Sign Australia’s commodities boom is about to end

Australians have been enjoying a boom that has seen us thrive financially – but there are signs this bubble is about to burst.

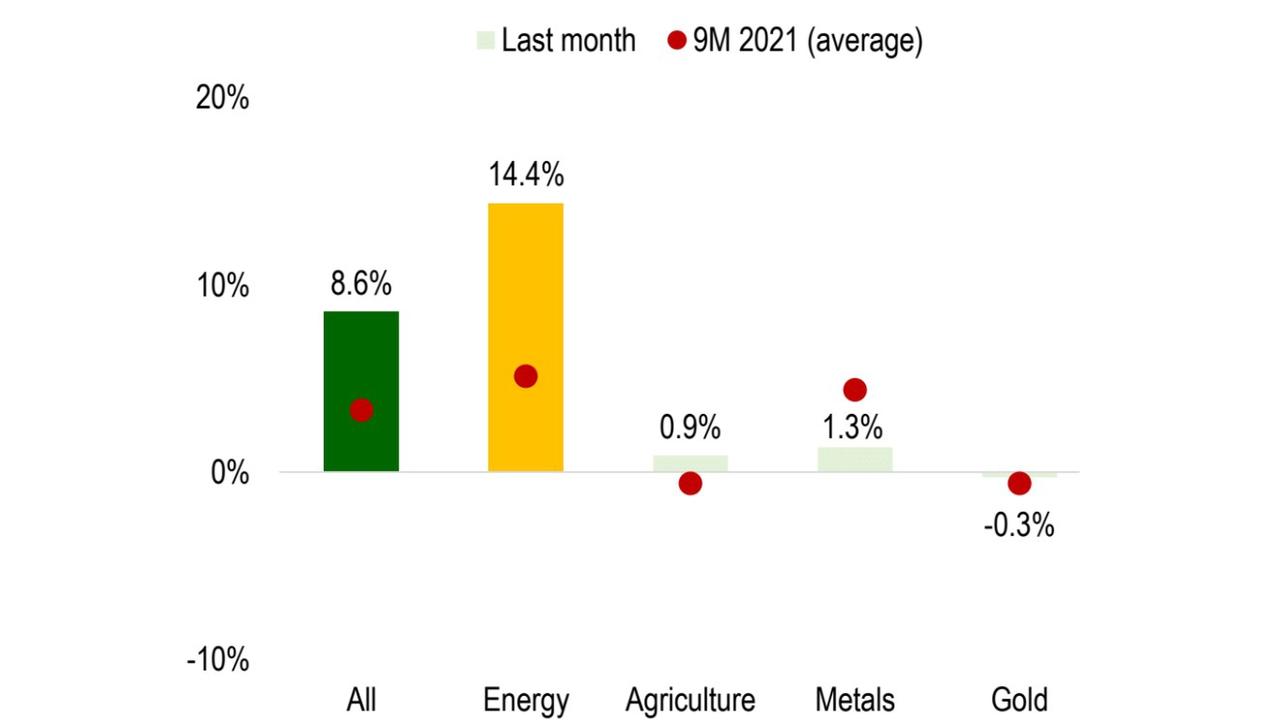

Australia is enjoying another of its periodic modern commodity booms. Iron ore has boomed and busted but energy such LNG and coal are at all-time highs. Also high are battery raw materials like lithium and some grains. The returns have been good all year for the commodity investor.

Over the past 40 years, commodity booms have arisen from three predictable and self-reinforcing sources. They are the catch-up growth spurt of a large emerging market. Weakness in the reserve currency (USD) leads to fears of inflation. And a hoarding cycle that follows both.

This is the formula for a sustained commodities boom for a very good reason.

Catch-up growth in one or several emerging markets – such as Japan in the 1970s or China in 2000s – is very construction and commodity-intensive. Much more so than services-driven developed economies. Such economies add a large and sustained demand source for raw materials that were not there prior so prices rise to stimulate more supply.

A weak US dollar is significant to commodity prices because it adds a financial spur to demand. Raw materials are generally priced in US dollars, so when it falls in value, they rise in value. Add to this that the falling US dollar can lift inflation and financial markets can begin to buy commodities as a “hedge” against that outcome.

Finally, when these two forces converge, a positive sentiment cycle kicks in and drives prices. As people’s inflation expectations for commodities entrench, they begin to hoard which, in turn, adds to demand and absorbs supply so we can see a melt-up in prices.

How does today’s commodity boom stack up against this formula? Actually, not very well.

Of the three preconditions for a bullish structural cycle – emerging market boom, falling US dollar and hoarding – today we only met the last. Why have prices gone up at all then?

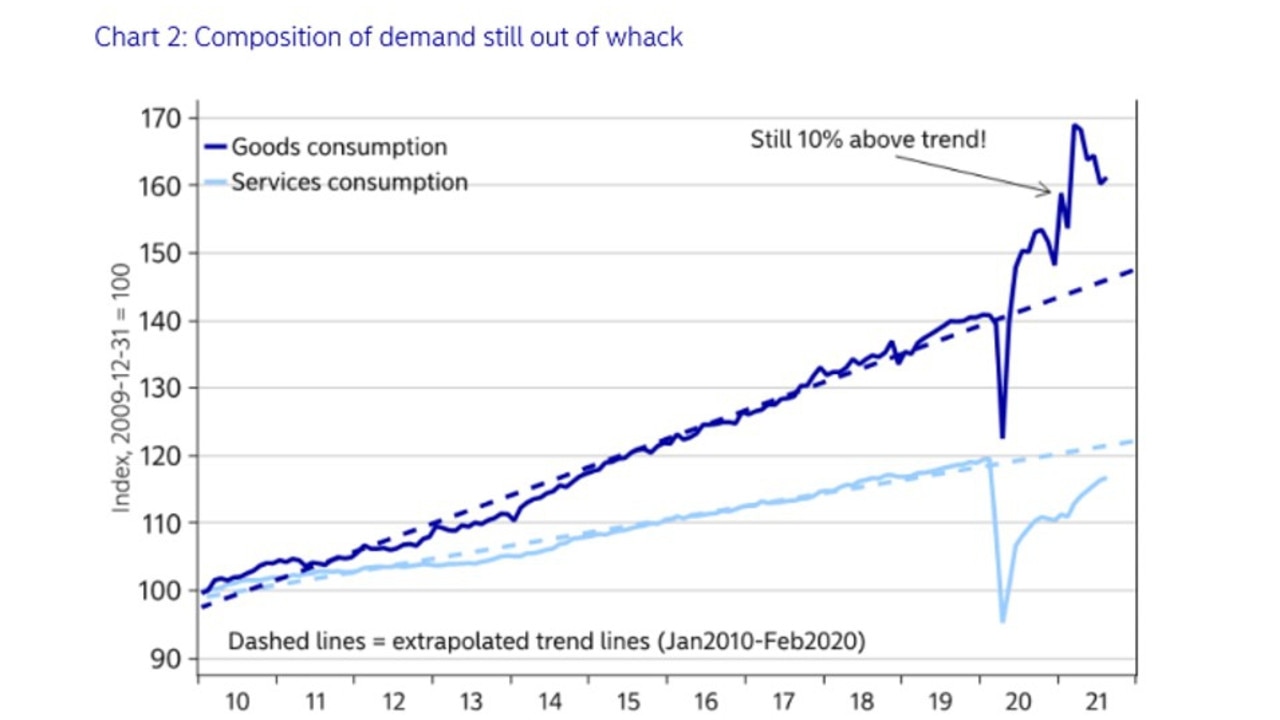

The primary driver of the demand for commodities this year has not come from an emerging market at all. In fact, it has come from extreme US stimulus and Covid spending distortions leading to enormous goods demand.

In turn, this has driven a huge export boom in emerging markets. And that has lifted commodities demand worldwide.

Will the commodities boom continue?

When we assume that the commodities boom is going to continue, we are also assuming that this immense demand for goods is going to continue. That is a bold assumption given as economies reopen, services activity is already rebounding and excessive goods demand is heading steadily back to trend. Not to mention that stimulus is radically reversing.

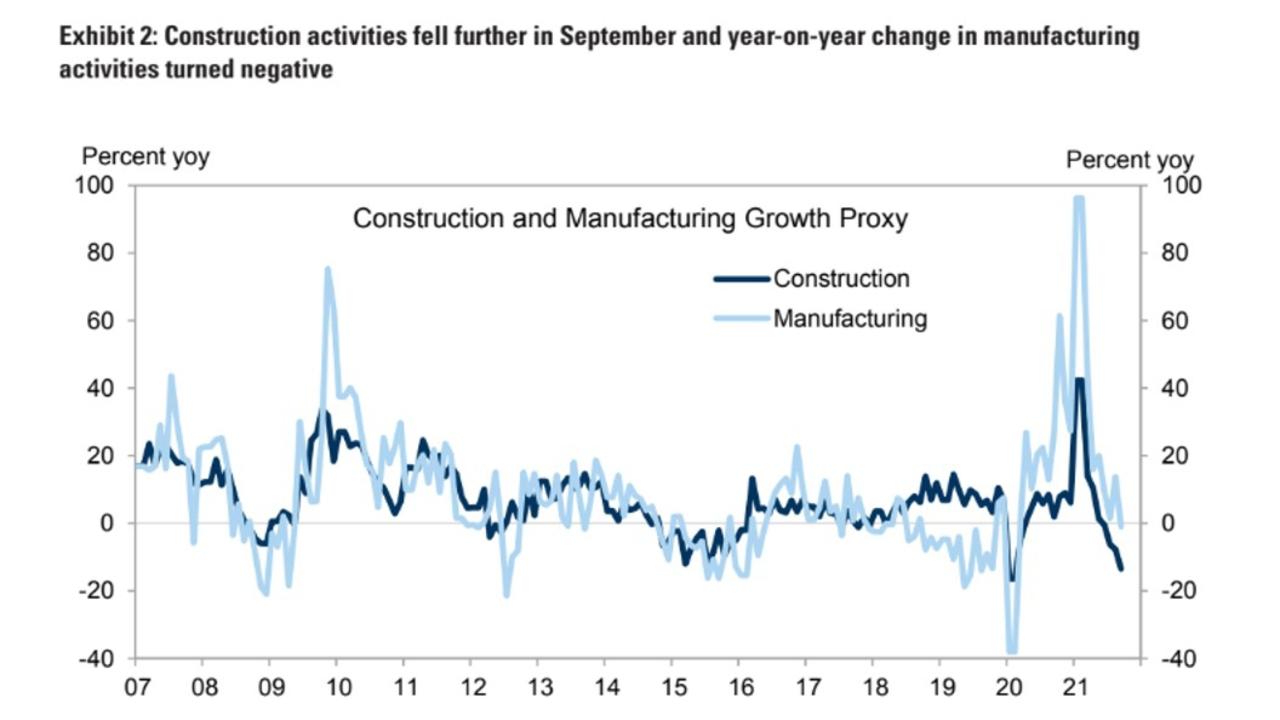

The other possibility for sustained commodities demand is that falling goods demand might be replaced by another surge in emerging market construction. But that isn’t happening, either. The only emerging market large enough to matter, China, is going backwards fast as it shakes out its property developers.

The fundamental demand source for a sustained commodities demand boom is just not there.

US dollar and commodities

How about the financial demand for commodities then? The news is not great there, either.

The US dollar did fall for a while in 20/21 but more recently has begun to strengthen owing to America’s growth, inflation, and yield advantages.

In fact, the US dollar has now diverged noticeably from its long-term and very close negative correlation with commodity prices (that is, they move in opposite directions). Now they are both going up (note the US dollar is inverted on the chart).

Once again, if we are to assume that commodity prices will remain high or go higher, then we have to assume that this time it is different. That commodity prices will rise in stark contrast to all of the other periods of a strong US dollar.

Hoarding cycle

Finally, that brings us to a hoarding cycle. We are seeing markets pile into commodity stockpiling. The copper market has been cornered in London. Multiple commodity futures markets have been stormed by speculators and trading houses. Energy markets are being crunched by parsimonious cartels.

But, if the only real reason that commodity prices are going up now is that traders are assuming higher prices and inflation, then what we are witnessing is much closer to a bubble that it is any kind of sustained super cycle for prices.

And that’s where it can all turn on its head rather suddenly and precipitously. If underlying goods demand does return to trend, as it has begun to do, and China keeps its jackboot on its property developers, which it appears determined to do, then all of those frenzied commodity hoarders are going to wake up one day soon to falling prices and panic sell.

That bust will spell the end of global inflation in 2022.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review. MB Fund is underweight Australian iron ore miners.