Double disaster looming for Australia after China move

Two of Australia’s most important exports are facing an uncertain future thanks to a crisis in China that doesn’t appear to be going away.

You could be mistaken for thinking iron ore is cheap. After all, it is down by two-thirds from its recent highs. You’d very likely be wrong.

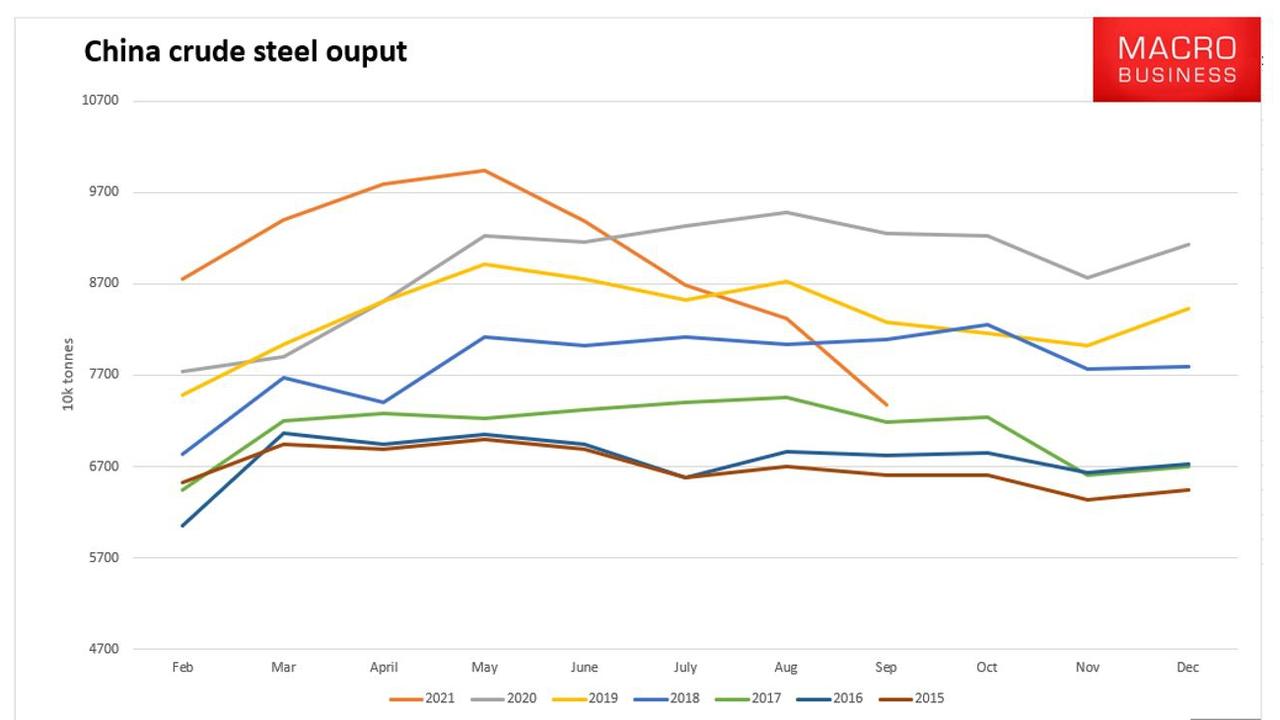

The reasons that iron ore collapsed earlier this year are still in play. Chinese steel production is still down by 14 per cent from last year over the past three months.

Chinese real estate and infrastructure are down heavily too and will get worse for many months yet if the determination of policymakers is to be believed.

And now, there is one more factor to consider.

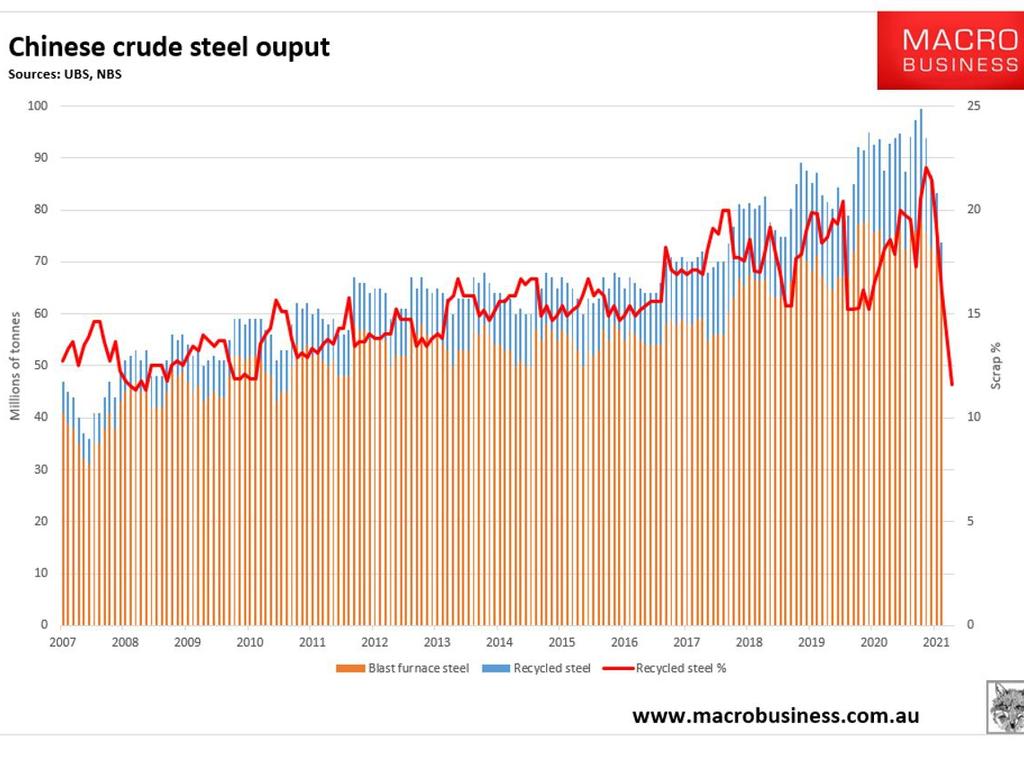

For the past few months, the iron ore market has been strangely protected by a boom in the coal market. China’s brief energy crisis caused a lot of metals production to shut down. This included 120 million tonnes of electric arc furnace production which uses power to melt scrap steel and recycle it.

But, suddenly, that power crisis has passed and the thermal coal price is crashing back to earth. Increasingly, shuttered Chinese metals production is being brought back online.

Again, this will include the 120 million tonnes of closed steel recycling.

The underlying weakness in demand is still there. So, as recycled steel output returns, it is going to add far too much product for the market to handle.

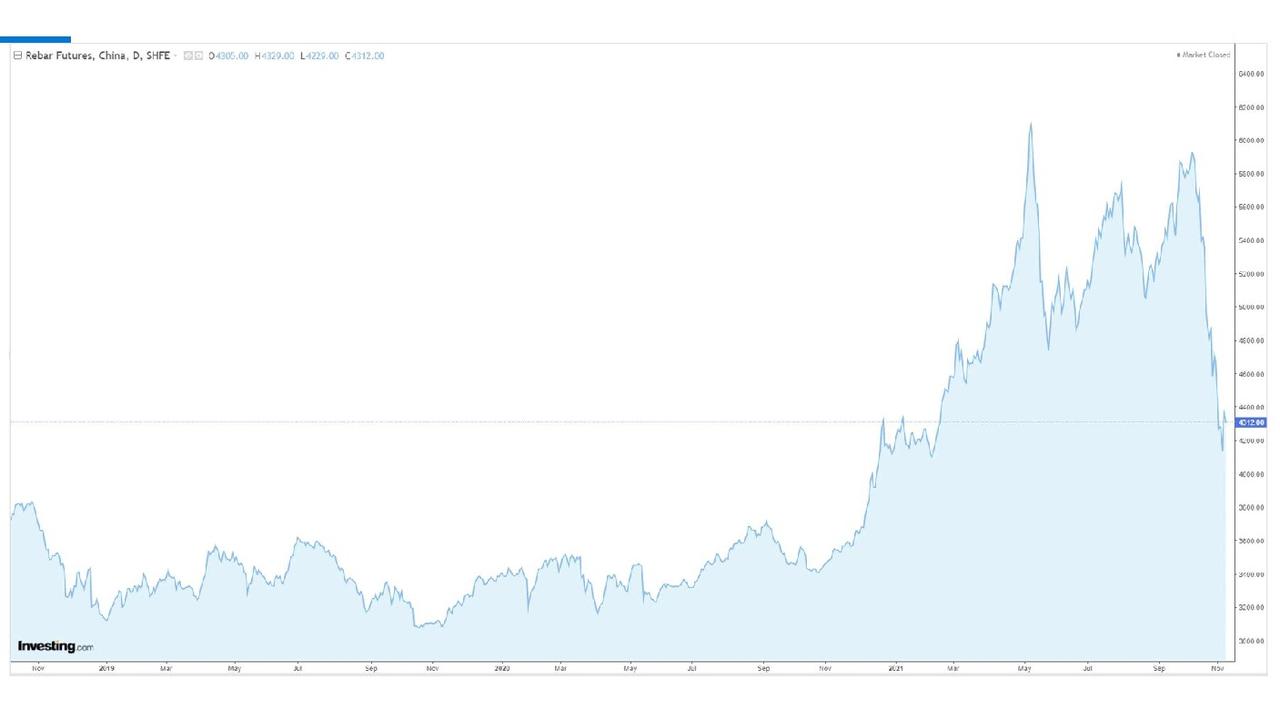

Prices of steel in China are already crashing owing to this glut. This will likely continue and go global in due course as cheap Chinese steel returns to export markets.

It will also mean that Chinese steel producers have to cut back on their blast furnace output which is much dirtier than recycling. This is the kind of steel production that uses iron ore and coking coal.

If the steel recycling sector resumes the full 120 million tonnes of output, then 200 million tonnes of iron ore and 100 million tonnes of coking coal will no longer be needed.

This is 20 per cent of the seaborne market for iron ore and one-third of the seaborne coking coal market. This is an immense developing oversupply of Australia’s two most important commodity exports.

It may be that China will stimulate its construction sectors again as its economy cools next year and some of this slack will be taken up. But the longer it waits, the more that commodity markets have to deliver prices that shut down the excess production for both commodities.

To achieve this scale of cuts to supply, the iron ore price will need to fall much further. No production of serious volume will be cut above a price above $60. If the full excess 200 million tonnes of iron ore needs to be priced out then that will require a bowel-shaking price down in the $20 range.

For coking coal, the price for a reduction in supply begins around $120. To take out so much supply would require half of that.

It is impossible to know precisely how much supply rationalisation will be required in both commodity markets over the next year. What is obvious is that it will be a lot and it’s odds-on that prices will have to fall a long way yet.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review. MB Fund is underweight Australian iron ore miners.