Three reasons the Australian dollar could decline in 2022

Three paramount factors which buoy the Australian economy are combining to create a financially uncertain 2022.

ANALYSIS

There are many factors that go into the price of a currency. Some are structural, like the external and fiscal balances. Others are more cyclic, like the level of interest rates.

In the case of the Australian dollar, three factors are paramount.

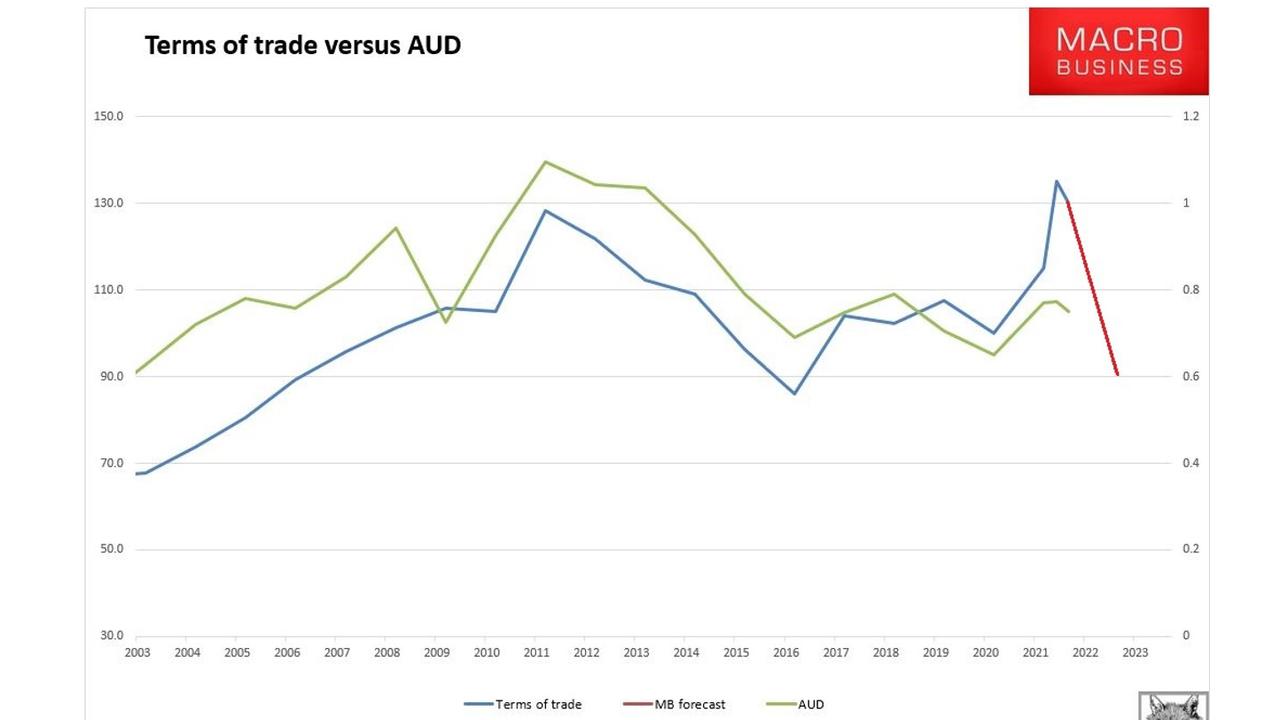

Terms of trade

The price of commodity prices expressed as a percentage of our import prices, known as the terms of trade (ToT), is the first. The AUD has a long history of following this measure closely.

In 2021, the ToT boomed and the Australian dollar rose (though much less than previous iterations).

The ToT has now rolled over as China slows trade. Iron ore, the two coals plus LNG will fall heavily in 2022 unless we see more Chinese stimulus, which it appears loath to undertake.

Interest rates

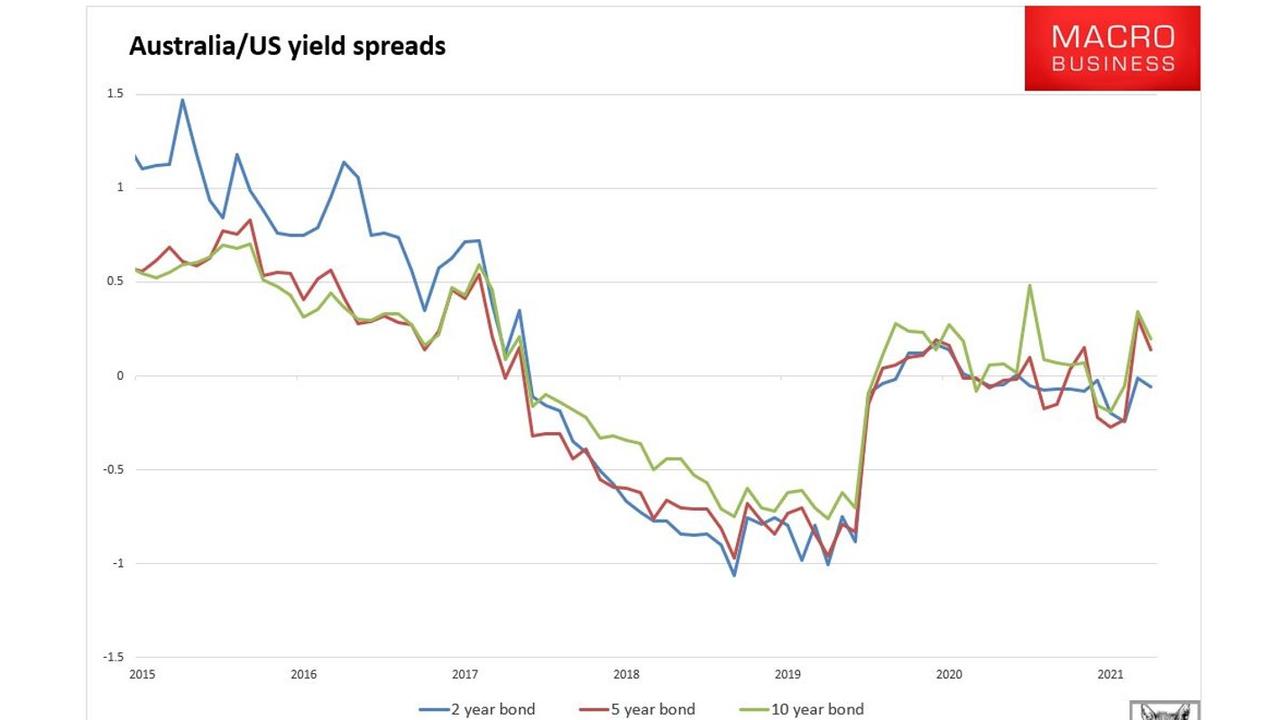

The second most important factor for the AUD is relative interest rates. If Australia is running higher interest rates than other countries, especially the US, then global hot money flows into local assets and lifts the currency. The opposite also applies.

At the moment, Australia has a positive “carry” – a positive difference between interest rates – versus the US but it is neither large nor convincing.

Moreover, there are good reasons to expect higher interest rates in the US versus Australia over the next year. Inflation is much stronger in the US. Unemployment is lower and wages growth is much stronger.

As well, Canberra intends to reboot wage-crushing mass immigration as soon as possible and falling commodity prices also hit inflation hard.

Finally, the Australian mortgage market is currently undergoing a material shock to fixed mortgage rates which will slow local property markets and dent consumer confidence.

All of these factors mean that US interest rates will likely rise faster than Australian in 2022 and the “carry” will reverse to a US yield advantage.

Value of the US dollar

The third most important factor in the Australian dollar’s value is the relative value of the US dollar itself. The American economy is booming out of Covid much more strongly than all other developed markets. This is making its currency very strong as its inflation, yield and growth advantage suck in capital:

There is no end in sight to this American advantage as the Biden administration passes another large fiscal stimulus to begin next year and boost growth for the next five or six years.

In turn, a strong US dollar tends to weigh on the growth of emerging markets and the value of commodities, exacerbating underlying forex trends.

There are lots of other factors in setting the value of a currency, including technicals and sentiment. But these are the three pillars of value and all of them are now pointing the US dollar higher and the Australian dollar lower over the medium term.

Unless or until the growth pattern of the global economy shifts and either China or Europe stimulate with equal vigour to the US, the Australian dollar is likely to keep on falling throughout 2022.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super.David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review. MB Fund is underweight Australian iron ore miners.