China housing market crash hurts Aussie iron ore but benefits coal

China’s current financial crisis is the combination of two moves that have sparked mayhem. And while it’s hurt one Aussie industry, another is thriving.

Over three decades, China has steadily opened up its economy to the influences of markets to advance human utility.

Over that period it has always been careful to try to avoid the financial excesses that overtake capitalism from time to time. On this basis, after the Global Financial Crisis (GFC), Beijing expressly eschewed the Western model of over-liberalisation and financialisation.

For instance, China was never so foolish as to let Wall Street bankers loose in its mortgage market, as the US had done in the post-millennium period, resulting in the greatest mortgage bond and property price bubble and bust in history. Equally, China has been very cautious in freeing up its interest rate markets and currency, preferring to keep them largely under centralised control.

But, for all of its efforts to do so, China found homegrown methods to blow its own, even larger property price and construction bubble after the GFC.

In China’s case, it was more political than financial greed that was the key driver. The ruling Communist Party felt its legitimacy hung upon endless high GDP growth and the only way to deliver it was to build vast cities of apartment buildings – whether occupied or not.

That is until Covid came along and changed the calculus. After Covid, Beijing has drawn two conclusions. The first is that it can no longer afford to pointlessly build empty apartments to meet growth targets. There is too much debt.

The second conclusion was that as all other nations simulate like crazy, and by doing so suck in huge quantities of Chinese exports. Now was a great time to address the property bubble.

This makes perfect sense. The Chinese export boom will keep unemployment low and sustain incomes as the property bubble is deflated. Australia did something similar in the 2010-11 period quite successfully.

The best-laid plans

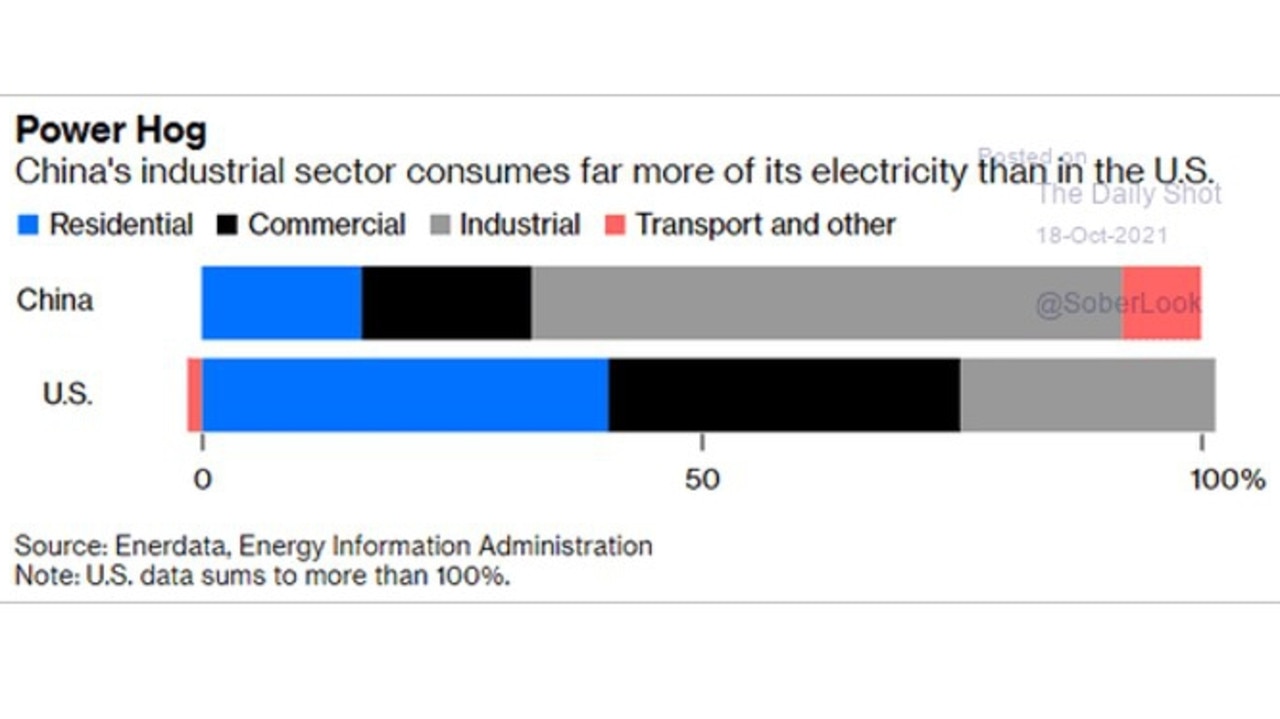

But something has gone wrong with this plan. China’s industrial export boom has turned out to be so large that its power consumption has boomed. Unlike developed markets, the vast majority of Chinese electricity is used in industry. At its peak earlier this year, Chinese power output was up an astonishing 16 per cent year-on-year, though that has slowed to about 5 per cent in September.

This had led to power shortages and big demand for electricity raw materials such as coal, LNG, oil and even uranium.

There is plenty of such fuel to go around in the global economy. All of these markets are fundamentally well supplied. Or, they were before Covid. Virus disruptions introduced some new short-term curtailments, as did Russian geopolitics, at an inconvenient moment. Even so, any disruptions should have been manageable.

Super-selling the super-cycle

But that is when Wall Street got involved. Unbeknown to China, which has so studiously avoided the American carpetbaggers, Wall Street got a hold over the Chinese economy this year when its investment houses started selling the idea that the green energy revolution is going to leave the world short of key commodities for decades. It was called a new “supercycle”.

This notion has very little actual mathematics behind it. Most, if not all, of the posited shortages are made up. Energy raw materials like coal and gas were never central to the idea. But there is nothing that Wall Street loves more than a great story to sell and the result, today, is a full-blown commodity mania and hoarding cycle. Especially in the energy commodities that China needs to keep its industry powered up.

So, just as China has deliberately crushed its property developers, Wall Street’s commodity bubble has grown so large that it is forcing power curtailments upon the Chinese industrial economy. Suddenly, instead of one engine and one brake, the Chinese economy has hit two brakes. Hence, it barely grew at all in the September quarter and faces much the same in the December quarter.

Australia’s booms and busts

Australia has been both beneficiary and victim of this strange turn of events. The great iron ore crash was the first signal that the Chinese property developer shake-out had arrived. But, since then, we have enjoyed a historic boom (in both speed and scale of price gains) in our energy commodity exports. So much so, that it has completely wiped out all of the losses from iron ore.

In the short term, this will mean a few things. The benefits of the commodity boom will swing from the budget of Western Auatralia to those in NSW and Queensland, where the coal exports happen. Gas is not taxed very well anywhere so that won’t make much difference to anybody.

Moreover, because the basis of the high prices is tenuous, the energy bubble will probably burst almost as quickly as it arrived. If we have a warm northern hemisphere winter then the bubble will likely burst before new year. Even if it is cold then it will be deflating by March and gone mid-2022.

While it lasts, the Chinese economy is caught in a Wall Street trap. Property prices, developments and finance continue to shrink but Beijing can’t support the property deflation with stimulus for fear of blowing Wall Street’s energy bubble sky high and in the process shutting down its industry anyway.

So Chinese property is on its own, and downside momentum in that market can gather pace. If it overshoots, the greatest victim of the short-term energy bubble may ultimately be lower iron ore prices, as well as energy.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review. MB Fund is underweight Australian iron ore miners.