages (and therefore inflation) without once mentioning the real cause: the permanent supply shock of cheap foreign workers.

In its last Statement on Monetary Policy, the RBA warned nine times that it feared a wage inflation breakout was imminent in the US owing to its closing of the borders to foreign labour.

Yet, in its special section on why Australian wages are structurally weak, it did not once mention the highest absolute immigration rates that anybody can remember.

Enough said.

A reformed RBA

Only in the weird world of Australia’s political economy could such a farce play out.

Another reason why everybody is sceptical of an April cut is the installation of the new RBA board structure, with management and monetary policy separated.

The main reason behind the reforms was the RBA’s shocking wage (and inflation) forecasting record in the decade before Covid-19.

Yet here we are, with an even more hawkish RBA that has now cancelled any mention of the true driver of weak wages (and inflation), with a new board that is certain to have been selected for its willingness to toe the same line.

Only in Australia do you get long and complex reforms that return you to precisely the same point that you left behind.

This is some form of very deep and immovable politicisation.

No cuts for you.

And so, what we will get is an ongoing pantomime that the RBA is independent and not interested in politics, even as it refuses to cut rates because of politics, an inherently political position, and justifies that by brainwashing itself.

The cuts will come. But not before the RBA has pretended for long enough that Australia’s current economic model produces wages and broader inflation – thereby ensuring another unnecessarily weak economy that further damages living standards, followed by another round of RBA reform.

Rinse and repeat.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.