Late 30-somethings in NSW will cop interest rate rise the most

There’s one age group and one state that will be impacted most by cash rate rises – and it comes as no surprise who be copping it hardest.

By now we all know that suffering is coming. Inflation is high and rising, which is bad enough, but now the RBA is going to put up interest rates to fight inflation. And that is going to make the suffering worse, in the short-term. So who will suffer most?

The market expects official interest rates to hit three per cent by the end of the year. That’s a big jump from the 0.35 per cent that official interest rates are at now, and it is likely to push mortgage interest rates over 5 per cent.

If you haven’t checked in with what interest rates are expected to do lately, the recent change could come as quite a shock. We always knew interest rates were going to rise this year, but expectations of just how much they would rise have skyrocketed.

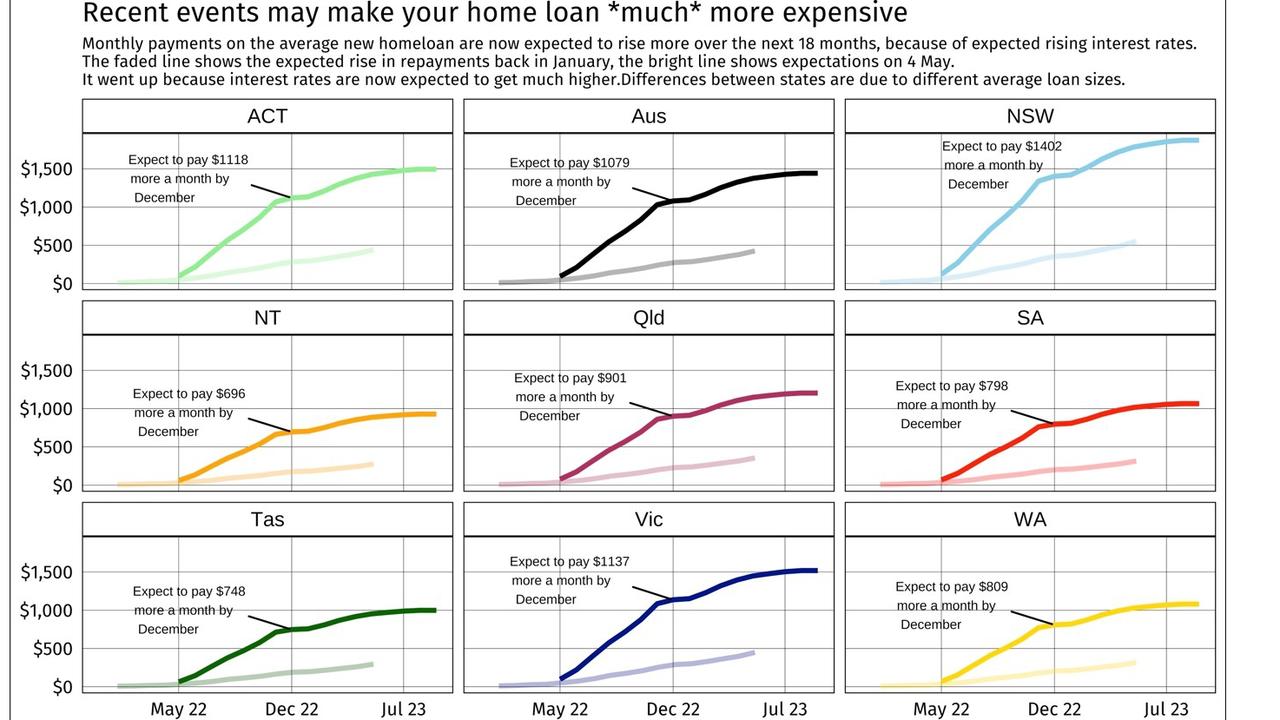

That means skyrocketing mortgage repayments, as the next chart shows. By December the average Aussie who took out a new 30-year home loan in January 2022 will be paying $1079 a month more than in January 2021 – assuming they have a variable rate mortgage, assuming banks pass on official interest rate rises, and assuming market predictions of interest rates come true.

The suffering will hit hardest in places where loans are biggest: in Australia, new home loans are biggest in NSW, because that’s where property prices are highest.

Now, you might be asking, it looks bad, but should we trust market expectations of future interest rates? The answer is not to trust them exactly, but they can act as a useful guide sometimes.

For example, when the RBA was saying it wouldn’t raise rates in 2022, and maybe not even in 2023, market expectations were pretty confident that was nonsense. Markets had “priced in” a lift in rates in 2022. Which is exactly what we got this week when the RBA hiked official interest rates for the first time in over a decade.

On the other hand, as the difference between the faded lines and the bright lines in the graph above shows, interest rate expectations can change a lot in a short time. So take the above chart as a guide only.

Suffering for the 30-somethings

Where else does suffering fall when rates rise?

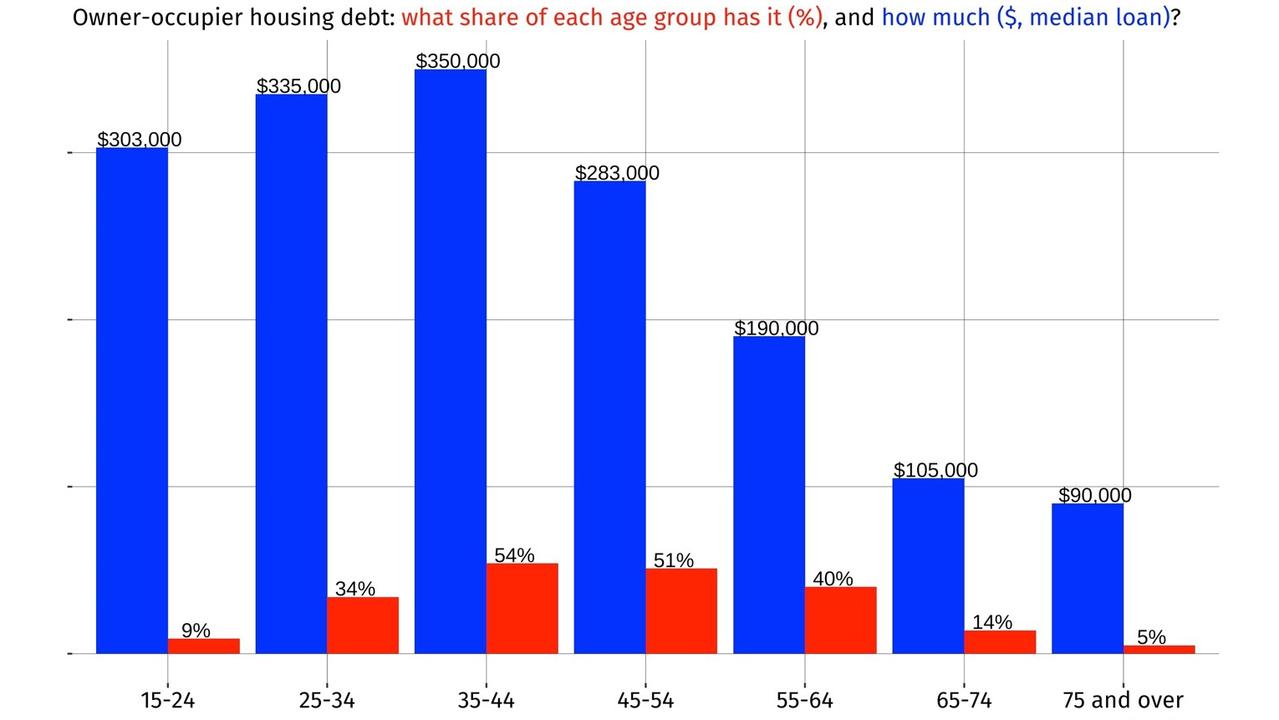

One answer is that the old won’t be suffering as much as the young. For starters, the old are most likely to have cash in the bank, which, if banks pass through interest rate hikes, should finally start earning some interest again. But also, by the time of retirement, home loans are getting smaller, and far fewer households have them.

The biggest whack will be to those people in their late 30s whose are most likely to have home loans, and whose loans are biggest.

I also feel for the 15 to 24 year olds in the above graph because their earning power is unlikely to be as strong as the 30-somethings.

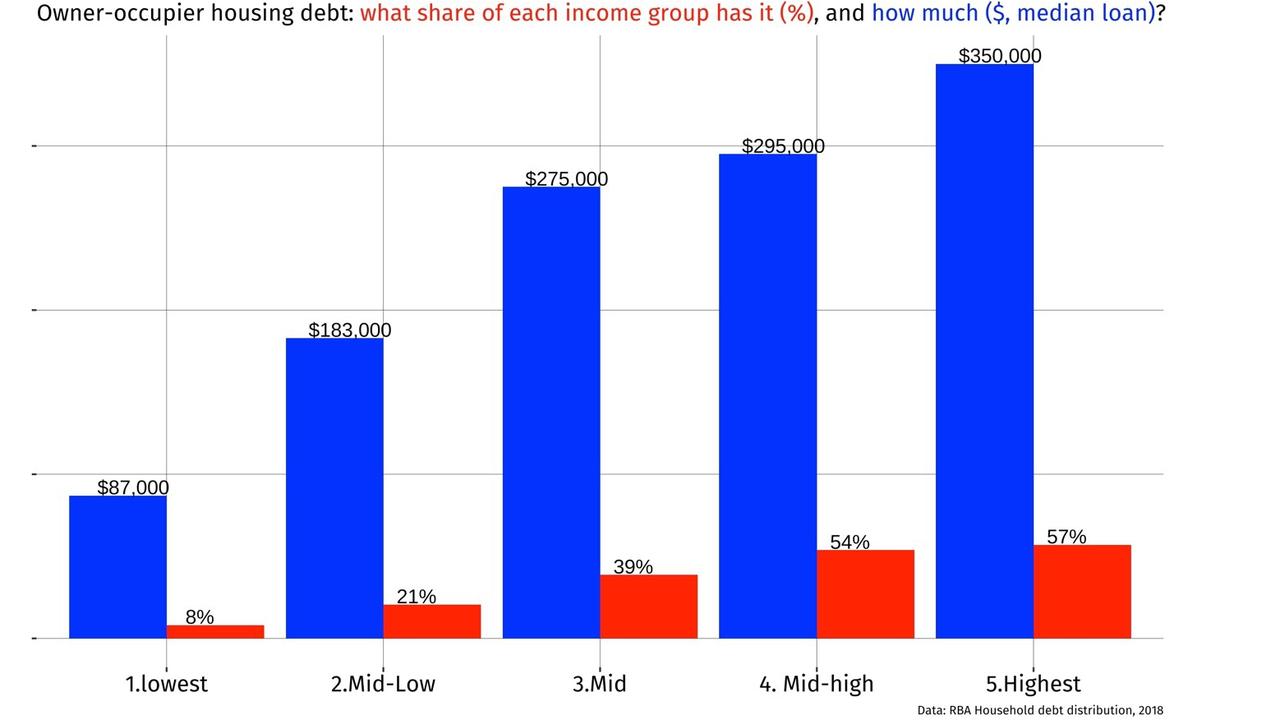

Speaking of earning power, we can break down household debt by income. What we see is higher income earners will be shouldering a good chunk of the burden of reducing inflation, because they are the ones who higher interest rates will hit most. Higher income earners are more likely to have owner-occupier housing debt and their debts are higher.

However they’re not the only ones who will hurt. They may well have cash to spare and finding meeting their extra mortgage repayments easy. Plenty left over to the fill the BMW with premium fuel.

It’s the left hand side of the graph who will find the next few years – people who may have smaller mortgages but also have less money to service them with. They’re the ones who’ll be eating home brand beans when their mortgage goes up.

High inflation is bad because it shrinks our real buying power. The problem is the cure works in the same way, cutting people’s disposable income by making mortgage payments higher. What little people have left after paying their mortgages now buys less at the supermarket. It could be a painful few years and we have to hope the RBA gets inflation back down fast, and keeps it there.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.